Selling your home is always a daunting task. There are so many things to consider. How should I price my property? Should I find someone to buy it? Where should I list it? However, while pondering these questions, you must first decide when you should sell. In this article, we’ll be explaining key considerations in exit strategies.

Key Policies Related to Selling:

SSD – Seller’s Stamp Duty (SSD)

You probably know this by now.

SSD is one of three stamp duties for properties. It was introduced in 2010 as a cooling measure applied within the property market to ensure a stable and sustainable property market. The other two are Buyer’s Stamp Duty (BSD) and Additional Buyers’ Stamp Duty (ABSD). These work as taxes to prevent excessive buying and selling for second and subsequent properties.

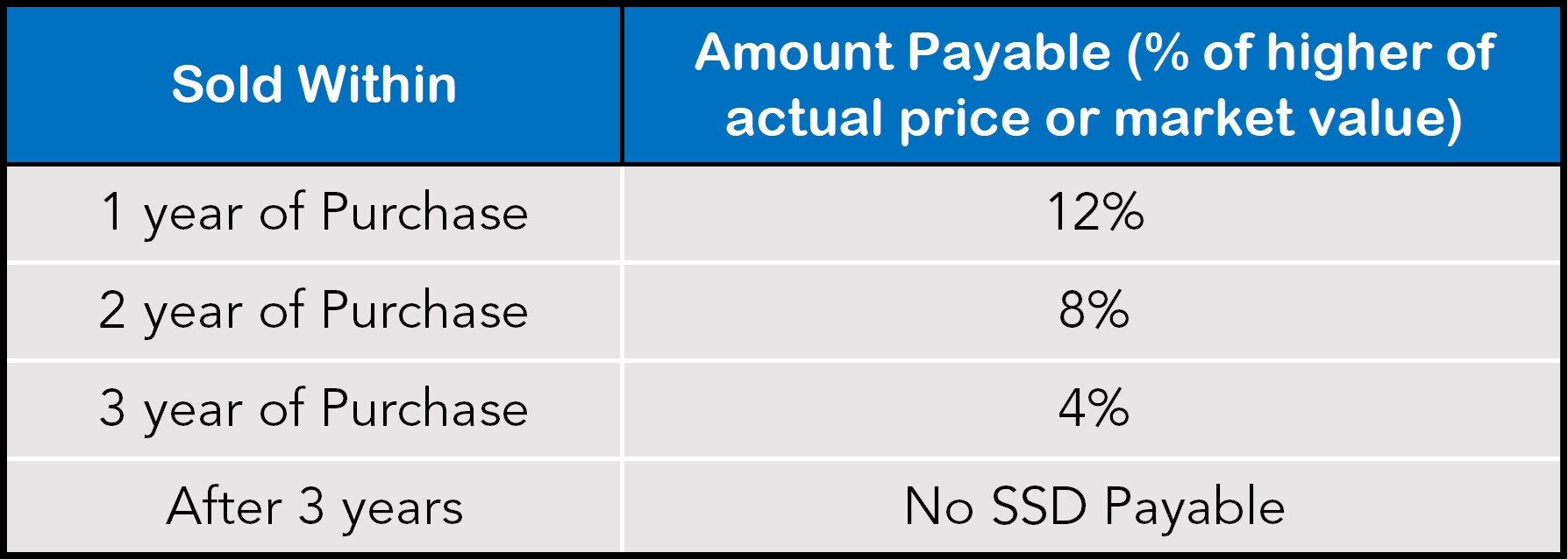

SSD is payable upon the sale of residential properties within the holding period. We’ve compiled a table for easy reference on how much is payable here:

MOP – Minimum Occupancy Period

Alternatively, while SSD is not applicable to ECs and HDBs, they do have a minimum occupancy period of 5 years, during which you’re required to physically occupy your flat. This means no renting out or selling. If you wish to sell your property before the 5 years, you’d have to get written approval from HDB and they are quite rare.

Consideration #1: Flipping

Back in the 90s, flipping was embraced to make a quick yet hefty profit from the property market. So what’s flipping? Flipping refers to when investors purchase a property (or any asset) with the intent of selling it for a quick profit rather than holding on for long-term appreciation.

