AMO Residence has been eagerly anticipated by many since the site was last won by UOL Group, Singapore Land Group and Kheong Leong Company against 14 other bidders back in May 2021. To Singaporeans, this might be a play on its location in Ang Mo Kio. It also has a nice meaning in Spanish, “love”. Speaking of love, developers are probably hoping that young families and investors love what they can get from AMO Residences.

In this article, we cover the specific features that will appeal to young families and investors. We then compare AMO Residence with other private property options in the OCR. Finally, we run some quick calculations on affordability from the perspective of young families and investors.

We want to highlight that this article does not intend to be a full review of the new launch. Instead, we’re looking at what stands out the most for the property, and which profile of buyers would benefit from this project the most.

Family Friendly Features

After looking through the location and the amenities surrounding AMO Residence, we have found some family friendly features of AMO Residence. This includes surrounding primary schools, avenues to experience nature and the outdoors, and lifestyle options.

The first thing young parents would look out for are the primary schools within the vicinity. Why does this matter? Young parents would have to send their children to primary school after they turn six according to the Compulsory Education Act. There is a balloting preference for entry that goes by nationality (Singaporean Citizens) and residential distance (within 1km and then 1-2km). If your child is a Singaporean Citizen that is living within 1km of the school, priority would be given for the ballot. Parents who have already gone through this process would be familiar. If you are planning to have a child soon, or if your child is under the age of six, check out the MOE website for more registration information and guides.

There are three primary schools within 1km of AMO Residence. CHIJ St. Nicholas Girls’ School, Ai Tong School, and Ang Mo Kio Primary School. It is no secret to Singaporeans that while all schools are good schools, some are more popular than others. Around AMO Residence there are a substantial number of popular schools that parents might want to send their children to. Within the 1-2km distance, we have Catholic High School, Anderson Primary School, Teck Ghee Primary School, Mayflower Primary School, and Jing Shan Primary School.

These options are plentiful, and the close walking distance would make life much easier for parents working as well. Having a school near your home takes a load of worry and anxiety off your mind. It also means less time in rush hour transit while sending your child to school. Above all, being able to provide the best for the child in terms of education and opportunities is often foremost in the parents’ minds.

The important thing to note for parents or soon-to-be parents is that AMO Residence is a new launch. The TOP is likely to be in four to five years time. A lot of forward planning is required. This might be a key factor for you if you just had your newborn child, are expecting, or planning to have a child soon.

For these younger couples, there are great amenities nearby for pre-primary children. There is a child care facility within walking distance, with a nearby 5-star socialising point for children called Shangri-la Playground. To build on this point, some parents are beginning to become more aware of addiction to digital technologies. AMO Residence is close to Bishan-Ang Mo Kio park and also Lower Pierce Reservoir. These natural outlets will help parents and their children with the digital detox on a daily basis. A fun fact to drop here is that AMO can also mean “fish-hook” in Italian, but don’t let that give you ideas. (Fishing is not allowed in Bishan-Ang Mo Kio park or Lower Pierce Reservoir)

Image courtesy The Smart Local

These family friendly features are great for couples with or planning to have children. But what’s in it for parents? Will it be easy to get to the office via public transport? AMO Residence will be wedged between the new Mayflower and Bright Hill MRT station (Thomson-East Coast Line). While not exactly at your doorstep, it should be a modest 5-minute walk. By the time AMO Residence hits TOP, the Thomson-East Coast Line should be completed if there are no delays. This would hit the spot for accessibility.

AMO Residence seems to bring the most to the table for younger families. It could also be a boon if your parents live in the same neighbourhood. Moving ahead on this premise, investors can benefit from the fact that the property appeals to younger families. In this particular case, it might be easier to exit for larger apartments. Four to five bedroom apartments might find more demand from families that want more space and comfort while keeping their options open to expand their family. AMO Residence offers 45 units for 4-Bedders and 22 units for 5-Bedders. This is out of the total of 372 units in the project. Four and five bedders will account for 18% of all units.

The Singapore Census 2020 also hints at smaller average family sizes. This might mean that mid-sized condominium units will see more attention in the future. If smaller family sizes means anything for the property world, it would be that 3-Bedders would be seen as a potentially more efficient choice. All the variations of 3-Bedder rooms (with & without study) make up a total of 118 units, which makes up approximately 32% of the all units in AMO Residence. This might be a possible entry point for people looking for a more affordable option.

