Pure landed properties in Singapore are highly coveted yet exceedingly rare. Comprising only about 5% of all residential properties—approximately 73,000 homes—the supply of pure landed properties has remained stagnant, with little room for future growth. This scarcity cements their status as the ‘hardest’ and most ‘inelastic’ real estate asset in the country, making them a reliable option for wealth preservation and capital growth.

Like any other property type, several factors influence the potential for capital appreciation. One key factor is the Volume Effect, part of our proprietary MOAT Analysis. A higher number of transactions for a specific property type within a neighbourhood or district often sets a precedent for rising prices, as previous sales establish benchmarks for future transactions.

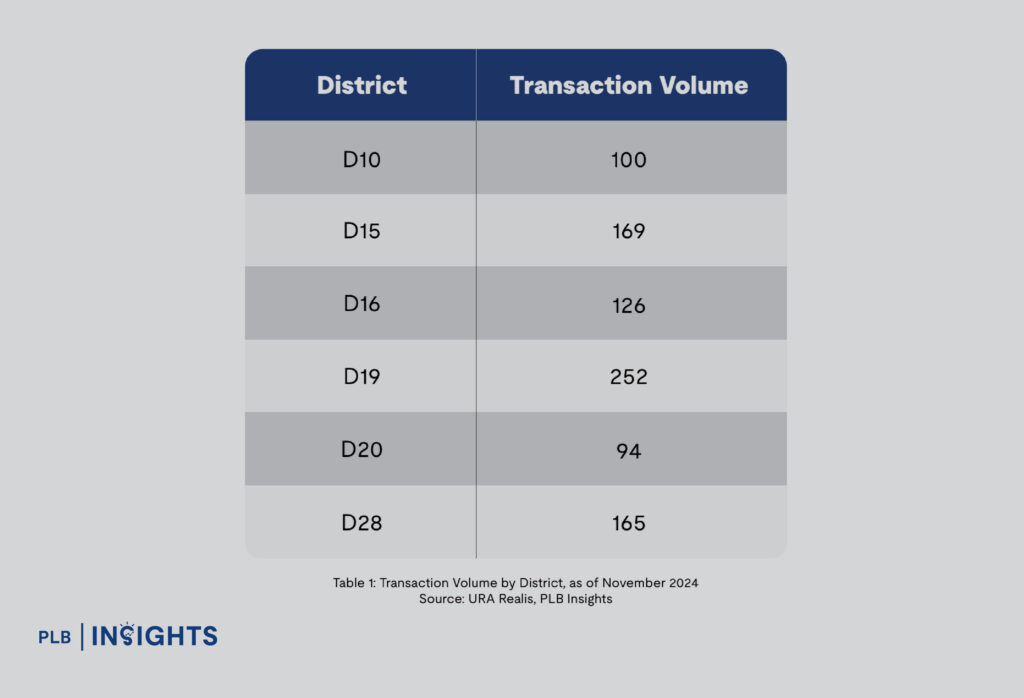

District 19 (D19) stands out as one of the most popular districts among home buyers across various property types. For pure landed homes specifically, D19 has recorded the highest transaction volumes over the past decade. This trend positions D19’s pure landed properties—whether inter-terraced, semi-detached, or detached homes—as compelling assets for wealth preservation and growth.

In this article, we’ll delve into the price trends and growth of pure landed homes in D19, focusing exclusively on properties with 999-year leasehold or freehold tenures.

D19’s Exceptional Growth: Outperforming OCR in Compound Annual Growth Rate

Between 2015 and 2024, pure landed homes in D19 achieved a Compound Annual Growth Rate (CAGR) of 5.4%, surpassing the median CAGR of 4.7% for pure landed homes in the Outside Central Region (OCR). This underscores the investment appeal and resilience of D19’s pure landed properties.

As one of Singapore’s largest districts, D19 includes highly sought-after landed enclaves in Serangoon Gardens, Hougang, Sengkang, and Punggol. Its strong market demand and robust transaction volume are evident, with D19 recording the YTD sales transactions for pure landed homes across all districts in Singapore.

The significantly higher number of pure landed home sales in D19 compared to other districts can be attributed to its attractive combination of convenience, proximity to amenities, and relatively more affordable overall quantum prices compared to many other districts in Singapore. In fact, when compared to the next highest-performing district, D28, D19’s YTD sales transactions are an impressive 52.7% higher.

Price Trends Of Pure Landed Homes in D19

In this section, we will delve into the price trends of each pure landed property type in D19. The insights are drawn from our recently published report on D19’s pure landed homes, carefully curated and prepared for our recently concluded D19 Landed Clinic.

