Singapore’s private residential market is poised for a dynamic year in 2025, with over 30 new projects—including three executive condominiums (ECs)—expected to introduce approximately 14,000 units. This marks a significant increase from 2024, which saw 24 projects (including two ECs) with over 7,300 units launched.

Regional Distribution and Market Segmentation

The upcoming launches are evenly distributed across Singapore’s three main regions of Core Central Region (CCR), Rest of Central Region (RCR) and Outside Central Region (OCR).

This distribution offers a diverse range of options for both buyers and investors, catering to varying preferences and investment strategies.

Key Projects in the Core Central Region (CCR)

Several high-profile developments are slated for launch in the CCR:

Aurea: A 188-unit, 45-storey residential tower within the Golden Mile Singapore mixed-use development on Beach Road. Jointly developed by Far East Organization and Perennial Holdings, Aurea will benefit from the ongoing revitalisation of the Beach Road and Ophir-Rochor Corridor, and the Kallang Alive sports and lifestyle hub.

W Residences Singapore – Marina View: This luxury development by IOI Properties Group comprises 683 residential units and a 350-room hotel within a 51-storey tower. Its prime location in the Downtown Core, proximity to Shenton Way MRT Station, as well as nearby retail and dining options enhance its appeal.

Holland Drive Development: A 680-unit private condominium by CapitaLand, UOL Group, Singapore Land Group (SingLand), and Kheng Leong Co. Situated near Holland Village MRT Station, this project offers residents access to vibrant F&B, entertainment, and retail options. It is adjacent to the newly completed mixed-use development One Holland Village. Therefore, future residents will benefit from the convenience of F&B, entertainment, and retail options nearby.

Anticipated Launches in the Rest of Central Region (RCR) and Outside Central Region (OCR)

The RCR and OCR are set to see significant developments:

The Orie: A 777-unit project located at Lorong 1 Toa Payoh, developed by CDL, Frasers Property, and Sekisui House. Its proximity to Braddell MRT Station is expected to attract strong interest.

Bagnall Haus: A 113-unit development by Roxy-Pacific Holdings is located on Upper East Coast Road, near the upcoming Sungei Bedok MRT Station, the interchange for the TEL and Downtown Line that is bound for completion in 2028. This project will likely benefit from the pent-up demand as it is the first new residential development in District 16’s East Coast neighbourhood since 2010.

Elta: A 501-unit development at Clementi Avenue 1 by joint developers CSC Land Group and MCL Land. This project is located near to reputable schools such as Pei Tong Primary School, Nan Hua High School, as well as National University of Singapore.

Lentor Central Residences: 477-unit residential project by GuocoLand, Hong Leong Holdings, and CSC Land Group is expected to launch in 1Q2025. This project is located in the Lentor Hill estate, and is GuocoLand’s fifth residential project in the area.

Parktown Residences: A mega-development with 1,193 residential units, part of an integrated mixed-use development at Tampines Avenue 11. Developed by CapitaLand, UOL, and SingLand, it includes a shopping mall, hawker center, community club, and transport hub.

Market Outlook and Pricing Trends

Analysts project that the influx of new supply in a softening market will keep private home prices in check. Developers are expected to adopt conservative pricing strategies for new launches, aiming to attract a broader spectrum of buyers.

The narrowing price gap between properties across OCR, RCR and CCR has created attractive opportunities in the high-end market, a trend likely to continue into 2025. However, buyers are anticipated to remain selective, favouring well-designed, high-quality projects located near MRT stations, essential amenities, and reputable schools.