Relative Performance to Other OCR Options

Now that we have settled for the demographic that might best benefit from AMO Residence’s value offering, we look at the relative performance of AMO Residence and its district to other OCR options. To start, AMO Residence is located in D20 (OCR), and has a land cost of $1,118 psf ppr. This is technically much higher than usual OCR land costs. However, it is geographically much closer to the centre of Singapore, with reasonably good amenities nearby.

To say the least, it is a reasonable price for the location despite being on the high side. With construction costs, logistics and profit margins accounted for, buyers can expect AMO Residence to hit the market with an approximate average price of around $1,800 – 2,000. The prices are not released yet as of the time of writing and are not indicative of the actual prices developers will eventually put up. PropertyGuru has put up a potential quantum range of $795,000 – $3,084,900 and a psf range of $1,327 – $2,200.

Another recent OCR new launch that buyers might be eyeing is North Gaia, which is in D27 (OCR). It has a quantum range of between $1,140,000 to $1,999,000. And it has a psf ranging from $1,176 to $1,395. As of now, 170 out of 446 units are sold. This roughly puts North Gaia around 27.6% sold. Compared to AMO Residence, the psf and quantum range is lower but at the same time it is more distant from central Singapore. The price range is reasonable for North Gaia given that their land cost was around $576 psf ppr. This is almost half of AMO Residence’s land cost.

