*This article was written on January 2024, and does not reflect data and market conditions beyond*

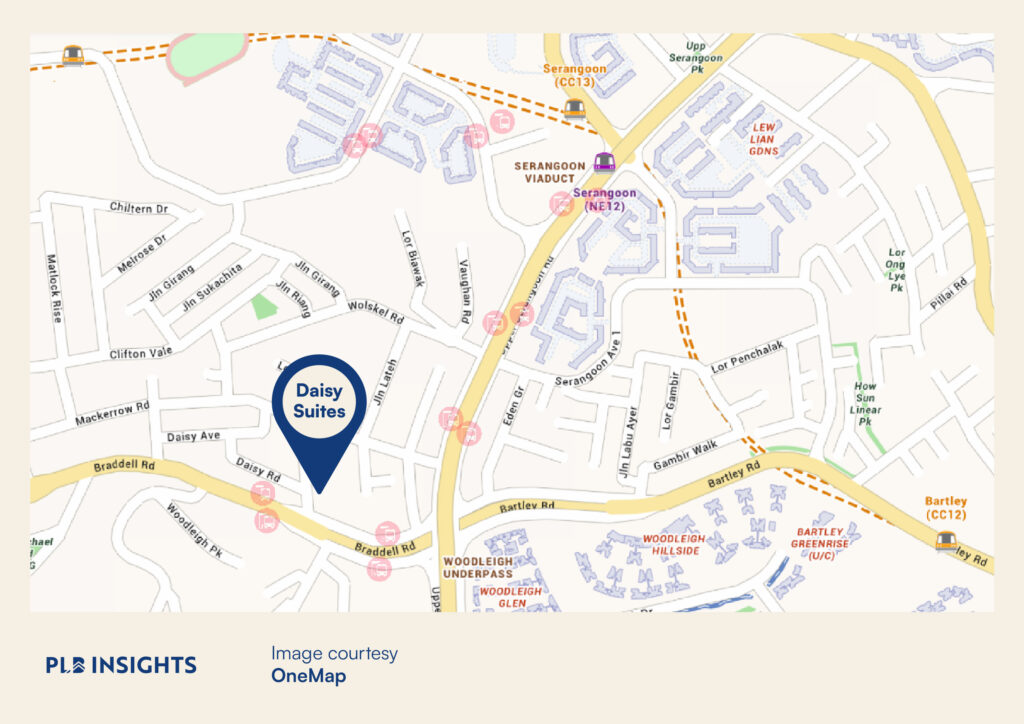

Daisy Suites is a quaint boutique apartment located along Daisy Road in District 13. It houses only 25 units in a single block, spanned across 5 floors.

The site of this development is situated in the highly coveted Woodleigh neighbourhood, while offering the advantage of it being a freehold apartment.

The Woodleigh and Serangoon locale boasts a high demand for housing owing to its exceptional convenience. Within close proximity, there are a myriad of eateries, while the integration of Serangoon MRT Interchange with NEX Mall ensures residents in the area not only enjoy the amenities but also effortlessly connect to the rest of Singapore.

This article provides an overview of Daisy Suites, covering its location, price, floor plans, and amenities. It aims to assist readers who are interested in a freehold boutique apartment within the area by providing comprehensive details about the residence. The review focuses on the features of the development and the advantages it provides to potential buyers.

Project Details

Location Analysis

Boasting convenience, the apartment is conveniently situated in close proximity to four major MRT stations. The nearest Woodleigh MRT station, as well as the well-connected Serangoon MRT interchange, both cater to the North East Line. Additionally, Lorong Chuan and Bartley MRT stations connect residents to the Circle Line.

Woodleigh MRT station is conveniently located just an 11 minute walk away (750 metres), with Serangoon, Lorong Chuan, and Bartley stations situated at distances of 1.1 KM, 1.4 KM, and 1.3 KM respectively. Although Daisy Suites is not in immediate proximity to any MRT stations, it benefits from the accessibility of three nearby bus stops, all within a short walking distance.

Residents with personal transportation can effortlessly connect to workplace nodes by connecting from Braddell Road towards the CTE and Upper Paya Lebar Road.

Furthermore, Daisy Suites boasts a myriad of eateries in its immediate vicinity, with even more options just a single MRT station away in the vibrant Serangoon and Kovan neighbourhoods.

Families with school-going children will also find the location of Daisy Suites particularly convenient. YangZheng, St Gabriel’s, Maris Stella Primary Schools are within a 1 KM radius, and St Gabriel’s Secondary School is just a short distance away.

