When it comes to the buyer’s side of the property market, price is often the most mentioned part of the deal. Price. Quantum. PSF. These are the most mentioned aspects of the deal when buyers are looking for properties in the market. Whether you’re a first-time buyer, HDB upgrader, Condo hunter, or long-time investor, it boils down to price and quantum for most.

For some more savvy buyers, they might already be formulating an exit plan in their minds. Thinking of whether their new property will be desirable for future buyers. This often marks the buyers as people with foresight. Yet, many still get stuck with the construct of price alone. And seldom move beyond that in the analysis. This is of course besides the focus on location (which is a beaten-to-death concept in the real estate world.

In this article, we will be focusing on the volume of transactions as an important concept in how properties perform over time. For more experienced real estate players in the market, there is something unique about this concept of transaction volume. Let us go through why volume matters to you.

Why would Transaction Volume Matter?

Why should the number of transactions or deals even matter in the first place? Isn’t a done deal just a done deal? Many people might look at transactions in isolation. Paying more attention to how much other people have sold their properties for, and using that as guidance as to how much to ask for (if they are sellers) or how much to offer (if they are buyers).

Using past transactions as price guidance is not a bad idea. Of course, that is based on the assumption that previous transactions in the market are reasonably priced. From time to time, we may see some exceptions. Desperate times call for desperate measures. And as a result, we see really low or high prices depending on the situation of those individual deals.

Apart from this price guidance mechanism, the volume of transactions is an important factor of how properties are evaluated by financial institutions. Here, we are talking about loans and property valuations. Among realtors in Singapore’s housing market, it is a well-known fact that volume affects property valuations.

Due to this common knowledge, some more experienced realtors will advise buyers to avoid boutique properties or smaller developments due to the lower volume of transactions. The theory is that bank valuations of the properties will be low. Thus appreciation is affected and kept tepid even though surrounding projects that are larger in size are appreciating around them. Still due to the low transaction volume, banks and valuers reference the last 6-12 months of transacted property prices as a reference to value the property when the seller wants to sell.

In turn, sellers will find it sometimes puzzling why their property has failed to appreciate or is appreciating more slowly, in some cases, freehold boutique projects appreciate slower than its nearby huge 99 years project and this makes the property owner puzzled on why their freehold tenure did not allow their property valuations to move up.

What is Transaction Volume Associated with?

When we look at what kinds of properties have low transaction volume, we naturally think of a few characteristics that are associated with this low deal flow. The first is obviously that it is a small development, which means to say that the number of units available in that project is much lower to begin with. Naturally, this would then mean that the number of transactions would be proportionately smaller.

Next, if we imagine transactions occurring across a larger time frame, naturally we will find that more popular projects will have a higher transaction volume over time. This might be related to how the property appreciates over time. If it appreciates at a good rate, and sustainably so, we can see the property change hands a few times in its lifespan. And each owner would get to keep a slice of the capital appreciation.

On the flip side, projects which are unpopular or have inherent problems discovered over time will have lower transaction volume. The deal flow would also be a lot slower if the upside is limited. There will be fewer incentives for owners to let go of their properties if the capital appreciation is low or negligible.

As an additional point to note, properties which are really comfortable for owners might see a low number of transactions as well. This might be more of an exception than the norm. Few homes would fit the bill of “too good to sell”.

Other than the association transaction volume has with the total number of units available, the size of the development, the quality of the project, and the number of condo facilities etc, there might be some additional factors that are more loosely associated with transaction volume.

Identifying the Top and Bottom 10% of Projects by Volume

In this article, we do not look at what in particular creates this high or low volume of transactions for the property. We simply examine how the average psf has moved over the years for these low transaction volume projects. Do condominiums and apartments with high transaction volume necessarily do better in terms of capital appreciation?

The first step to answering this question would be to identify the project names of these condominiums and apartments. We have to account for when the project was launched, and also decide the timeframe we are looking at.

