Lower quantum condos launched pre-TDSR in 2012/2013 will be a hot favourite in 2022/2023.

Much has been said about the relationship between cooling measures and the property market. Cooling measures serve to regulate the market. They also have great effects on consumer behaviour and one of the most powerful cooling measures is the 2013 Total Debt Servicing Ratio (TSDR).

In this article, we discuss the rejuvenated shift towards the resale market for apartments and condos and what this means for your real estate journey. We start with the origins of this shift towards affordable properties – the introduction of the 2013 TDSR, and explain how the property development cycle sets new price benchmarks for the market. Finally, we predict that the combination of these two factors will culminate in a rush towards lower quantum resale units by buyers looking for affordable but spacious homes in the coming year.

W. Edwards Deming famously said: “In God we trust. All others must bring data.” In this special article, we feature our Insights research publication – TDSR Condo Analysis – that serves two purposes. First, to demonstrate the evidence that lower quantum resales are coming back into focus in 2022. Second, to provide our readers with materials that you can use for your own property research.

You can get a copy of the publication here.

Low quantum units are bigger in the past (pre-2013) compared to the units launching nowadays because of TDSR measures.

History of TDSR

The introduction of TDSR as a structural measure in Singapore’s real estate market has defined the purchasing behaviour of buyers by making large quantum homes less affordable.

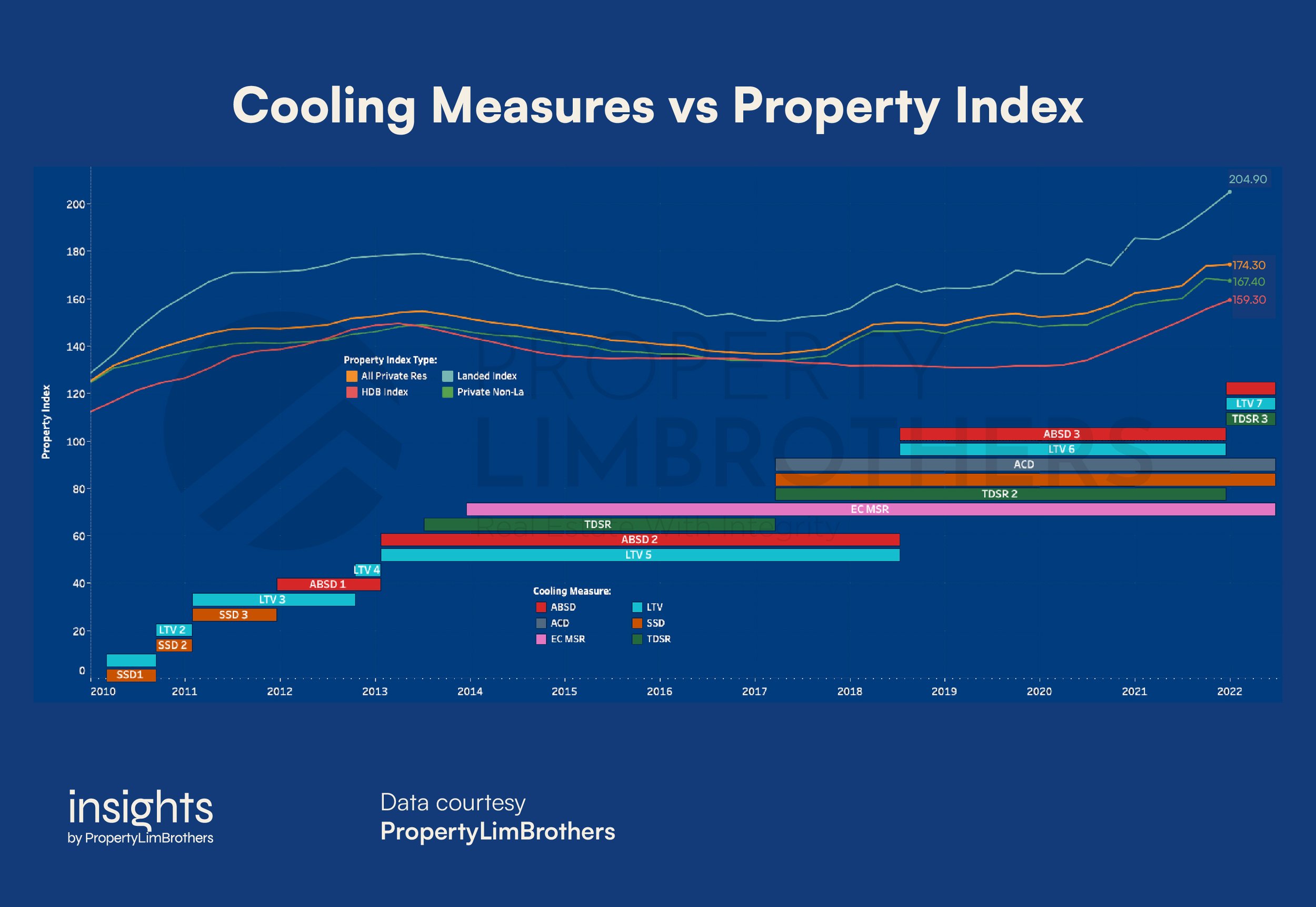

TDSR was first introduced in 2013, amidst a wider slew of other cooling measures that the government enacted to dampen a white-hot market. While the accompanying changes to measures such as ABSD and LTV served to make it more expensive upfront to frequently buy properties, TDSR is aimed at limiting the value (and loan) of the property that can be bought based on monthly income. Thus, while ABSD and LTV tend to affect people who purchase multiple properties, TDSR affects all buyers who finance their purchase through loans.

