Singapore’s dynamic real estate market offers prospective buyers a range of options, both landed and non-landed, to choose from for their next investment. The choice between condominiums and landed properties is a significant decision for investors as each property type offers distinct benefits, challenges, and financial implications. Moreover, rising property prices, shifting demographics and government regulations play pivotal roles in shaping the real estate landscape and investment choices of buyers.

In this article, we explore the two property types, current market trends in Singapore’s property market, and the investment potential and risk factors associated with condominiums and landed properties, ensuring that your investment strategy aligns with your lifestyle preferences and investment goals.

Understanding The Property Types

Condominiums and landed properties both offer buyers unique features that set them apart. They also come with their own set of advantages and investment dynamics that are catered to a large pool of buyers with varying financial goals and preferences.

Condominiums and Their Key Features

Condominiums are multi-unit residential buildings where individual units are privately owned and common areas within the development are shared among residents. These common areas include but are not limited to swimming pools, gyms, gardens, parking areas, playgrounds and clubhouses. With this property type, there is a focus on convenience, accessibility and a sense of community.

Owners of condos have complete ownership over their units and have shared ownership over the common areas within the development. These common areas are typically maintained by a management company, ensuring that residents do not have to manage the bulk of personal maintenance responsibilities for a fee.

Landed Properties and Their Key Features

Landed properties refer to houses that come with their own land. There are several types of landed properties in Singapore, these include inter-terraces, good class bungalows, and semi-detached and detached houses. Owners of landed properties have full ownership of the building or structure as well as the land the property occupies.

As owners have complete ownership of the land and property, this property type allows for more customisation and the freedom to renovate as desired. Despite not offering the convenience of facilities and amenities in common areas like condos do, landed houses typically come with more space that can be used to meet any lifestyle needs.

Market Dynamics

Factors such as economic indicators, demographic trends, and government policies can have a significant impact on the value and demand of condominiums and landed property in Singapore. Let’s review some factors shaping the current market dynamic in Singapore’s property market.

Government Regulations

Government regulations and policies play a pivotal role in shaping the property market in Singapore. Factors such as cooling measures, stamp duties and Loan-to-Value (LTV) limits are designed to ensure a sustainable property market. These policies can significantly impact the affordability of buyers and influence their buying decisions. Additionally, urban planning initiatives and the development of new transport hubs and residential precincts can also enhance property values in those areas.

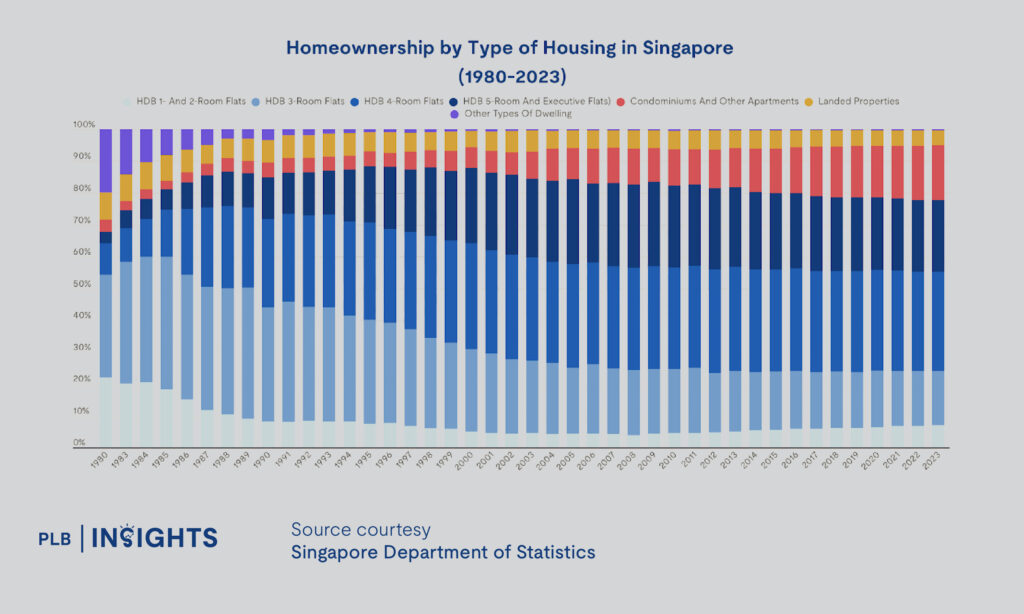

Demographic Trends

The demographic makeup evolves as lifestyle preferences and trends shift between locals and foreigners residing in Singapore. For instance, young professionals and millennials may gravitate towards urban living, where they favour the convenience and amenities offered by condominiums. Larger families, especially those with children, may also seek condos with more space and those closer to schools for convenience and accessibility or eventually plan on upgrading to a landed property for more space. Those with more financial capacity may gravitate towards landed property due to their limited supply, which ensures value retention and long-term appreciation.

