Talks of the next cooling measure for private properties might be considered soon. What can expect from the market when it takes effect? Photo courtesy Normanton Park

The property industry is sizing up for another round of cooling measures for 2021.

This comes after Singapore’s authorities remarking on the market trends, which was discussed in our round-up for 2020. URA reported a rise in private home prices by 2.1% in Q4 2020 — a record high since 2018, before cooling measures were set in place. It was also cited that Normanton Park’s strong response was another factor.

While some analysts feel cooling measures may be premature, Deputy Prime Minister and Finance Minister Heng Swee Keat mentioned that the government is paying “close attention” to Singapore’s real estate market. He also stated that “we do not want to see the property market run ahead of the underlying economic fundamentals.”

With the private residential launches thriving, it is clear that our industry might be moving a tad too fast compared to other industries in Singapore.

This is supported by National Development Minister Desmond Lee’s comment that the government is monitoring the property market “very closely”.

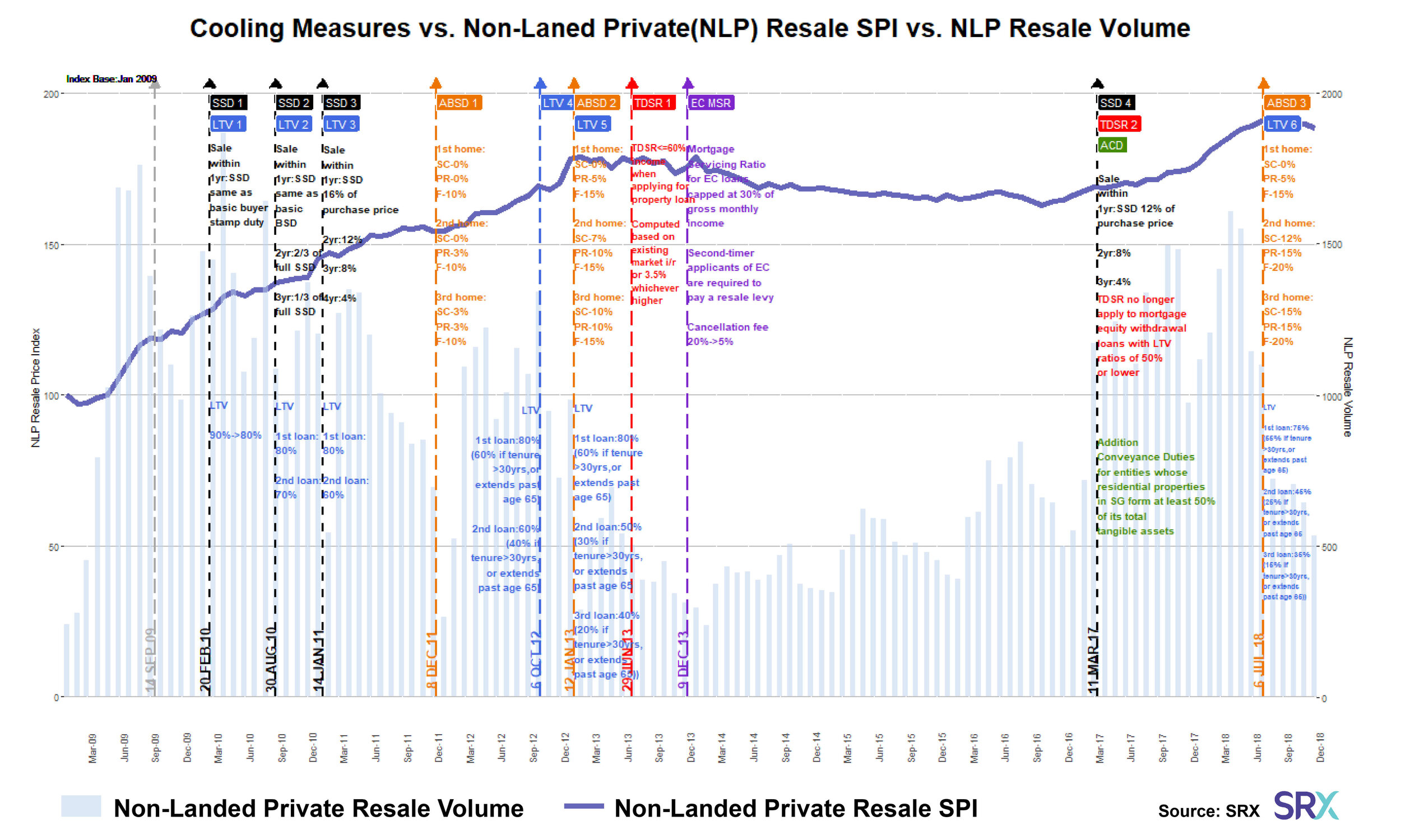

Cooling Measures vs. Non-Laned Private (NLP) Resale courtesy SRX.