Inter-Terraced and Corner Terrace Homes

Inter-Terraced homes are primarily positioned as entry-level options within the pure landed property market. These properties offer an accessible gateway for buyers seeking land ownership at more affordable price points. Among the Inter-Terraced and Corner Terrace listings in D19, 47% fall under the $4.0 million to $5.0 million range, predominantly categorised as Cat 1 properties under the PLB Landed Framework. These homes typically require significant rebuilding or redevelopment, appealing to buyers with a preference for customisation or long-term investment opportunities.

Meanwhile, 44% of listings are in the $5.0 million to $6.0 million range, where a majority of them are classified as Cat 2 properties. These homes typically offer a balance between affordability and quality, requiring renovations or Additions & Alterations (A&A) to enhance their appeal. They cater to buyers who seek properties with solid foundational features and the flexibility to personalise according to their preferences.

Corner Terrace homes in D19 exhibit slightly higher price brackets, offering larger land sizes and more exclusive layouts. The majority (51%) of Corner Terraces are priced between $4.0 million and $6.0 million, catering to mid-tier buyers seeking properties with enhanced liveability and architectural potential. Additionally, 42% of Corner Terrace listings are priced between $6.0 million and $7.0 million, with most falling under the Cat 3 category.

The absorption ratio for Terrace homes, which includes both Inter-Terraced and Corner Terraces, stands at a healthy 12.2 months. This highlights robust demand and liquidity, underscoring their appeal to a broad spectrum of buyers. The faster turnover rates for these properties, combined with their consistent price appreciation potential, make them a favoured choice for both homeowners and investors.

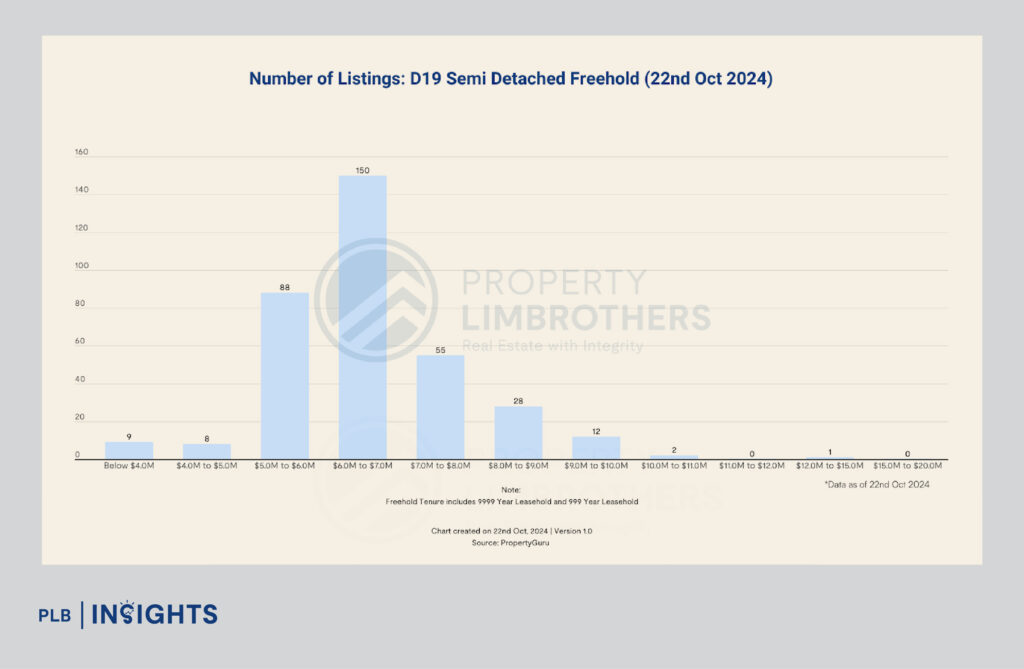

Semi-Detached Homes

Semi-Detached homes in D19 offer a diverse range of options across various price tiers, making them attractive to a broad spectrum of buyers. The report highlights that a significant portion of these homes, approximately 42% of the listings, fall within the $6.0 million to $7.0 million price range. These properties are predominantly classified as Cat 2 homes, which are characterised by their balance between affordability and exclusivity. They are particularly appealing to buyers seeking more substantial land plots and enhanced privacy compared to terrace homes.

The report also indicates that the distribution of Semi-Detached homes spans multiple categories. About 27% of these listings are categorised as Cat 2 properties, showcasing a broad price spectrum within this segment. Furthermore, Cat 3 homes, which generally feature enhanced features, represent 24% of the listings. This distribution demonstrates the flexibility and variety available to potential buyers. At the higher end of the market, a small but notable segment comprising 4% of listings falls under the Cat 4 ultra-luxury category, with prices ranging from $9.0 million to $15.0 million.