Economic Indicators

With slight ups and downs, Singapore’s economy has shown resilience even amid global economic fluctuations. Indicators such as employment rates, consumer confidence and GDP growth are essential to the growth of Singapore’s property market. A robust economy can boost demand, property prices, and rental yields. Following a contraction in 2020 due to the pandemic, Singapore’s economy rebounded and has performed well since, with an overall economic growth of 1.1% in 2023.

Investment Potential: Condos Vs Landed Properties

When considering investment opportunities in the property market for both condominiums and landed properties, there are a few factors buyers can research to gain a comprehensive understanding of the potential of each property type as they influence potential financial returns and appreciation rates.

Market Performance and Price Trends

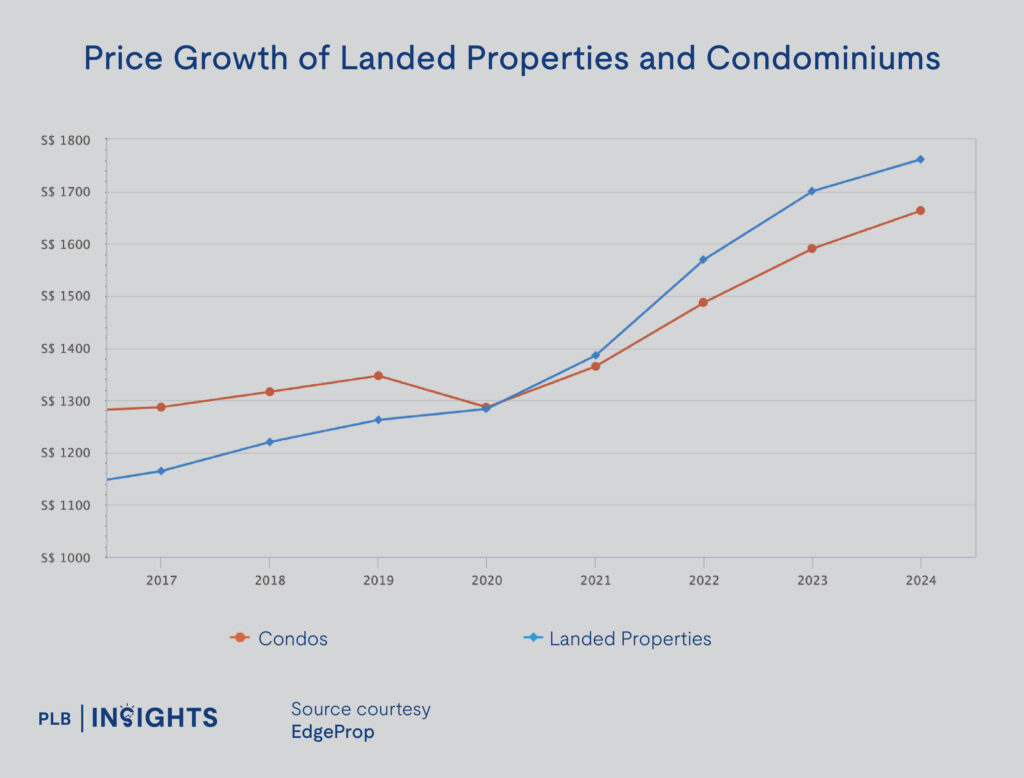

As shown in the graph above, both landed homes and condominiums have experienced an appreciation in price over the years, especially after 2020, indicating a recovering market post-pandemic.

With a large pool of buyers ranging from young professionals to couples and families purchasing their first private property, the demand for condominiums have been steadily increasing.

