Recently, you may have heard of an absurd number of resale HDB flats being sold for millions of dollars. A few months back, PLB likewise successfully closed resale flat deals above the million-dollar mark.

With more than 14,000 HDB flats reaching Minimum Occupation Period (MOP) status, it will no doubt generate a surplus in the resale market if owners choose to sell their MOP-ed units after occupying their homes for five years. So how will this surplus affect prices?

In this article, we will explore the impacts of an enormous amount of HDB MOP flats entering the resale market and how this surplus will serve those waiting for their Build-To-Order (BTO) flats. We will also put out essential considerations for those thinking of right-sizing.

How and Why will this impact the Resale Market?

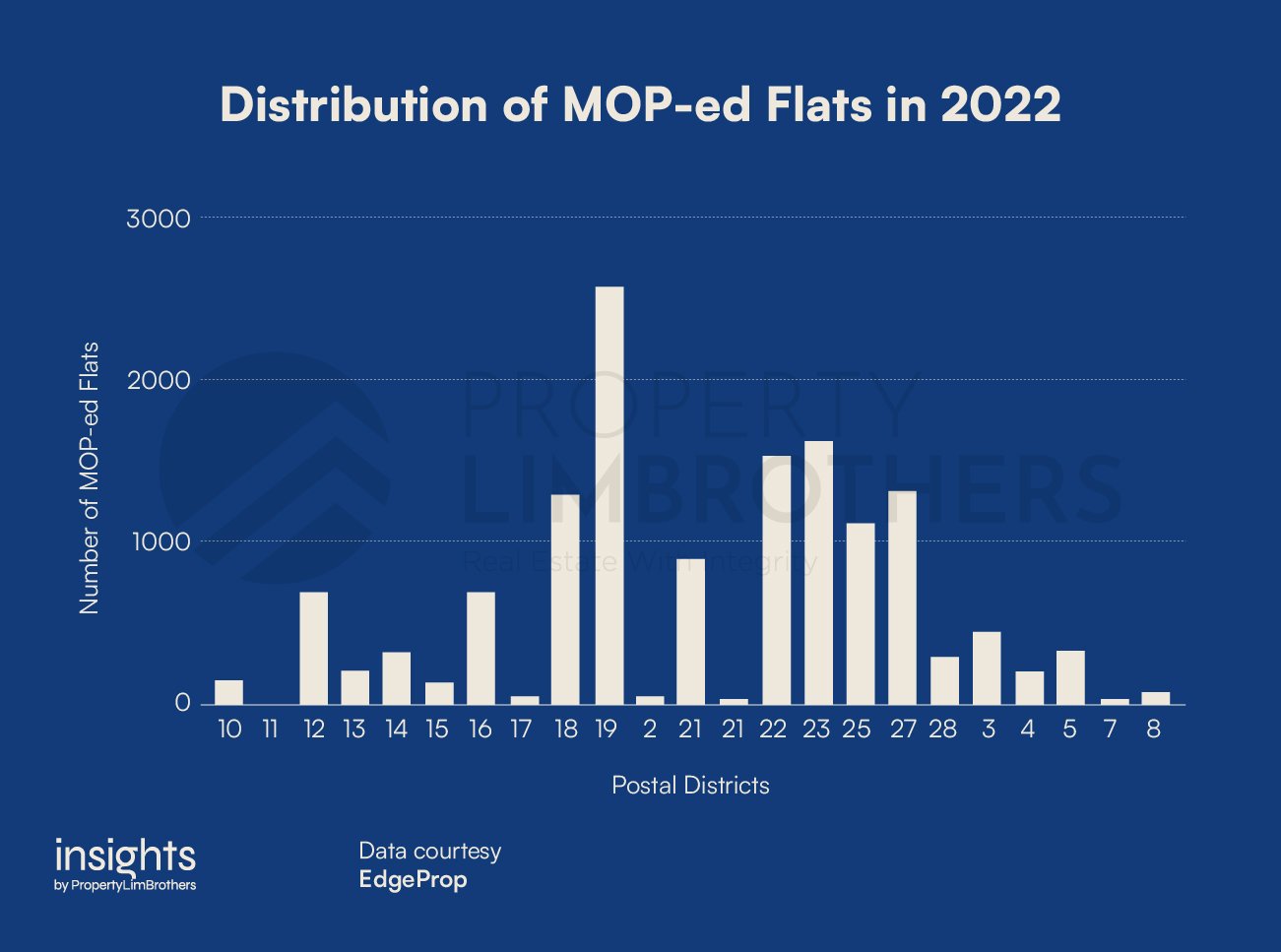

Before we dive right into the impacts on the resale market, we need to know where the surplus of the HDB MOP flats is located.

We zoomed in on the number of freshly MOP-ed units in each district throughout 2022. Overall, Punggol, Jurong and Choa Chu Kang in districts 19, 22 and 23 respectively have the highest MOP flats. Coincidentally, these three districts are all non-mature HDB estates.

Typically, non-mature HDB estates are less than 20 years old and are less developed than mature HDB estates. Eventually, non-mature HDB estates will be more equipped with amenities and infrastructures, maturing over time. Recently, more people gravitate towards non-mature estates for the following reasons:

-

More upcoming developments such as the Punggol Digital District, Jurong Lake District and Jurong Region Line at Choa Chu Kang

