There are several landed enclaves that are especially popular with homeowners looking to own a piece of land. However, are all of them the same? Join us in this first installation where we review the performance of the District 19 Landed Housing market over the last 10 years.

District 19 is one of the largest districts in Singapore, which consists of Serangoon Gardens, Hougang, Sengkang and Punggol. It would then come as no surprise that D19 also has a larger number of landed properties. Most of the landed properties are consolidated around the Serangoon Gardens and Kovan area. When considering to move into a landed property, D19 is definitely one of the top considerations. With the multitude of sought-after schools, abundance of food establishments and proximity to the Central area, buyers usually face stiff competition when hunting in this area. But the more important question is, how has the landed market performed over the last 10 years? And is it worth your investment cost? Let’s find out!

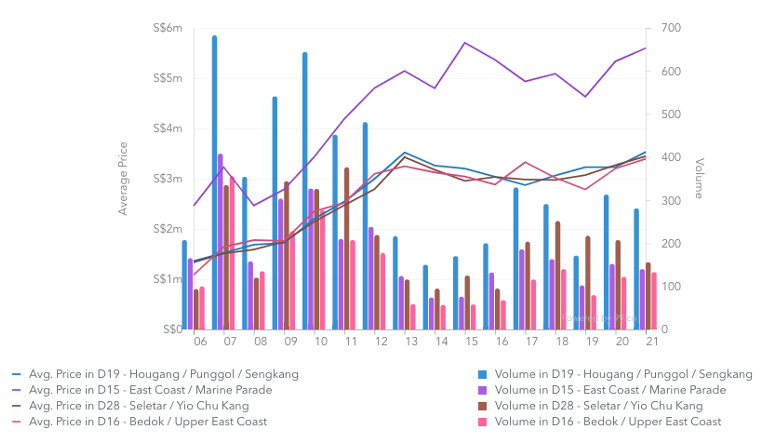

Transactional Volume

Transactional volume in D19 has constantly surpassed other districts. Given the mass supply of landed properties in the area, this is well expected. In any given market, having the right volume could enhance the profitability of the investment. With an oversupply, prices may deflate. On the other hand, a lack of supply will sometimes lead to inflated prices. This is exactly what we can observe that is happening in D19. Given the volume of transactions, the popularity of D19 is considerably the best in Singapore. However, we can also observe that prices are a notch below that of District 15. Of course, D15 has other driving factors that allow it to command a different pricing level, but that is a topic for another article (teaser).

Coming back to our focus on the performance of D19 in the last 10 years, we think it is pretty safe to say that even though prices may not climb as steeply as areas with a lower supply like D15, entering and exiting the market would definitely be much easier in D19 with a high volume of supply & demand across the years. This would be encouraging for newer buyers who are looking to enter the landed market. Afterall landed housing, while economically sensible and relatively future-proof, might not be for everyone. Some would still prefer to live in high-rise private developments, or even integrated developments if only considering the private residential market.