That is not to say that TDSR as a measure is a bad thing. It is precisely the strict limits imposed on mortgage financing that has made Singapore homeowners to be financially prudent in their spending. In fact, TDSR is a brilliant measure to protect homeowners against overleveraging and is an overall plus for our society as a whole. Nevertheless, everyone from buyers, sellers, and developers were greatly affected by the changes in buying behaviour caused by the introduction of TDSR.

Cooling measures from past to present, and their impact on the real estate market, PropertyLimBrothers.

As of 2021, the TDSR sits at 55% at MAS 3.5% interest rate over a max of 30 year tenure, meaning that a buyer’s total monthly loan repayments cannot exceed 55% of their income. Note that this total refers to all loans including things like a second property, car, and personal loans.

Before 2013, the equivalent measure was the Mortgage Servicing Ratio (MSR) of 50% at a fixed 1.5% interest rate over a max of 35 year tenure. This was a much more lenient measure as it did not account for other loans, had lower interest rates, and had longer tenures. MSR also only applies to HDBs and Executive Condominiums.

Comparing the old MSR to the TDSR, buyers in the past could leverage their income into much larger mortgages, and hence purchase larger quantum properties. TDSR effectively caps the price quantum of all buyers based on their income which completely changed the affordability of properties at the time.

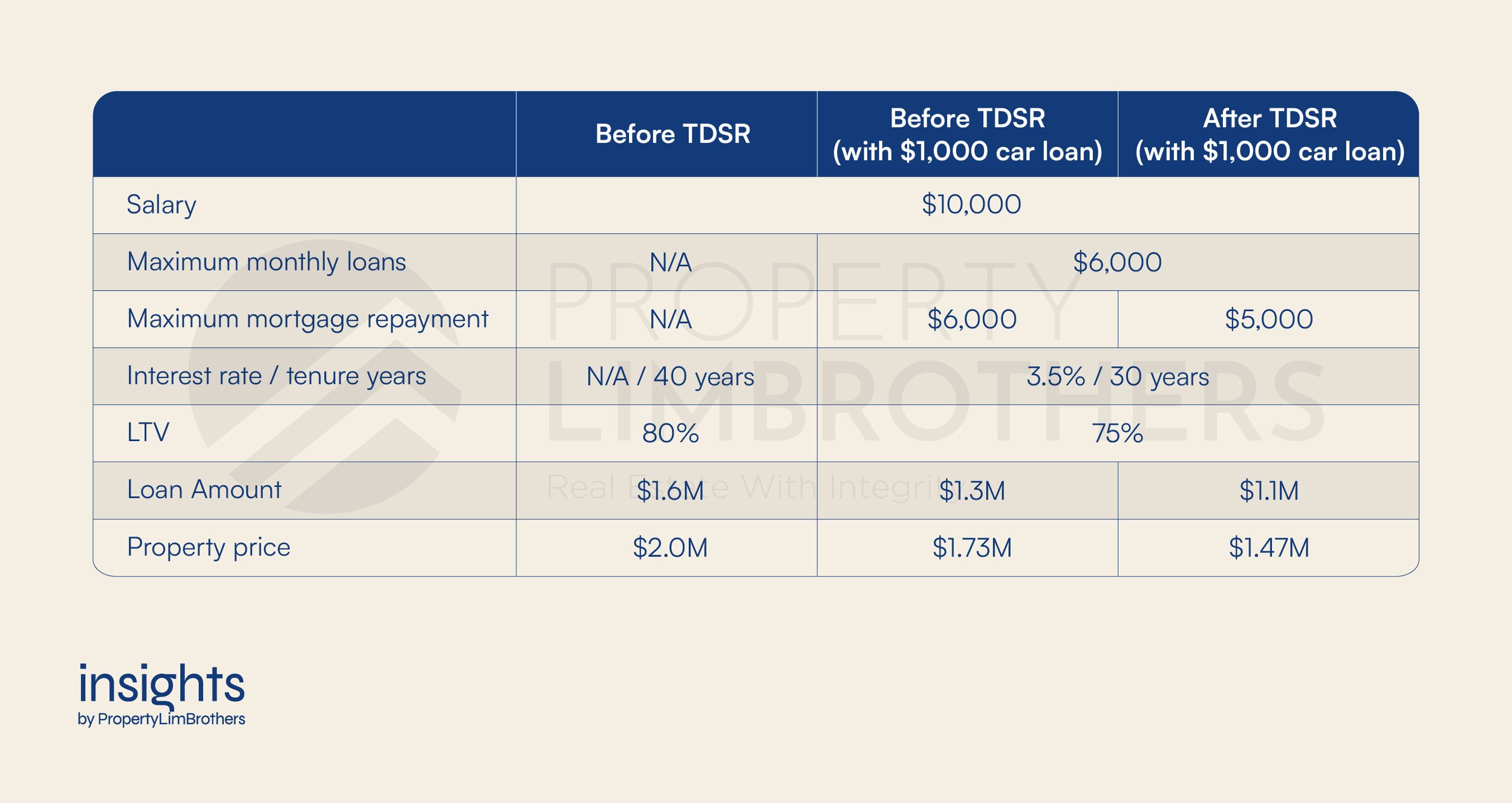

To visualise how much impact this had on affordability, let us look at the largest quantum the same buyer could purchase with the old MSR vs. the new TDSR limit.