DBS analysts observably stated that private home prices have been fuelled by low interest rates, HDB upgraders and former en bloc sellers returning to the market.

Buyer confidence have also been increased, of which the DBS analysts warned that if price trends accelerate, it may put the property market in a “frothy territory”.

Possible cooling measures

To counter this, DBS analysts suggested additional tweaking of additional buyer stamp duties for investors and foreigners. They mentioned it has proven to slow the pace of price increases, tightening mortgage terms and adjust up the average minimum home size for new developments.

Additional comments

Mr Wong Xian Yang, Cushman & Wakefield’s associate director of research for Singapore and South-east Asia, commented that the rate of price growth for each quarter should be observed closely, along with land price growth.

He also had this to say:

“Most of 2020’s 2.2% growth came from the fourth quarter, which registered a 2.1% growth.”

“Might be too early to assess if price growth is on an unsustainable trajectory.”

“The government can introduce further loan curbs for both local and foreign investors.”

“Don’t think additional buyer’s stamp duty (ABSD) should be increased further given, given that different sectors have performed differently.”

“Prime or core central region prices fell by 0.2 per cent in 2020, while prices in the rest of central region (RCR) and outside central region (OCR) rose 5.1 per cent and 3.1 per cent respectively. Increasing ABSD may result in more divergent performance across sectors.”

“To ensure that home purchases are prudent, the government can introduce further loan curbs for both local and foreign investors… I don’t think additional buyer’s stamp duty (ABSD) should be increased further given that different sectors have performed differently.”

What we can deduce from Mr Wong’s comment is that if the current ABSD is tweaked to address current property trends, it might not be a “one size fits all” ruling. Facts and figures of 2020 may prove that the market may be thriving, but it may not have transcended throughout all typologies.

What this means for developers

Singapore Skyline courtesy Luxuo.

Mr Lee also urged developers to remain prudent in their land bidding, and households to exercise caution when purchasing property, given the uncertain economic outlook.

We also expect City Developments Ltd., UOL Group Ltd. and APAC Realty Ltd. are stocks that will be potentially affected by any government measures, according to Yeo Kee Yan, an analyst with DBS.

What this means for homebuyers

Currently, Loan-to-Value (LTV) is at 75% of the overall purchase. If the cooling measure is implemented to cap this further, we may see a an initial drop in transactions and may plateau. However, the market has a tendency to get used to restrictions as proven from previous cooling measures.

Alternatively, they might target ABSD, currently at 12% for the second property purchase. If it were to increase, entry buyers may be deterred temporarily. However, we have observed that throughout the past measures, as properties being a stable investment vehicle, we might see a recover soon after.

What we think

Cooling measures this time round may be to curb the LTV ratio for mortgage loan or ABSD for second property purchase by Singaporeans. We have shared previously an article on 2020’s round-up, that not only global factors such as increased liquidity from the QE policies in US, low interest rate loaning cost for properties and instability in neighbouring countries may contribute to this; local preference has been shifting towards larger properties, for work-from-home and study rooms for the children as the latest sea change.

Landed properties and large-sized apartments are also in demand throughout the past seven months since circuit breaker, with positive responses for listed homes.

Properties are Singapore’s safer investment vehicle

Private properties in Singapore (condos, apartments and landed houses) have proven itself as a great store of value in these uncertain times. With Singapore’s resilience throughout the pandemic, strong governance is recognised as a stability point for real estate investment to maintain its value and appreciate in the mid- to long-term. Aside from this, properties go through gradual appreciation, due to land scarcity within Singapore compared to other countries.

We’ll be keeping a close eye on this, as buying a property now might be a wiser choice to avoid any changes that may tweak the market landscape.