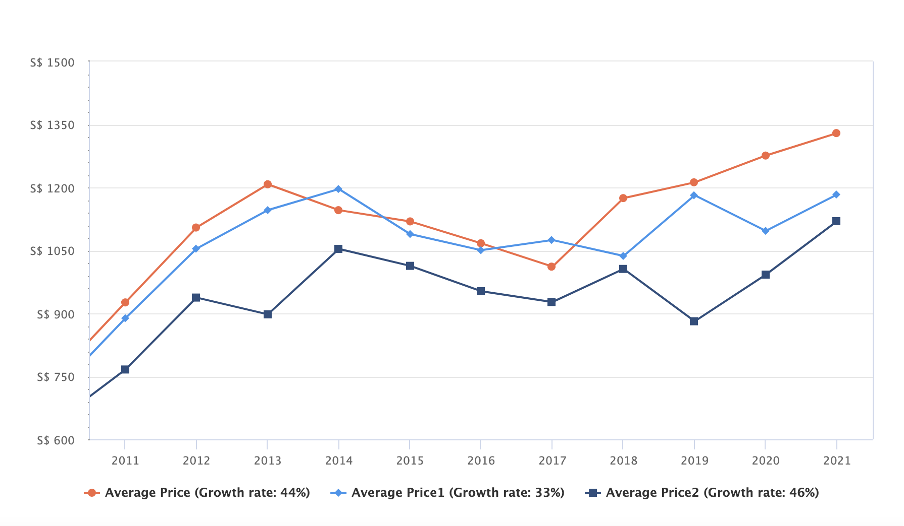

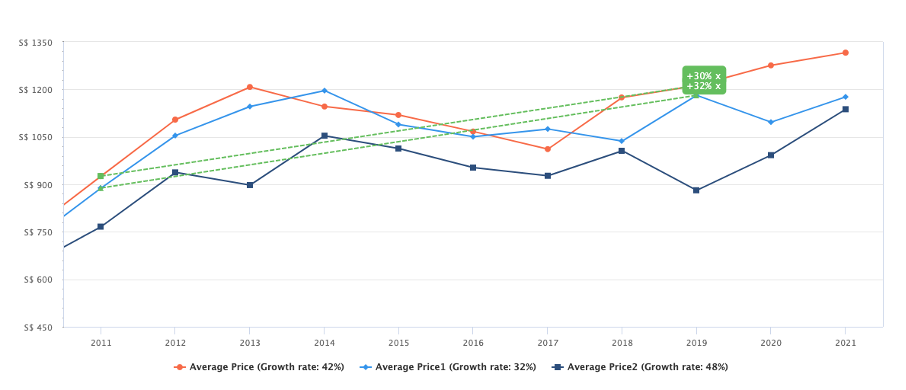

Performance across types

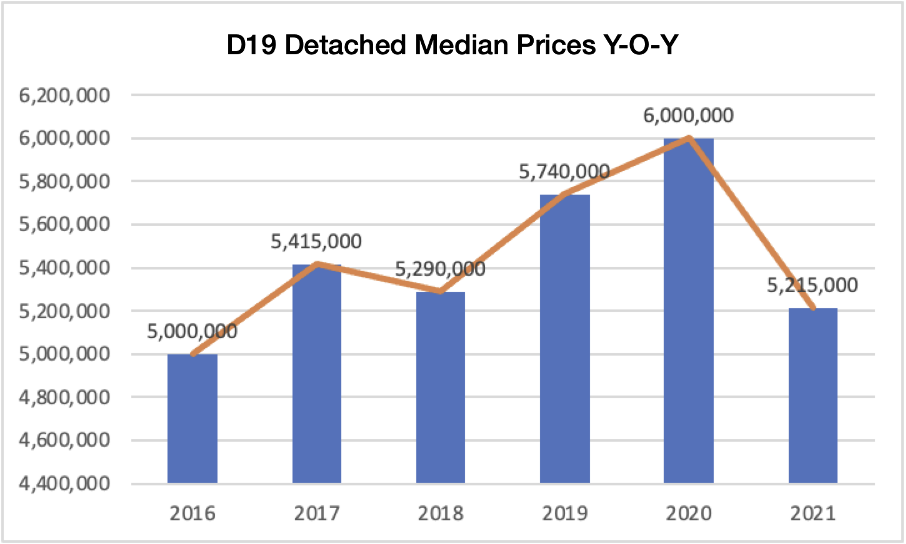

The orange index represents Inter-Terraces, light blue for Semi-Detached houses and the darker blue is Detached houses. For the benefit of those who are relatively new to the landed market, yes the darker blue is indeed detached houses. Detached houses are usually built on larger plots of land. If you were to calculate PSF using the larger plot of land, technically it will be lower than using a smaller plot of land. Does that mean that detached houses are cheaper? No. Detached houses usually command a higher quantum as well, depending on their land plot size. Detached houses were also the best performing type of landed housing over the last 10 years at a growth rate of 46%. Although D19 does not have any Good Class Bungalow Areas, there are still a good number of detached houses given its vast area. Not only sought after by homeowners but also developers who seek to purchase these plots of land and redevelop them into a stretch of inter-terraces or a bundle of semi-detached houses. Hence, the quantum in this type of landed property is usually quite high because of the redevelopment potential and the rarity of these larger plots of land.

