Image courtesy: PropertyLimBrothers.

2020 has been a tough year for the world with the COVID-19 pandemic, harbingering a financial crisis that has sent the global economy into a decade low. As we head into 2021, it’s always good to reflect on events from the past year and perhaps then we may learn how we can progress from here. Let’s have a look at how the real estate market fared in 2020 and anticipate what we can expect this year.

Reflections on the COVID-19 pandemic and the entailing financial crisis that engulfed the world

By the end of 2020, global deaths by the virus had surpassed 1.7 million, making COVID-19 one of the worst pandemics we have seen in recent decades. The implementation of lockdowns in many countries has caused major disruptions to the livelihoods of people worldwide.

Businesses across several sectors were heavily affected by drastic lifestyle changes as consumers began to seriously reconsider their needs. This sparked a sudden shift in the market’s demand for certain products and services, with life essentials such as food and healthcare remaining prioritised as true necessities.

Image courtesy: SCMP.

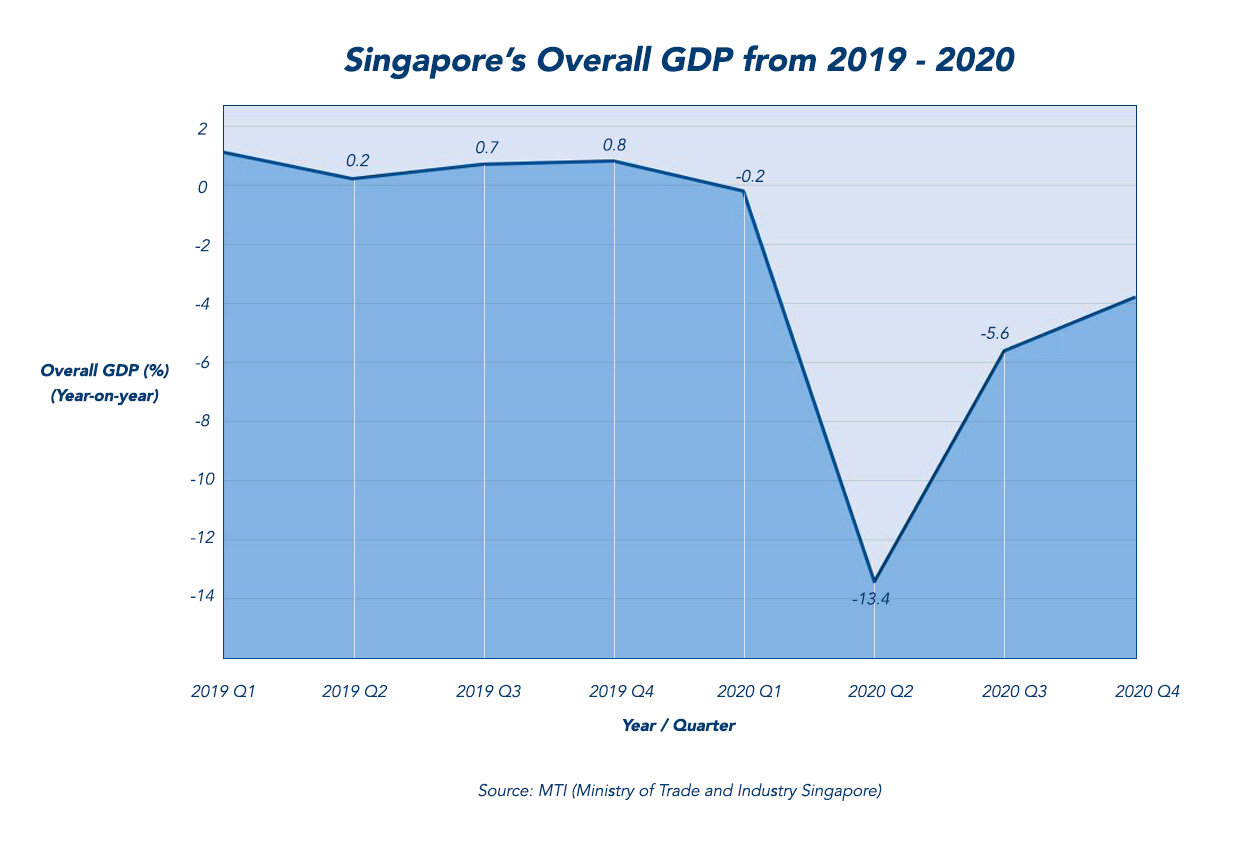

Global markets were crashing and Singapore was certainly not spared from this. Singapore’s economy dwindled significantly from the previous year as the nation’s Gross Domestic Product (GDP) contracted by as much as a record 13.2% by the second quarter of 2020, although the contraction did gradually ease out by the end of the year.

