As a young adult, the prospect of finding your own space in Singapore’s housing market can be both thrilling and daunting. The choice between renting and buying is more than a financial decision; it’s a profound reflection of your dreams, your chosen lifestyle, and your evolving definition of ‘home.’

In this article, we will be exploring the nuances between renting and buying, all while keeping essential considerations in mind. Join us as we navigate through the current housing scene, bringing you closer to your dream home.

Current Happenings

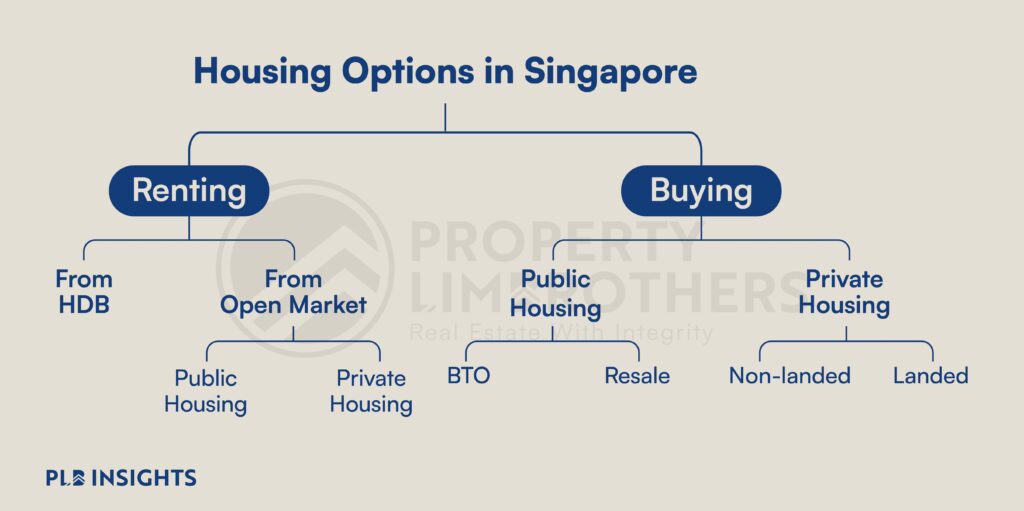

Let us lay out the various renting and buying options available!

1) Renting From HDB

While HDB is widely recognised for developing public housing for residents to purchase, it may come as a surprise that purpose-built rental flats are also part of certain BTO developments. These rental units offer prospective tenants the advantage of lower rental rates compared to the open market.

HDB rental units cater primarily to two groups of people: low-income individuals and households, and families awaiting the completion of their BTO flats. The schemes for renters to apply are the Public Rental Scheme and Parenthood Provisional Housing Scheme (PPHS), providing support to those in need of short-term accommodation and financial support. For those interested in the PPHS rental scheme, look out for our upcoming article and an inside look of applying for one from our very own in-house writer.

This approach to integrating rental flats within BTO developments serves a dual purpose. Firstly, it promotes social integration and inclusivity by enabling individuals from diverse socioeconomic backgrounds to reside in the same neighbourhoods. This strategy fosters a sense of community and notably reduces the stigmatisation often associated with public housing, creating a more inclusive and harmonious living environment for all residents.

It is important to note that while renting from HDB provides a more affordable housing option, there are stricter eligibility requirements, such as having a monthly household income below $7000 (at the time of your BTO application) for PPHS, and the process of securing housing may be a longer one since you have to ballot for it as well.

2) Renting from the Open Market

In addition to HDB rental flats, renting from the open market is a common option for individuals and families in Singapore. Renting from the open market typically involves leasing a residential property directly from its owner or through a property agent.

One of the key advantages of renting from the open market is the flexibility it offers. Tenants have a wide range of choices when it comes to property types, locations, and lease durations. This flexibility allows individuals to find rental properties that best suit their specific needs and lifestyles.

However, renting from the open market can often come at a higher cost compared to HDB rental flats. Rental rates are influenced by market forces and can exhibit variability based on factors such as location and property type.