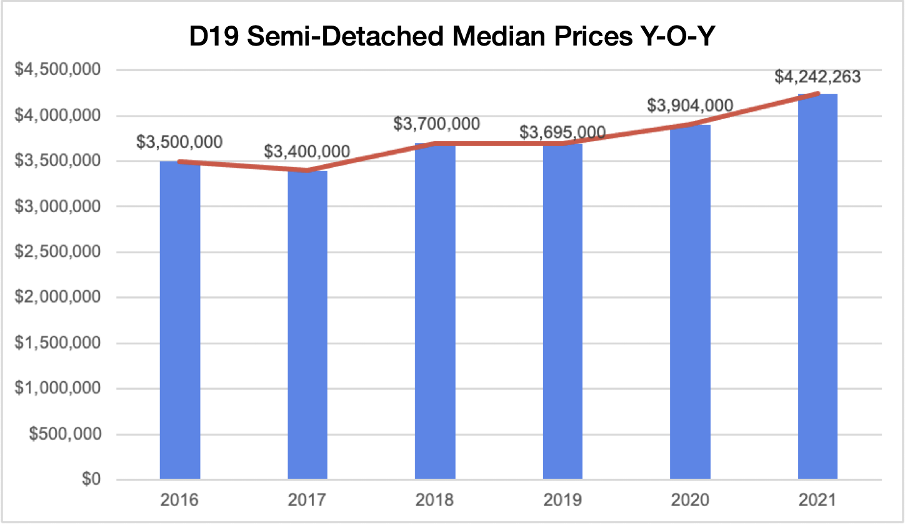

Coming back to the majority type of landed housing, inter-terraces and semi-detached houses. Inter-terraces usually make up the largest supply of landed housing in many districts. Just because they require lesser land area to build on and is the most space-efficient type of landed housing utilizing the most of any land plot, due to having lesser setback requirements. WIth semi-detached houses, there are front and back plus side setback requirements. It is also because of these requirements that you may end up with a relatively similar build-up area in a semi-detached house compared to an inter-terrace, even though you have a larger plot of land. This is why the prices of semi-detached houses and inter-terraces are often intertwined. Because when buyers want to upgrade into the landed market, their main concern is often the amount of build-up space they can get. There are some years where it would make more sense to pay for the extra land when the average PSF of semi-detached houses are lower than inter-terraces. Then there are also other years where if you just want the build-up space, inter-terraces would be the cheaper option.

If we were to purely base our observation of the performance between inter-terraces and semi-detached houses from the year 2011 to 2021, it would seem that inter-terraces outperforms semi-detached houses by an eye-catching 10%. But if we were to just pull back the comparison 2 years back, semi-detached houses actually performed at a similar rate as inter-terraces. A broad observation across the 10 years, we can also see that the average prices of the 2 types have always been intersectional. It is almost like the 2 are playing a cat and mouse game, with one playing catch up and the other running ahead. This observation implies that the prices of semi-detached houses are on a gradual increase and are poised to catch up with the inter-terrace houses because it now makes more economic sense to purchase a larger plot of land for a cheaper price per square foot. Until the time where semi-detached prices reach a similar level as inter-terraces and are no longer viewed as a bargain, we believe that the demand for semi-detached houses will be on the rise.

At this point, it would be prudent to remember that, as we have already mentioned, the land plot for semi-detached houses are usually larger in size, which means that they will be of a larger overall quantum. Inter-terraces will still have their own audience because of the lower quantum they offer. At the same time, inter-terraces are often viewed as the entry-level of landed housing for those new to the market and is a more palatable quantum for those who are unfamiliar with the landed market. Inter-terraces will likely still gain their audience from upgraders who are looking for more bedrooms or more space and are considering perhaps between a 4- or 5-bedder compared to a landed house. This would then bring into question, will your money be better placed in perhaps a condominium development?