For the purposes of this article, we look at a time frame of 2015 to 2022 Q2. This is so that we examine the time period after a bulk of cooling measures have been previously introduced from 2009 to 2014. To identify the Top and Bottom 10% of projects transacted in this period, we take the total transaction volume divided by the number of months elapsed since the first transaction in this time frame.

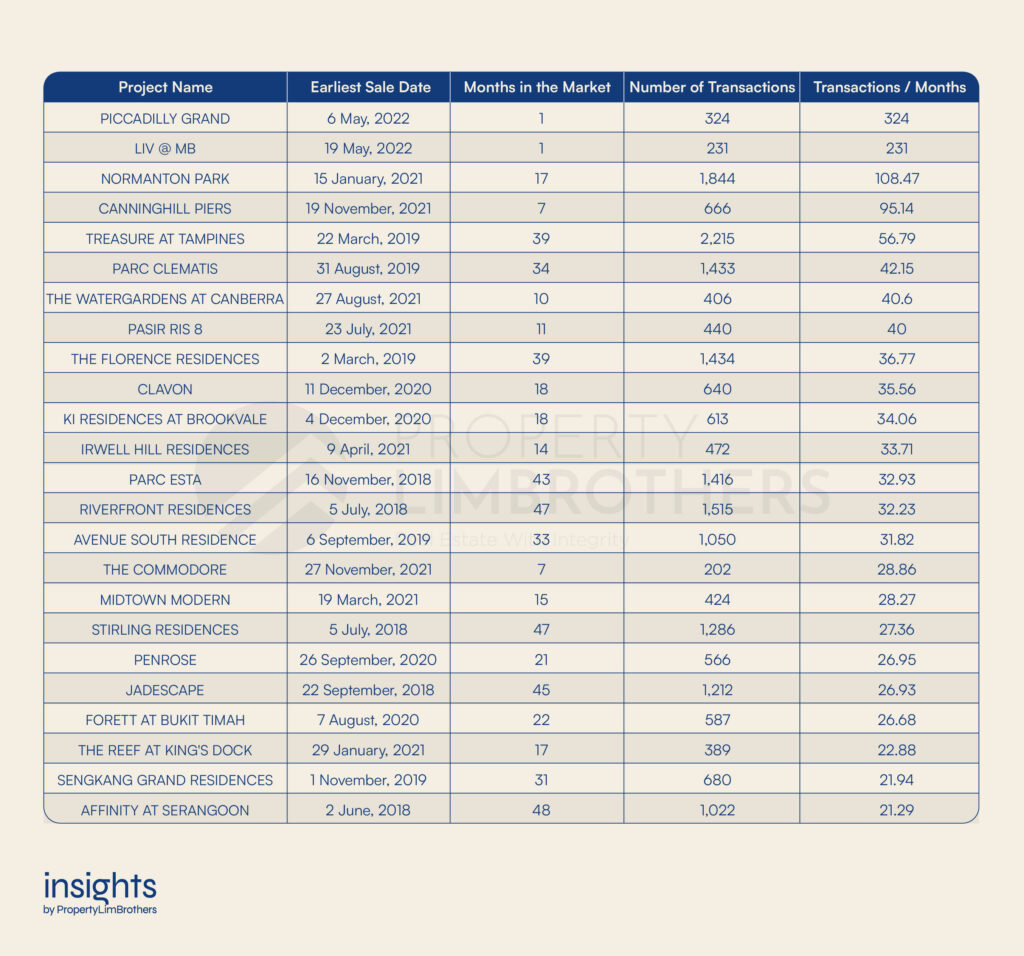

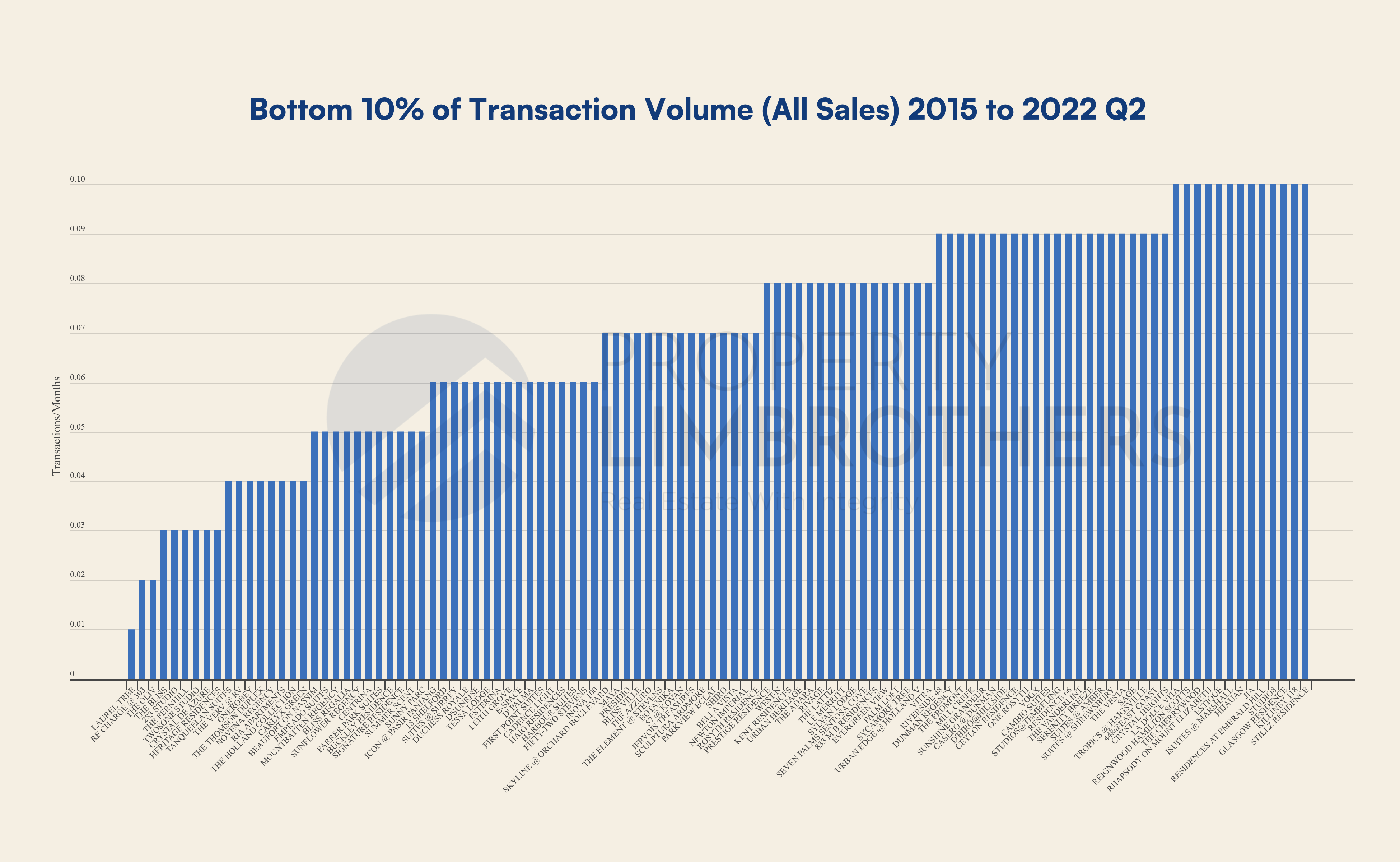

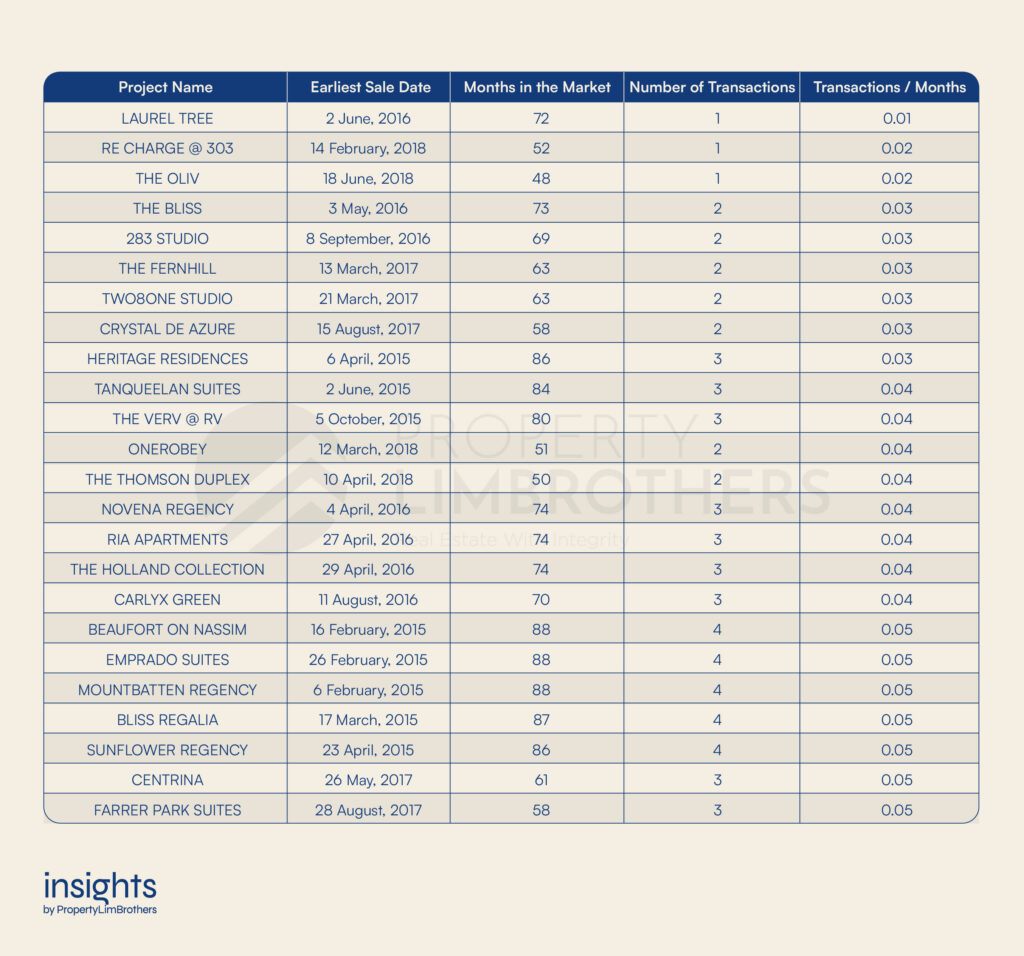

This way, we arrive at our list of the Top 10% by Transaction Volume and the Bottom 10% by Transaction Volume. There are a total of 110 project names for each list. You may take your time to peruse through them to see if there are any familiar names. Some of them might spark your interest in the future if you are looking at this as an additional criteria to shortlisting properties.

The top 3 properties by average volume in the timeframe given are Normanton Park (1862 total units) in first place, followed by Canninghill Piers (696 total units), and then Treasure At Tampines (2203 total units). We do not count Piccadilly Grand and Liv @ MB as part of the top 3 as they have only been on the market for 1 month, which inflates their average volume score.

In some sense, this tells us that a lot of volume in the recent property cycle is driven by new launches, which may be part of the reason why new launch condos are priced so much higher than their resale alternatives. It also makes sense that new launches make it to the list as the entire project is up for sale, volume would technically be concentrated in the new life of the property. The bottom 3 properties are Re Charge @ 303 (6 total units), and then The Oliv (23 total units), followed by 238 Studio (7 total units).