-

More affordable price points

-

Higher number of newer clusters with a longer balance lease

-

High growth potential

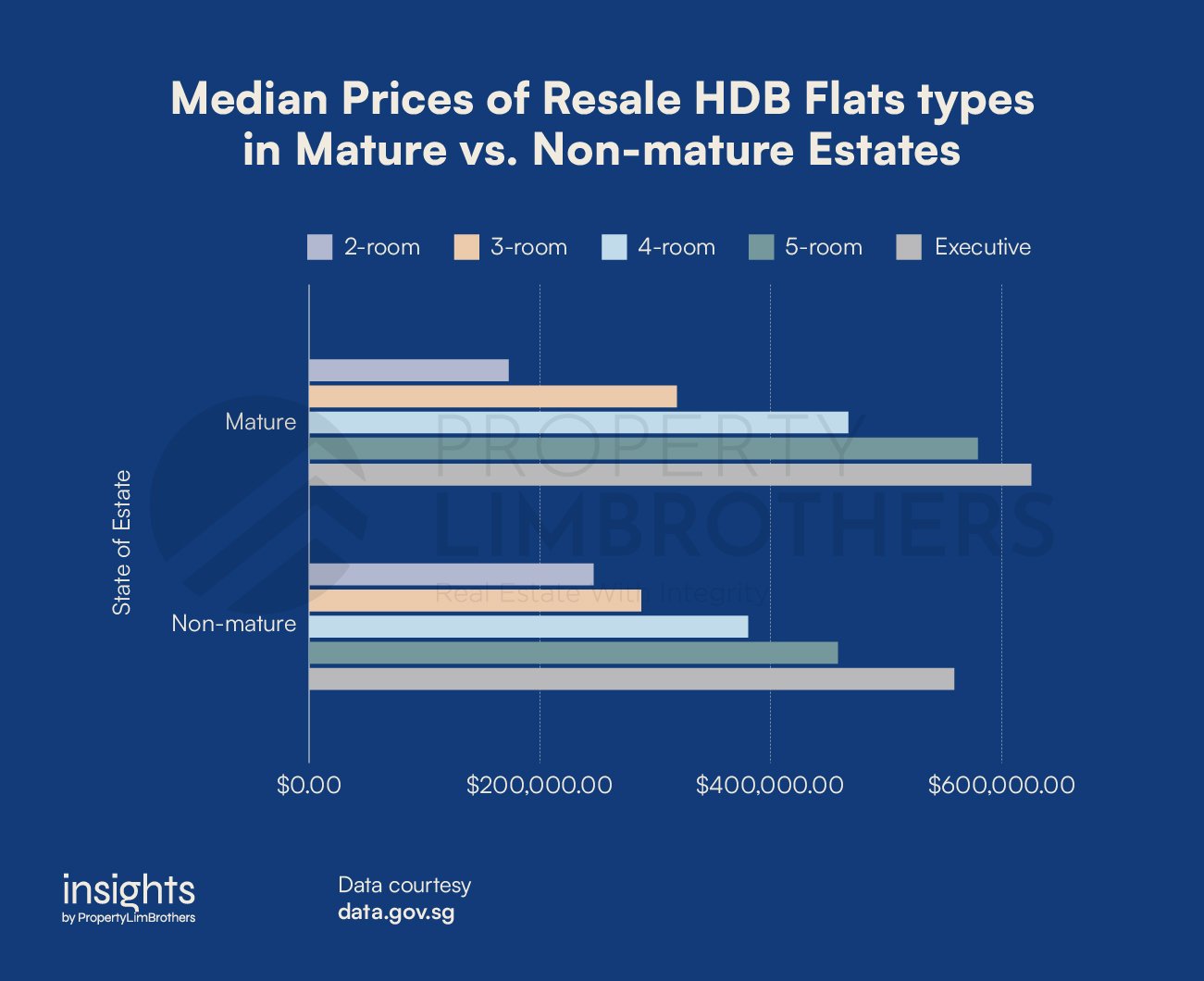

The prices of resale flats in non-mature estates are becoming more and more comparable as smaller bedroom types are outpacing those in mature estates. This hints that there is a growing preference for flats in non-mature estates, contributing to the rise in prices. Generally, we see a similar increase in median prices across all flat types in both mature and non-mature estates. 1-room flats are omitted because they are usually rented out. The median prices of all flat types in mature estates supersede those in non-mature estates except for 2-room flats, which are more expensive in non-mature estates. Why is this the case?

Back in September 2013, a change in HDB policy allowed singles aged 35 and above to purchase BTO 2-room flats. This new policy mitigates the housing needs of singles previously who could only buy a BTO or private property. As such, a significant number of 2-room flats were built mainly in non-mature HDB estates such as Punggol to meet the surge in demand. This addition to the supply of HDB flats trickles down to the HDB resale market upon reaching its MOP. The high prices of the 2-room resale flats in non-mature estates can be attributed to the rising proportion of singles who remain single by choice or get married later.