One way to flip would be to purchase a property at a discounted rate during fire sales and selling them at a higher price. Alternatively, you could purchase an undervalued property, make cosmetic improvements to it and/or renovations and sell it at a profit.

The question now is why isn’t flipping as common today? Firstly, the prices of homes have risen significantly making it harder for most of us to purchase lightly. But more importantly, the implemented SSD hinders investors from flipping — since it requires one to hold the property for at least three years, lest they incur additional costs. Instead those who would like to quickly dispose of their properties, would wait for after the 3 year mark so that they don’t have to pay the extra SSD.

Consideration #2: Capital Appreciation

Alternatively, the most common exit strategy would be to wait for the area to develop before selling it off. Many investors bank on long-term capital appreciation, waiting for the area to develop before they sell. Let’s use Midtown Modern to demonstrate how some projects stand to benefit from future developments.

Midtown Modern is located along Tan Quee Lan Street, directly above Bugis MRT station. It’s an Integrated mixed-use development part of GuocoLand’s ambitious Guoco Midtown project. Bugis, while currently pretty developed, will be undergoing further developments in accordance with URA’s Master Plan.

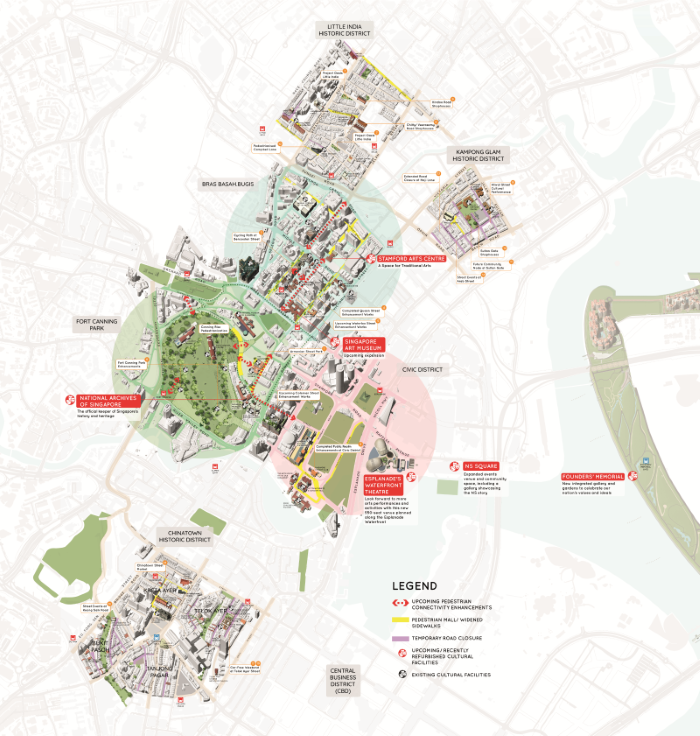

URA Master Plan for Bugis

According to the Plan, Bugis is to be transformed into a pedestrian-friendly Arts, Culture and Heritage Hub via centralising key arts education institutions such as NAFA and School of the Arts (SOTA) and creating more spaces to host arts and cultural events such as the Singapore Night Festival. Moreover, CapitaLand has won a three-year tender for integrating Bugis Village and Bugis Street which will definitely benefit Guoco Midtown and Midtown II’s price growth. Thus, while the Guoco Midtown and Midtown II areas are slated as hubs for professionals for networking and collaboration, the facelift could rejuvenate that area for the next generation of students and artists.

Guoco Midtown’s future Grade A Office Towers will also attract businesses looking for flexible rental options, while there are other Grade A offices at Duo Tower and South Beach Tower. Other offices include The Gateway, Suntec City Towers, the upcoming Shaw Towers, Boon Sing Build, Great Eastern Houses WeWork Beach Centre, and further down North Bridge Road, the entire Central Business District area surrounding Raffles Place.

Beyond Bugis and Midtown Modern, there are some other major development works in the Singaporean pipeline including the revamp of the Greater Southern Waterfront (GSW).