Site Plan and Unit Distribution

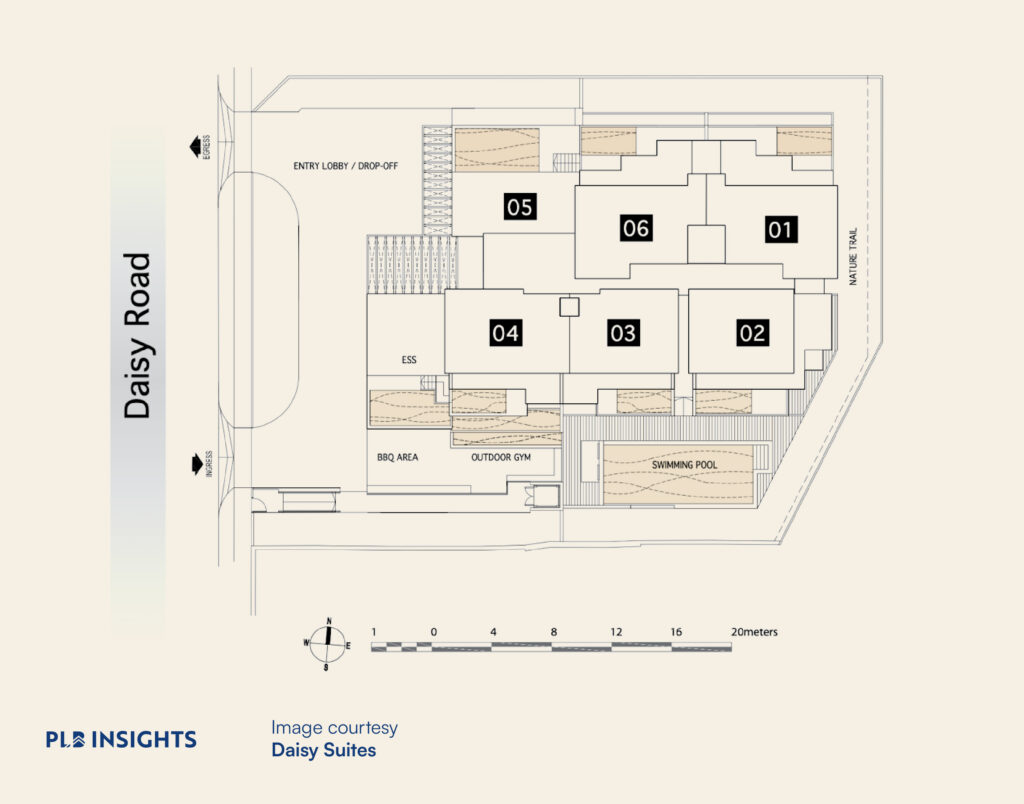

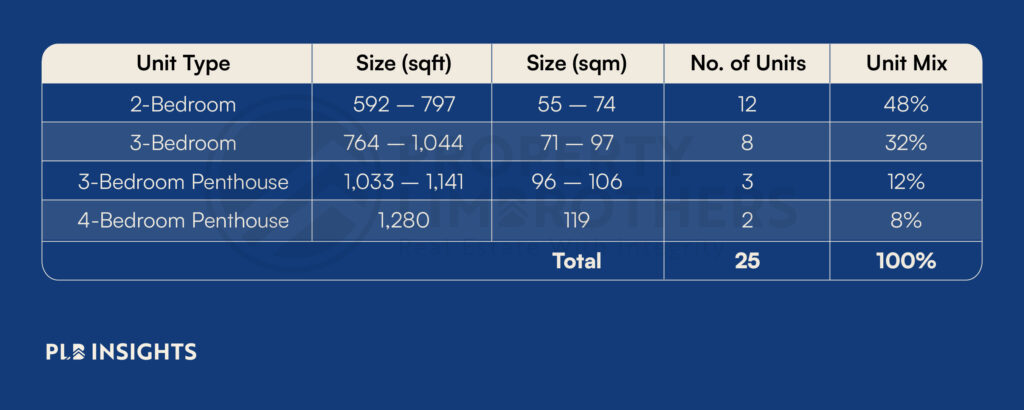

Daisy Suites comprises 25 units distributed across 6 stacks in a single block, featuring configurations ranging from 2 to 4 bedrooms. Notably, all units are strategically positioned with a North-South orientation, offering residents the advantage of avoiding direct sun exposure in the afternoons. Stacks 1, 5, and 6 face North, providing views of the landed enclave. On the other hand, Stacks 2, 3, and 4 are South-facing, overlooking the swimming pool and Braddell Road.

Among the shared amenities include a BBQ area and outdoor gym located at the front, near the apartment entrance. The swimming pool and a serene nature trail are tucked away towards the rear of the development. An additional notable feature of Daisy Suites is the inclusion of a private pool with every unit as a standard offering from the developer.

The residential layout in Daisy Suites includes 12 units designed as 2-bedroom homes, 8 units as 3-bedroom residences, and 3 exclusive 3-bedroom penthouses strategically situated in stacks 2, 3, and 4, all oriented to the South. Moreover, there are 2 generously sized 4-bedroom penthouses located in the North-facing stacks of 1 and 6. Daisy Suites accommodates a diverse demographic with its unit distribution, catering to couples, families with children, and smaller multi-generational families.

Floor Plan Analysis

In this section, we present our picks from each bedroom configuration type offered at Daisy Suites that we feel could potentially offer an ideal opportunity for own-occupancy or investment purposes. By providing this information, we aim to help you make an informed decision about which unit layout at Daisy Suites would be the most suitable for your aspirations.

2 Bedroom

Our first pick for the 2 bedroom configuration is the A2-G patio unit in Stack 2. This layout maximises space efficiency with an open dumbbell concept, placing the master bedroom and attached bathroom on the right side upon entering, while the common bedroom is tucked near the living room area towards the back. The kitchen has an open concept, integrating seamlessly with the dining area, but residents have the option to create a closed kitchen by adding a partition wall.

One notable feature is the private pool on the patio, offering the flexibility to be decked up for a larger patio area, perfect for al fresco dining and relaxation while overlooking the development’s swimming pool. With an area of approximately 733 square feet, this patio layout is particularly suitable for smaller families, encouraging quality family time within its open design.

Type A-1A in Stack 3, spanning the second to fourth floors, also presents an open dumbbell concept. The kitchen is immediately to the right upon entering, while the master bedroom and attached bathroom are on the left. The common bedroom is neatly positioned towards the back on the right, close to the living room area.

Homeowners can opt for a closed kitchen with a wall partition and can deck up the private pool to expand the balcony space that overlooks the common swimming pool, creating an extended living area. With a footprint of 592 square feet, this layout is well-suited for smaller families seeking a cosy home with a more manageable overall price. For investment purposes, this layout could appeal to working professional tenants, as its smaller size ensures easier upkeep.