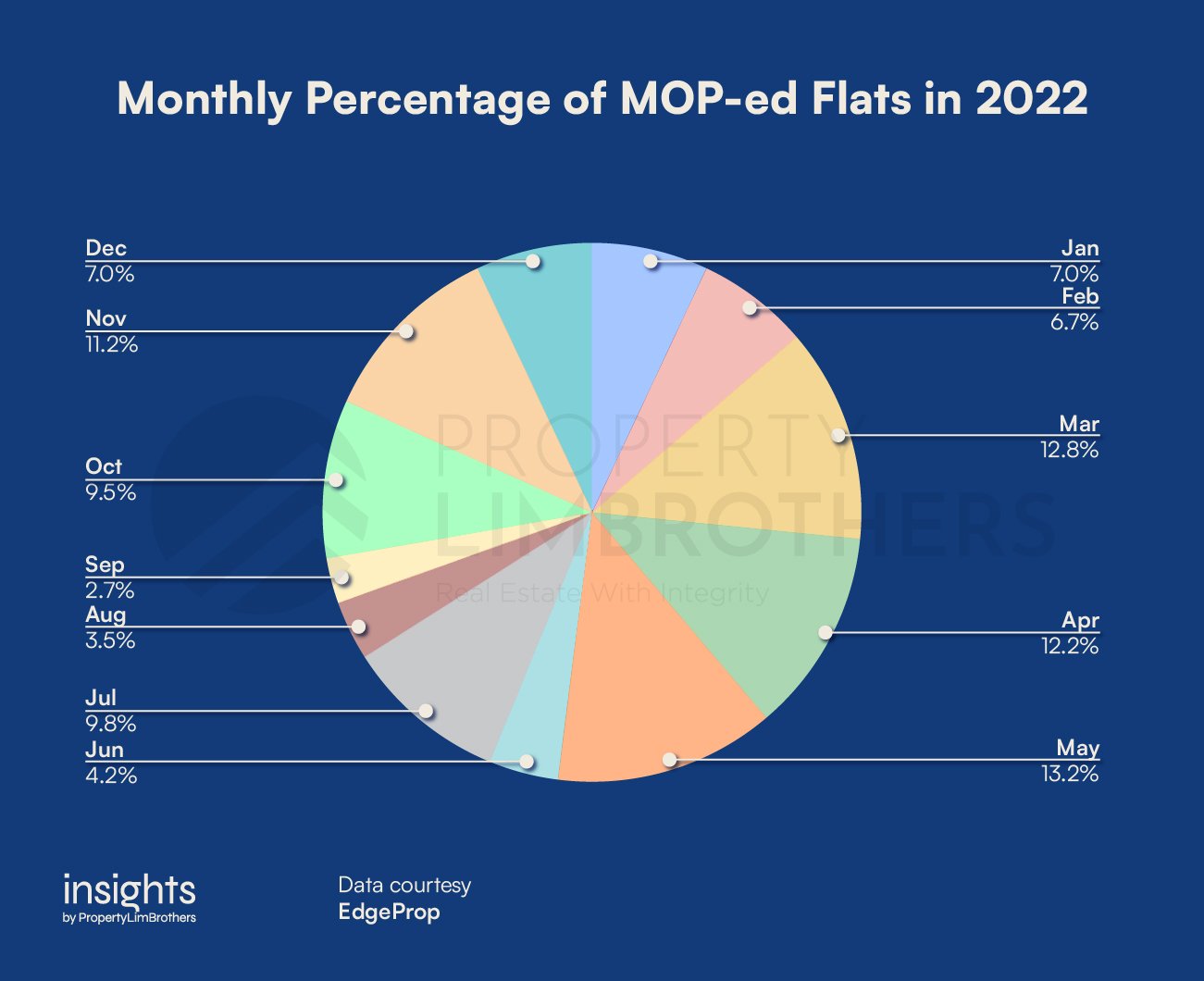

The bulk of the HDB flats to reach MOP was the greatest from March to May this year. How would this impact resale HDB prices? Will prices continue to rise? Moving forward, we foresee a spike in resale HDB prices due to the reduced number of MOP-ed flats in June and July compared to the previous months.