Landed vs Condo in D19

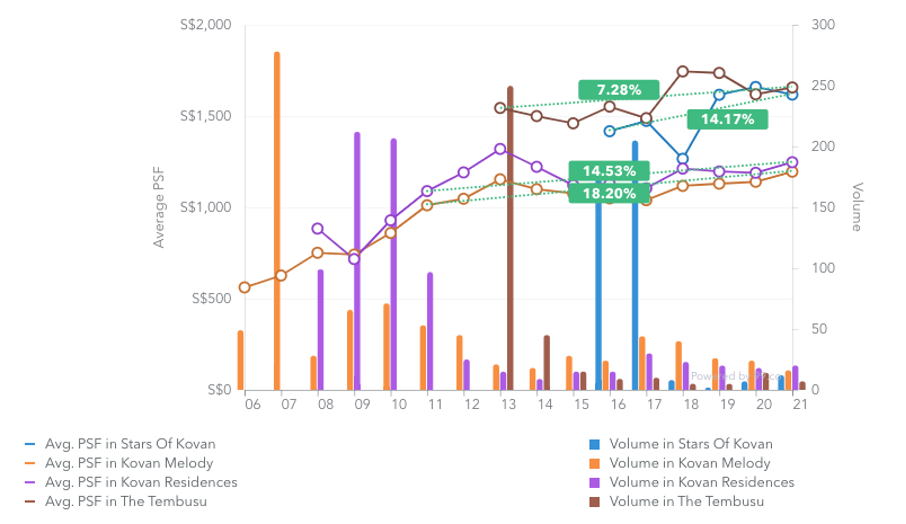

For the purpose of a precise comparison, we will be referencing the landed enclave nearer to the Kovan MRT Station to better portray this example. The developments in the immediate vicinity of the landed enclave would consist of the better-known developments like Stars of Kovan, Kovan Melody, Kovan Residences and The Tembusu. Just for reference, the first 3 developments mentioned are 99-year leasehold, and The Tembusu is a freehold development. Stars of Kovan and The Tembusu are still relatively young developments, so for the sake of comparison, we will be using the earliest possible data of price, which is at the respective launch years. The 4 projects have all seen an overall gain if you were to enter into the development at the respective time periods. The 2, which are closer to the Kovan MRT Station, have outperformed the other two even at a 10-year indication of their gain in average prices at about 14% and 18%, respectively. If we were to consider these 2 developments in the same 10 year holding period, technically, your money would have performed better in a landed property in the same district by 3 times. Furthermore, Kovan Melody and Kovan Residences are 99-year leasehold projects, which means they will inevitably reach a tipping point of lease decay which will cause prices to drop.

However, Condo developments will still have their dedicated audiences for several reasons. Firstly, you do not have to bear the entire cost of maintenance of your compound/home. Whereas in a landed property, you will have to bear your own cost of painting, landscaping, pest control, etc. Secondly, you get better views. With landed houses being able to reach a maximum of 3.5-storeys, a unit on the 5th level of a condominium could already overlook a landed enclave. Lastly, the facility options. If you want a swimming pool at home, you will probably have to look towards semi-detached and/or larger land to have a sizable pool. All these factors considered, if you can live without or compromise to a certain level, would then open up the landed market to your consideration. But the problem starts to get complicated when a house with fewer bedrooms is almost the same price as a landed house. Take The Tembusu, for example, 3-Bedders are already going for the upper tier of $2 million, approaching the $3 million mark. For the compromise of no facilities over having 2 or 3 more bedrooms, buyers hunting around D19 will face a dilemma of what the heart wants over what the head knows. The Tembusu, which has still appreciated since their sale launch, has been the least performing development in our comparisons at 7.28% over 8 years. Purely from the standpoint of making your money work the hardest, the landed market has outperformed the private developments in D19 by quite a substantial amount. But we have also mentioned earlier that landed living is not for everyone, and there are still homeowners who would prefer living in the skies, just as the case of The Tembusu has presented even though it has a similar price tag to landed property. It would be interesting to see how much further the initial investment in the area can be pushed when the Cross-Island line is completed, which will provide enhanced connectivity for the D19 residents.