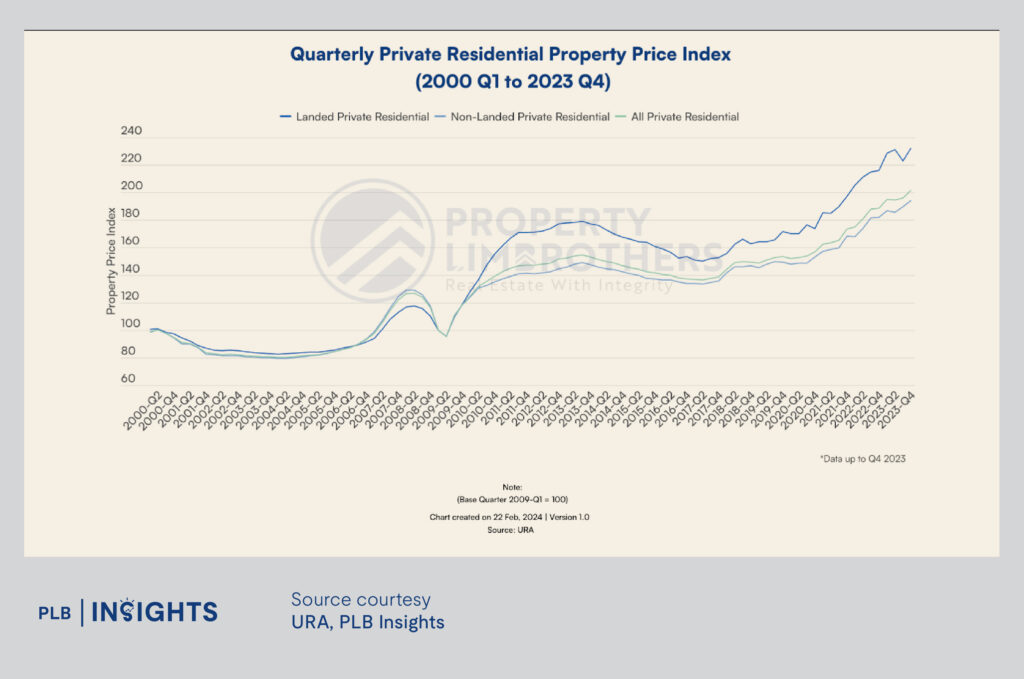

Moreover, landed properties outperformed condos after 2020 and have been appreciating at a faster pace. The graph below illustrates a notable divergence between the price growth of landed properties and non-landed private properties. While both property types have experienced appreciation, the steeper and faster appreciation of landed properties result in a widening disparity gap between the two asset classes.

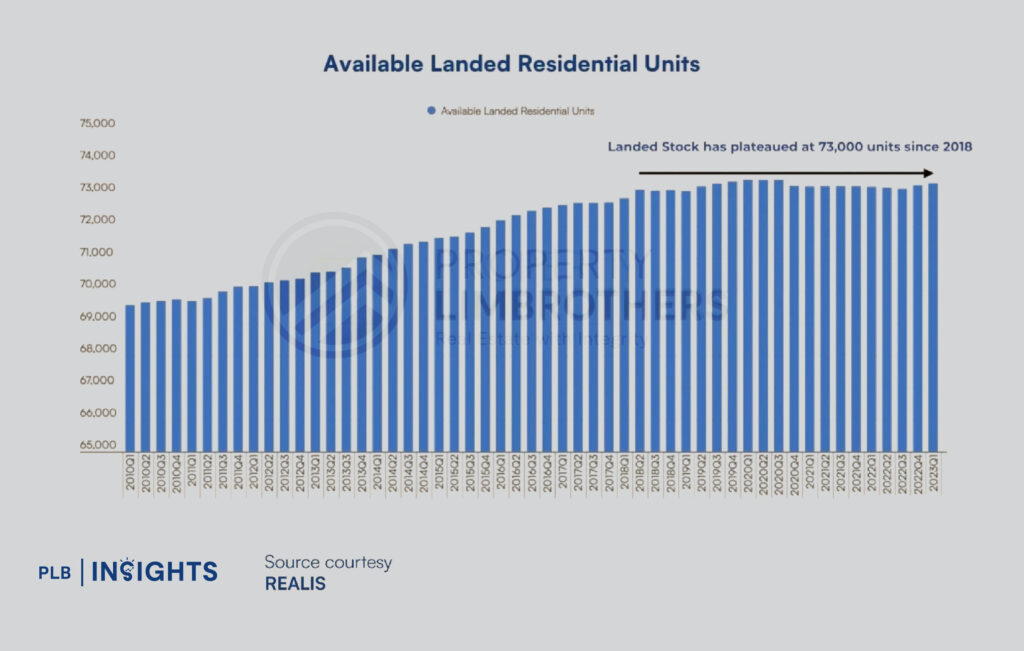

The appreciation of landed properties is largely due to the limited supply of land in Singapore. The supply of landed homes have plateaued around 73,000 units since 2018, making landed homes a highly sought-after asset class that retain their value over time.

Rental Yield

Condominiums, especially those located in prime locations, can offer attractive rental yields to owners. With demand in Singapore for rentals being driven by young professionals seeking convenient and modern living spaces, expatriates, and families, property owners can receive good rental yields. Landed homes, on the other hand, may not have rental yields as high as condos. However, they can attract long-term tenants which may result in lower vacancy rates.