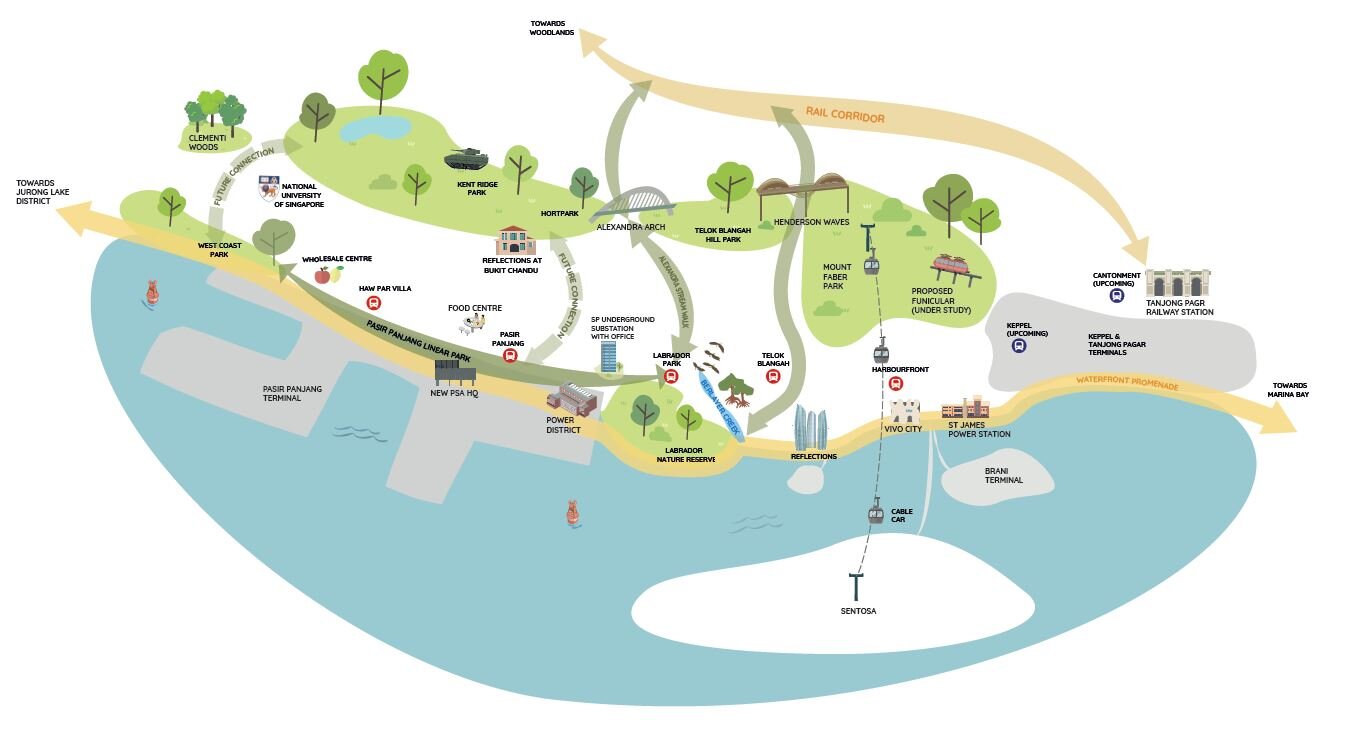

GWS Courtesy URA

Announced in 2013, GSW is a 30km coastline from the Marina East to Pasir Panjang. It is of a gargantuan scale: 2,000ha of land, six times of Marina Bay. Following Keppel Club’s lease expiring in 2 years’ time, the state will be building 9,000 BTO units and high-end condominiums to form a new residential precinct. A continuous waterfront promenade will line the developing stretch, with a green corridor labelled Pasir Panjang Linear Park that connects West Coast Park and Labrador Nature Reserve. This will be connected to Mount Faber that is due for enhancements to the cable car experience as well.