Under the old MSR rules, a buyer with a monthly income of $10,000 purchasing a property at 80% LTV will be able to afford up to a $2.0M price tag. The same buyer now, would only be able to afford a $1.7M property due to TDSR, or about 15% less. If we assume that the buyer has other loans such as a $1,000 car loan, the maximum price drops another 30% to $1.1M!

Due to TDSR, the actual price that a buyer can afford dropped between 15% to 45% depending on how much other loans they hold. Such drastic changes in affordability completely changed how housing developers designed their projects.

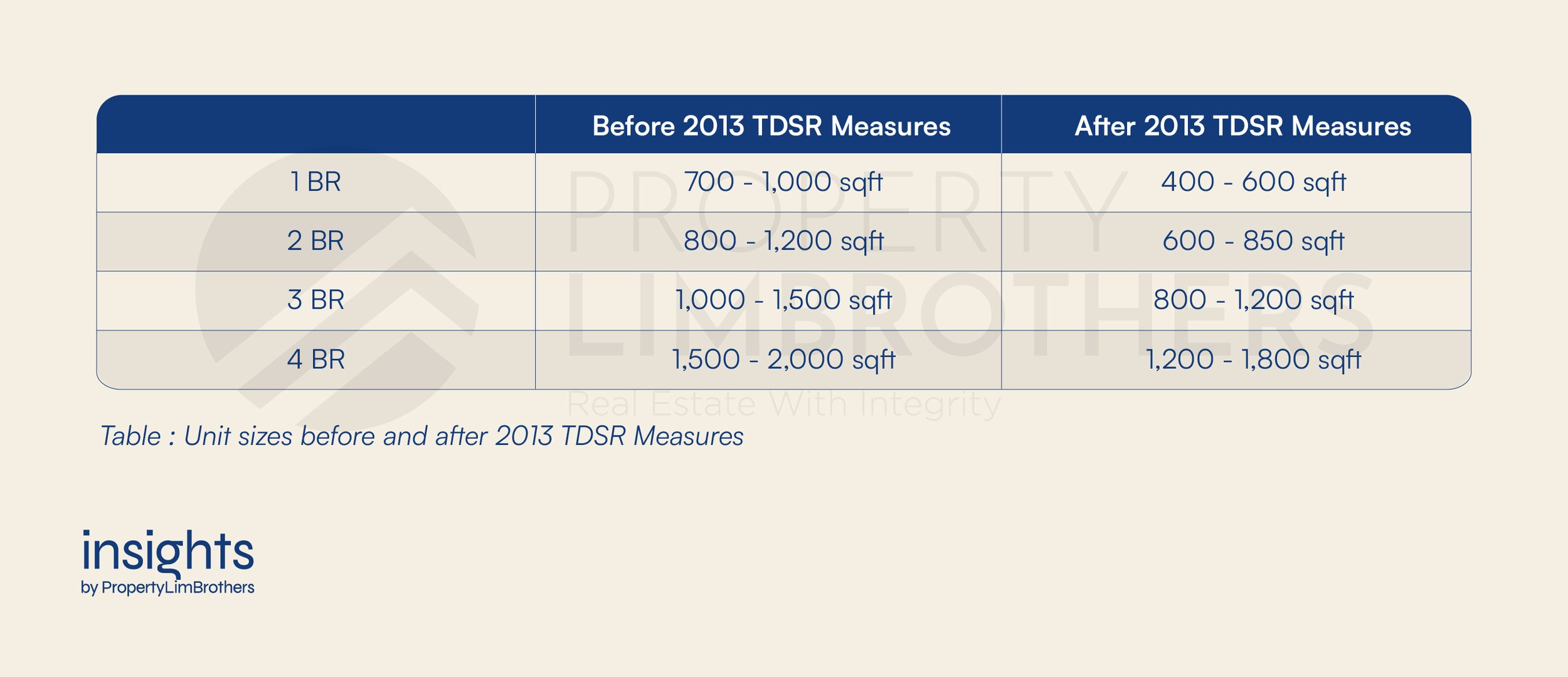

Developers build smaller (lower quantum) units to cater to this shift in affordability

As buyers’ affordability were forced lower, developers had to adapt their new launch prices to cater to buyers looking for lower quantum units. One way of doing this was simply to construct smaller homes at the same psf prices. This change in buyer and developer behaviour is clearly seen in comparing many of the projects constructed before and after 2013.

