Singapore is a thriving hub of business and commerce in Southeast Asia, with a highly developed economy and a robust real estate market. For foreigners looking to invest in property in Singapore, there are a range of options available, including commercial and industrial properties. Commercial properties include offices, retail spaces, and other business premises, while industrial properties are typically used for manufacturing, storage, and other industrial purposes.

However, the decision to invest in commercial or industrial properties can be a complex one, with a range of factors to consider, including market trends, investment goals, and local regulations. In this article, we will explore the pros and cons of investing in commercial or industrial properties in Singapore as a foreigner, and provide practical advice on how to make the most of your investment. We will examine the current state of the Singapore property market, including key trends and developments, and provide insights into the unique challenges and opportunities facing foreign investors in this dynamic and competitive market.

Whether you are a seasoned property investor or a first-time buyer, this article will provide valuable insights and practical tips to help you make an informed decision about investing in commercial or industrial properties in Singapore. By understanding the key factors that influence property investment in Singapore, you can maximise your investment potential and achieve your financial goals in this vibrant and dynamic city-state.

Why Look at Commercial or Industrial Properties in the First Place?

An important factor to consider when investing in commercial or industrial real estate in Singapore is the Additional Buyer’s Stamp Duty (ABSD). ABSD is a tax imposed by the Singapore government on buyers purchasing residential properties, including apartments, condos, and landed homes. The purpose of ABSD is to regulate the residential property market by curbing demand and controlling property prices, particularly for foreign demand which might inflate property prices in Singapore.

However, it is worth noting that ABSD does not apply to commercial and industrial property investments for foreigners. This means that foreign investors who purchase commercial or industrial properties in Singapore are not subject to ABSD, which can significantly reduce the overall cost of investment. In contrast to residential properties, foreign buyers of commercial and industrial properties are not required to pay an upfront ABSD, which is 60% of the purchase price for residential properties as of April 2023.

The exemption of ABSD for commercial and industrial property investments is seen as an attractive incentive for foreign investors who are seeking to invest in Singapore’s property market. This is because the exemption allows foreign investors to invest in commercial and industrial properties without incurring a significant tax burden, which can be a barrier to entry for many residential property buyers. In addition, it provides more flexibility for foreign investors to diversify their investment portfolios and allocate their capital to different asset classes.