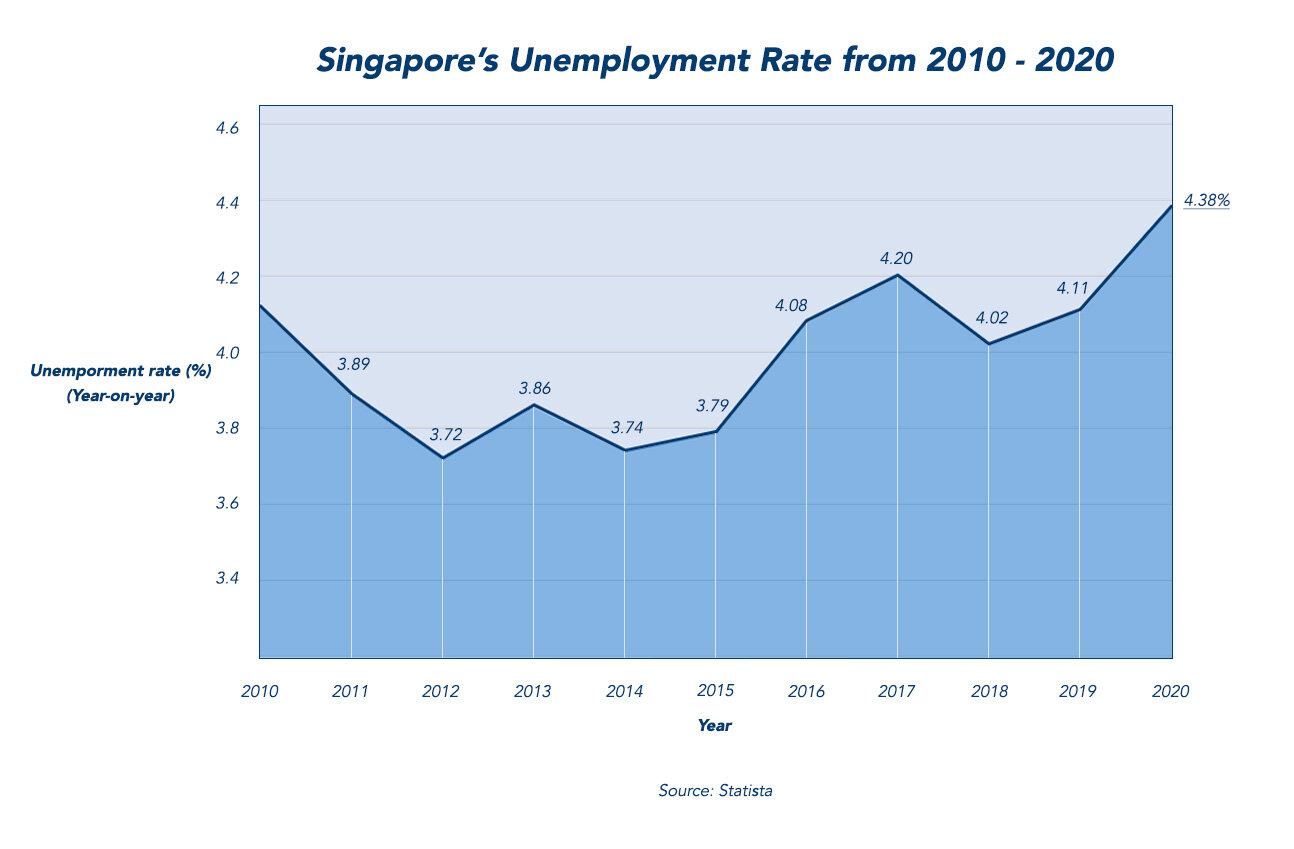

Unemployment rates in Singapore also drastically increased from 4.11% in 2019 to 4.38% in 2020. All of these factors were expected to create an indirect impact on the real estate market, as without a stable income, it is unlikely for one to be able to comfortably afford the exorbitant cost of properties.

Most would expect a natural decline in luxury property transactions, or perhaps some major price corrections of property prices – which did occur multiple times during the Global Financial Crisis in 2008 and the Asian Financial Crisis in 1997. But despite the severity of the present global circumstances and disruptions to physical property viewings during the two-month “circuit breaker”, the overall sales for the properties in Singapore in 2020 surprisingly defied some generally low expectations for the year, particularly in the luxury residential market.

How did Singapore’s Property Market defy bleak expectations?

Increased demand from property investors kept local real estate market bustling

While some people who have been more seriously impacted by the economic downturn would begin to instinctively tighten their belts and mindfully manage their finances, several wealthy investors have instead been actively on the lookout for value assets in the luxury property market in hopes of seizing the opportunity to grow their wealth.

In the first 10 months of 2020, the sales for new homes were down by only 4.5% as compared to 2019. Following URA’s clampdown on the re-issue of OTPs (Option-To-Purchase), which was aimed at curbing inflation of property prices and encouraging financial prudence amid the economic crisis, property sales also saw a dip in October last year. Despite this measure, the predicted full-year sales for 2020 was expected to range between 9,000 and 9,500 units; which is not too far off from the previous year’s sales.

Wallich Residence, The Pinnacle of Luxury Living, courtesy: Wallich Residence.

In the luxury property sector, many multi-million dollar transactions were also sealed; boosting sales by a great deal. More than 2,000 luxury condominium units were successfully sold by the third quarter of 2020 and as for the higher end of the market, approximately 160 sales were secured with properties exceeding S$5 million in value and 33 other luxury property transactions were valued above S$10 million. Similarly, landed housing has also received a significant increase in demand with more than 1,000 landed properties sold in 2020.

Overlaps of HDB upgraders and en bloc sales fever

HDB upgraders make up half of the private condo consumers and approximately 48,500 HDB flats which were sold in 2014 and 2015 would have completed or would have completed their minimum occupation period (MOP) by 2020 or 2021. This would make these HDB owners eligible to sell their HDB and open to the choice of a property upgrade to a condominium or landed property.

Singapore’s iconic Rochor Centre was demolished in June 2018 following an en bloc sale, Image courtesy: Channel News Asia.

To add on, if we recall the massive en bloc sales fever that happened back in 2017 and 2018, record-breaking annual total sales of approximately S$7.3 billion and S$10.5 billion were secured respectively. Considering that these development projects have been continuously running, some of these projects would have been completed by 2020, explaining the sudden surge in new property launches in that same year.

With an ample supply of new launches and resale units on the market to meet the growing demand for property, the real estate market has been flourishing throughout 2020, even surpassing pre-pandemic transaction records.