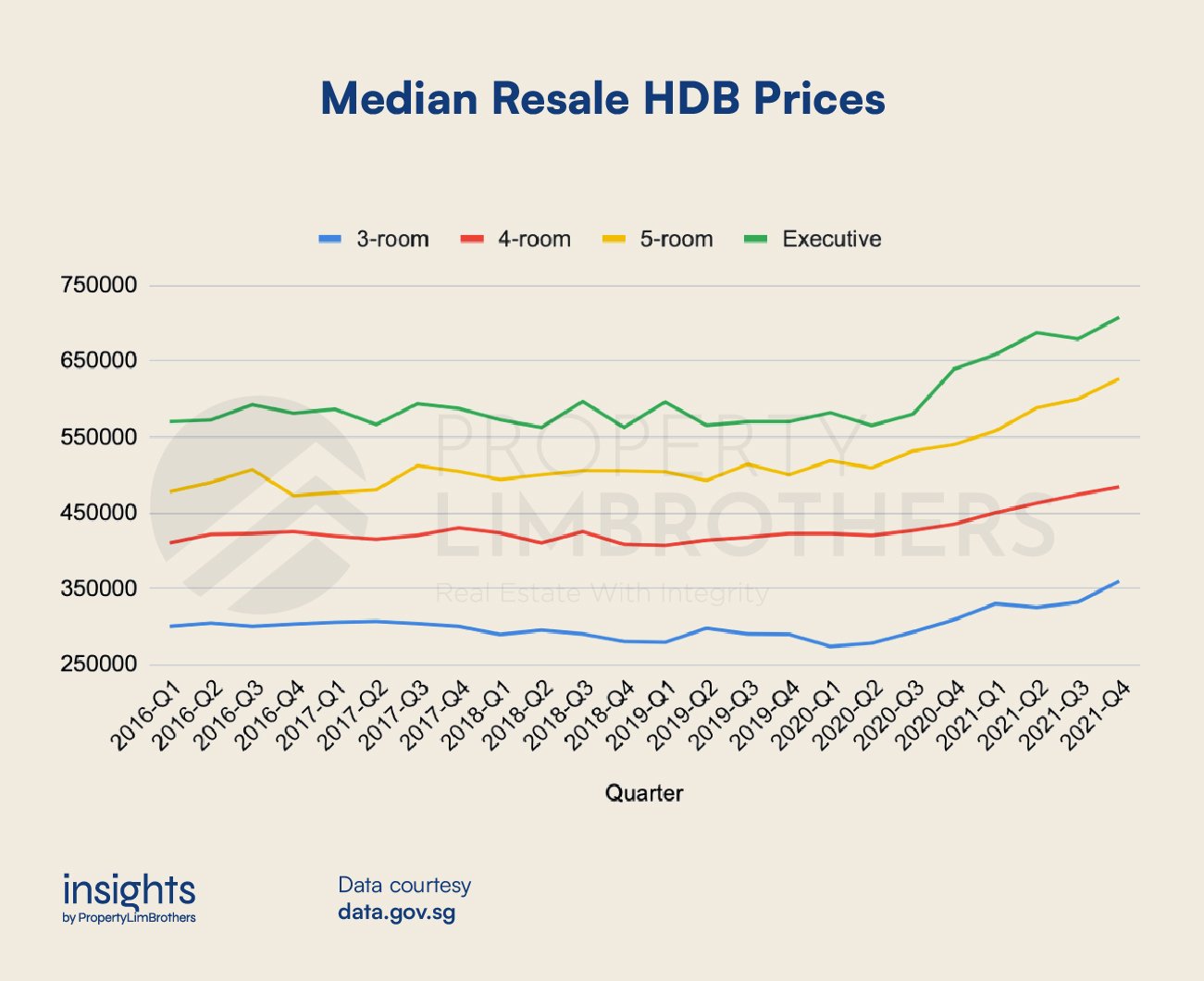

Generally, the median resale HDB prices increase over time for 3, 4, 5-room and executive flats.

When the Covid-19 pandemic struck in 2020, the median prices across all flat types soared, with 3-room flats showing the most significant increase in prices of 31.6%. Median resale HDB prices increased by 14.6%, 20.9% and 21.6% for 4, 5-room and executive flats respectively. This demand fuelled by low-interest rates propped up prices further.