3 Bedroom

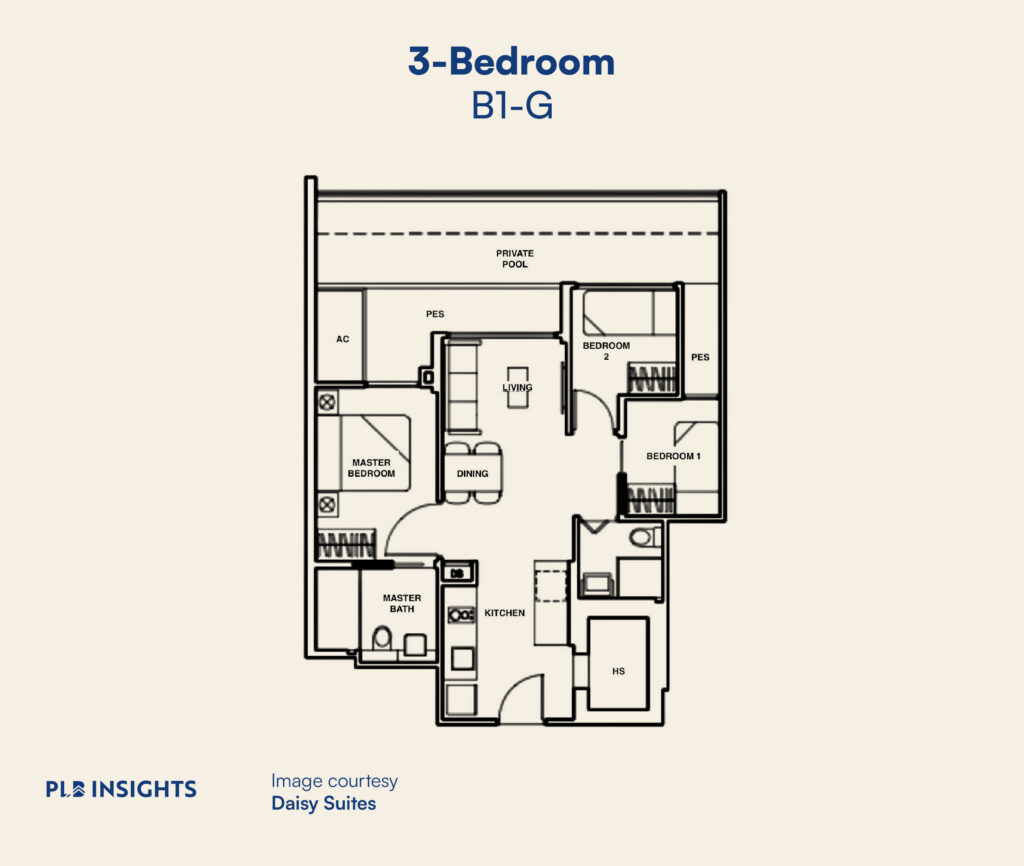

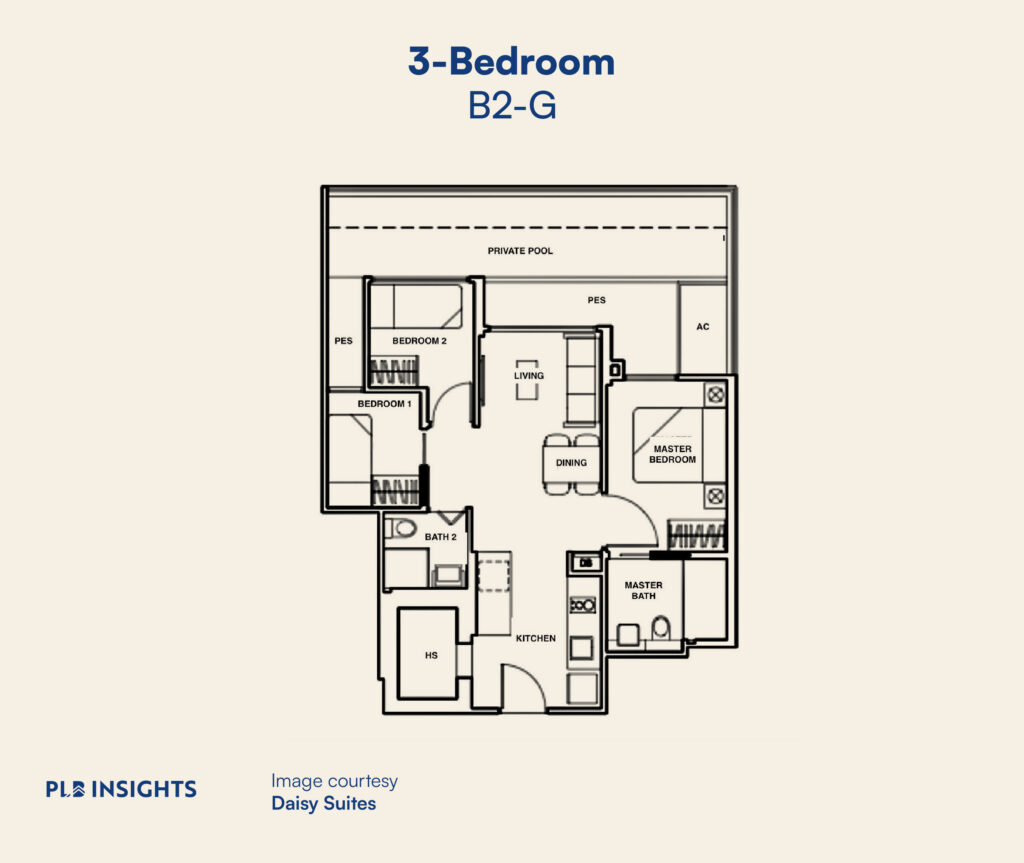

The 3-bedroom patio units, B1-G (Stack 6) and B2-G (Stack 1), boast an approximate area of 861 square feet. Upon entry, homeowners encounter an open concept kitchen seamlessly connected to the dining and living areas. Depending on the layout, the bedrooms are positioned on opposite sides, with the master bedroom and attached bathroom on one side, and the two common bedrooms and shared bathroom on the other.