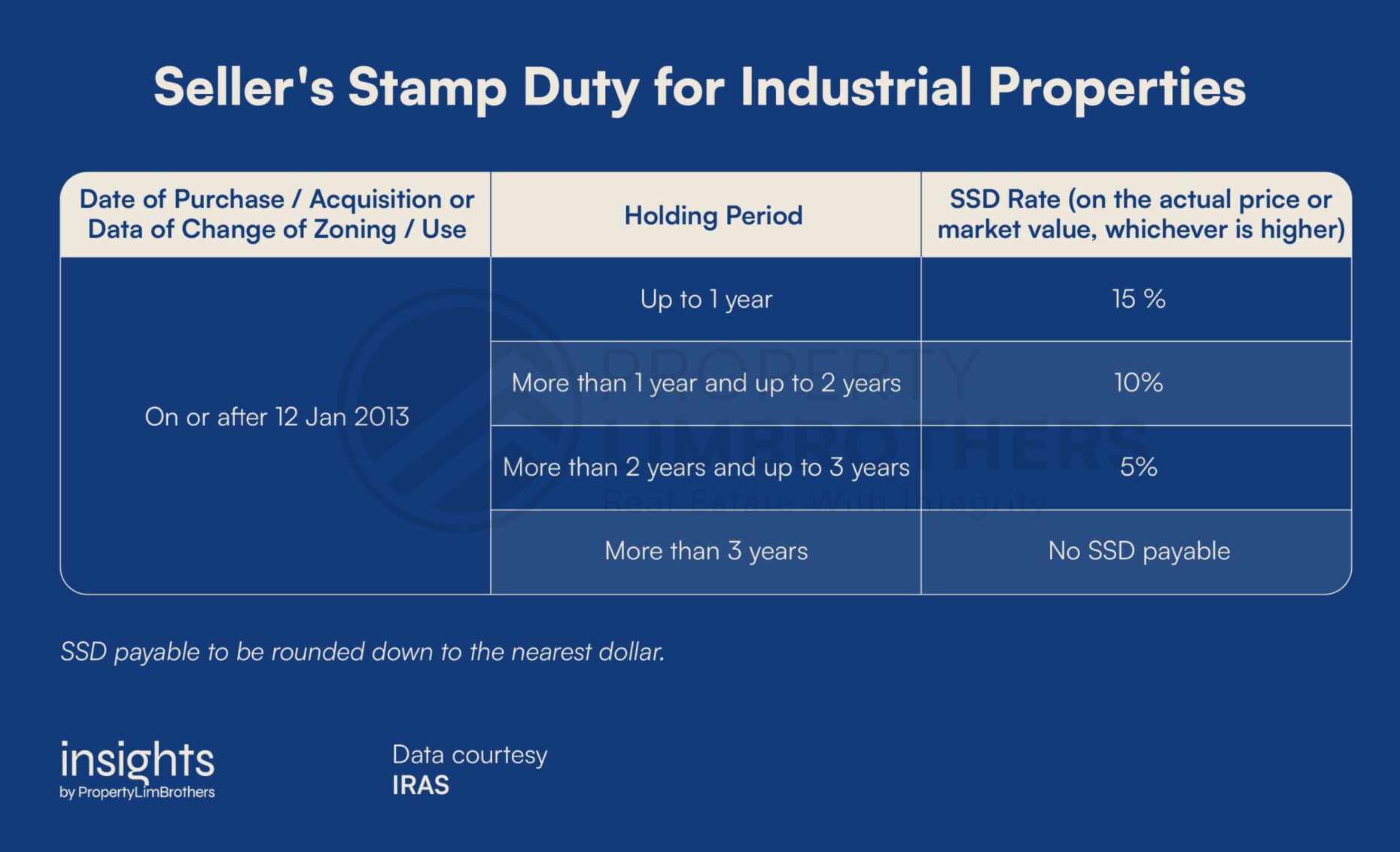

However, it is important to keep in mind that there are still other taxes and fees associated with investing in commercial and industrial properties. For instance, property tax is imposed on all property owners in Singapore and is calculated based on the annual value of the property. Additionally, Seller’s Stamp Duty is payable on the short-term sale of industrial properties. This Seller’s Stamp Duty applies to industrial properties (warehouses, factories, etc.) but not commercial properties (offices, shops, medical suites, shophouses) and is a key distinguishing factor between these two types of non-residential property.

This greatly affects the investment flexibility. Most investors would favour commercial properties unless they are planning to use the industrial property for the purposes of their own business. Therefore, foreign investors should carefully consider the overall costs and benefits of investing in commercial or industrial properties in Singapore, taking into account the various taxes and fees associated with such investments.

In summary, the ABSD exemption for commercial and industrial property investments is the key distinguishing factor when it comes to making these investments more attractive than residential properties to foreign investors. Even for local investors, commercial and industrial properties would be another avenue to owning multiple properties without incurring ABSD.

The Benefits of Investing in Commercial or Industrial Properties in Singapore

Investing in commercial or industrial properties is an attractive option for many investors due to a variety of reasons. Firstly, commercial and industrial properties generally offer higher rental yields (~5%) when compared to residential properties (~2-3%). Businesses and industrial tenants usually sign longer leases and are willing to pay higher rents for properties that can support their operations, making them a more compelling option for investors looking for a steady stream of rental income.

Moreover, investing in commercial and industrial properties can provide an additional layer of diversification to an investor’s portfolio. These types of properties have a different risk profile compared to residential properties, and can offer a hedge against market volatility. As a result, they are popular options for investors who are looking to diversify their investment portfolio. Do note that diversification for diversification’s sake may also have a chance of hurting performance without meaningfully reducing your portfolio risk.

In addition, commercial and industrial properties also have the potential for capital appreciation over the long term. Singapore is a thriving hub of business and commerce in Southeast Asia, and as the city-state continues to grow and develop, demand for commercial and industrial space is likely to increase. This is expected to drive up prices and lead to potential capital appreciation for investors. On this aspect, investors would need to be keenly aware of the sectors that Singapore is known for. The preferences of these businesses on their operating locale will determine not only the capital appreciation but also the rental yield. Thus, the choice of location and type of commercial or industrial property seriously matters

Furthermore, commercial and industrial tenants often have greater stability compared to residential tenants. Businesses and industrial tenants typically have more resources and are more likely to have the financial stability to support their operations. This can provide a more stable and predictable income stream for investors. Singapore is also in 2nd place on the World Bank rankings for ease of doing business among 190 other economies. This would greatly help bring in more global businesses and help the formation of new businesses in Singapore, both of which are good news for commercial and industrial property investors.

Finally, investing in commercial and industrial properties can also offer potential tax benefits, such as deductions for mortgage interest payments, property taxes, and depreciation. This can provide significant savings for investors running their own businesses in the commercial or industrial property and are looking to maximise their return on investment.

However, it is important to carefully consider the unique risks and challenges associated with investing in these types of properties. Market volatility, regulatory compliance, and property management requirements are just a few of the potential risks that investors should be aware of before investing in commercial or industrial properties. In the next section, we will explore the key disadvantages of commercial and industrial properties that you need to be aware of if you are considering investing in these assets.