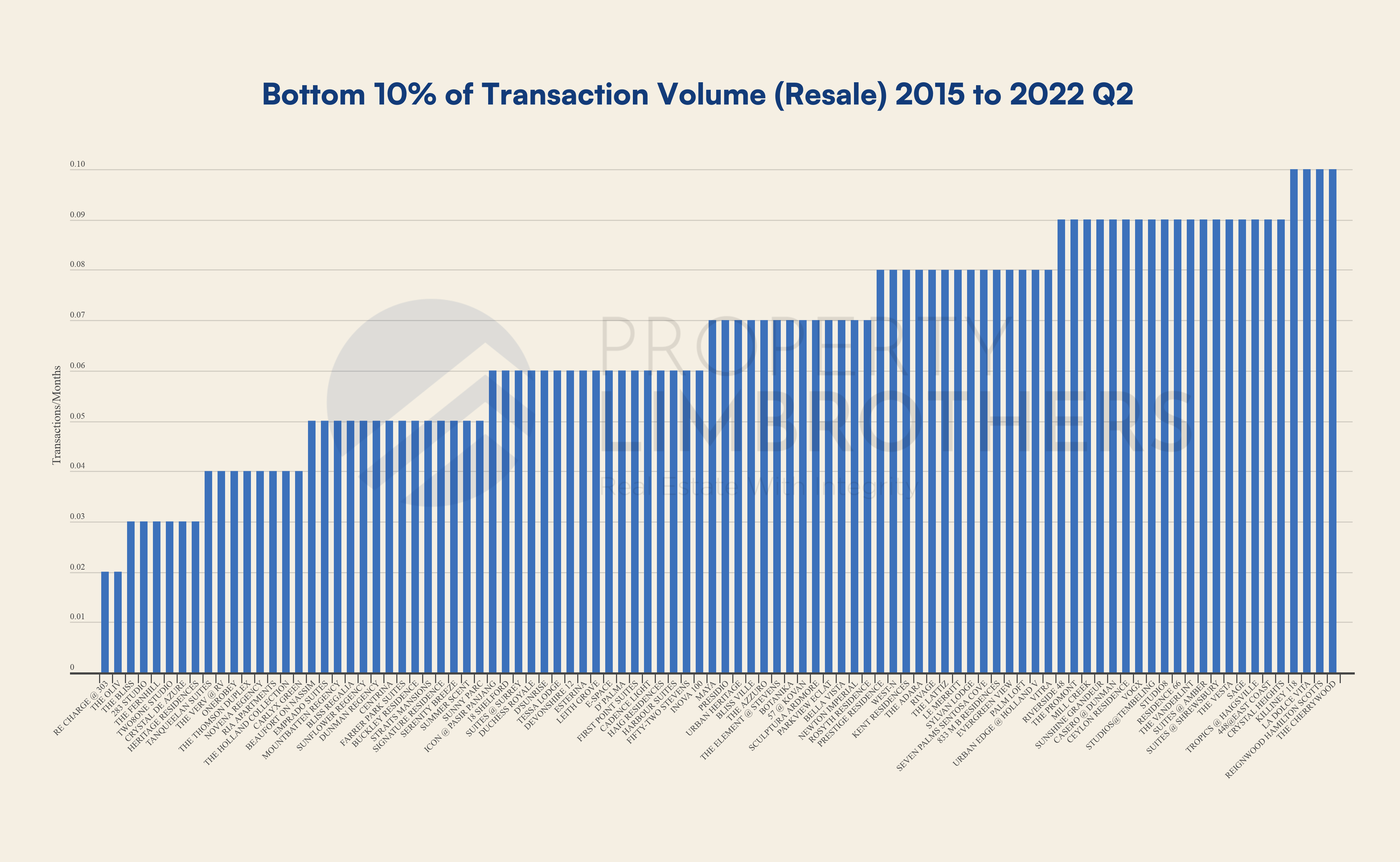

After excluding the new sales from the sample above, we look at a more specific subsample of Top and Bottom 10% when it comes to only resale transactions in the same time period of 2015 to 2022 Q2. The top 3 properties are 8 Saint Thomas (250 total units) coming in at first place, followed by High Park Residences (1390 total units), and then The Tapestry (861 total units). Interestingly, only 2 out of the top 3 high average volume properties are large developments. Furthermore, all of the high-volume top projects have changed but none of the bottom 3 has changed. The bottom 3 properties are Re Charge @ 303 (6 total units) in last place, followed by The Oliv (23 total units), and then 283 Studio (7 total units).

Generally, after taking out the new condo launches, we see that the top properties by volume experience more changes whereas the bottom properties by average volume remain roughly the same. This is an interesting finding, but intuitively, most of the transacted volume for each property should happen during its launch since all of the units are more or less available for sale as opposed to later in the property’s life.

How does the Price Performance differ by Volume?