All Types in D19

In one of our earlier articles, we spoke about how the need for space has propelled prices in the landed market over the course of the pandemic. Our Insights Research Team has taken the liberty to piece together the prices of all landed types in D19 over the last 6 years against where it currently stands. Although we are currently reviewing the performance of the landed market over 10 years, in our opinion, the recent prices are a better representation of the current market climate.

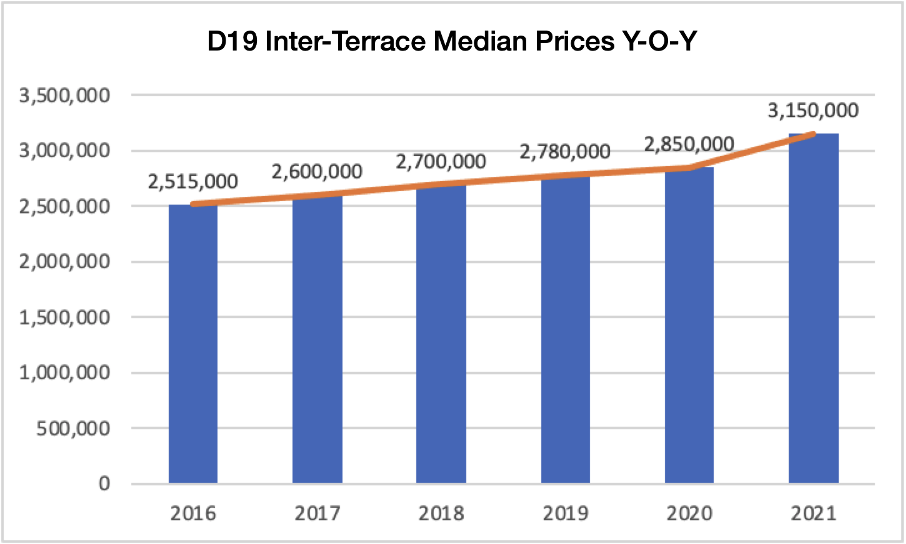

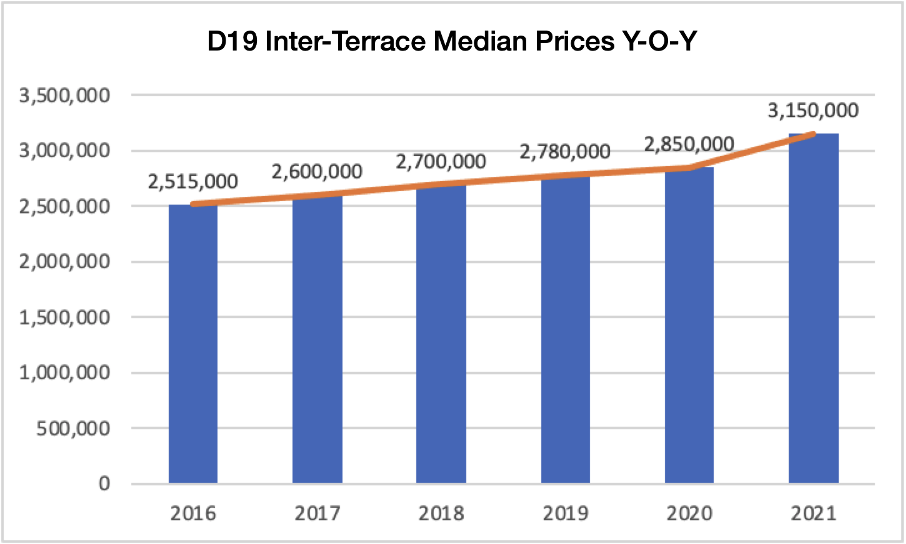

Inter-Terraces

From 2016 to 2020, there was a gradual increase in median prices, but since the pandemic has hit, we observed a steep climb of $300,000 increase in the median prices. If we were to put things into perspective of how significant this is, the total increase in median prices from 2016 to 2020 was about $350,000. This means that just in a single year, prices jumped the equivalent of the previous 5 years. This is a very powerful indication of how quickly the market is moving. Another reason for the price increase is also the limited supply of landed housing. The demand is clearly overweighing the supply, and in order to secure a unit, buyers would have to pay the highest possible price in order to secure the unit. Furthermore, as we have mentioned, if a 3-bedder in a high-rise development is at a similar quantum to that of an inter-terrace, inter-terraces will now be under consideration by these buyers who are looking to upgrade into the private market as well. Overall, we are quite optimistic about the inter-terrace demand in D19 given its locale and relatively palatable quantum in comparison to every other region in Singapore.