Projected New Launches in 2025

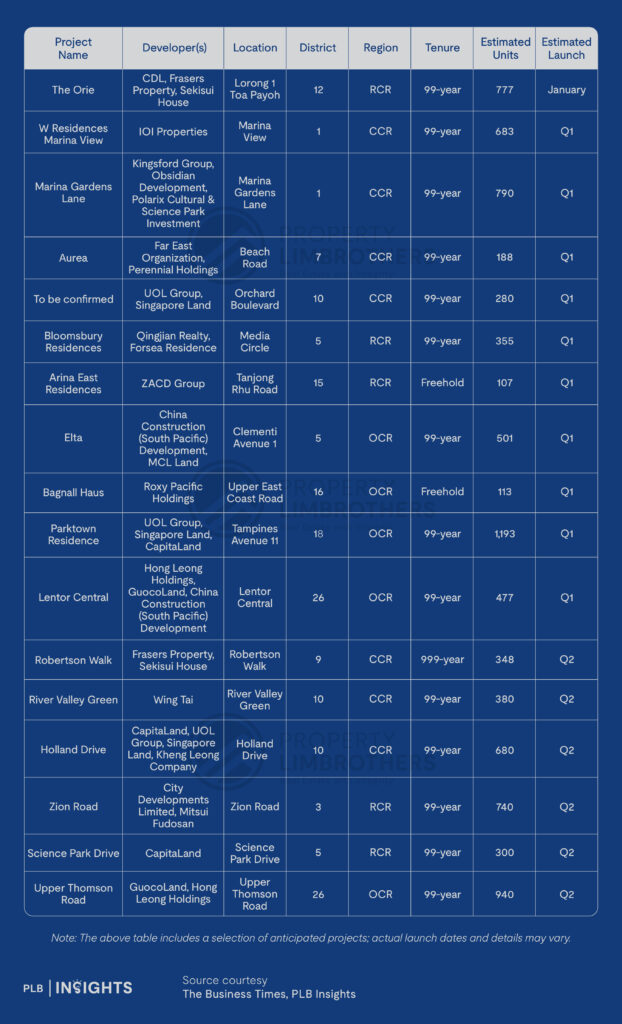

Here is a table of projects expected to launch in the first half of 2025:

Outlook for 2025: Navigating Opportunities in a Selective Market

The Singapore residential property market is poised for a dynamic year in 2025, marked by increased supply and evolving buyer preferences. With heightened activity expected in the Rest of Central Region (RCR) and Outside Central Region (OCR), these segments are likely to capture robust demand. Higher land acquisition and development costs have catalysed more pronounced price growth in these regions, drawing attention from buyers seeking value-driven opportunities.

Resilience Amid Narrowing Price Gaps

The narrowing price disparity between properties in the CCR, RCR, and OCR presents an interesting dynamic for the upcoming year. Historically, CCR properties have underperformed relative to their suburban counterparts, primarily due to cooling measures rolled out in April 2023 that tempered demand from foreign buyers and investors, traditionally the mainstay of the CCR market. However, with RCR and OCR prices having risen significantly in recent years, the relative value proposition of high-end CCR developments is gaining renewed attention.

While some CCR launches in 2024, such as The Collective At One Sophia and Union Square Residences, faced measured sales due to higher price points, projects like Chuan Park, Emerald of Katong, and Nava Grove performed well, bolstered by their competitive pricing and strategic locations.

43% of units sold at Chuan Park and Emerald of Katong were priced below $2 million, with Nava Grove registering an even higher proportion at 51%. This underscores the importance of affordable price quantum in driving demand, especially in a high-interest-rate environment.

Key Developments Expected to Lead 2025

In 2025, several highly anticipated launches are expected to generate significant buyer interest. Projects like The Orie in Toa Payoh and Elta in Clementi are set to resonate with upgraders and first-time buyers due to their strategic locations, comprehensive amenities, and competitive pricing. Similarly, the large-scale Parktown Residences in Tampines North is poised to attract HDB upgraders from the surrounding towns, offering a wide array of housing options and integrated facilities.

Prime developments in the CCR, such as those in Zion Road, River Valley, Holland Drive, and Margaret Drive, will test the resilience of the high-end market. These projects, located near key transport nodes and amenities, are expected to appeal to buyers seeking properties with long-term value potential. Developers’ ability to position these launches competitively will be pivotal in driving absorption rates amid increasing supply.

Selective Demand and Developer Strategy

The 2025 market is expected to reflect a more selective buying environment, with demand concentrated on developments offering strong locational attributes, practical layouts, and realistic pricing. Developers will likely adopt targeted strategies to address these preferences, such as value-added features to differentiate their projects.

Conclusion: A Year of Opportunities and Adjustments

2025 will likely be a transformative year for Singapore’s residential property market, especially with rate cuts on the horizon. The strong pipeline of launches across all regions offers buyers a diverse range of options, while developers face the challenge of positioning their projects effectively. The interplay of affordability, value, and location will remain central to determining market performance.

Stay Updated and Let’s Get In Touch

Curious about the 2025 Real Estate outlook in Singapore? Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.