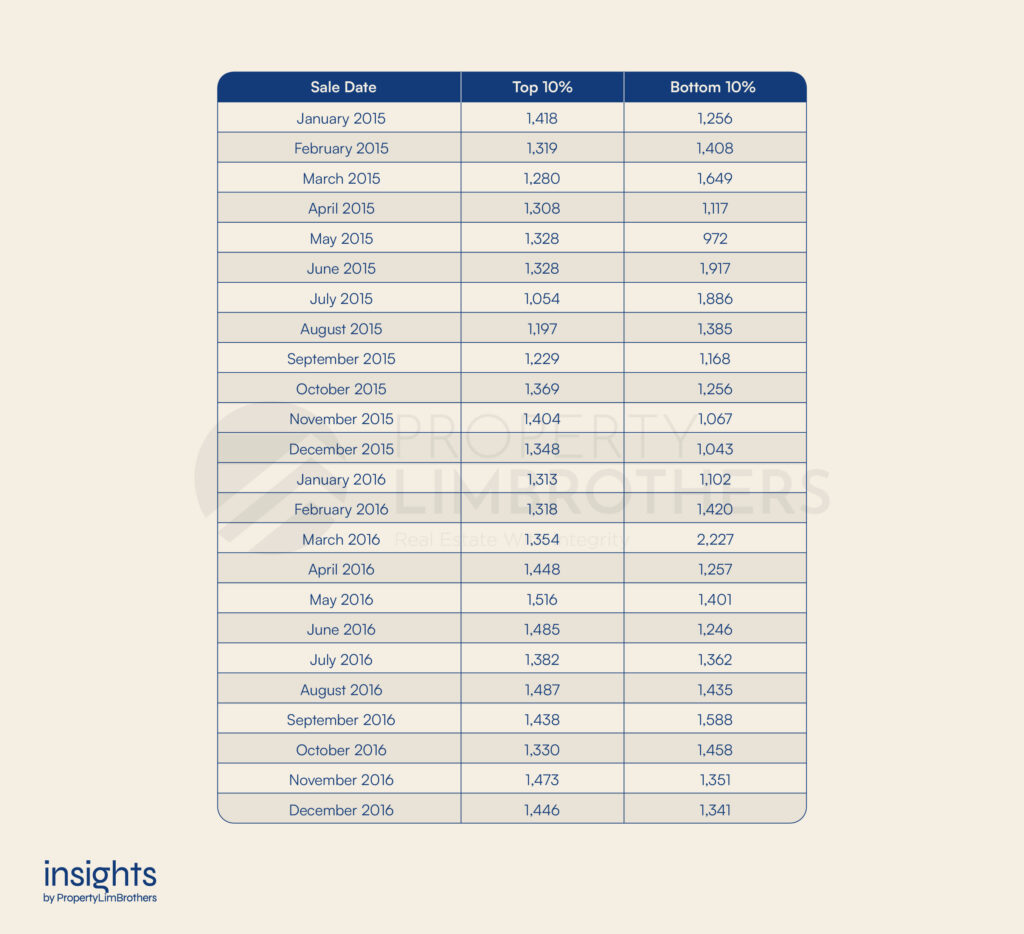

Once we have identified the top and bottom deciles by average volume, we can plot how their average psf has changed over time. In the chart below, we can clearly see the difference between the performance of the top and bottom deciles. The Top 10% of properties by average volume have consistently performed well over the 7 years. The average psf has climbed from around $1,438 psf in 2015 to $2,152 psf in 2022. This top decile presents more upside volatility and limited downside volatility.

On the other hand, the Bottom 10% has performed very inconsistently across the 7 years. This is expected as the projects in this list are mostly boutique condominiums. Typically freehold and have a small number of total units. As a result, the average psf of some months might spike when there are transactions of boutique condos near or in the central region during those months. This presents very high volatility and inconsistent price movements.

The volatility and inconsistency of the price movement for the bottom decile might also be due to how the low volume of transactions makes it hard for the market to value the property. Both buyers and sellers will find it difficult to agree on the valuation of the properties in this group. Apart from this, the average psf over the 7 years has only climbed from around $1,256 to $1,425.

Comparing the Top 10% and the Bottom 10% of properties by average volume, we see that high-volume properties outperform the boutique group. Price performance is much better. The simple annual appreciation of the Top 10% is approximately 6.6%, and for the Bottom 10% the simple annual appreciation is almost at 1.8%. These numbers are the average performance for the group. There might be some exceptions that might underperform to a large extent.

We now move on to see how this price performance gap changes when we remove new launches from the picture.

Looking specifically at the top and bottom 10% of properties by average resale transaction volume only, we observe a much higher volatility in the Top 10%. In addition, we observe that the Bottom 10% is less frequently able to cross above the $2,000 psf price range (3 times with just resale transactions as opposed to 5 times with all sales transactions). Between the two, the Top 10% generally outperforms the Bottom 10% but with an inconsistent margin. This is an interesting finding, but not entirely unexpected.