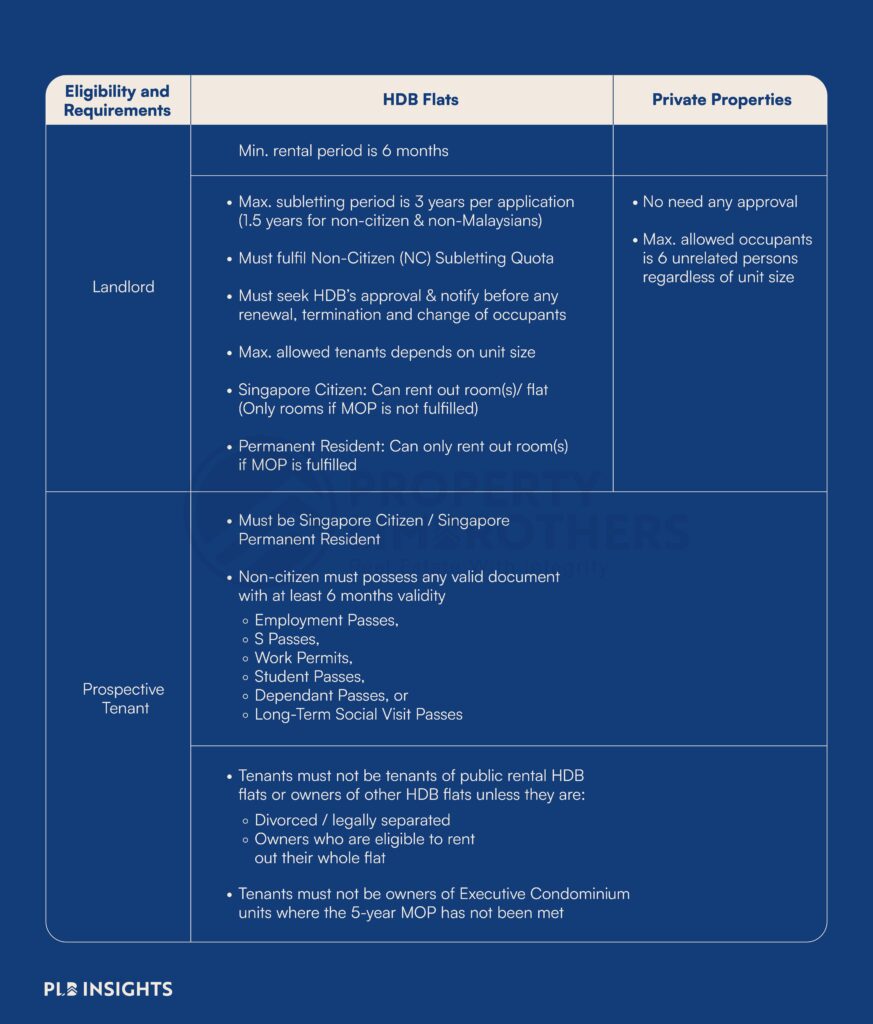

Additionally, it is worth highlighting that HDB flats in Singapore are primarily intended for Singapore citizens, and there are stricter regulations when renting an HDB flat as a non-citizen. These regulations may affect the eligibility criteria and rental process for non-citizens seeking HDB accommodations.

On the other hand, renting private properties provides a level of flexibility not typically found with HDB flats, thanks to their private ownership structure.For instance, landlords of private properties do not need to seek government approval for lease renewals or terminations, which can expedite the rental process. This means that the tendency may begin without any further delays. This absence of an MOP in private properties (aside from Executive Condominiums) means that private property renters have the opportunity to rent a brand new unit without being bound by such constraints, providing more options and choices in the rental market.

The renting of both types of property ultimately requires a minimum rental period of six months and a cap on the occupancy to ensure the orderly management and efficient use of the properties. Generally, one and two room HDB flats have a cap of four people including the owner and three-rooms and larger have a cap of six individuals. As for private properties, the rule of thumb is six unrelated persons per property.

Overall, renting from the open market provides flexibility and a broader range of choices, but it also comes with potentially higher costs and responsibilities. Renting is a suitable option for those who prioritise specific housing features and are willing to explore the diverse rental offerings available in Singapore’s open market.

3) Buying Properties

When it comes to the exciting decision of buying property, one often faces the age-old question: should you opt for a private property or a HDB flat? We have a wealth of articles to help you explore the myriad of public housing options and private property types available. If you are a Single Singaporean looking for housing options, check out Lester’s article on just that.