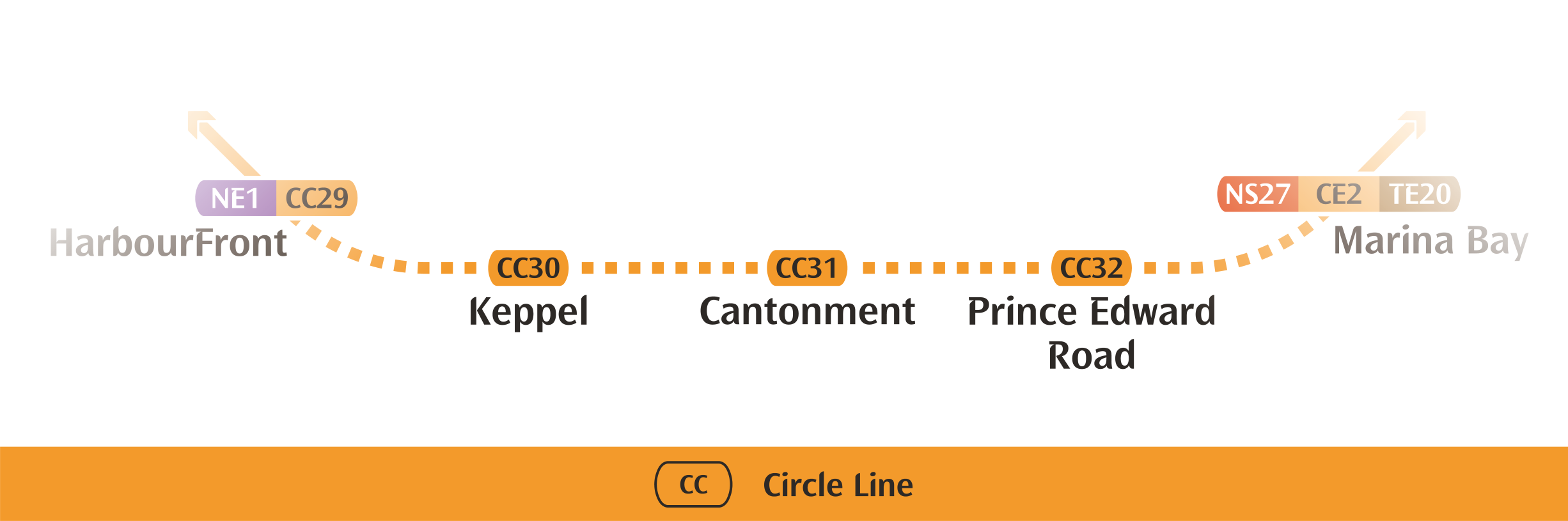

CCL6 3 New Stations courtesy LTA

The GSW will also be served by three new Circle Line Stations, namely Prince Edward, Cantonment and Keppel MRT stations. These are set to be completed by 2025, though with the pandemic slowing productivity over the last year, we expect a slight delay.

Overall, from these upgrades within the vicinity, properties within the vicinity such as Avenue South Residence and The Reef, are likely to see great capital appreciation in the long-run.

There are also several other urban transformations such as the rail corridor, Punggol Digital District, Paya Lebar Airbase and more, in the pipeline. Thus waiting for future developments to come to fruition before making the sale allows sellers to capitalise on the property’s full potential.

Consideration #3: The Ebb and Flow of Property Worth

Beyond future developments, another key consideration will be timing. While not as volatile as the stock market, the real estate market also experiences fluctuations stemming from wider market trends.