Notably, the appealing feature of these 3-bedroom patio units lies in the spacious private pool area. Homeowners can deck up the private pool, expanding the patio for extended living space. These units are featured in our picks for their reasonable size in both living and patio areas, providing residents with a sense of ‘landed’ living.

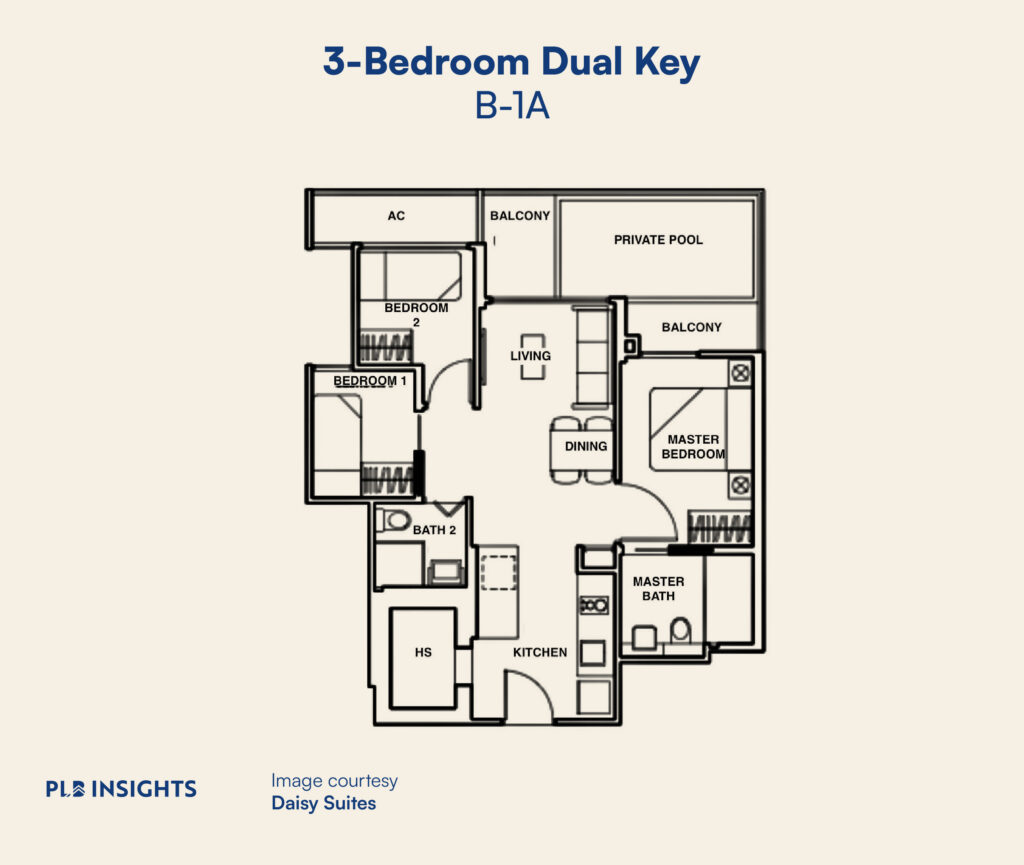

At around 764 square feet, Type B-1A in Stack 1 (second to fourth floors) boasts an open dumbbell concept. Upon entry, homeowners encounter an open kitchen, seamlessly connecting the dining and living areas. The master bedroom with an attached bathroom is on the right side, while the two common bedrooms and shared bathroom are on the left.

The balcony stretches from the living area to the master bedroom, featuring a private pool in between. This unique layout provides an ideal space for hosting barbecues or casual gatherings. With ample room for everyday activities, the overall unit size ensures an appealing quantum price.