One significant change that is making waves is the implementation of the new HDB classification framework, which you can learn more about here. However, this article’s focus is not centred around the classic debate of public versus private housing. Instead, our attention shifts to essential financial considerations that come into play when deciding between renting and buying a property.

Money Matters

Money matters undeniably play a significant role in the rent vs buy decision. Understanding the financial implications of both options is crucial for making a well-informed choice.

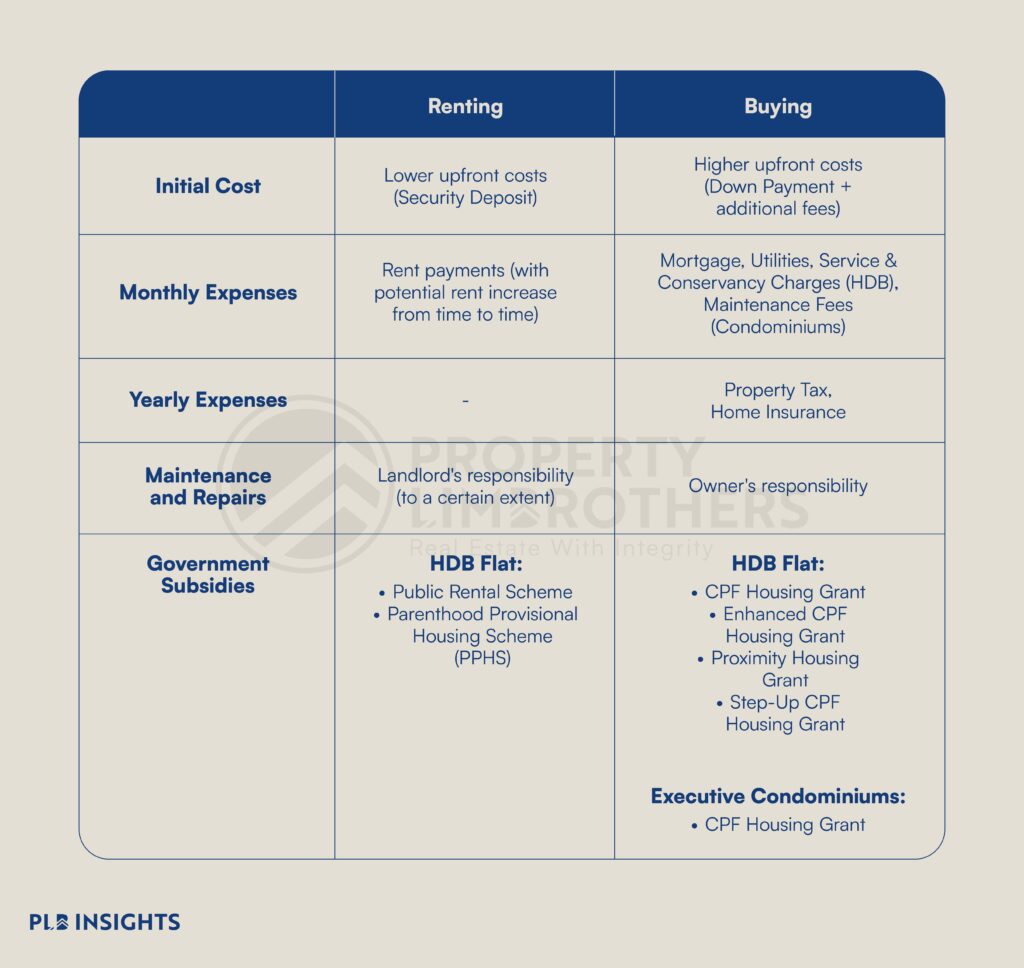

Renting often offers a more financially accessible entry point, especially for individuals with limited savings. Usually, renters are required to pay a security deposit, typically equal to one to two months’ rent, in addition to the first month’s rent. This lower initial financial burden is appealing to those seeking immediate housing solutions. Moreover, the landlord typically shoulders the expenses related to maintenance and repair resulting from fair wear and tear, such as repainting walls or replacing faulty appliances (provided the tenant is not at fault).

Adversely, buying a property comes with higher upfront costs including down payment, stamp duty, legal fees, and more. Owning a property also means having ongoing monthly expenses beyond the mortgage payment. These expenses include utilities, service & conservation charges and maintenance fees depending on the property type. Nevertheless, as buyers pay off their mortgage, they also accumulate equity, creating a valuable asset for their financial portfolio. For those embarking on home ownership for the first time, government housing grants can provide essential subsidies and support. This may seem like an insurmountable task for a young adult in Singapore, but as our latest guest on our NOTG podcast proved – it is very much doable.