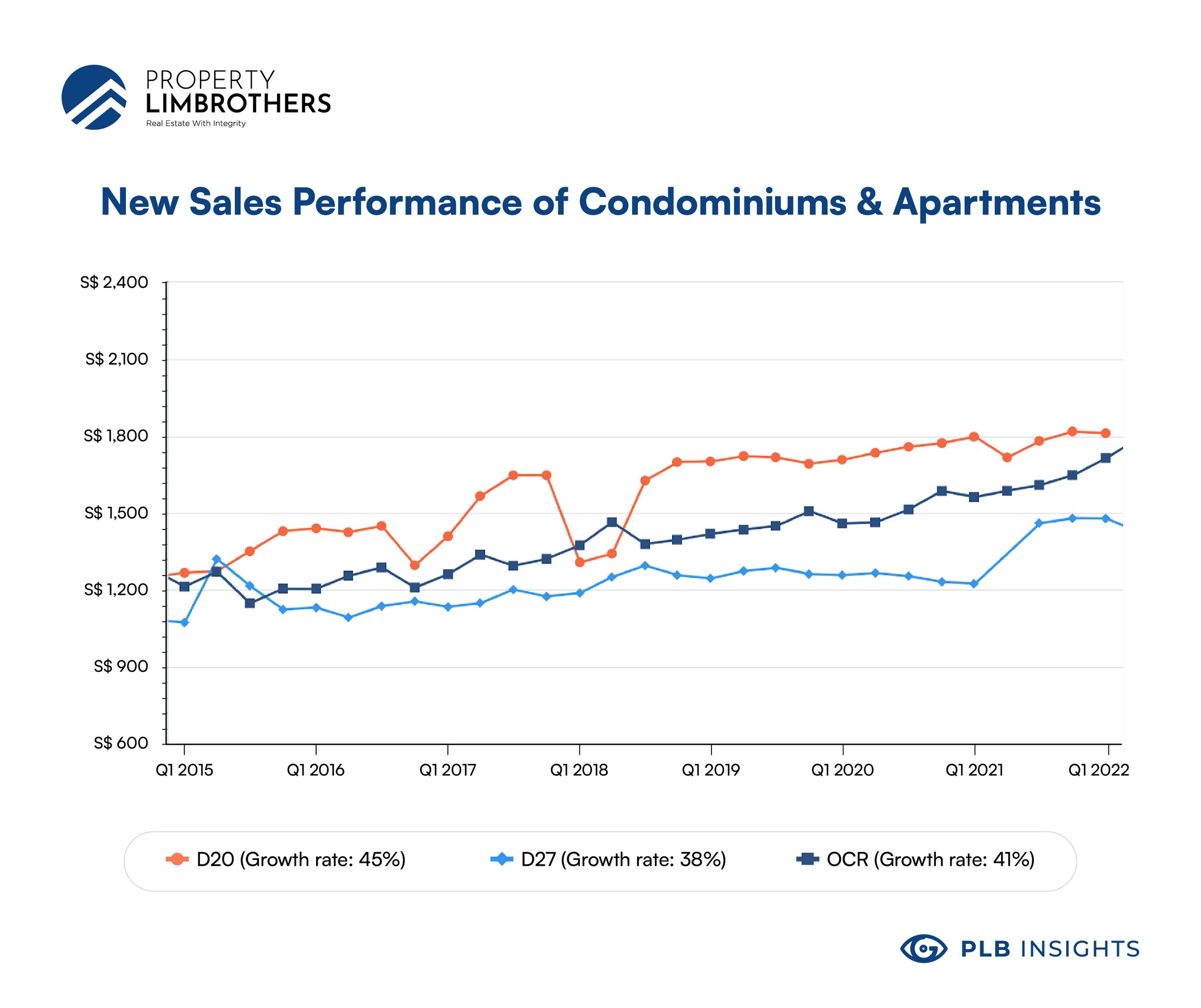

Let’s look at the performance of new sales for condominiums and apartments in D20 and D27. We will also compare this to the average OCR performance of new sales.

D20 new sales are priced higher due to its distance from the city centre, and had the highest growth rate of the categories we are comparing. OCR average new sales have been growing at an accelerated pace especially after 2019. On the other hand, D27 has only recently experienced a huge bump in price after 2021. Looking at the price trend, the overall OCR prices for new sales are increasing. This could be due to rising costs that push up the prices of property island-wide. Between D20 and D27, D27 has more potential for appreciation but might take a longer time to realise it. The northern corridor has been slow on the growth side for a considerable period of time. It will take some shifts in the market before they ever command a premium over other districts.

We now look at the resale performance for D20, D27, and OCR averages. This is to look at how private properties can perform on exit thereafter.

D20 still takes the top spot for growth rate (45%) over the past 7 years. Interestingly, the growth rate for resale D27 is higher than the OCR average. This might be due to the value effect. As D27 new sales are priced at a discount compared to the OCR average, they are more likely to clock gains in the resale market. That being said, the momentum for D20 appreciation beats this value effect by an even greater margin. This should not come as a surprise. Not all areas appreciate at the same rate. District 20 has enjoyed accelerated growth due to the central location and development of amenities.

This shows good promise for capital gains down the road should the current price trends and growth momentum maintain. However, note that we are talking about a long time horizon. Whether you are looking for an ownstay or investment property, the current market conditions are a cautionary sign for you to make sure that you have holding power. Nonetheless, AMO Residence has a strong location and we expect it to perform over a long time horizon.