The Disadvantages of Commercial & Industrial Properties that You Need to be Aware of

Investing in commercial or industrial properties can be a lucrative opportunity for many investors, but it also comes with certain disadvantages that investors should be aware of before making any investment decisions. One major disadvantage is the higher upfront costs associated with these types of properties. Commercial and industrial properties tend to be larger than residential properties and require more specialised features to support business operations, such as loading bays, specialised machinery, and office spaces. These features can increase the overall cost of the property and require a higher level of capital investment.

The cash outlay required for commercial and industrial properties will feel a lot higher for local investors as you cannot use your CPF for the down payment. The loan-to-value ratio typically stands at around 80% but could be much less depending on the financial health of the individual or company that intends to purchase the commercial property. TDSR will apply to individuals purchasing non-residential properties as well. While not a necessary condition, investors with a business entity (with a good financial history) to enter into commercial and industrial property investments. Individual investors might have to fork out larger amounts of cash depending on the LTV situation with the bank loan.

Although commercial or industrial properties are not subject to ABSD, there are other considerations that foreign investors should keep in mind. For instance, when purchasing a commercial property from a GST-registered company, buyers are required to pay GST on the purchase price. However, if the buyer is also registered for GST, they can claim back the amount paid. Conversely, if the buyer is not registered for GST, they must pay the full amount. This can have an impact on the overall cost of the investment and should be factored into the investment decision. Additionally, it’s important to note that if GST is applicable to the property, it will also be applicable to the rent collected from that property. Investors will need to remember that the GST rate is going to increase by another 1% in 2024, bringing the total up to 9% GST. It is also important to note that if you are not a GST-registered entity, you are not allowed to collect GST on the rent of the commercial or industrial property, that would be a crime.

Another disadvantage is the longer vacancy periods associated with commercial and industrial properties. These properties can take longer to find tenants than residential properties, as businesses and industrial tenants may require more specific features or modifications to the property in order to accommodate their needs. As a result, vacancy periods can be longer and result in a loss of income for the investor. Thus, the tenant-owner relationship for commercial and industrial properties is very important. Each should consider the other as a business partner in some sense, since the tenancy is likely a long-term affair.

Moreover, commercial and industrial properties tend to have higher management and maintenance costs than residential properties. This is due to the more complex features and specialised systems required to support business operations, such as elevators, heating, ventilation, and air conditioning (HVAC) systems, and parking lots. Furthermore, commercial and industrial properties often have multiple tenants, which can increase the management and administrative burden on the investor. This depends on the type of commercial and industrial property investors are going for. From retail, offices, medical suites, to shophouses and factories, there are many different options. These management and maintenance costs can vary dramatically depending on the type of commercial or industrial property.

Another potential disadvantage of investing in commercial or industrial properties is the higher risk of being impacted by economic downturns. During times of economic uncertainty, businesses and industrial tenants may be more likely to downsize or close, which can impact the investor’s rental income and overall return on investment. This can be a significant risk for investors, especially those who have invested a large amount of capital into a commercial or industrial property. This is a much larger risk for non-residential properties as they are more greatly affected by economic downtowns. Depending on the type of commercial or industrial property, it will face a varying level of impact based on the type of sector its tenants belong to (e.g. manufacturing, healthcare, etc.).

Lastly, commercial and industrial properties are subject to a variety of regulatory requirements, such as zoning laws, building codes, and environmental regulations. This can be a complex and time-consuming process for investors, as they must comply with these regulations in order to avoid penalties and ensure the property is safe and suitable for tenants. This is especially so for foreign investors who are new to Singapore’s property market. Which is also why it is important to find a competent, experienced, and well-informed realtor on this property segment.

While investing in commercial or industrial properties can offer attractive rental yields, diversification, and potential capital appreciation, it also comes with certain disadvantages that investors should carefully consider before making any investment decisions. These include higher upfront costs, longer vacancy periods, higher management and maintenance costs, higher risk of economic downturns, and regulatory compliance requirements. By carefully weighing the costs and benefits of investing in commercial or industrial real estate, investors can make informed investment decisions that align with their investment goals and risk tolerance.