Comparing Average Price and Transaction Volume of Condos and Landed Houses

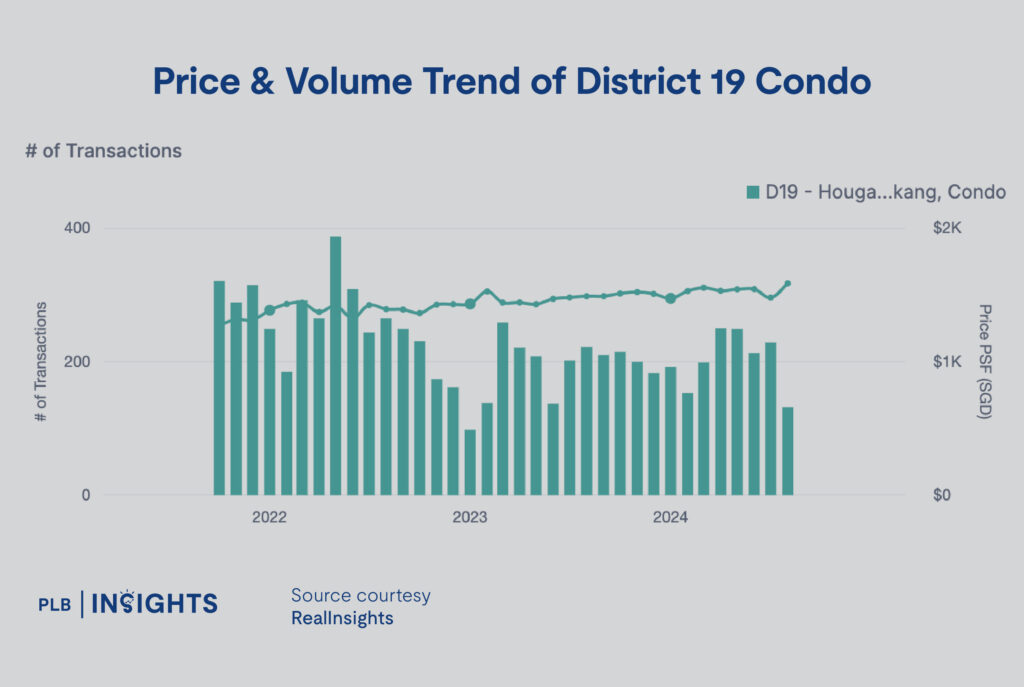

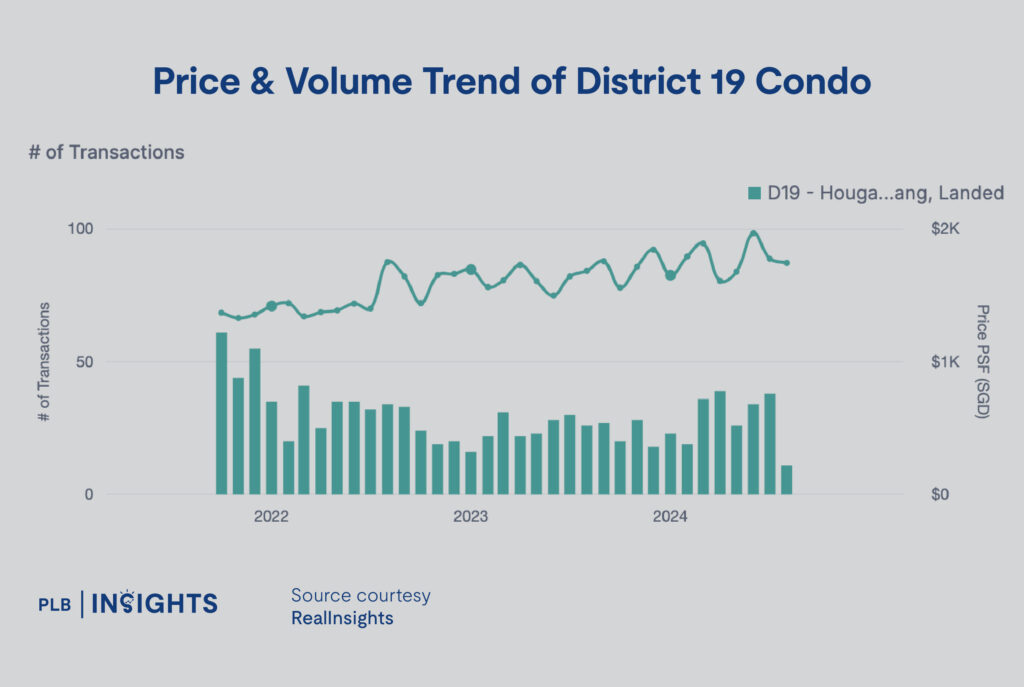

For the purpose of comparing market trends, specifically in terms of transaction volume and price, we will focus on condos and landed houses in District 19.