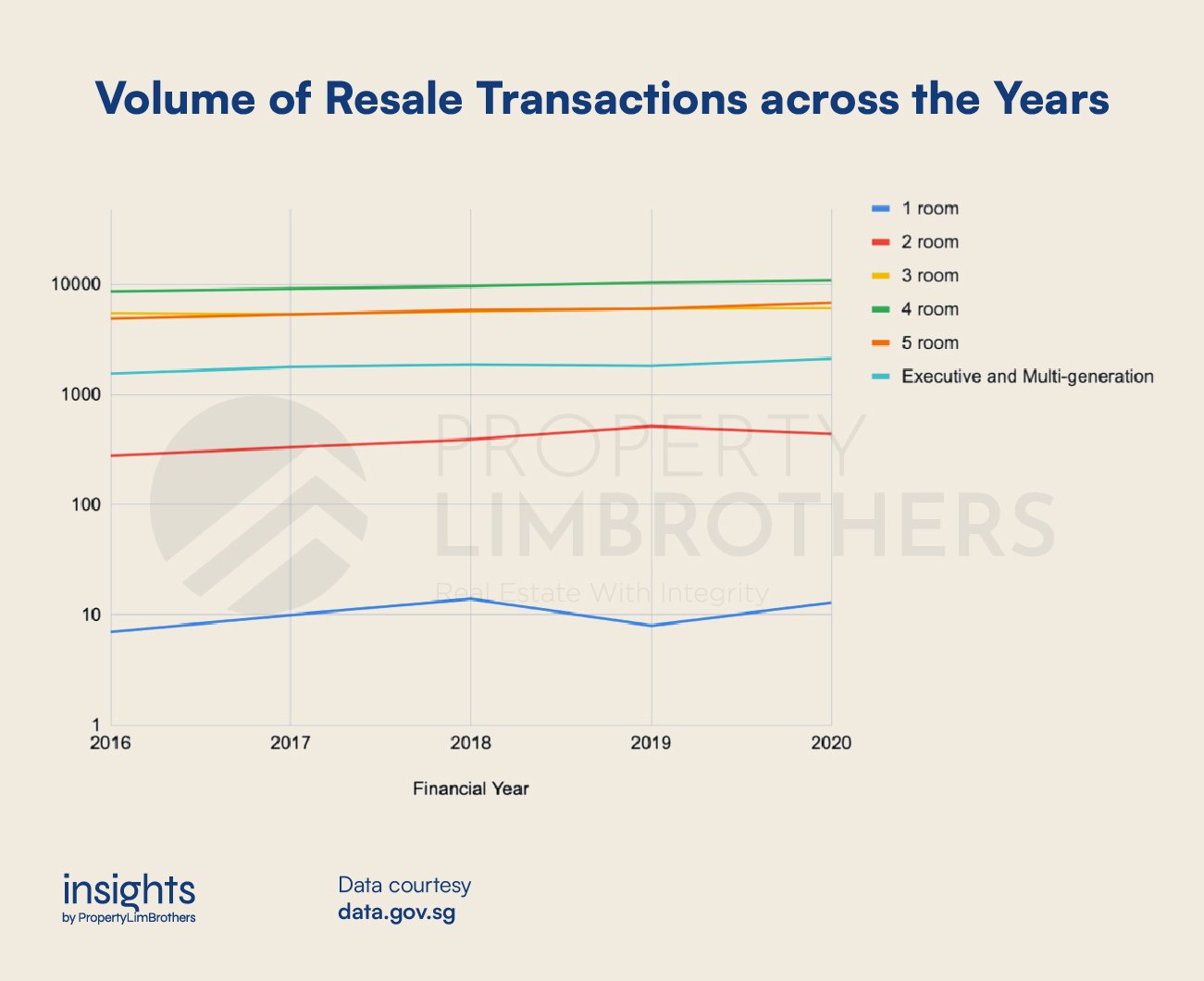

Regarding resale transactions, 4-room flats have the highest transaction volume, but this may result from a larger proportion of 4-room flats being built compared to smaller room types. Usually, a smaller proportion of 1-room flats would be constructed as it would most likely be rented out.