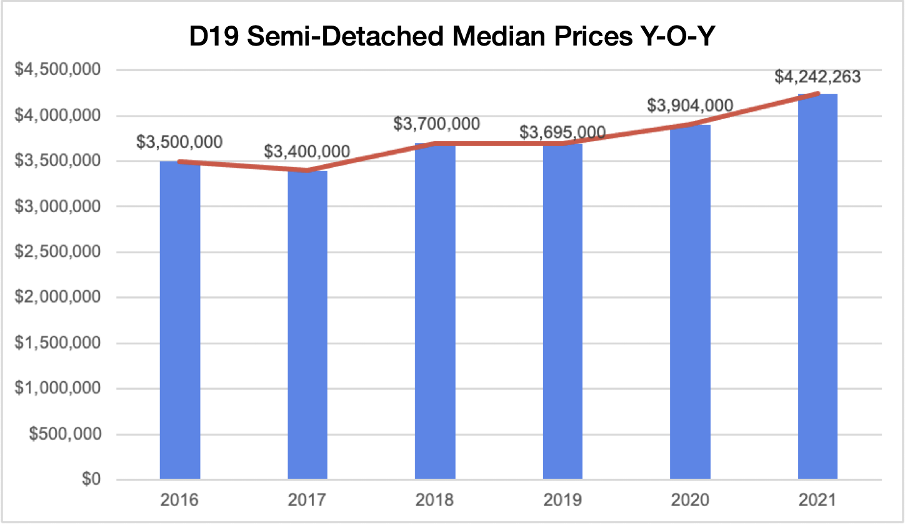

Semi-Detached

If you have been keeping up with this article, you may have noticed that we have not mentioned one other type of landed housing, and that would be Corner Terraces. Corner Terraces have similar traits as a semi-detached house, where you have a single party wall and a setback requirement on one side of the land. Hence, the two are typically grouped together, with their prices being very similar. From our research done by our Insights Team, we also noticed a similar increase in median prices between 2020 and 2021 at about $350,000 to that of the time period of 2016 to 2020 at about $400,000. This further emphasizes that the entire landed market is collectively in a pandemic fuelled acceleration. Once again, we would like to mention that inter-terraces and semi-detached houses have an intersectional relationship. Almost as if there are seasons for the respective types. Semi-detached houses also have an advantage in relation to this intersectional relationship because they are not only being considered by new buyers in the landed market, they would also attract those that have exited from their inter-terraces and are looking to upgrade to reinvest back into the landed market. However, the price performance of the semi-detached houses is relatively lacklustre considering that inter-terraces fetched a similar increase in prices of about $300,000 at a lower quantum. On a percentage comparison, as we have highlighted in one of the earlier charts across 10 years, inter-terraces saw a 44% growth rate while semi-detached houses are at a 33% growth rate. Hence, we believe that in the following years, from 2022 to 2023, semi-detached houses will likely have the best growth rate, which will position them in a similar performance position as inter-terraces.

