What are some key factors that a property investor would need to keep in mind before buying a property with the intention to rent out for yield, while waiting for capital appreciation?

Here, you should take note that there is a difference between gross rent and nett rental yield. If you rent out your property at $3000 monthly, $36,000 annually, your entry price is $36,000 divided by your purchase price. This is the gross figure, but from an investor’s perspective, holding a property for rental purposes would mean some other costs that you will incur, and thus should be taken into consideration.

Your first cost would be a 25% down payment if this is your first property, or an ABSD if this is your second property. Other acquisition costs include legal fees (usually amounts to around $2000), and buyer’s stamp duties. Furthermore, you will be subjected to running costs, like maintenance fees, which eat into your rental yield. Annual property tax, determined by IRAS every year, is 10%. Agency fees to market your property and find tenants are payable to your broker. You will also have other miscellaneous (but not necessarily minute) costs like repair costs. As a property investor, you need to be prepared to set aside a buffer in funds to cover all these costs.

Another important factor we should pay attention to is the vacancy rate—the average period that your property is left empty without a tent in between tenancies. When your property is left vacant, you would still have to continue paying for the instalments, and during this vacancy period, without any rental income you would have to fork it out of your own pocket. By looking at the number of rental transactions in the development, vis-à-vis the number of competing neighbour units, we can find the approximated vacancy rate. Another method is to look at previous records of how long, on average, the rental property has been in the market. This data is usually collected from our subscribed sources.

Another important factor is competition from nearby projects, which are, for instance, near an MRT station like your property is. This widens the range that your potential tenants have to choose from, and therefore poses a threat to your vacancy rate, as well as rental prices.

Oftentimes we hear that some developments are popular with Korean expats, and some others are popular with Australian and American expats. We call this a grapevine—we hear by word-of-mouth about the demographics or other characteristics of particular developments or areas. This may affect your future vacancy rates and rental pricing as well.

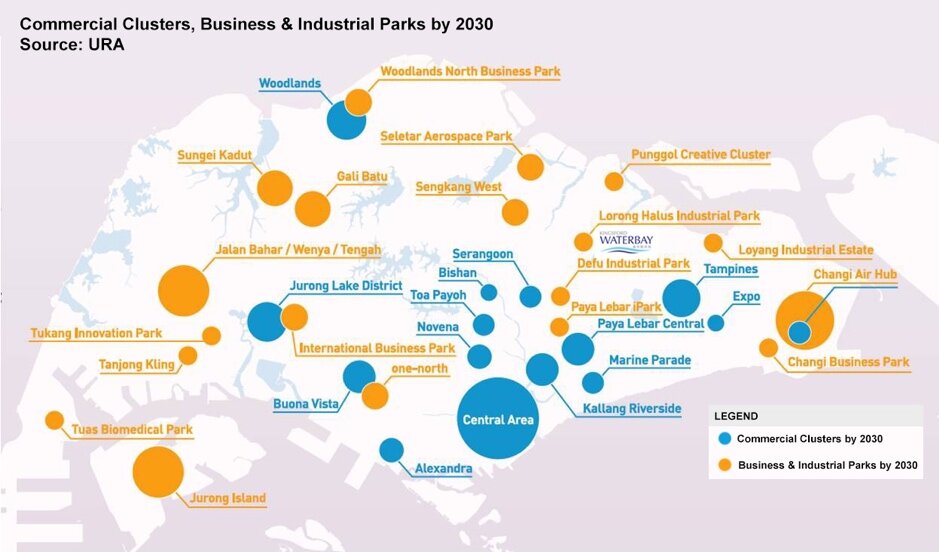

Of course, accessibility is an important factor. For example, staying close to the workplace or near an MRT station, is crucial in reducing travelling time. This is partly why developments near the CBD area are popular among expats who work at CBD. If you look at the future commercial clusters in Singapore (see the figure below), it would be likely that developments near these clusters would have large tenant pools.

Last but not least, is the schools factor. Many expat families with children, whom will attend international schools near their place, will therefore want to stay near the international schools. On the other hand, local families will be looking to stay near good local schools, so that they can qualify their children for these schools. Therefore, the demand in these areas with international schools and reputable local schools will remain high, in terms of both sales and rentals.

It is essential to think like a tenant. If you are an expat, coming to Singapore with your family, or alone, what will your thought process when deciding on a place for your stay? When you reverse engineer in this manner, you will likely be able to think of these important factors more easily. Look out for these key factors when choosing a property to purchase as your investment. The property should be highly desirable and easily rentable for your future tenants.

If you would like to exit this property market in the future, is there anything you can point out as plus points of your property to potential buyers? You may also want to consider other factors like the potential capital growth of the property investment you are interested in. Do the numbers make financial sense to you? Is this the rental yield you are targeting?

It is crucial to think twice, and think again about each and every one of these factors.

All the best for your future property investments.