Condominiums in D19

Landed Houses in D19

Both condominiums and landed houses have experienced fluctuations in the transaction volume and average price PSF in the last two years, as highlighted on the graphs above. Notably, transaction volumes in District 19 for the two property types reached its lowest point in January 2023, with a total of 16 landed homes and 97 condo units sold, indicating a period of decreased buyer activity.

Despite this, the average price for condominiums has shown a steady upward trend, with prices increasing with consistent demand since 2022, at an average of $1,587 PSF as of August 2024. On the other hand, landed houses have experienced a more volatile price pattern, perhaps suggesting varying levels of buyer interest as well as available stock for transaction volume, with the averaged transacted price at $1,746 PSF as of August 2024. Additionally, condominiums and landed houses in D19 experienced an average growth rate of 20.1% and 32.5%, respectively, from January 2022 to August 2024.

Risk Assessment

Investing in the property market, whether in condominiums or landed property, comes with inherent risks that potential buyers and investors should consider. Having a thorough understanding of the potential risks associated with property investments is essential for making informed decisions and strategies that provide buyers with long-term stability and risk mitigation.

Condominiums

Maintenance and Management Issues: Condominiums are subject to the decisions of the management committee of a condo development. This can either positively or negatively impact property values and living conditions. Poor management can lead to issues such as increased fees and insufficient maintenance. Buyers must review the management structure and financial health of a condo prior to investing in one to mitigate the risk of poor management or maintenance.

Leasehold Concerns: A large number of condo developments in Singapore are leasehold properties with a 99-year lease, which can affect the long-term appreciation of these properties. As the lease decays, property values may decline and lead to potential losses. This can be the case for older condos. As such, buyers should consider the remaining lease term and its implications for resale in the future before committing to purchasing a property.

Market Saturation: In areas with a higher concentration of new condominium developments, an oversupply could lead to stagnation or even a decline in prices. This can be a risk factor, particularly if demand does not keep up with the influx of new condo units available in the market. Analysing the market conditions and occupancy rates of specific neighbourhoods is essential for investors.

Landed Properties

Higher Initial Investment: there are higher upfront costs associated with landed properties, and this can pose a risk, especially if the property market experiences downturns. In the case that this happens, investors may find it more challenging to recoup their investments if property values decline. Careful financial planning, budgeting, and risk assessment are essential and can prevent larger issues when committing to a big purchase like a landed property.

Higher Maintenance and Renovation Costs: Because maintenance is not carried out by a committee like in condos, landed properties come with greater maintenance responsibilities that can lead to unforeseen expenses. These include renovations, repairs, and consistent landscaping to ensure the property is well-maintained.

Market Liquidity Risk: Landed properties can be less liquid than condominiums. This means they typically take longer to sell in comparison to condos, especially during market downturns. If the market slows, investors and homeowners may find it more challenging to sell their property without a significant price reduction. Another implication of this risk is that investors may face delays in accessing their capital if they need to sell quickly too.

What Is The Right Choice For You?

Ultimately, the choice between investing in landed property or condominiums depends on the unique combination of your investment goals, financial capacity, and lifestyle needs and preferences.

Owning a condo can come with a vibrant community lifestyle that offers residents access to modern amenities and lower maintenance fees, making it a good choice for busy professionals or those seeking more convenience. This is also a good choice for homeowners looking to upgrade from public housing to private housing, or for rental income. In contrast, owning a landed property provides residents with more space, privacy, and freedom in terms of customisation and exclusivity. However, landed homes also come with a higher quantum and require careful consideration for long-term investments.

By carefully evaluating these factors and seeking professional guidance when necessary, you can make decisions that align with your property goals and needs. Whether you choose a condominium or a landed property, understanding your priorities will ensure you choose the ideal home or next investment property in Singapore’s property market.

Closing Thoughts

Both condominiums and landed houses present unique investment opportunities and advantages in Singapore’s property market. While condos may appeal to those seeking immediate rental income or a modern lifestyle, landed homes may be ideal for those seeking long-term value and the benefits of land ownership. By assessing your goals and preferences to make informed choices, prospective buyers can find an investment that aligns with their needs and preferences.

Get In Touch With Us

Ready to advance in your property journey? Whether you’re exploring landed or non-landed properties to invest in, we’re here to help. Feel free to contact us here with any questions or concerns regarding your property portfolio.

Until then, see you in the next one.