4 Bedroom

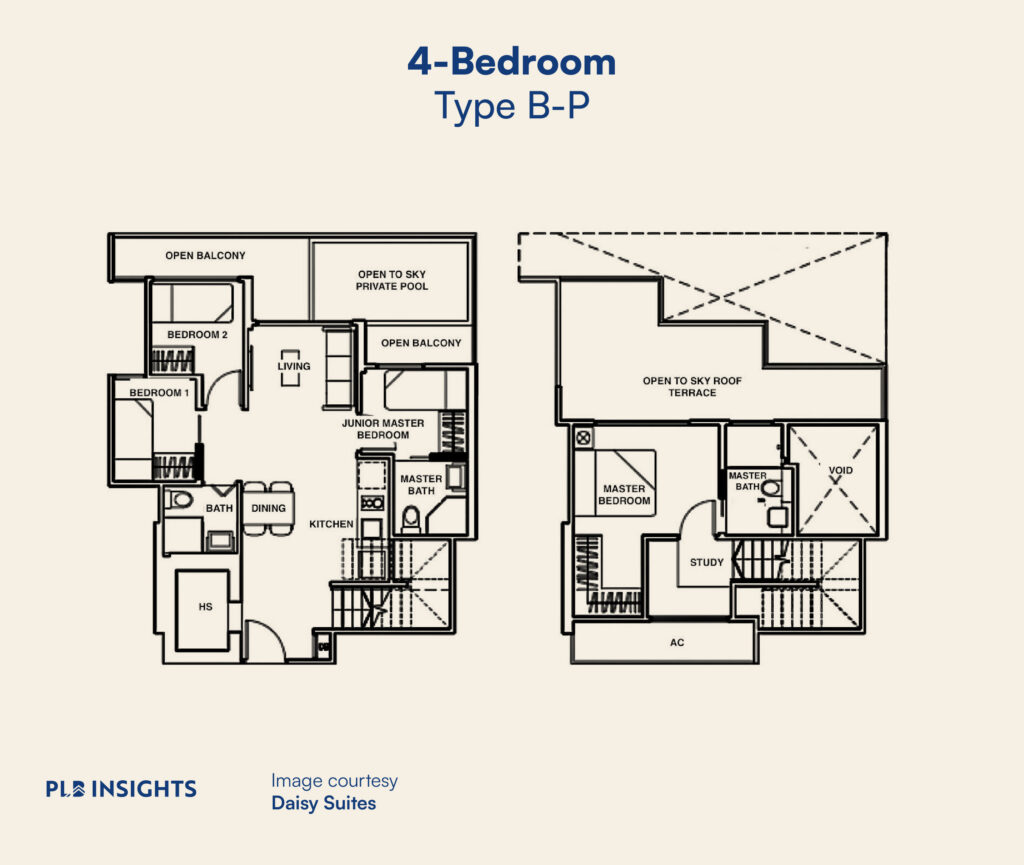

Among the 25 units in the development, only 2 are 4 bedroom penthouses located in Stacks 1 and 6, spanning the 5th storey and attic. The first floor follows a similar open dumbbell layout with the open concept kitchen and junior master bedroom on one side, and 2 common bedrooms on the opposite side.

The spacious master bedroom, walk-in wardrobe, and study area are peacefully situated on the second floor. The distinctive features of these penthouses include a wide open balcony with a private pool on the first floor and an impressive sky roof terrace connected to the master bedroom on the second floor.

Homeowners have the option to create a closed kitchen, extend the open balcony by decking up the private pool, and modify the second-floor study area for an enlarged master bedroom or a studio-like room. These units provide a unique opportunity for a part-stay, part-investment strategy, allowing homeowners to partition the space for tenant privacy and maximise rental income based on family dynamics.

Price Analysis

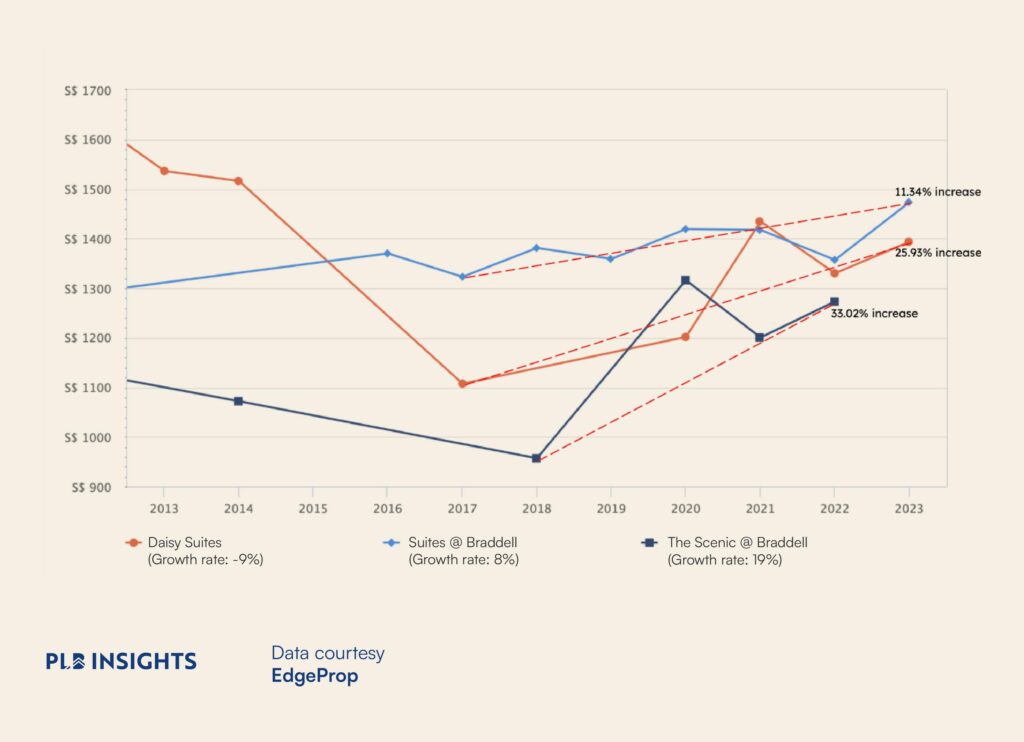

To start off our price analysis for this development, we’ll compare it with two neighbouring boutique freehold counterparts: Suites @ Braddell and The Scenic @ Braddell. Suites @ Braddell is a direct neighbour, housing 33 units and achieved its TOP status in 2015. The Scenic @ Braddell has a total of 18 units, and achieved TOP status in 2010. We have conducted our price analysis from 2017 onward, extending until the end of 2023.

In the provided image, The Scenic @ Braddell demonstrated the highest average price per square foot (PSF) growth from 2018 to 2022, reaching 33.02%. Notably, The Scenic @ Braddell has limited transaction volume, with no recorded transactions in 2017 and 2023, possibly due to its smaller size and fewer homeowners engaging in resale activity. As of the end of 2023, the average PSF for The Scenic @ Braddell is $1,273 PSF.

Daisy Suites experienced a 25.93% growth in average PSF, while Suites @ Braddell saw an 11.34% increase. Interestingly, despite both achieving TOP status in 2015, Daisy Suites outpaced Suites @ Braddell in PSF growth, even though the latter had higher transaction volumes from 2017 to 2023. The observed difference is possibly due to the PSF price for Suites @ Braddell having already reached an optimal level that is widely accepted by the public for a freehold apartment in this neighbourhood. To contextualise, as of 2023, the average PSF for Daisy Suites stands at $1,394, while it is $1,473 for Suites @ Braddell. This situation potentially positions Daisy Suites favourably for capital appreciation as its PSF price gradually narrows the gap with that of Suites @ Braddell over time.