Corner-Terraces

Sandwiched between inter-terraces and semi-detached houses are Corner Terraces. Buyers typically prioritise semi-detached houses over corner terraces given the same plot size. Although both houses are very similar in nature in terms of the facade and built-up areas, to the untrained eye, they may look and feel the same with no difference at all. Technically they are still inter-terraces, but just that they are positioned at the end of the stretch. Hence, there is provision for side setback requirements and you can utilise this space as you would in a semi-detached house. But because it is at the end of a stretch of inter-terraces, sometimes the placement of the house is not as prime as you would have in a semi-detached house. However, because the prices for inter-terraces have been picking up steam which in turn drove semi-detached prices up as well. We have seen popularity pick up based on ground feedback. Buyers these days are also more open to considering corner terraces because they form that sweet spot of having a large land plot and yet being at a suitable quantum for consideration. Although landed housing has this “status symbol” that comes with the house, we have noticed that this traditional perspective is not as prominent in younger buyers these days. The added bonus for corner terraces is that they are a rarity of their own, with only 2 on each stretch of inter-terraces. Whereas you may have a whole stretch of semi-detached houses. We believe that corner terraces will continue to pick up steam within buyers who value the space.

Detached

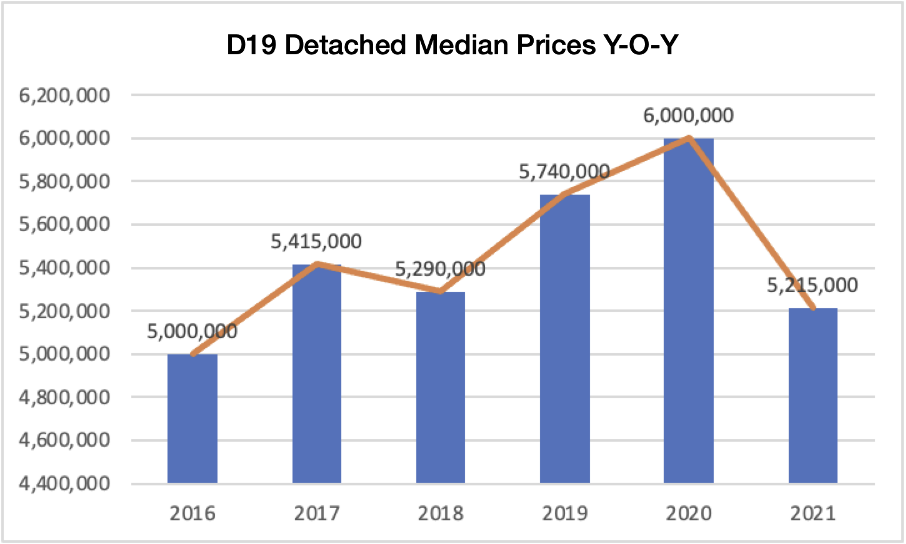

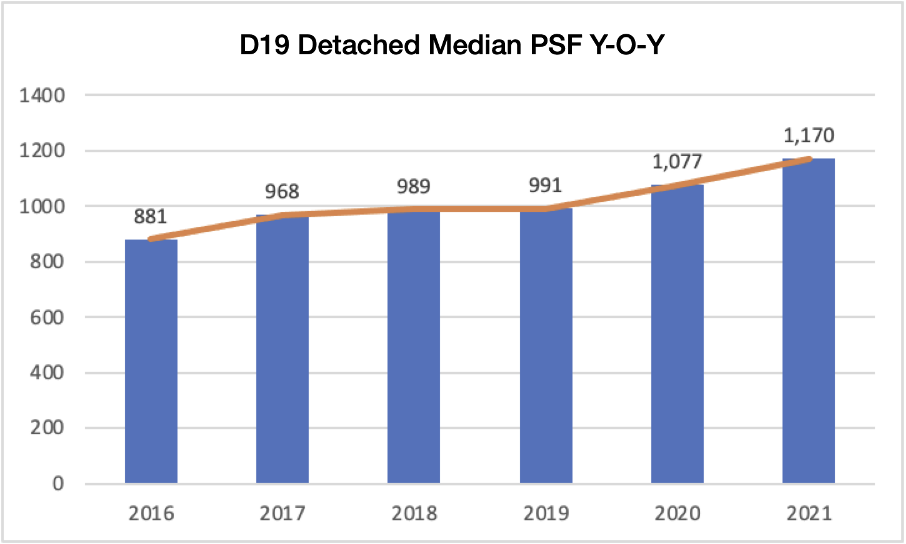

If we were to base our observation on detached houses purely on the median prices across the years, it would seem that the detached houses did not perform at all per se. The sharp decline in median prices from 2020 to 2021 could be largely attributed to the wide spectrum of land sizes. Because of the various different land sizes for detached houses, the quantum for this type of landed housing has a wide range of pricing as well. The sharp decline could simply imply that there were fewer sales of larger plots of land/detached houses. Hence, the result of lower median prices. However, the indication on median PSF prices from the research that our Insights Team has done as well presented a gradual increase in PSF prices across the years. If we were to further conceptualise the increment in an example of a 5000 sqft piece of land, disregarding the build-up area and condition of the house structure in the same time comparisons that we have mentioned for inter-terraces and semi-detached houses, we notice some very interesting figures.

From 2020 to 2021

Price in 2020: $5,385,000 ($1,077 PSF)

Price in 2021: $5,850,000 ($1,170 PSF)

Difference: $465,000

From 2016 to 2020

Price in 2016: $4,405,000 ($881 PSF)

Price in 2020: $5,385,000 ($1,077 PSF)

Difference: $980,000

Total Growth from 2016 – 2021: $1,445,000

Unlike inter-terraces and semi-detached houses which have seen similar growth in the two time period comparison. Detached houses have not performed in an equivalent manner similar to the other two types. However, if we were to compare the growth rate of the 3 types, detached houses have performed the best at about 32% over the course of 6 years. Whereas inter-terraces and semi-detached houses have seen a growth rate of about 25% and 21% respectively. This further proves that the minimal number of detached houses in the landed market will potentially reap the best appreciation in a limited supply market. Attention will not only be garnered from homeowners but also from developers who are willing to pay a premium over the market rate to secure the land in order to redevelop the plot. Given its larger size in nature, detached houses have the potential to be rebuilt into several houses, provided it complies with the respective guidelines of redevelopment.