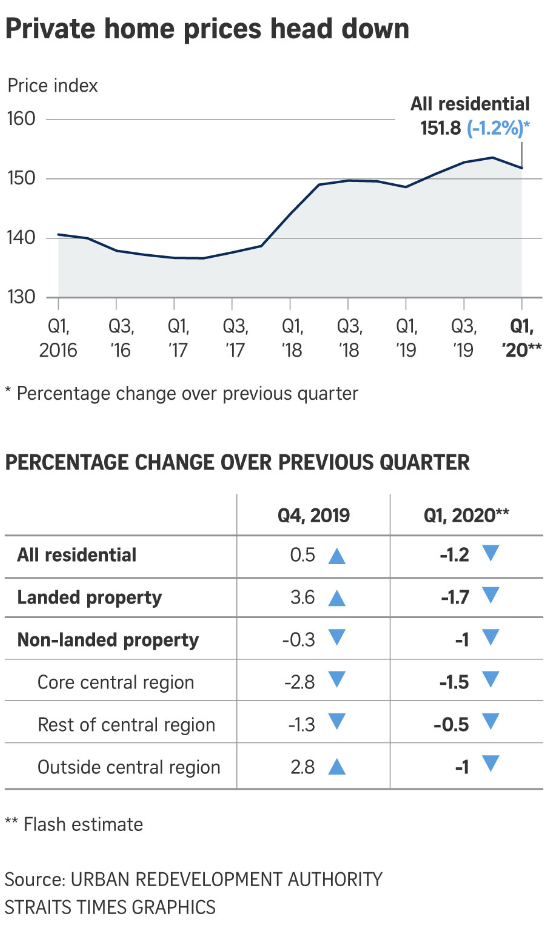

Let’s get the most obvious variable out of the way first. COVID-19. It’s the perfect example to illustrate how the Singapore property market can fluctuate. Following the virus outbreak, the Singaporean private home market saw a broad-based 1.2% dip in property prices for the first quarter. The fall was seen by landed properties and condos alike ranging from 0.5% (RCR condos) to 1.7% (landed properties).

Percentage Change Over Previous Quarter Courtesy URA and StraitsTimes

However, by the end of the year, private home prices managed to increase by 2.2%, driven by non-landed properties and developers making attractive offers. The lower prices and prolonged uncertainty caused by the pandemic probably pushed many to invest in the property market since it is generally seen as a safe haven, aside from lowered bank interest rates. The biggest gainers were condos in the Core Central Region (CCR) and Rest of Central Region (RCR) that saw a 3.2% and 4.4% increase in the fourth quarter respectively. This is most likely due to investors realising value in properties within these regions and finally being able to afford it due to the lower prices. Dissimilarly, the rental market saw a decline of 0.6% for the whole of 2020. While not a massive plunge, this dip could be owed to the exodus of foreigners and closed borders.

Moreover, the introduction of new infrastructure could also drive up prices. A study conducted by researchers from the National University of Singapore aimed to illuminate the relationship between a new Mass Rapid Transit (MRT) line construction and housing wealth, using evidence from the Circle Line. They found that the opening of a new urban rail line increases the value of non-landed private homes located within 600 metres of the MRT stations by 6.3 per cent and that properties near interchange stations have an additional 4 per cent premium. Interestingly, their study also found that the announcement of a new MRT line had little effect on property prices.

This can also be observed in how following the announcement of the Thomson-East Coast Line in August 2012 there wasn’t an exorbitant increase in property prices within District 15 that’ll house some of the new stations like Marine Parade and Tanjong Rhu.