The influx of Foreign Direct Investment (FDI) in Singapore following key global events

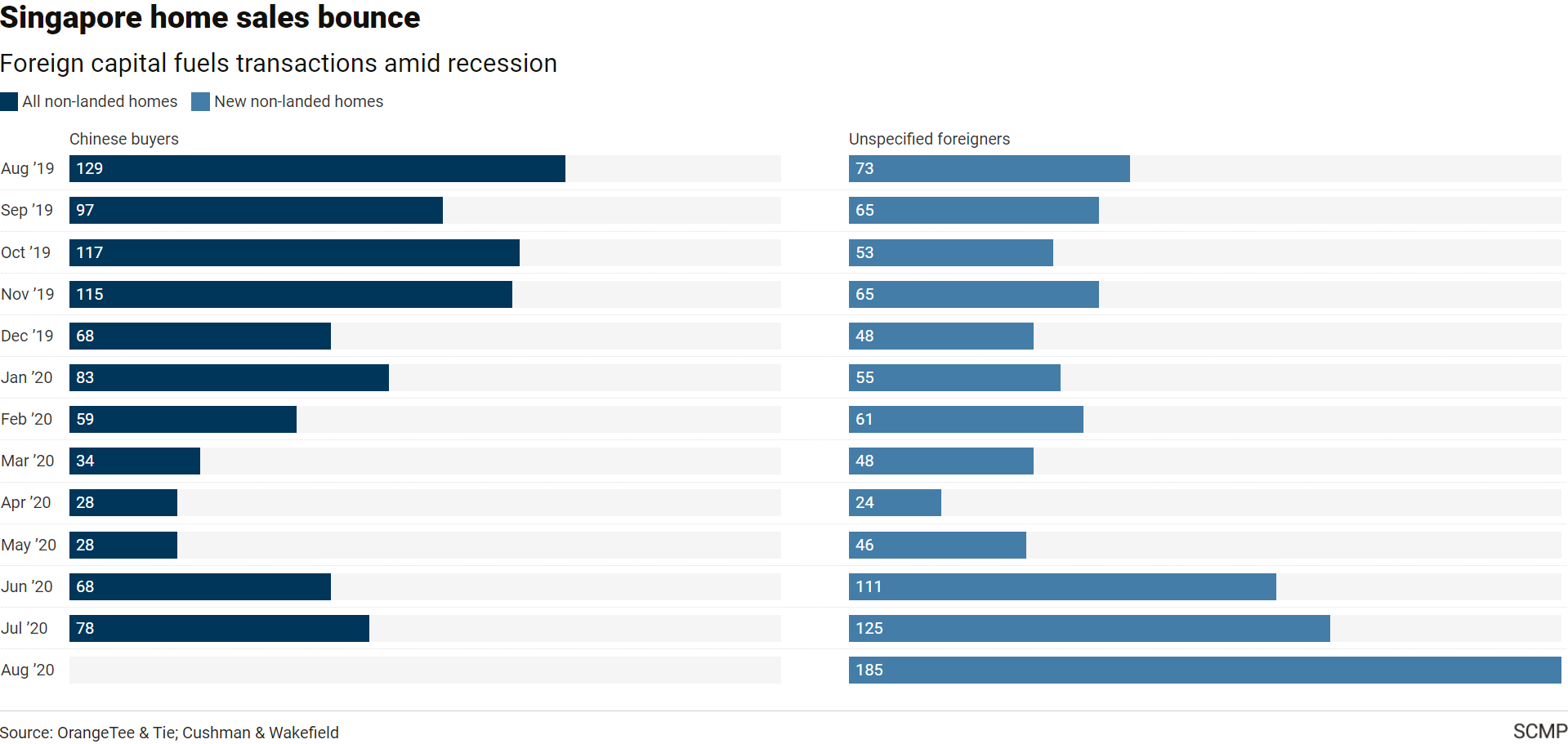

Another factor that potentially contributed to the success of the real estate industry in 2020 is the strong interest of foreign investors and permanent residents of Singapore as possible sources for the increased demand in the private residential property market.

Image courtesy: Straits Times

With ongoing tensions in other countries such as the controversial Quantitative Easing (QE), United States (US), the US-China trade war, Brexit woes in the UK and the longstanding Hong Kong riots, Singapore’s neutrality towards these events has helped to maintain peaceful diplomatic relations with other countries. With our transparent policies and political stability, many foreigners still perceive Singapore as one of the best countries in the world for investment.

Singapore also faces very little competition in the property market within the region. While Hong Kong is a strong contender, the ongoing political instability makes it much less appealing for investors. Australia’s property market fared considerably well through the pandemic too, but certain regulations on foreign buyers along with ongoing political tensions with China are likely to redirect Chinese investors to other countries like Singapore.

Marina One Residences., nestled in 21/23 Marina Way within walking distance to Marina Bay MRT station, Image courtesy: Marina One Residences SG.

Another reason for the sudden influx of Chinese investors in Singapore can be linked back to the devaluation of the Chinese yuan, which has prompted several investors to redirect their funds into luxury properties, with Singapore being one of their favourite destinations. One such property project that saw great success with wealthy Chinese buyers was the Marina One Residences which is located just five minutes away from Marina Bay Sands. The development saw lucrative transactions with three Chinese clients who purchased six apartments valued at S$20 million combined even without any virtual tours. Another investor spent about S$12 million on three separate three-bedroom units in the same development.

Also, when considering the dangers of COVID-19, Singapore ranks as one of the safest countries in Southeast Asia and the fourth safest place to live in the world, considering how the containment of the virus and management of the local financial crisis was handled with great prudence by the Singaporean government. The promising economic and health stability that Singapore has to offer is the probable reason why several foreign investors, including both independent entities and multinational corporations (MNCs) from mainland China and other unspecified foreign countries, have since flocked to Singapore following the pandemic, confident of potential investment opportunities in a haven that may grant them peace of mind.

Graph reflecting the surge of property transactions involving foreign purchasers in 2020, courtesy: Data Wrapper.

What has the government done to help the property industry through the pandemic and economic crisis?

Lowered mortgage interest rates and deferring of loan payments allows for buyers to continue purchasing property with lower servicing commitments.

To counter disruptions caused by the COVID-19 pandemic, governments and central banks around the world authorised monetary programmes and stimulation packages to provide support for people and to hopefully encourage spending during the pandemic. With interest rates falling at a recurring low, investors sought to capitalise on the low interest rates to secure lower mortgage payments for the future.

In Singapore, measures which allow borrowers to defer their loan repayments were introduced. Singaporean couples who purchased a second residential property are now allowed up to a year instead of the previously regulated six months to sell their first residential property to be granted a remission of the Additional Buyer’s Stamp Duty (ABSD).