Closing Thoughts

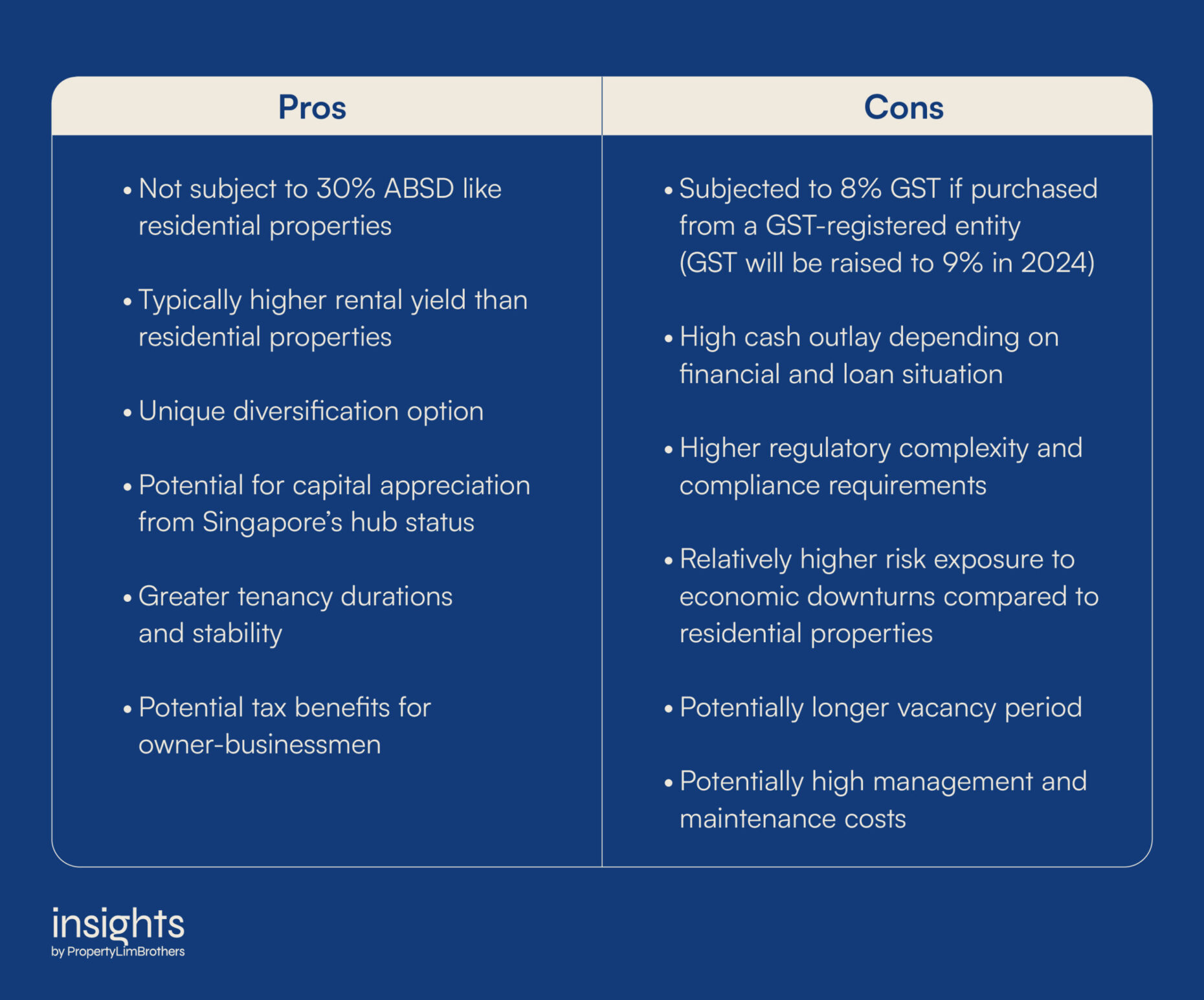

In conclusion, foreign investors interested in commercial or industrial properties in Singapore have much to consider before making investment decisions. While these properties can offer attractive rental yields and diversification, they also come with certain disadvantages that need to be weighed. To help with this decision-making process, we have provided a table outlining the pros and cons of investing in commercial or industrial properties.

If you are particularly interested in buying shophouses, we invite you to read our step-by-step guide to purchasing this type of commercial property in Singapore. In this article, we provide detailed information on the process of buying a shophouse.

We understand that investing in commercial or industrial properties can be a complex process, and it’s natural to have questions or concerns about your investment options. If you are seeking personalised advice on investing in Singapore’s real estate market, our experienced inside sales team is here to help. We have a wealth of knowledge and expertise in the industry, and we can provide you with insights and advice tailored to your specific needs and investment goals. So if you would like to discuss your options further, please don’t hesitate to reach out to us. We look forward to hearing from you and helping you make the most of your investment.

Disclaimer: The information provided in this article is accurate as of the date of publication and is based on the rules and regulations concerning stamp duty rates and taxes in effect at the time. While we strive to update our past articles diligently, please be aware that tax laws and regulations can change frequently, and it is essential to verify the most current rules and guidelines from the relevant government authorities or consult with a qualified professional for the latest updates and accurate advice.