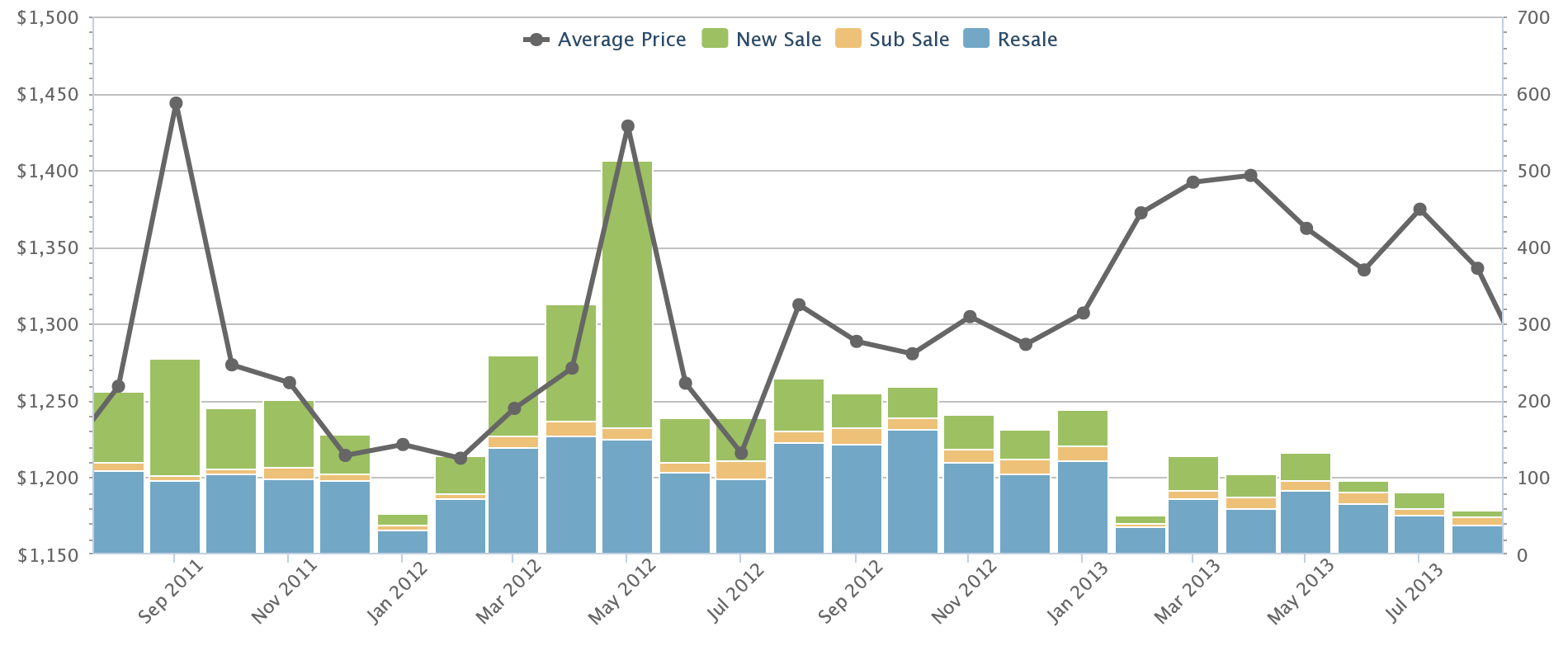

District 15 Price Chart Aug 2011 to Aug 2013 Courtesy SquareFoot

Even if we zoom in to properties within close proximity such as Casuarina Cove located within 5 minutes, approximately 450m away from Tanjong Rhu MRT Station, you’ll see that there isn’t such a massive increase in property prices.