Other temporary relief measures issued by the government were targeted to help developers. Such measures included a granted waiver of extension charges for up to six months for the completion and sales of all residential, commercial, and industrial developmental projects that may have been affected by the pandemic.

The implementation of these measures has likely helped to prevent homeowners and developers from slashing prices to push for sales, avoiding major price corrections that would have been upsetting for the property market here.

“Cooling measures” were maintained to keep the surging demand for property in check

The Additional Buyer’s Stamp Duty (ABSD) tax was introduced in 2011 as a“cooling measure” to discourage both foreign and local entities from purchasing multiple properties; thus, suppressing any excessive demand. ABSD rates were then increased in 2013 and more buyer profiles were included to be accountable for the tax. In 2018, ABSD rates were once again raised but have remained unchanged since.

In the same year, other additional cooling measures were also introduced, such as the Total Debt Servicing Ratio (TDSR) and Seller’s Stamp Duty (SSD) which reduced the volume of property transactions rather significantly by regulating responsible mortgage loans based on a buyer’s means.

With these existing measures in place, the surge in demand for property in Singapore has been effectively managed, preventing the massive inflation of property prices so that housing prices will remain reasonably affordable for Singaporeans.

What can we expect for the real estate market in 2021?

Image courtesy: Retalk Asia.

The Real Estate Market in Singapore is expected to hold steady

Considering how the local real estate market is still prospering despite such a dire global economic situation, property sales and price indexes are speculated to maintain or even ascend this year, especially with the eventual alleviation of the pandemic’s disruption to daily life.

Singapore’s Prime Minister Lee Hsien Loong receives Pfizer-BioNTech coronavirus vaccination, courtesy: The Straits Times.

Being the first country in Asia to receive doses of the Pfizer-BioNTech COVID-19 vaccine, Singapore is embarking on the path to recovery from the COVID-19 outbreak. There has also been talk about how the vaccine could potentially salvage the local aviation industry, which has been left in a devastating plight due to a strict curtailment on international travel, should Singapore be turned into a transhipment hub for vaccines in the near future. Ultimately, economic activity in Singapore is expected to recuperate soon, with our GDP growth expected to improve between 4% and 6% in 2021. Although the employment rate dipped drastically in 2020, Singapore’s employment rate has also begun to show steady signs of recovery as we head into 2021.

With a steadily recovering economy, investors are expected to continue investing in local property rather proactively. A big bulk of the MOP Market of HDB upgraders is also likely to carry over to this year, sustaining a stable demand for property for 2021.

Low Mortgage Interest Rates likely to continue

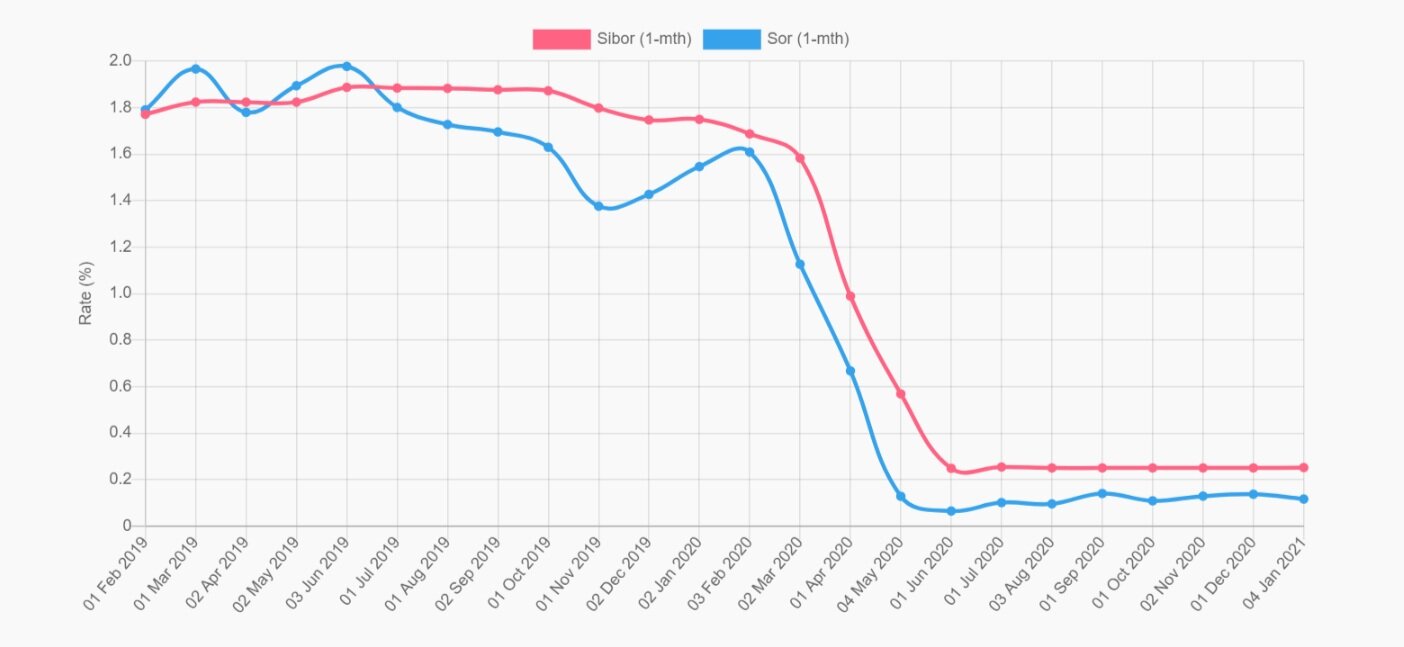

Due to the United States Federal Reserves’ (the Fed) decision to begin QE and slash interest rates, there has been a direct impact on SIBOR (Singapore Interbank Offered Rate) rates which plunged as low as 0.247% in September 2020, which is a hefty dip when compared to the rate 1.87% just a year earlier.