The volatility in resale prices of the top transacted properties might be attributed to the resale property cycle. On the other hand, the bottom transacted properties may be driven generally by the smaller sample size of units. Owners of those properties are either unwilling to let go of their properties, or that the properties are unable to command the prices much higher than their launch. We will not be able to find out exactly why with the data at hand.

Looking purely at resale transactions, the Top 10% started with an average psf of $1,232 in 2015 and grew to $1,551 in 2022 Q2. This translates to a simple annual growth rate of almost 3.5%. On the other hand, the Bottom 10% started with an average psf of $1,301 in 2015 and grew to $1,613 in 2022 Q2. This would mean a simple annual growth rate of almost 3.2%. The performance difference between the Top and Bottom 10% suddenly becomes much smaller when new launches are not in the picture, yet volatility increases.

Nonetheless, this answers the question of how price performance differs by the average volume of transactions. We see that high-volume properties are “safer bets” in some sense for both new launches and resale transactions. The price analysis doesn’t take into account the time to exit the property, which might be a larger issue for lower volume projects due to the lower deal flow.

Closing Thoughts

To conclude this article, we would first like to point out that price performance is not the be all and end all when it comes to a property purchase. Although most people may conventionally look at properties as investments and as a way to grow wealth, not everyone might take it that way. Some are looking purely based on the criteria of rental yield. Others look at exclusive boutique properties that just fit the vibe that they want.

If you are buying just for your own stay and you never intend to sell it after, then the rules of the game might be very different. Price performance over time may not interest you as much. The search and evaluation process will be entirely different and we acknowledge that.

Still, for the majority of buyers that look at price and how it changes over time, we hope that this piece of information on how volume positively affects the change in price over time will be useful when you choose your next property. Typically, it would be safer to buy mid-large sized developments and newer projects, especially if they are leasehold.