Tanjong Rhu MRT Station and Casuarina Cove Courtesy Street Directory

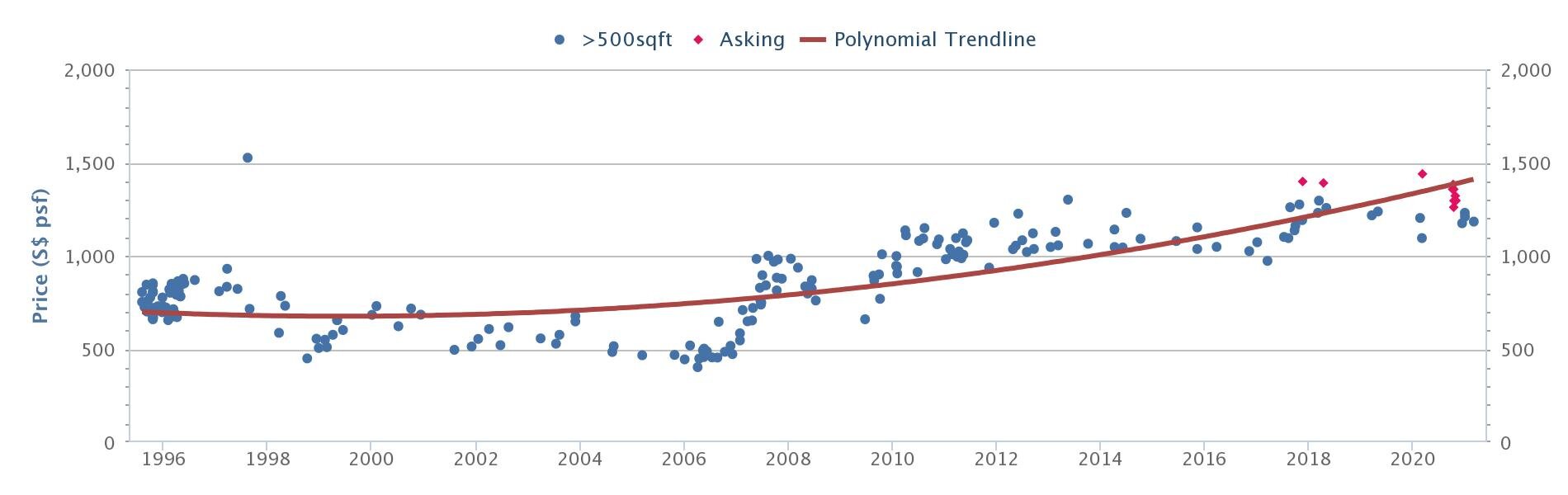

Casuarina Cove Price Chart Courtesy SquareFoot

This graph from SquareFoot shows us how while prices have been going up, it’s a gradual increase and not a sharp one following the announcement. The study explained that this lack of enthusiasm is most likely due to an disinclination of investors and home-owners to move in during the construction phase due to the noise and air pollution. However, it’s pretty likely that after the construction of Thomson-East Coast Line, District 15 will see significant capital appreciation.