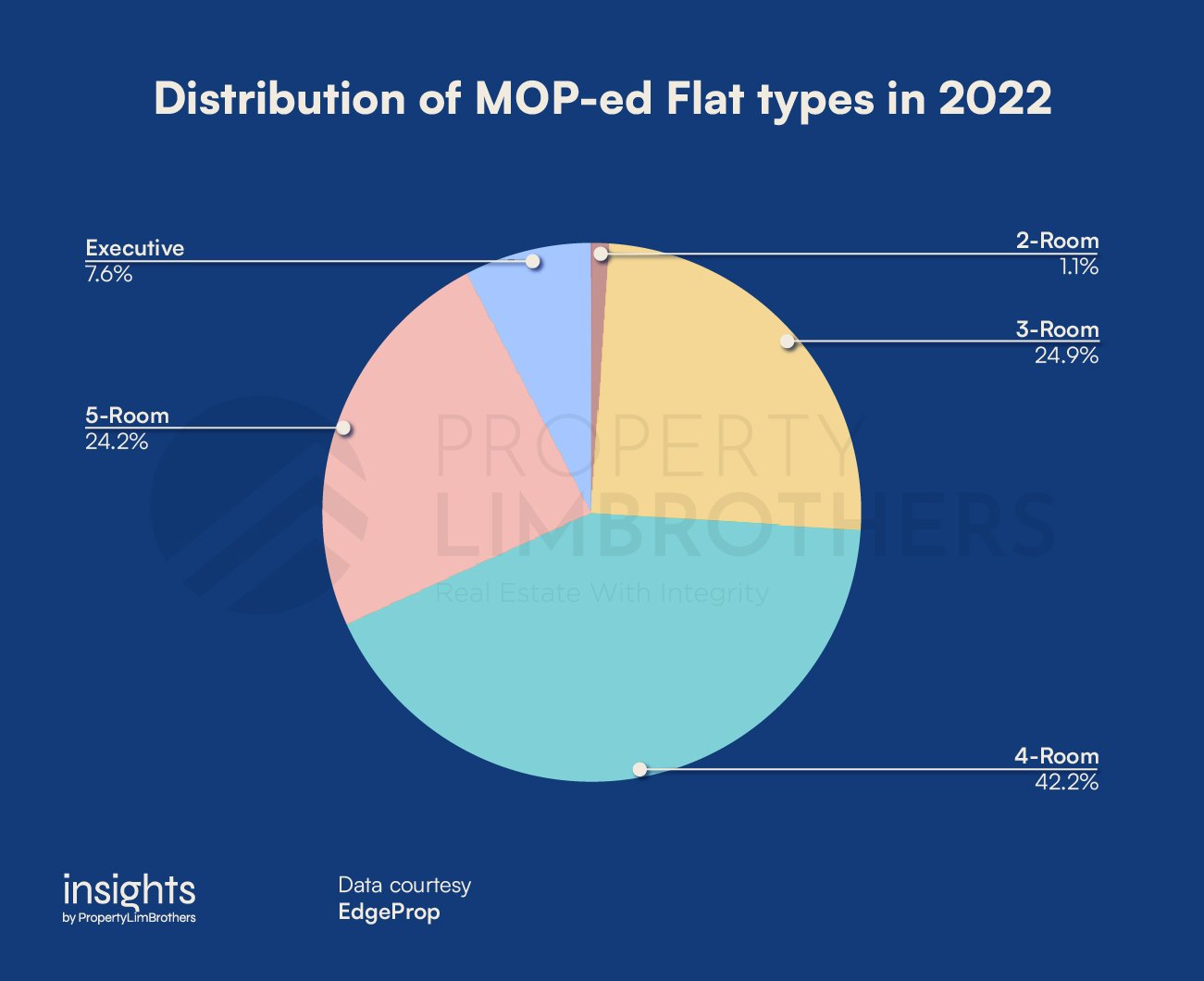

So does the surplus of freshly MOP-ed flats meet the rising demand for resale flats? Focusing on MOP-ed flats, the 4-room flat type accounts for the most considerable proportion of the entire bulk (42.2%). Other dwelling types soon hitting MOP include 1, 2, 3, 5-room, executive, jumbo and terrace HDBs.

Last year, there was a sizable number of HDB MOP flats amounting to more than 20,000. Dipping this year to slightly more than 14,000, the reduction in the resale flats’ supply may push prices up further as demand remains strong. How would this year’s supply of resale HDB flats serve those waiting for their BTOs? This brings us to the next section of the article.

What does this mean for people waiting for their BTOs?