Overall, with rental prices being on the rise in recent years, some individuals are considering whether it might be more financially prudent to invest in home ownership instead. Owning a home can provide stability in terms of housing costs, as buyers are less susceptible to fluctuations in the rental market.

Here is a summary of the financial considerations between the two housing options:

Beyond Finances

For many young adults in Singapore, the pursuit of housing goes far beyond just the numbers on a balance sheet. It is an emotional journey, a quest for a place that embodies security, identity, and belonging.

When it comes to housing, everyone has different priorities and goals in mind. Sitting down with your partner or family members to discuss needs and wants is a step in the right direction. Here are a few considerations to kick start your conversation.

How Important Are Your Support Networks?

Your housing decision is deeply intertwined with your relationship with your family and support networks. The role of these networks, especially family ties, should never be underestimated. As the saying goes, “Distance makes the heart grow fonder.”

Consider if you have family members who may require your proximity for caregiving or support. Respecting boundaries and maintaining a sense of independence will be crucial, but the convenience of being just a walk away for small everyday things is a unique advantage. These small, regular interactions can be invaluable, particularly when it comes to checking in on ageing parents or simply offering a helping hand. Sometimes, the simplest gestures can foster meaningful connections.

What Lifestyle Do You Desire?

Another significant consideration is the proximity of your home to your workplace. For some, a short commute takes precedence, valuing the time saved and the convenience of living near their job. In contrast, others may prioritise more affordable housing options located farther from the city centre. Renting, in this context, offers geographical nimbleness, providing the flexibility to explore different neighbourhoods and living arrangements.

Renting also entails regular communication with a landlord or a property agent. This dynamic can have both advantages and limitations. On the positive side, it means that when issues arise, such as maintenance or repairs, you can typically rely on the property owner or agent to address them promptly. This can provide a level of convenience and peace of mind, knowing that you do not have to bear the sole responsibility for property upkeep.

However, renting also comes with certain restrictions. Since you do not own the property, you have limited control over it. You may not be able to make significant alterations or renovations to the space, which can limit your ability to personalise it to your exact preferences. This is where home ownership offers greater freedom, as you have the autonomy to modify your property as you see fit, making it truly your own.

Where Do You See Yourself in 6 Months, A Year and A Decade?

Recognising that lifestyle preferences can evolve over time, anticipating big milestones can affect your decision on whether to rent or buy.

Consider where you envision yourself in the immediate future. Are you planning to change jobs, start a new relationship, or embark on a significant life change? Looking one year ahead, what are your goals? Do you anticipate career advancements, family expansions, or other life transitions? Thinking about the next decade, where do you see yourself? Are you planning to settle down, start a family, or build long-term roots?

Home ownership often necessitates a more enduring commitment, making it crucial to ensure your housing choice aligns with foreseeable life changes. For many, buying a property signifies a step into adulthood and settling down, making it an apt choice for those with long-term goals. Conversely, if you embrace change and adventure, renting may be a more appealing option. With the new BTO framework introducing more flats with a minimum MOP of ten years, BTO buyers will be financially locked in for a minimum of thirteen years including the built up time.

Final Thoughts

Overall, finding a home that resonates with you emotionally while also aligning with your financial capabilities and life goals will lead to a happy home. As you journey through life, regularly review your choice, reassess your goals, and adjust your housing strategy as your circumstances evolve. Flexibility and adaptability in your housing choices will help ensure that your home remains a place where you can thrive, both emotionally and practically, in the ever-changing landscape of your life.

Once you have made the decision to rent or buy, a new set of choices arises – deciding on the type of property that best suits your needs. Rashmi understands how overwhelming the renting process can be and has a Rental 101 guide on key details you will need!

This quest to find a place to call home will undoubtedly be filled with new learning experiences, not only in understanding how the rental and buying processes work but also in gaining a better understanding of your individual needs and values. This article has shed light on the often under-discussed rental options in Singapore, and we hope it has provided you with more clarity in your decision-making process.

If you are ready to move forward with your decision or have further questions on the rent or buy debate, feel free to contact our experienced consultants. Till next time!