SIBOR rates from February 2019 to January 2021, courtesy SIBOR.

Although some fluctuations in the rates have been anticipated, it is unlikely that the SIBOR rates would drastically climb back up anytime soon as speculated based on the rate’s trend during the 2008 Financial Crisis which took a rather long time to recover. The Fed plans to keep interest rates low till 2022, but even after that, the rates are still likely to remain reasonably low for a long while. Several financial institutions in Singapore will also begin to introduce Singapore Overnight Rate Average (SORA) rates in 2021, which is expected to provide better rates than SIBOR and potentially further ease mortgage rates for buyers.

Ultimately, mortgage rates are expected to remain affordable in 2021 which may prove as a highly opportunistic time for buyers who are actively seeking new homes or properties for investment purposes.

The potential return of the en bloc sales fever?

There has been some speculation that another cycle of the en bloc sales fever could potentially begin in 2021 based on the general trends happening in the real estate market currently.

In 2019, due to the oversupply of private residential housing under the Government Land Sales (GLS) programme, the government decided to regulate the supply by delaying the release of a few confirmed GLS sites for further development in Singapore.

Image courtesy: The Independent.

However, due to the cut back on GLS sites which limits the offerings to developers, these developers could instead be pushed to more en bloc sales, which ironically nullifies the government’s efforts to ease the oversupply of residential development and housing in Singapore through the delay of GLS site releases to some extent.

HDB resale and private property prices are still projected to increase

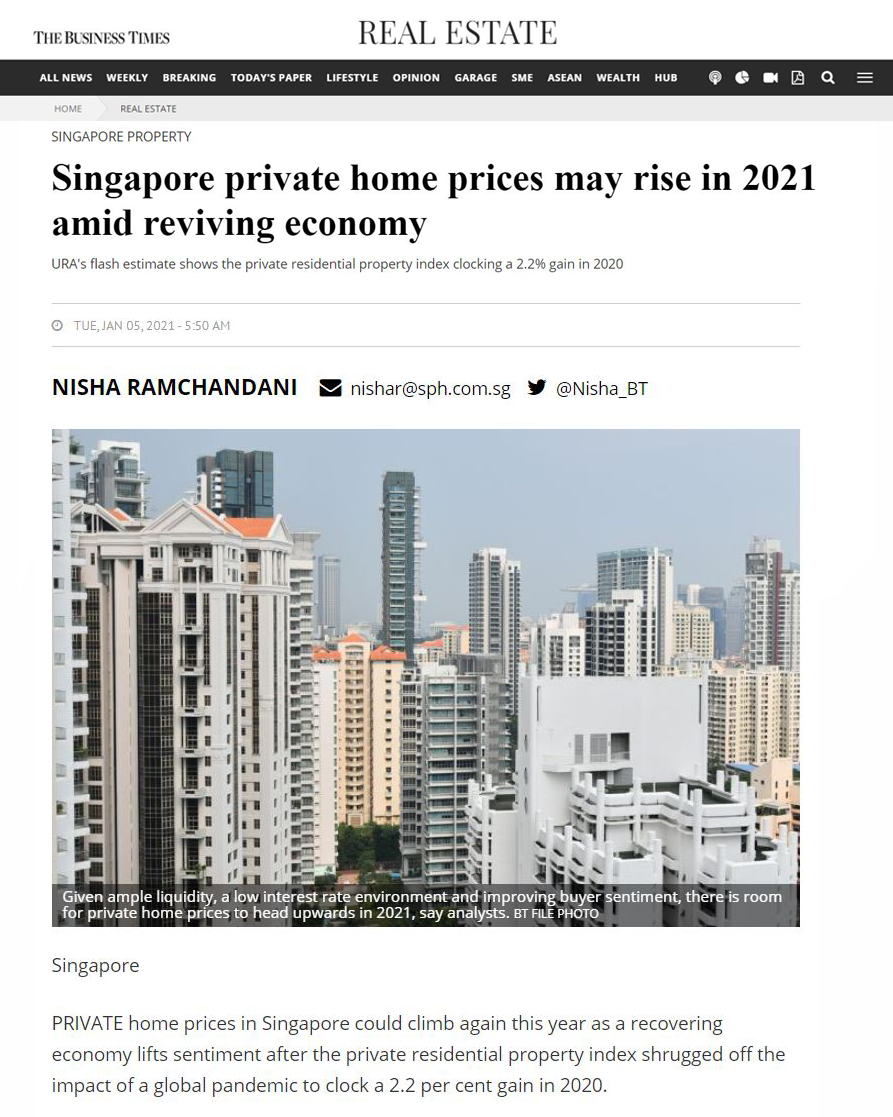

Image courtesy: The Business Times.