Affordability Calculations for AMO Residences

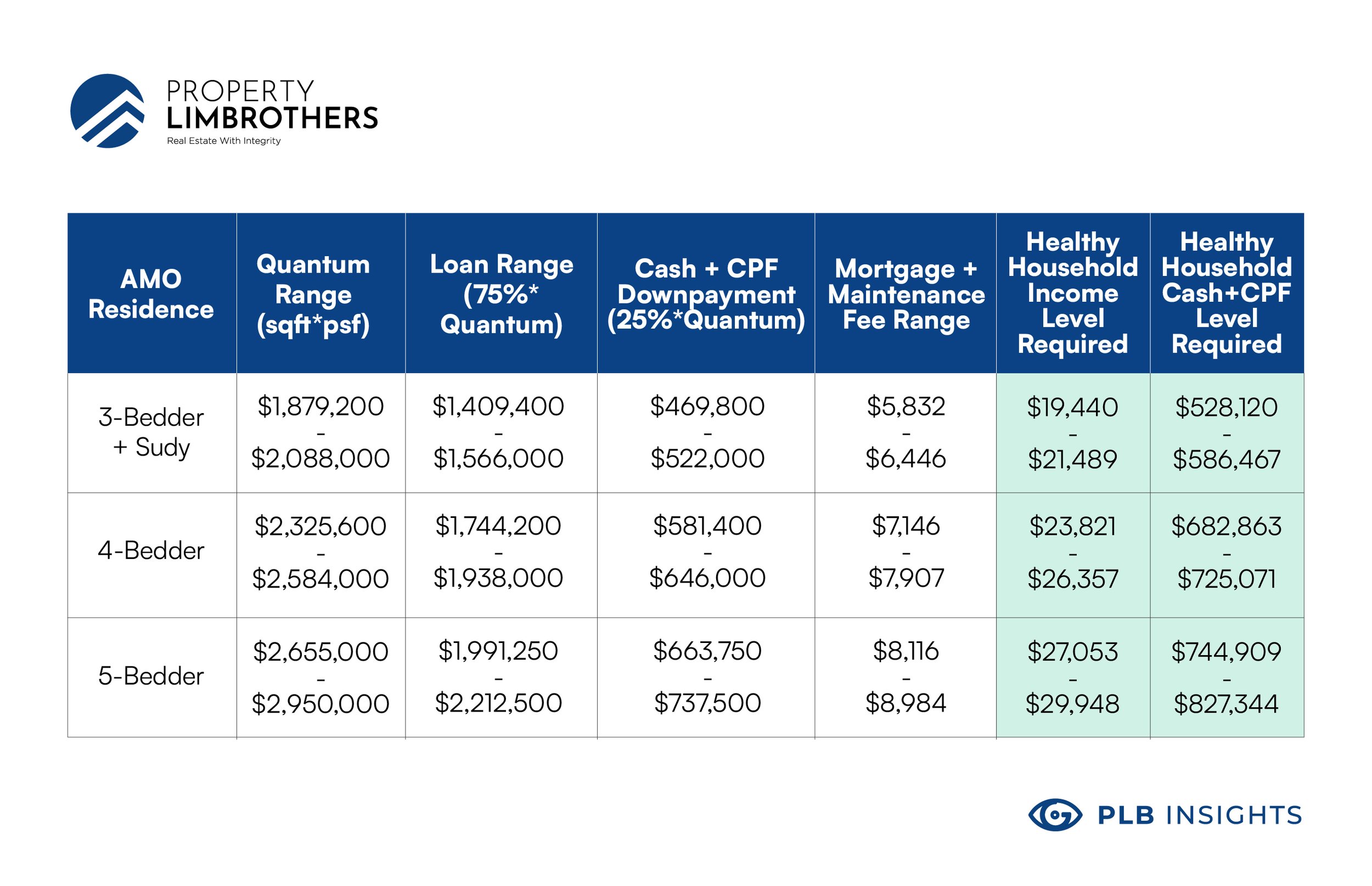

Now we will run some quick affordability calculations for those who want to know if they can afford the property at a glance. We will run the calculations for the 3-Bedder + Study (1044 sqft), 4-Bedders (1292 sqft), and 5-Bedders (1475 sqft). We will assume a Loan-to-Valuation of 75%, with a loan tenure of 30 years and interest rate of 2.45%. Out of the 25% cash down payment, only a maximum of 20% can come from CPF OA.

Since the price ranges have not been released, we will calculate based on a psf range of $1,800 – $2,000. We assume that mortgage plus maintenance fee should not exceed 30% of monthly salary. We will use the average monthly maintenance fee of $300. After paying the down payment, we assume that you need a minimum emergency cash savings of 3 months of income.

While the numbers in this table might look scary, it is a conservative estimate of how much you should have in order to comfortably afford the property and have diamond hands throughout the upcoming recession and economic downturn. Should you wish to go ahead with property purchases below this threshold, lifestyle expenses might be affected and you would need to have good cash management to stay solvent.

To summarise, for 3-Bedder + Study, a comfortable income range for the couple should be a combined income of around $20,000 and cash/CPF savings totalling $550,000. For each additional bedroom, you would need to earn $4,000 more as a couple and save around $150,000 more to be very comfortable with the purchase.

We use this conservative approach to calculating affordability due to the tough macroeconomic conditions. It is the best practice to include potentially bad market conditions into your affordability calculations to ensure that you are prudently managing your finances. Managing risks of unexpected events should also be factored into your financial decisions. The numbers we offer in this article might seem high but we consider it a good estimate so as to not bite off more than you can chew.

Closing Thoughts

This might not be a full-fledged review of AMO Residence, but we hope that it has been helpful in finding out if you are the right target market for this property. Moreover, you would need to know if you can comfortably afford the property too. We believe that AMO Residence would be most appealing to young families and expecting couples.

AMO Residence is located in a high growth district with many amenities that are family friendly for young children. Last but not least, we wish to give cautionary advice to individuals who are looking to enter the property market this year. Property prices are elevated and the market might gradually slow down due to rising interest rates and recessionary concerns.

If you do decide to enter the market for ownstay or investment purposes, enter it with both eyes open and have a high-standard thorough analysis of the market and your shortlisted properties. Our experts will be of great help in assisting you in your property search. Whether or not AMO Residence is for you, our experts put your interests first and offer top-of-the-line advice for property investments. You can reach out to us here or drop your favourite Inside Sales Team member a direct message on their socials.