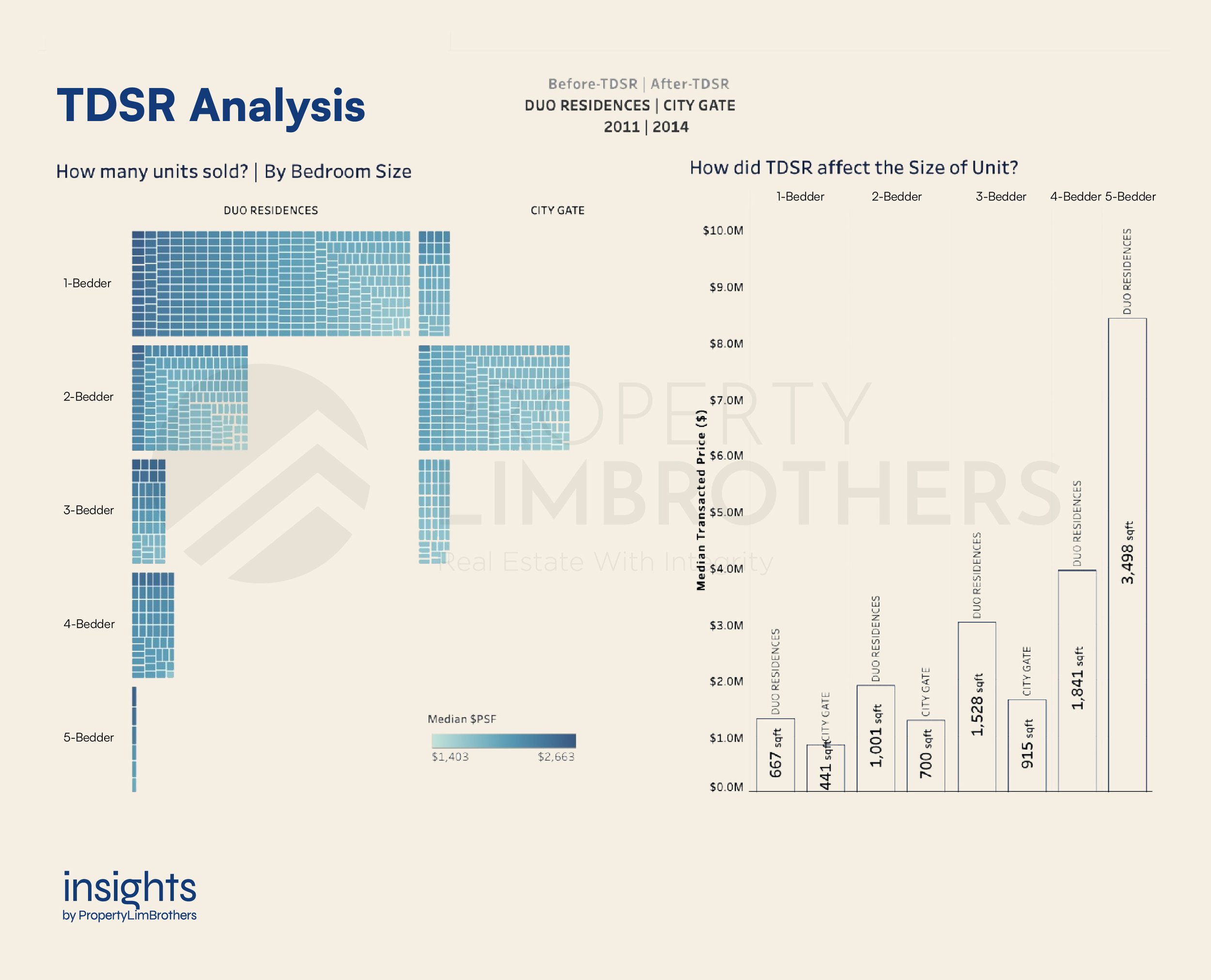

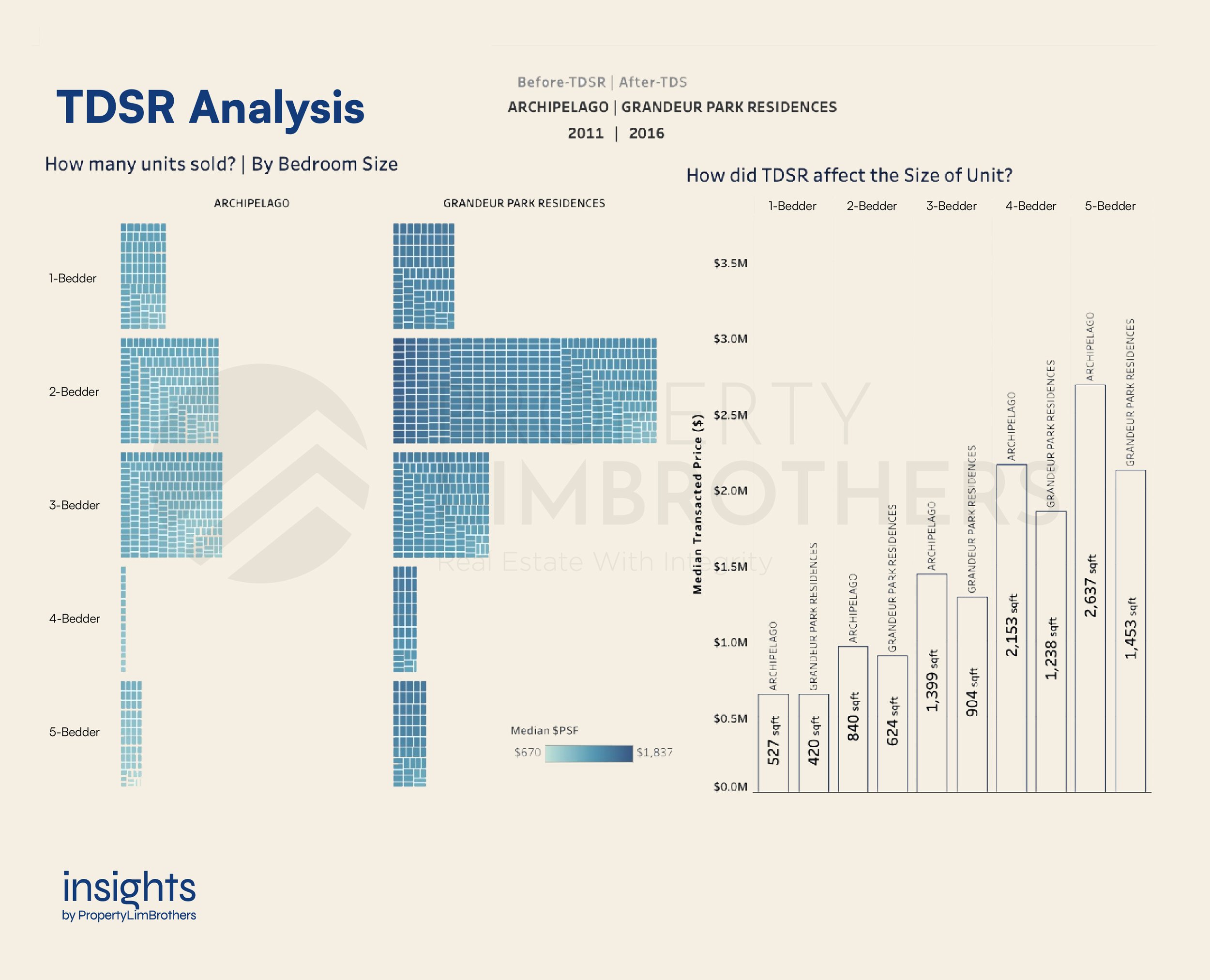

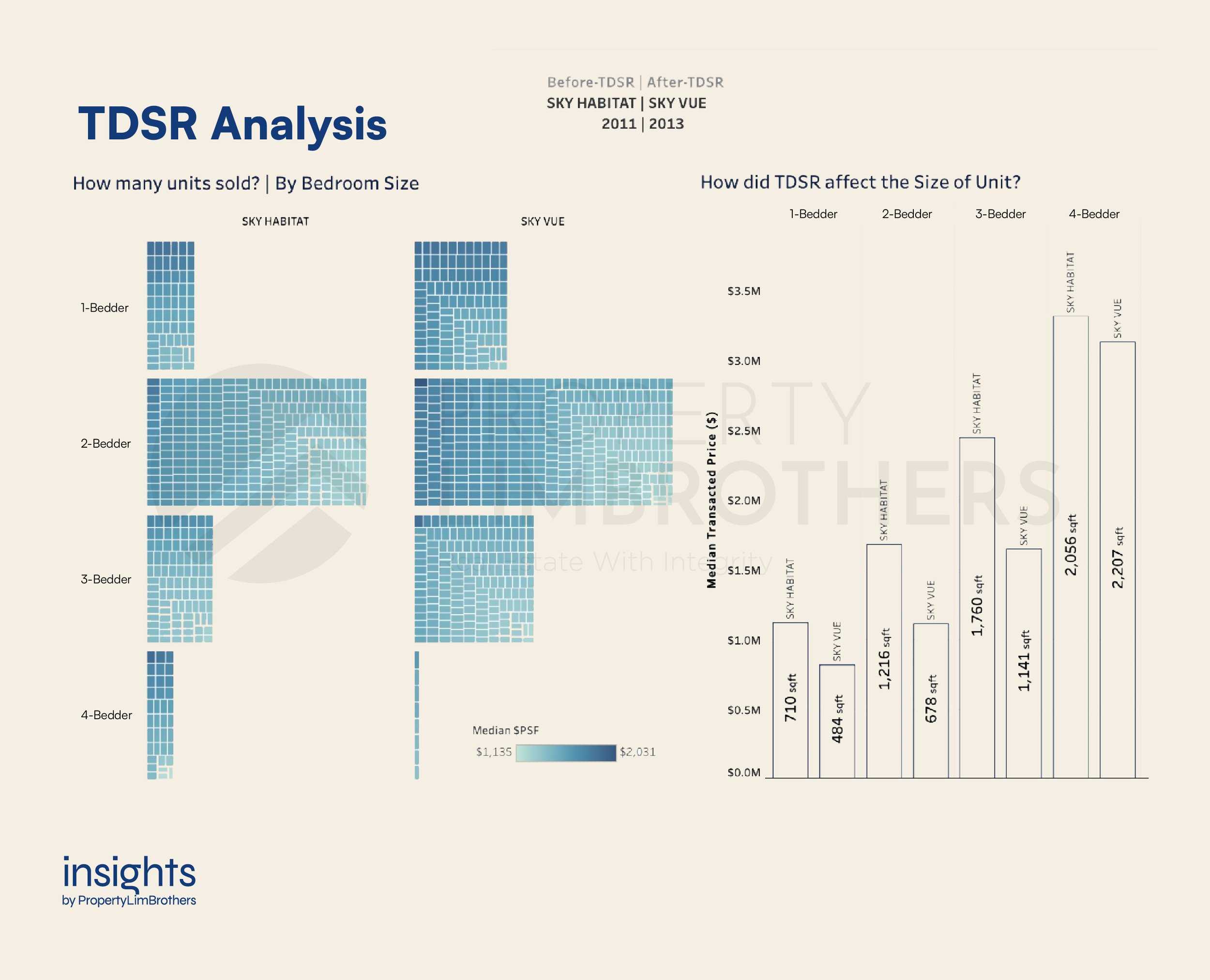

In fact, our TDSR Analysis publication was created to showcase the impact of TDSR on 10 pairs of projects where each pair were in a similar location but built at different times. Overall, we observed that the transacted price range and apartment size range fell drastically after the introduction of TDSR while psf remained constant or increased. Here, we feature 3 pairs of projects to demonstrate the effect that TDSR had on unit sizes and prices.