The absorption ratio for Semi-Detached homes is notably higher than that of Terrace properties, standing at 110.5 months. This reflects the larger inventory levels and slower turnover typically associated with this property type. However, demand for mid-tier Semi-Detached homes remains resilient, indicating that buyers continue to be drawn to properties offering strong value propositions within this segment. This trend, coupled with improving macroeconomic conditions, suggests the potential for gradual growth in this category of the D19 landed property market.

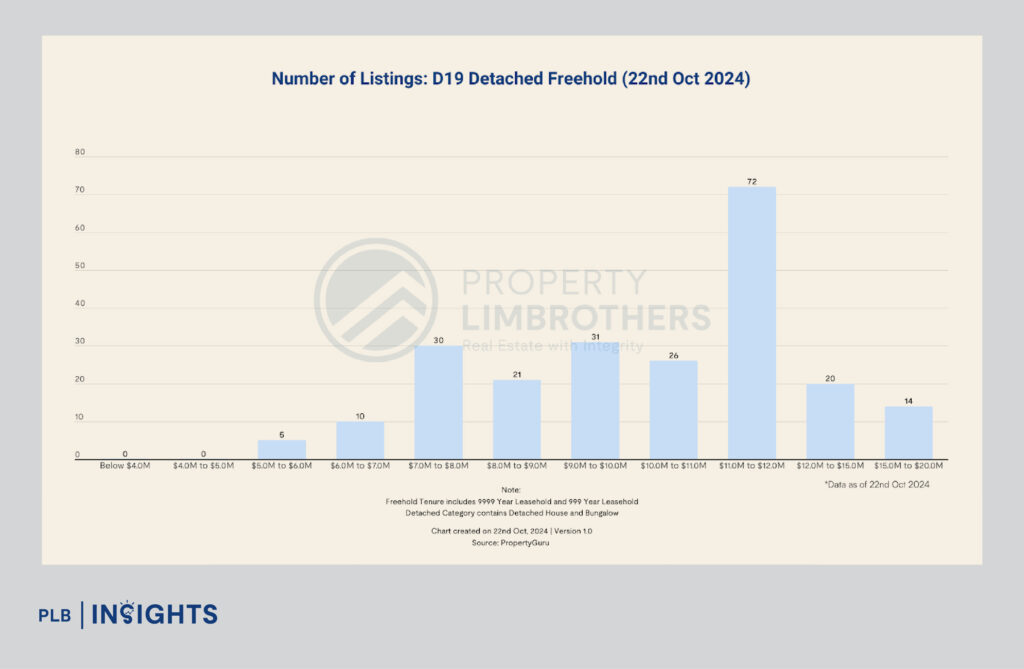

Detached Homes

Detached homes represent the upper echelon of landed properties, commanding premium price points that reflect their exclusivity and desirability. Approximately 31% of detached home listings in D19 are priced between $11.0 million and $12.0 million, predominantly falling under the Cat 4 category, which includes brand-new ultra-luxury developments designed to meet the preferences of high-net-worth buyers.

Mid-tier properties, priced between $7.0 million and $11.0 million, make up 47% of listings. These homes span a mix of Cat 2 and Cat 3 categories, offering a combination of practicality and luxury that appeals to a broader demographic within the high-end market.

The absorption ratio for Detached homes is significantly higher at 229 months, a reflection of the slower turnover characteristic of the ultra-luxury segment. However, demand remains relatively strong for properties in the $6.0 million to $7.0 million range, where Cat 1 & 2 properties offer a more accessible entry point for buyers within the premium market.

In Summary

D19 continues to solidify its reputation as a dynamic and sought-after market for pure landed properties in Singapore. With a consistent Compound Annual Growth Rate (CAGR) of 5.4% from 2015 to 2024, D19 has outperformed the OCR median, highlighting its investment resilience. The diversity in property types, ranging from entry-level Inter-Terraced homes to ultra-luxury Detached properties, ensures there is something for every buyer profile. Robust transaction volumes and healthy absorption rates further underscore the district’s enduring appeal, driven by its connectivity, amenities, and relative affordability compared to other districts.

Whether for wealth preservation, capital appreciation, or lifestyle upgrades, D19’s pure landed properties offer compelling opportunities. From the vibrant mid-tier Semi-Detached segment to the exclusivity of Detached homes, D19 remains a beacon of stability and growth in Singapore’s real estate landscape, making it a prime choice for discerning homeowners.

Buying a pure landed property can feel overwhelming with so many factors to consider. Let our expert consultants guide you every step of the way. From deciphering regulatory requirements to evaluating potential costs and ensuring compliance, we’ll steadfastly navigate this intricate process with you. Contact us today to ensure your property goals are met with confidence and ease.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.