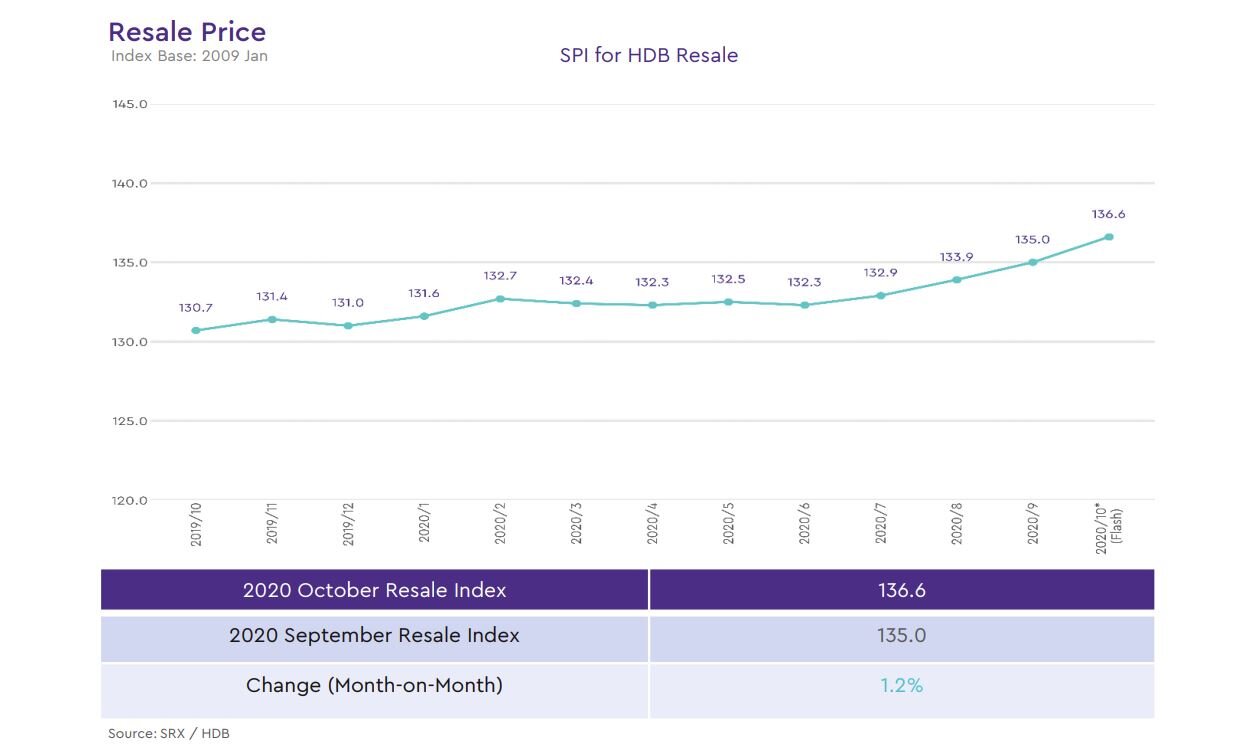

2020 saw a significant rise in the overall price index by 2.1% for private residential properties, which is the fastest increase since mid-2018. In the fourth quarter of 2020, HDB resale prices rose by 2.9%, which is the biggest quarterly hike in 9 years. 82 HDB resale flats were sold for at least S$1 million in 2020, which accounted for 0.35% of HDB resale flat transactions in 2020.

Image courtesy: Darren Ong.

By analysing the property market in 2020, the HDB resale market seems to be faring decently. HDB resales have sustained popularity throughout COVID-19 likely due to the high retrenchment rates and lower-income workers being pressured to cut costs by downgrading their homes and the reconsideration of more economical housing upgrade options. An oversubscription for HDB’s Build-to-order (BTO) flats is also expected to redirect unsuccessful BTO applicants to consider resale HDBs instead.

Despite COVID-19, the property market has not seen much discounts in 2020, yet the demand for property remains unwavering. From this, analysts have deduced that the current upward trend is likely to continue into 2021, which may disappoint buyers who seek lower rates.

Nonetheless, housing demand is likely to carry on into 2021. While prices are expected to keep rising, the increase could likely be slowed by the lower number of new launches planned for the year. With the situation improving for the real estate market, it is improbable that we will see a decline in prices in 2021, but instead, they are projected to continue rising.

Would it be wise to invest in property now?

Since the property market is expected to remain highly volatile and subjective to global conditions for the foreseeable future, you may be uncertain about whether it is still a good time to continue investments in property. Here’s our take on property investments in 2021:

It really depends on how you intend to use the property. If you are seeking a new property to serve as your primary residence, we think it may not be an advisable time to look into the market for the time being as prices are expected to continue to climb steadily in 2021. However, if you would like to purchase a property purely for investment purposes, we recommend keeping a close eye on the property market and proactively look out for good deals that may come by this year.

While we still encourage the buying of property, we advise that such investments should be done with a lot of prudent thought and good judgement. We have some advice that may help you make better decisions when purchasing property:

Look out for changing trends and demands in the market

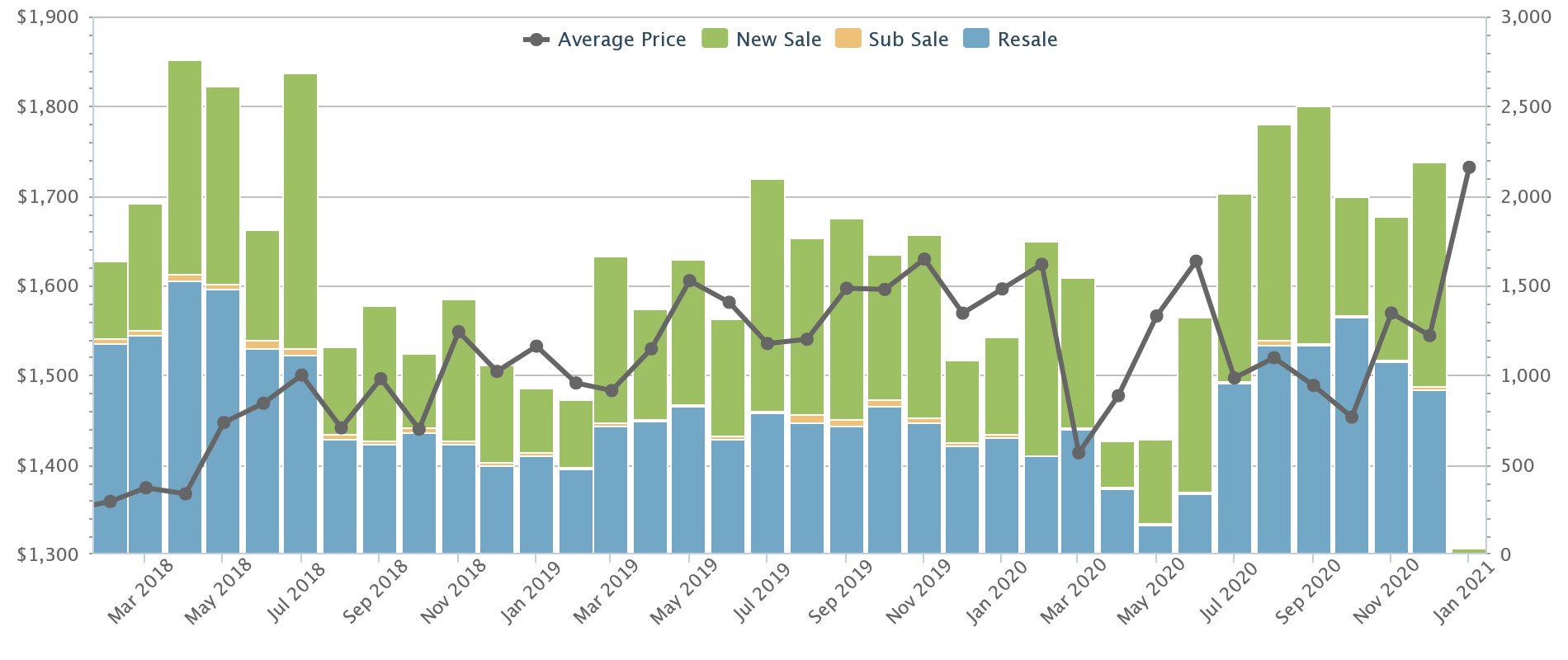

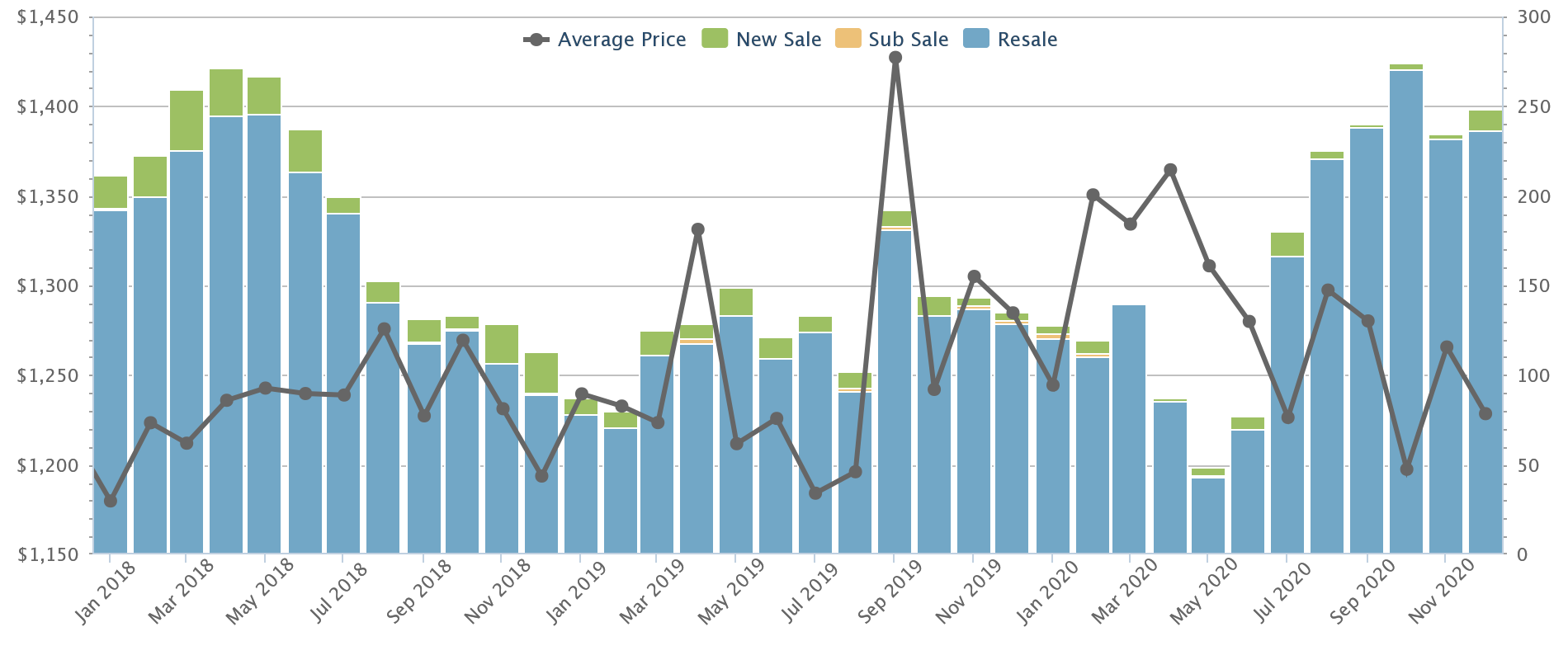

Research on the market should be done proactively for the market is highly volatile and trends are ever-changing. For example, penthouses have been particularly popular in the last year shortly after the circuit breaker began.

Sales history of all non-landed residential property in Singapore from 2018 – present, courtesy: Squarefoot.

Sales history of all landed residential property in Singapore from 2018 – present, Courtesy: Squarefoot.

Consumer needs and demands are always changing depending on the events happening in Singapore and around the world. Hence, it’s important to have a solid understanding of the real estate market’s behaviour both globally and locally within at least six to twelve months of a planned property purchase to make an informed decision. Keep an eye out on the news, and try to anticipate trends. Alternatively, you may approach us for more advice at PropertyLimBrothers here.

Visualise your exit in a few years’ time

Buying property is simple but a lot of people don’t think about the real challenge that comes during the exit when you eventually decide to sell your property – which is key to making smart decisions in investments. You will also require a strong marketing campaign to successfully sell your property quickly and at a good price. Here at PropertyLimBrothers, we advocate mindful purchases that envision your exit strategy. Feel free to explore more with our articles.

For starters, when purchasing a new property, don’t only think about your personal preferences but try placing yourself in a future buyer’s shoes and visualise theirs too. What will they be looking for in a few years time and what can you do to reduce any concerns they may have?

It is important to stay practical when purchasing a property, especially if the property is intended purely for long-term investment. Consider properties that can cater to a wide audience so that your property will be attractive to a bigger market of interested buyers.