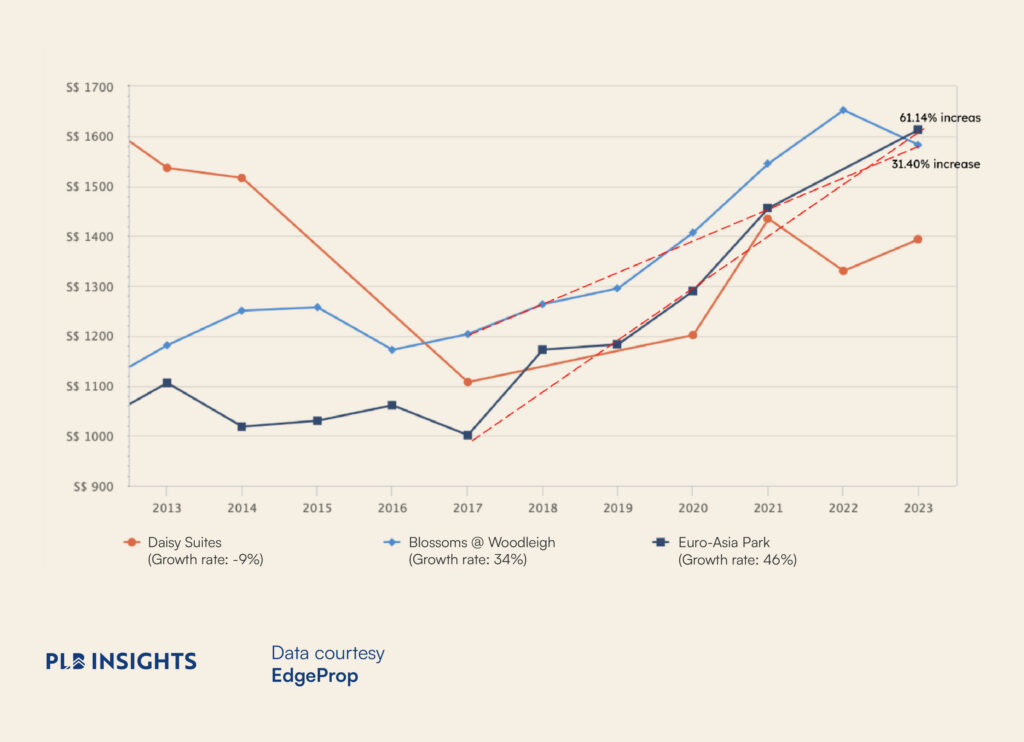

Expanding our comparison beyond nearby freehold developments, we turn our attention to two other freehold condominiums in District 13: Euro-Asia Park and Blossoms @ Woodleigh, both categorised as mid to large-sized developments. Euro-Asia Park, completed in 1996, comprises 163 units, while Blossoms @ Woodleigh, completed in 2007, features a larger scale with 240 units.

In our second comparison, highlighted in the image above, Euro-Asia Park has achieved an impressive 61.14% average PSF price increase from 2017 to 2023. During the same period, Blossoms @ Woodleigh experienced a significant 31.4% increase, approximately half of Euro-Asia Park’s growth. Although Daisy Suites saw a comparable 25.93% increase in average PSF price, as discussed earlier, there is a notable difference when compared to the other two. As of 2023, Euro-Asia Park averages at $1,613 PSF, and Blossoms @ Woodleigh at $1,582 PSF.

The substantial PSF price growth in the larger developments can be attributed to the ‘volume effect,’ where each transaction sets a benchmark for subsequent sales, leading to gradual capital appreciation. From another perspective, this dynamic presents a potential opportunity for homeowners at Daisy Suites. Over time, the PSF price for Daisy Suites is expected to adjust, closing the gap with other freehold developments in District 13.

Growth Potential

In addition to the potential for Daisy Suites’ average PSF price to align with other freehold developments in District 13, four key factors further anchor its potential for capital growth.

Close Proximity to Primary Schools

Proximity to nearby primary schools ensures high demand, as families seek homes close to their preferred school to enhance the chances of their children securing admission.

Downgraders From the Surrounding Landed Enclave

Surrounded by a landed enclave, it expands Daisy Suites’ potential audience for resale. Attracting downgraders seeking to right-size, particularly empty-nesters who have the preference of living in nearby areas.