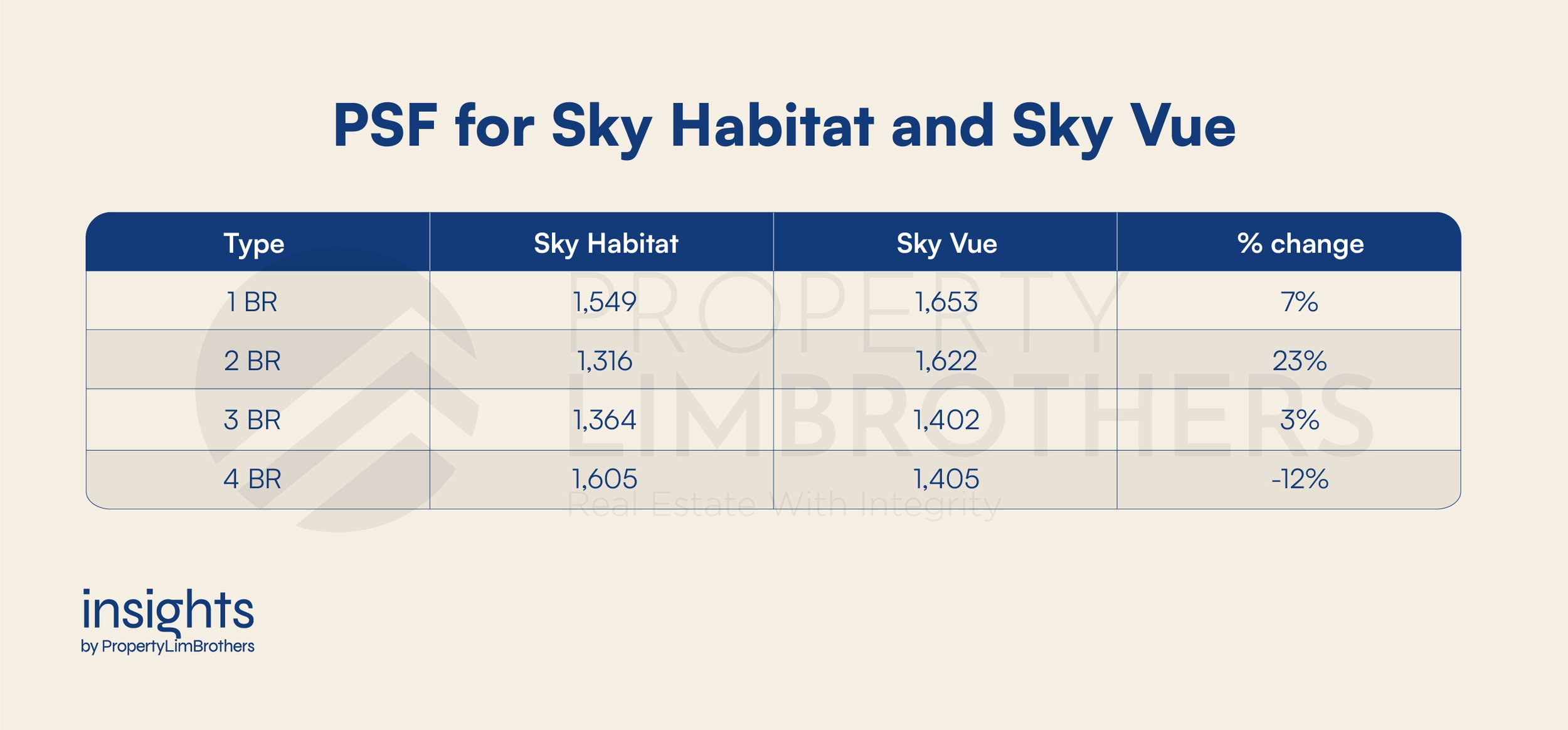

The last comparison pair of Sky Habitat (2011) and Sky Vue (2013) drives home the point. These two projects are located side-by-side in Bishan, and are both on 99-year leases. Yet, the median sizes and transacted prices are changed by up to -44% and -33% respectively for Sky Vue which was launched after 2013. Meanwhile, psf prices only changed by -12% to 23% which explains that the main drop in quantum was caused by developers designing smaller units and not a psf drop.

We know that TDSR has shaped the real estate landscape since 2013, but for most buyers, the TDSR has become a regular part of the real estate journey. The consideration of a 55% TDSR is now standard practice and the swing towards low quantum homes has stabilised.

While TDSR faded into the backdrop in recent years, its underlying effects will soon combine with an upcoming shift, much like the en bloc fever that happened in 2018.

