The private residential market in Singapore experienced contrasting trends in Q4 2024, with property prices surging while rentals stabilized.

Private Property Price Index

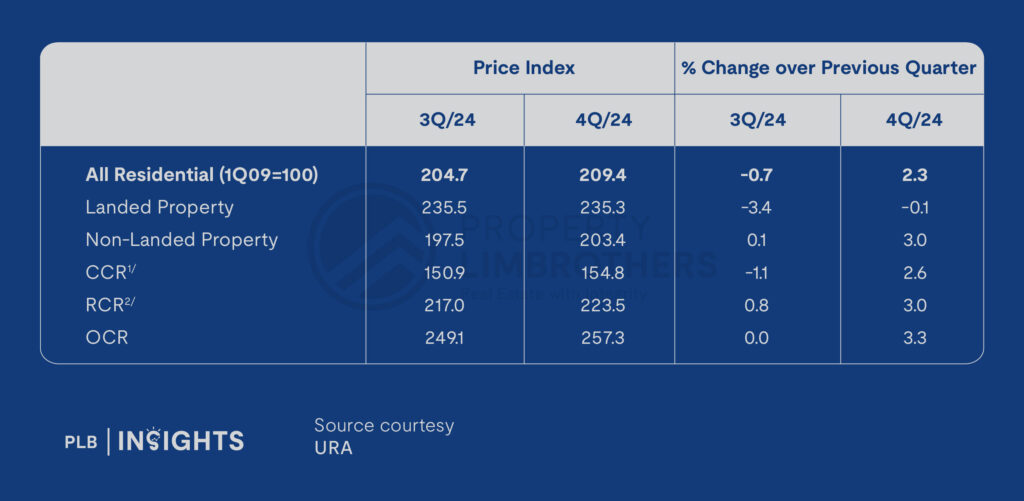

The Private Property Price Index rose by 2.3% in Q4, reversing the 0.7% decline in Q3.

For the whole of 2024, prices increased by 3.9%, reflecting a moderated pace compared to 6.8% in 2023 and 8.6% in 2022.

Non-landed properties led the price growth in Q4, with prices climbing 3.0%. Regionally, the Outside Central Region (OCR) recorded the highest growth at 3.3%, followed by the Rest of Central Region (RCR) at 3.0% and the Core Central Region (CCR) at 2.6%. In contrast, prices for landed properties fell slightly by 0.1%, following a sharper 3.4% decline in Q3. Annually, non-landed property prices rose by 4.7%, while landed properties increased by 0.9%.

Rental Market

The rental market, meanwhile, showed signs of cooling. Overall, rentals remained unchanged in Q4, following a 0.8% increase in Q3. For the full year, private residential rentals declined by 1.9%, reversing the 8.7% increase in 2023. Non-landed property rentals rose marginally by 0.2% in Q4, driven by a 0.9% increase in the Core Central Region (CCR) and a 0.3% rise in the Rest of Central Region (RCR), while rentals in the Outside Central Region (OCR) fell by 0.8%. In contrast, rentals for landed properties fell by 1.8% in Q4.

Year-on-year rental declines were broad-based across regions. Non-landed property rentals in CCR, RCR, and OCR decreased by 2.4%, 1.3%, and 1.3%, respectively, compared to rental growth ranging from 5.0% to 9.0% in 2023.

These divergent trends reflect a market balancing act: rising demand for private property purchases, spurred by newly launched projects, alongside easing rental pressures due to increased housing supply. Developers launched 3,425 uncompleted private residential units in Q4, nearly tripling the 1,284 units in Q3, and sold 3,420 units—indicating robust buyer interest in new projects.

As new supply continues to enter the market, the rental outlook may remain subdued, while property price growth is expected to stabilize further in 2025.