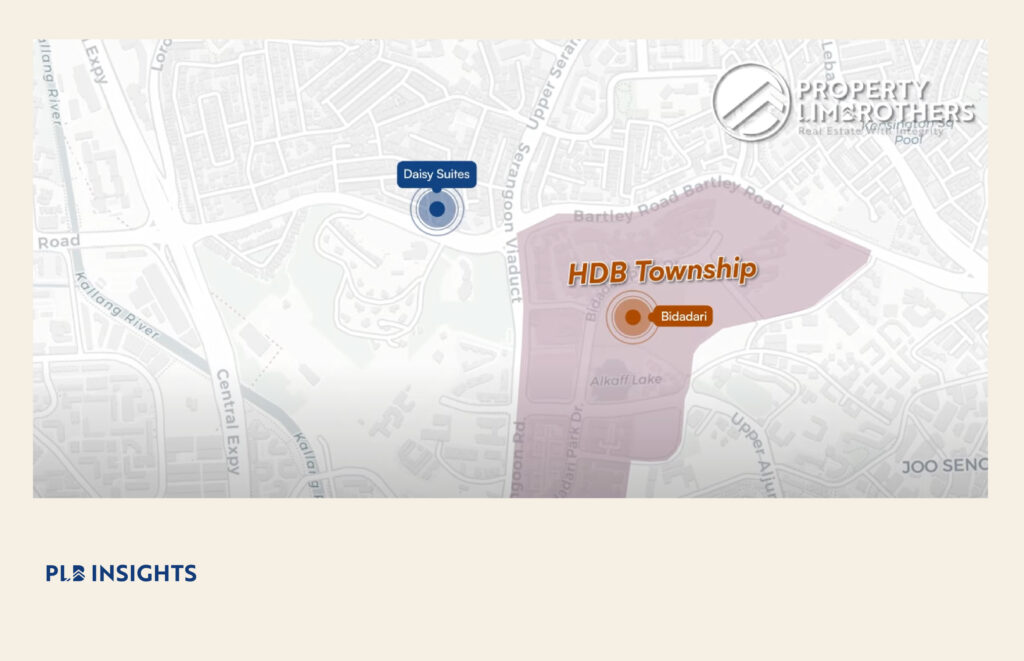

Upcoming Bidadari HDB Township

Scheduled for completion in 2025, this new HDB township will comprise approximately 8,872 units. After fulfilling the Minimum Occupancy Period (MOP), those aspiring to upgrade will form another potential resale audience for owners at Daisy Suites.

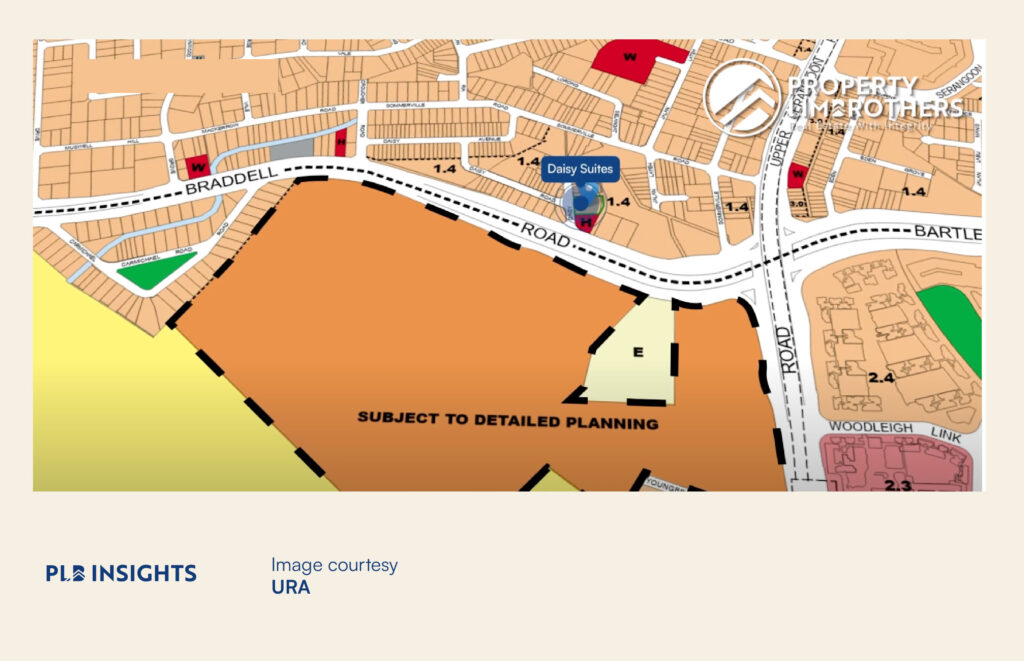

Designated Plot for Residential Development Opposite Daisy Suites

In the longer term, the completion of the residential development opposite Daisy Suites will boost housing demand in the area, potentially leading to an increase in Daisy Suites’ PSF price. Additionally, Daisy Suites’ freehold tenure offers an extended runway for capital appreciation.