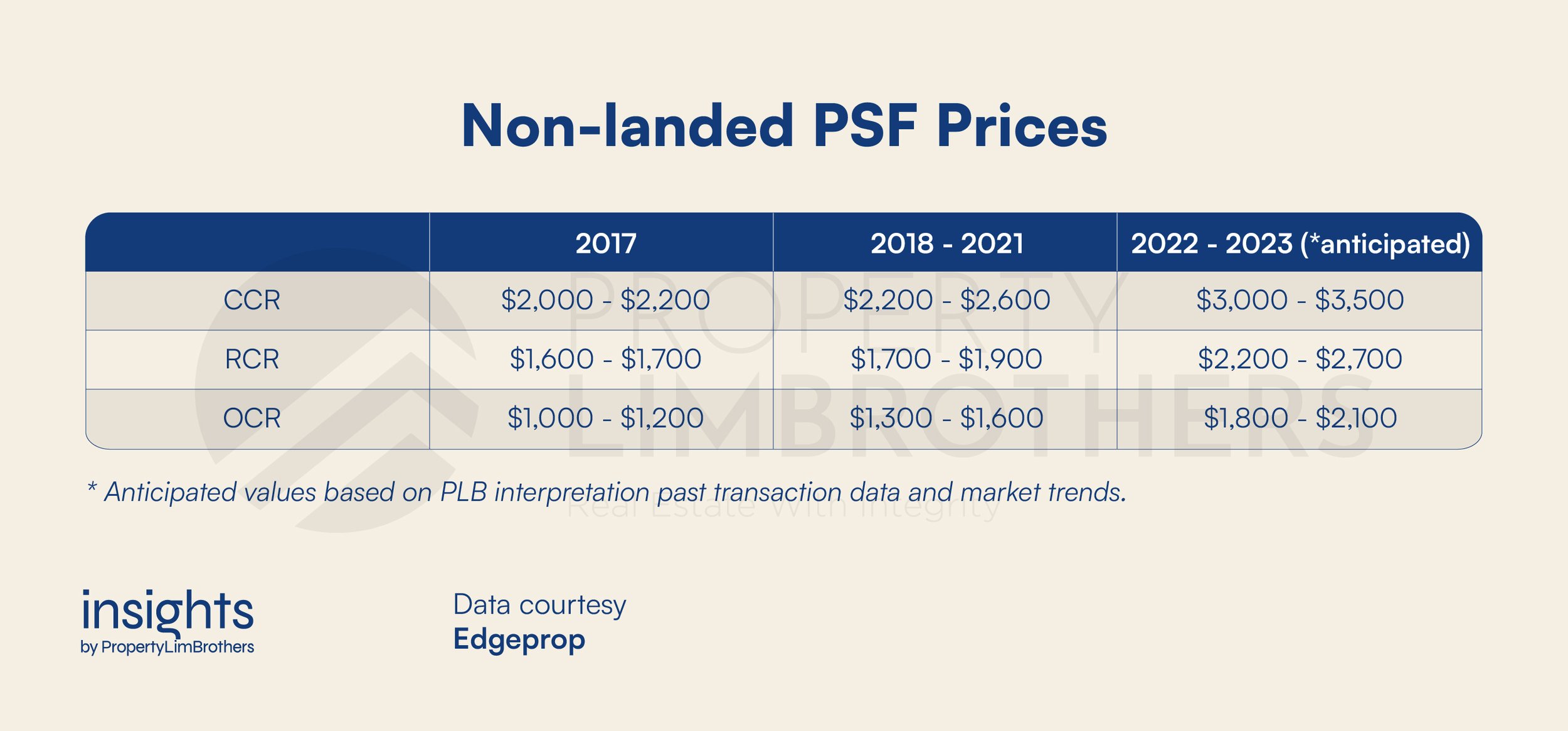

New launches in 2022/2023 are becoming very expensive for their size due to project development cycles.

Combined with dwindling land banks and competition for GLS, developers look to en bloc for land

2018 is remembered as the year of en bloc fever. Amidst the slew of new launches in the years leading up to 2018, and an ever increasing competition for government land sales, developers had turned to en blocs as a way to replenish their land banks.

With such high demand for resales and at such large scales (entire projects), psf prices shot up in 2018 and stabilised there as the market got used to the new pricing. Now in 2022, developers are once again nearing the end of their new launch cycle and are moving back to land acquisitions. We are likely to see a repeat of 2018 where the number of en blocs reach high levels not seen in the past few years. Likewise, we expect psf prices to set a new record high like they did back in 2018.

These elevated new launch psf prices will serve as the benchmark for the market which opens up the opportunity for more affordable resale to serve buyers who need more affordable options

Buyer interest is shifting towards pre-2013 resales which are similar quantum but bigger in size.