Kopar at Newton, 99-years luxury condominium in prime District 9, courtesy: Kopar at Newton.

Aside from comparing the unit’s layout and quantum between developments, consider the amenities in proximity to the unit that could provide for some essential needs which might build on your property’s value in the future. Some of these amenities are such as schools, transport services like MRT stations and bus stops as well as food options in the area. Try thinking for the long-term. These don’t have to be existing amenities, but speculated commercial projects in the future such as a new MRT station or a shopping mall in the vicinity could likely reap even greater profits once they have been completed and launched to the public for service.

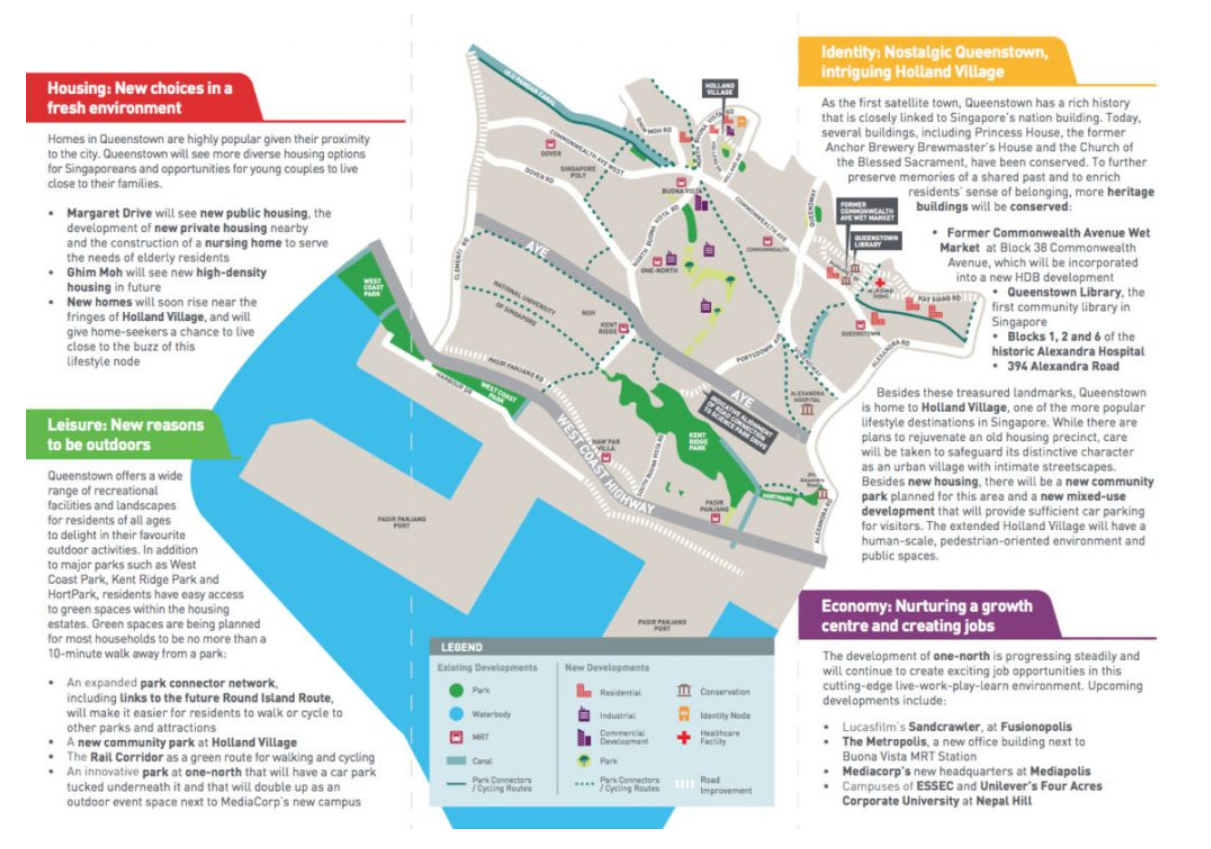

URA Master plan of Leedon Green showing future developments within the vicinity, courtesy: Leedon Green.

Consider the disparity effect

It is important to look for any disparity in factors such as the price and attributive disparities of properties. Staying consistently updated with the ever-changing trends and demands of the volatile property market in Singapore and around the world that may affect the value of certain properties would certainly prove useful when making decisions too.

To effectively evaluate your choices, try picking units with similar floor plan layouts and total floor area for comparison. By looking for any disparities in quantum between the layouts, other nearby developments, and developments located across different regions in Singapore (OCR, CCR and RCR).

If the disparity in prices is negligible enough, you should consider a potential upgrade to the better option as this may provide more promising returns in the long run when you decide to sell your property since your future buyer is very likely to consider these factors as well.

Keep your options open

Aside from the highly-raved new launches, the resale market has some pretty good options up for sale too. Sifting through the available units might be arduous, which is why PropertyLimBrothers is here to help you out for your next purchase.

When purchasing resale units, consider hunting for freeholds with good attributes that are in proximity to new launches while keeping the PSF (per square foot) benchmark prices in mind.

This is so that should you decide to sell your property in the future, buyers who are targeting the new launch in the area will be more likely to potentially consider your listing as a comparable option for purchase, which almost automatically grants your property listing a higher viewing rate with better marketing opportunities.

You could also consider properties with 99-year leaseholds that have lower quantums compared to neighbouring counterparts for an easier exit plan in the future. Generally, it’s good to go for unique and larger sized apartments such as the 4- and 5- bedders, penthouses and ground floor units that may be more attractive in the market.

We will be covering these more in-depth in our upcoming articles, so do stay tuned for that. Alternatively, we have a video here that touches on this too.

Image courtesy: Cadogantate.

We hope this article has been useful in providing a more comprehensive insight into the property market in 2020 and what we could expect for 2021. Should you require some advice from our team of real estate professionals, contact us here and stay tuned for the next article in which we will provide more in-depth advice on how to invest wisely in a volatile market.