Since the beginning of the Covid-19 pandemic, most BTO projects faced delays owing to the stricter border measures, manpower crunch and supply chain disruptions. Unfortunately, some contractors have pulled out of their respective BTO projects due to financial difficulties. This is seen in the Marsiling Grove project, where the contractor Greatearth discontinued operations. This has stirred concerns amongst those waiting for their BTO flats, disrupting their life plans. The Housing and Development Board (HDB) has been actively searching for a replacement to continue operations without compromising the safety and quality of the BTO flats. Even though the waiting times of BTOs are projected to be reduced in the next few years, the construction sector has not fully gotten back on track to pre-Covid 19 days.

The surplus of HDB MOP flats can be a potential alternative for those considering letting go of their BTO bookings due to the long waiting times or those looking to move in immediately. Why consider these freshly MOP-ed HDB flats? The newly MOP-ed flats will serve the BTO pool of buyers searching for a relatively new house with minimal renovations. There is a much higher chance of fitting one’s desired location because these resale flats can potentially be found at all locations. They are sold in the open market and the transaction duration is much quicker than waiting for a BTO. In contrast, BTO flats typically have limited location choices and buyers often cannot get a flat in their desired town unless they are very lucky.

In a past article, we mentioned that if you have found your “dream home”, we advise against timing the market but snag up that particular property as no two properties are the same.

Are you considering Right-Sizing?

Are you fully utilising all the rooms in your house? Or have your children moved out, leaving you with some empty rooms? If your answer is yes, perhaps it is time to consider right-sizing. Before we dive into right-sizing, we have to point out that there is a difference between right-sizing and downsizing. Commonly associated with negative connotations, downsizing is often seen as undesirable. However, suppose you view it as right-sizing. In that case, you are trying to find an environment that best suits your needs without stressing yourself out with the unsustainable debts you have taken to finance your purchase of an enormous house. It is all about figuring out what you need. Do you really need a huge house? It only translates into higher maintenance costs and utility bills. So if you are thinking about right-sizing from a landed property or private condominium into a freshly MOP-ed HDB flat, this section is for you.

As they say, less is more! Right-sizing allows you to save on your homeownership fees and most importantly, free yourself of financial commitments. It may seem like a compromise initially, but it is beneficial in the long run. Apart from cost savings, it also brings your family closer together. Usually in a large house, everyone just goes straight to their rooms without much interaction. The common areas promote family bonding because of a more compact layout by right-sizing from a landed property, condominium, or a larger HDB unit to a smaller HDB unit.

Motivated by the elderly, the government has implemented several schemes, such as the Deferred Downpayment Scheme (DSS). This scheme assists them by deferring their downpayment until the keys to their next home are collected. This is especially beneficial for elderly homeowners, easing their cash flows and smoothening their right-sizing process. On top of that, flat buyers intending to use their sale proceeds from their existing home to fund their purchase without taking up any loans are eligible for the Temporary Loan Scheme (TLS). This scheme not only eases cash flows, but it also facilitates the seamless transition from their existing home to their next one.

Final Thoughts

We have looked at the possible impacts of a vast surplus of HDB MOP flats, how it serves the BTO buyer pool and right-sizing. The question is, should you sell your HDB now? Knowing where your property stands on the property market cycle is crucial in making an informed decision.

Following the property cooling measures back in December last year, the tighter Total Debt Servicing Ratio (TDSR), higher Additional Buyer’s Stamp Duty (ABSD) and the lower Loan-To-Value (LTV) ratio was implemented to curb the heated property market. However, it was not enough to curb price increases. Demand remains resilient. Hence, prices are set to increase for ready-made houses.

From an investment standpoint, we support the hold decision rather than the sell decision. Of course, this depends on the unique traits of each property, your financial circumstances, and your life goals. The property market is predicted only to get hotter, escalating prices and allowing you to reap more profits further down the road.

If you have any questions about the specific property you are holding or want customised analysis and advice on your situation, you can contact our experts here. We hope this helps on your property journey!