Future Development

This map is referenced from URA’s website. The areas highlighted in red are the areas with restricted guidelines on the number of storeys and types of landed houses allowed to be built. While a large area in Serangoon Gardens has been zoned for 2-storey Mixed Landed housing, a large portion of the landed enclave in Kovan does not have this restriction. If considering between the two areas, perhaps potential homeowners would like to consider whether they want a 2.5-storey or 3.5-storey house. In that sense, developers would also be more interested in being able to have lesser restrictions so that they can sell a unit with more built-up area which would be more attractive to potential buyers.

When buying a property, many potential buyers are also considering the future developments around the vicinity in order to gauge whether their property will have the potential to appreciate at a greater rate. D19 is one of those areas which just so happen to have exciting developments just beside the district. With the relocation of Paya Lebar Airbase, D19 residents will be able to enjoy a fresh slew of developments that will overtake the 800ha land. It will also improve the connectivity between the North-Eastern region and the Eastern region. Redevelopment from a blank canvas allows the government to really curate the offerings of this area. With almost zero transportation facilities, perhaps considerations include providing for another MRT line to serve the future residents of Paya Lebar and to connect them to main transport nodes. While we cannot be sure of what is to come, expectations are definitely high for this prime area.

Our Take

With a fast-moving market and a wide spectrum of information to consider, decisions need to be made quickly but they also need to be made tactfully. However, if one of your considerations is to perhaps wait it out and see how, we would advise otherwise. In one of our episodes of Nuggets on The Go, we spoke about timing the market and how it is not advisable. Alternatively, if you would like a more in-depth analysis, you may feel free to contact our consultant team and we will be more than happy to assist your property needs.

The overall performance of the landed market in District 19 has been exceptional, to say the least. With a growth rate of close to 50% over the last 10 years and one of the largest volumes of landed property in Singapore, interest is very high in this region. With the large volume and wide spectrum of offerings in this district, buyers who are looking to enter the market will have much to consider. We believe that semi-detached houses will be on the rise for the factors mentioned in the article. Detached houses will likely continue their sterling performance given their minimal numbers in a limited supply market. We hope that with our Insights on the D19 landed market, you will have a better understanding of the movements and trends in the area. Till our next article, we will catch you on one of our Signature Home Tour Series, and take care!