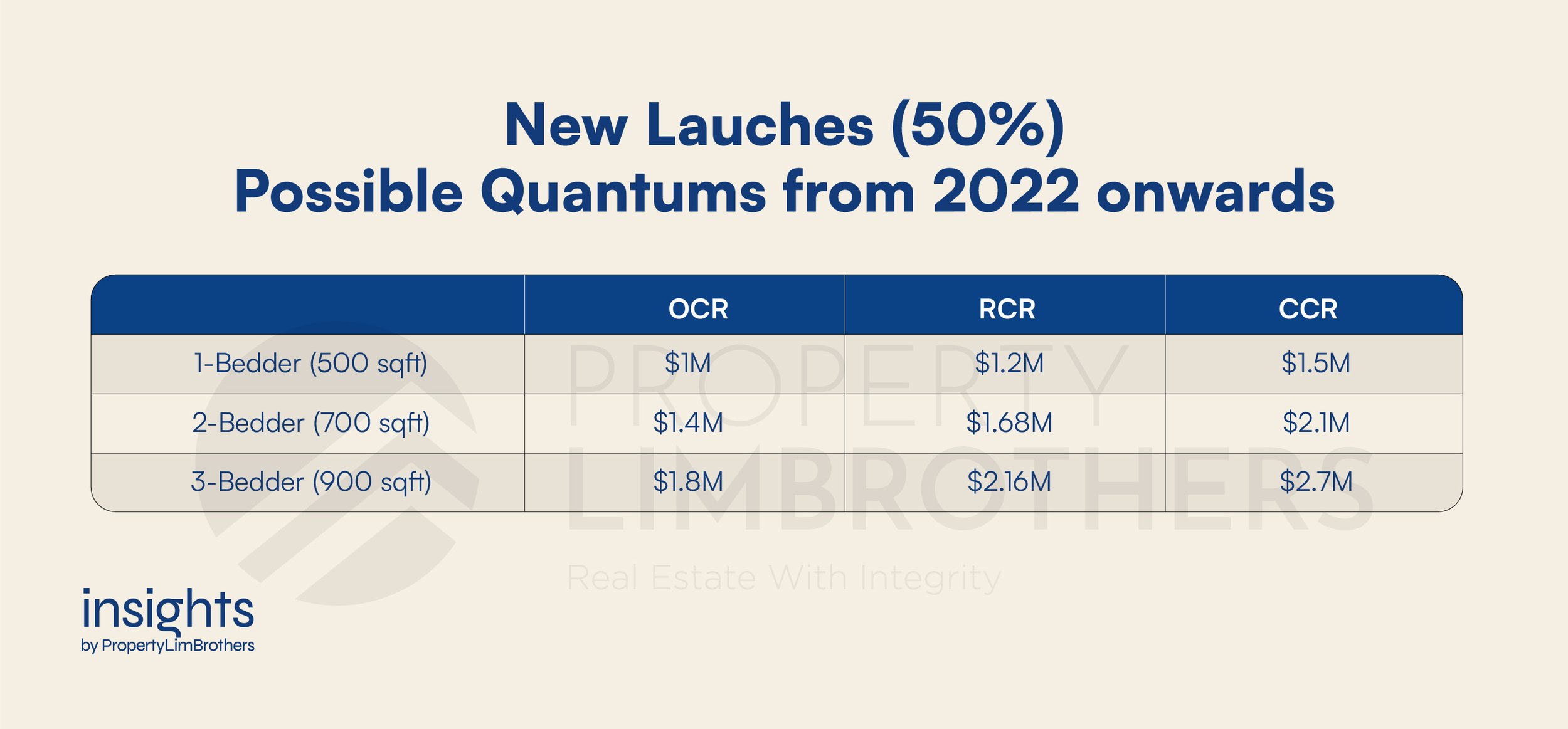

New launch prices have constantly been increasing due to a combination of factors. Developers are passing on already elevated land costs (from expensive enblocs) and construction costs hit by inflation, while demand for housing is unyielding. And yet, as homes become more expensive, incomes for most buyers have not increased at the same rate. This means that the quantum that buyers can afford has not changed much since 2013. It is unlikely that developers can design ever smaller homes that will be attractive to buyers. Hence, buyers limited by the quantum they can afford are forced to look elsewhere for more affordable options.

For the same quantum, buyers can get a resale that is bigger sized

This is where pre–2013 resale units stand out. Boasting much larger units at discounted prices compared to 2022 new launches, older resales are extremely attractive for low quantum buyers. With the prices for even new launch 1-bedroom to be in the range of $1.0M and up, a buyer with a $1.0M budget could get 2-bedroom resale in the RCR, or even a 3-bedroom resale in OCR, depending on the age of the property.

We are already seeing rising interest in these types of units as more buyers realise that older resales remain the best option for the majority of aspiring apartment owners. As the benchmark price for new launches become clearer towards the end of 2022, the market for resale will take off, and those looking to take advantage of this trend should be aware of the opportunities for these projects.

Existing and potential homeowners should be aware of the options they have in such a resale market.

For buyers who are upsizing from a smaller apartment or a HDB, it may be wise to move quickly to purchase these resales while they are still at a discount in anticipation for the increase in prices. For those downsizing, there is the luxury of picking a time to exit based on personal preference as the resale market adjusts to this new demand for older resale units.

Having gone through the origins of TDSR, its lasting effects on buyer behaviour, and types of projects that are in trend today, it is clear that all parts of the real estate market are connected. Despite the unpredictability of such measures and their long-lasting effects, current transaction data can inform us of the latest trends in the market. Based on our research, the trend for 2022 is clear: the increase in new launch prices spells good news for the resale market, especially pre-2013 projects with large unit sizes.

For a detailed breakdown of specific projects that might come back hot in demand: Download our free publication here.

If you enjoyed this article and research, and would like to learn more about what these trends mean for you as a buyer or seller, do not hesitate to contact us. As usual, we would be more than happy to assist you. Till then, see you in our next article!