MOAT Analysis

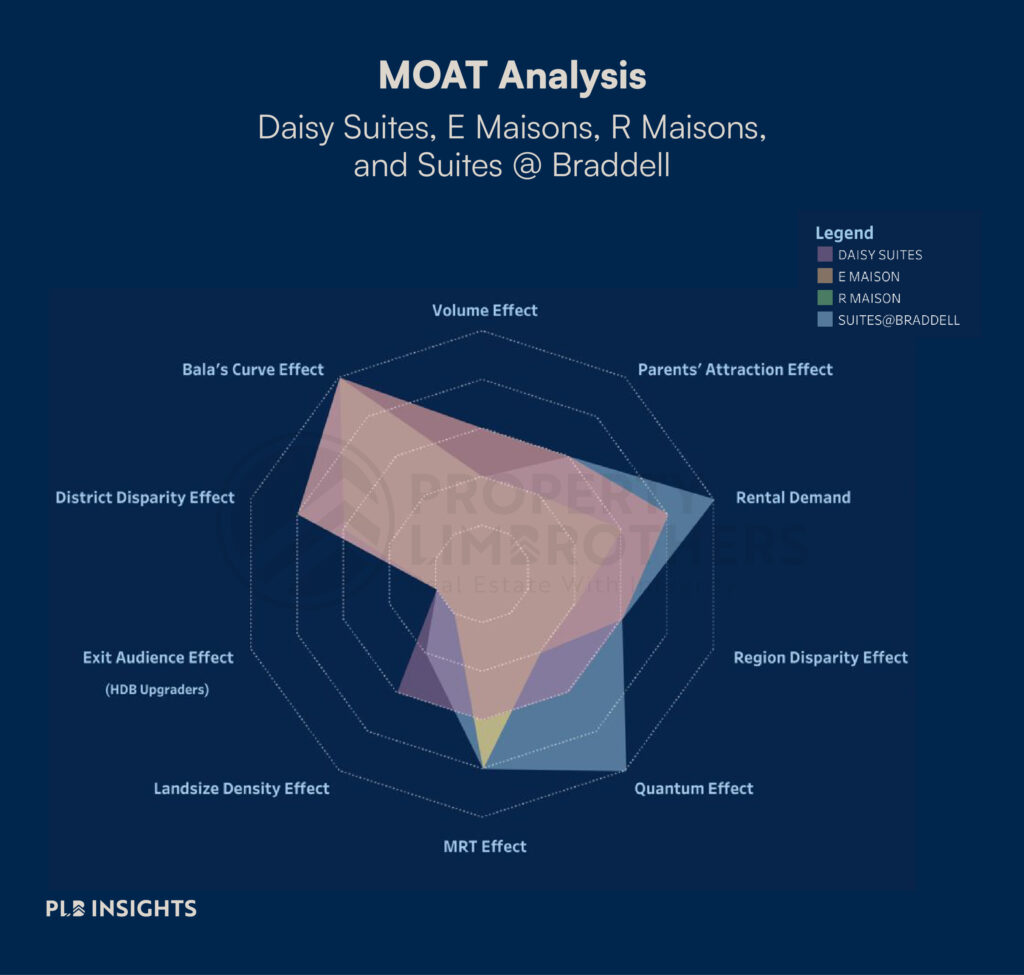

To provide an objective and thorough evaluation of Daisy Suites, we conducted a comprehensive MOAT Analysis that assesses the property from various perspectives. We analysed Daisy Suites as a resale condominium by comparing it with three other similar age freehold boutique resale options nearby: The Maisons (E Maisons & R Maisons), and Suites @ Braddell. E Maisons are both part of the same development, and collectively, are known as The Maisons. They both achieved TOP status in 2016. E Maisons comprises 130 units spanned across 3 blocks over 5 storeys, R Maisons is a boutique project that houses 45 units spread across 5 storeys in a single block.

Our MOAT Analysis methodically evaluated Daisy Suites across ten different dimensions to provide an impartial and balanced view of the property. For more in-depth information on our MOAT Analysis, please refer to our informative article available here.

In our MOAT Analysis, Daisy Suites secured a decent 62%, placing second after Suites @ Braddell, which scored 68%. E Maison and R Maison obtained scores of 58% and 48%, respectively.

In this MOAT Analysis, where all developments are freehold, they all received a perfect 5 out of 5 for the Bala’s Curve Effect. Notably, all developments, except R Maison, earned a good 4 out of 5 for the District Disparity Score, while R Maison scored an average 3. This underscores the attractive pricing of these developments in the resale market compared to other condominiums in District 13. Expanding the perspective to the entire region, all developments, except R Maison, received an average score of 3, while R Maison scored 2. This positions Daisy Suites attractively, indicating it remains reasonably affordable compared to other condominiums in the region, especially with its proximity to the city centre, being just one stop away from Serangoon MRT Interchange.

Daisy Suites, positioned furthest from a MRT station along Daisy Road, received an average score of 3, while other developments scored 4 out of 5. Despite its boutique nature, Daisy Suites achieved an average score of 3 for Volume Score, highlighting the notable interest from potential buyers.

When comparing Daisy Suites to Suites @ Braddell, the latter excels in both Quantum Effect Score and Rental Score, achieving a perfect score of 5 for each. In contrast, Daisy Suites scores an average of 3 for both measures. The difference in scores becomes evident when analysing the floor plans of these developments. Suites @ Braddell offers 1-bedroom, 1-bedroom + Study, and 2-bedroom penthouses, with the largest unit around 893 square feet. On the other hand, Daisy Suites features configurations ranging from 2 bedrooms to 4-bedroom penthouses, with the largest unit at 1,280 square feet.

Due to its smaller unit sizes, Suites @ Braddell provides units with a lower overall price quantum despite a higher average PSF price, leading to its perfect Quantum Effect Score. This also clarifies why Suites @ Braddell earns a perfect Rental Score, as its smaller configurations make it an appealing choice for single or couple tenants who are working professionals seeking a bachelor pad.

Interestingly, Daisy Suites, alongside the three other developments in this MOAT Analysis, received a low rating of 1 out of 5 for the Exit Audience Score. This may be linked to the absence of nearby HDB developments, eliminating the HDB upgraders demographic from consideration at the time of writing. Nevertheless, as emphasised in the Growth Potential section of this article, we anticipate that Daisy Suites will attract interest from diverse demographic groups in the years to come, thanks to its unique standout features.

The Verdict

Daisy Suites emerges as an excellent choice for both families seeking their own residence and investors due to its diverse unit configurations. The 2-bedroom units suit smaller families or individuals looking for a bachelor pad. The 3-bedroom and 4-bedroom units provide generous space for daily activities, and the open concept promotes family bonding, making it particularly attractive for larger families. Its close proximity to reputable primary schools adds to its appeal for families with school-going children.

While the Exit Audience Score may be low in our MOAT Analysis, we believe the four key anchoring points highlighted in the Growth Potential section of this article positions Daisy Suites for long-term success and potential capital appreciation. The added advantage of its freehold tenure offers an extended runway for capital appreciation. Additionally, Daisy Suites is situated in a sought-after neighbourhood with convenient connectivity. Whether for personal occupancy or investment, Daisy Suites stands out for its ability to cater to both preferences. This versatility is attributed to its reasonable pricing, making it a compelling option in comparison to other private developments within District 13.

If you are interested in Daisy Suites or if you are a current homeowner considering selling your unit, please do not hesitate to reach out to us to learn more about our services and how we can support you throughout your property journey.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice or any buy or sell recommendations.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.