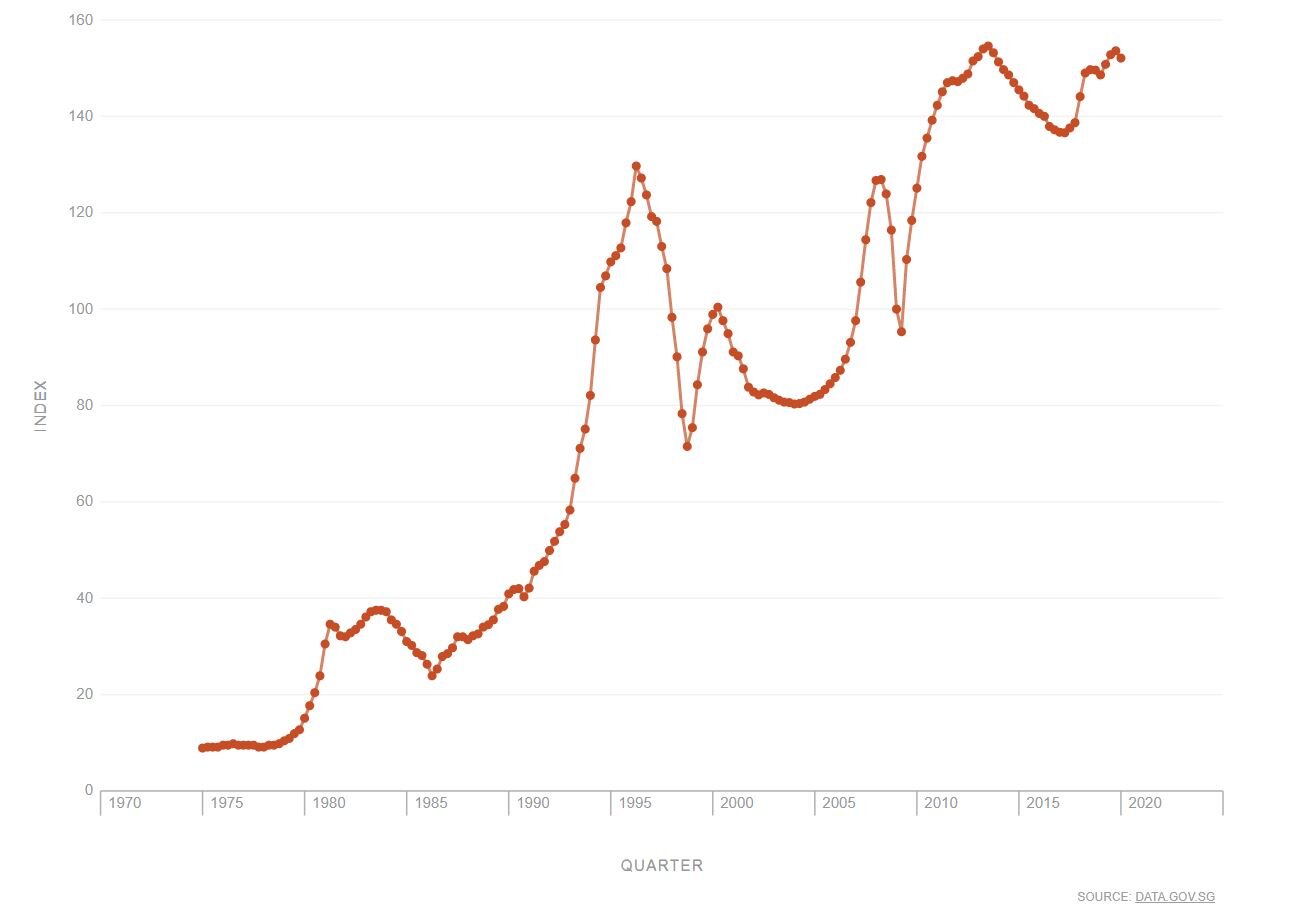

The final variable we would like to highlight would be the implementation of various legislations. The Singaporean government has famously adopted cooling measures such as the SSD, Additionally Buyer’s Stamp Duty and more to control the property market and prevent excessive price hikes. These measures have a profound effect on the property market. For example, following the eight rounds of cooling measures from 2009 to 2013, private property prices in Q2 of 2017 fell 18% from their peak in Q3 of 2013.

Private Residential Property Index Courtesy Data.gov.sg

Following the dip, when property prices started to hike again, the state announced further cooling measures in July 2018. This new round of cooling measures included raising Additional Buyer’s Stamp Duty (ABSD) rates and tightening loan-to-value (LTV) limits on residential property purchases. As a result of the announcement, many flocked to showrooms and agents to close deals on properties to avoid having to pay in accordance with the new requirements.

There was a more recent change in legislation that restricted the reissue of options to purchase in 2020. Option to purchase (OTP) refers to a contract that protects sellers while allowing potential buyers to reserve (or “chope”) a property they’re interested in. The OTP details the agreed price and period for consideration. Sellers issue the OTP to buyers following the price negotiation, and require an option fee – typically 1% of the purchase price. Buyers will then have to exercise the option within this period, failing which, they forfeit the option fee. Under the new rules, developers cannot re-issue an OTP to the same purchaser for the same unit within 12 months after the expiry of the earlier OTP. Taken together with the lack of new launches, private home sales plunged 51.7% in October 2020.

From this section, we can see how the property market fluctuates quite a bit and is subject to many variables. Thus, it’s imperative that you consider wider market trends and refrain from making hasty sales. The best people to keep track of these changes and their impacts are property agents, including our team here at PropertyLimBrothers. We offer our insights into market trends on our website here, that you can peruse to gain a better understanding of the property climate. If you’ve got further questions or would like to speak with one of us, feel free to reach out here.

Further Information: ABSD

If you’re on this article, chances are, you’re looking for your next condo or landed. As mentioned earlier, ABSD is one of the cooling measures adopted by the state to regulate the property market. It’s applicable to Singapore Citizens, Permanent Residents (PRs), Foreigners and Entities, at different rates. Fortunately Singaporean married couples can get a refund for ABSD and BSD, but will be ported over to CPF, which will then be locked. They would have to pay up in cash first though. However, there are several ways to get around paying ABSD as we highlight in this article. Spoiler alert: it’s better if you’re investing as a couple.

What about you?

We hope you have learnt something from this article. Ultimately, we think it’s a matter of circumstance. If you have been through several homes, you’ll get that every intent to sell differs, with location and timing affects the result of a sale.

After doing your research (or hiring an agent), if you are skeptical of the property’s ability to significantly appreciate, selling it after the three years might be a better bet. However, generally, Singapore is always redeveloping and upgrading, thus we suggest that after thorough research, if you find that it has potential for appreciating significantly, it might be in your best interest to hold until after developments in the area are completed.

PropertyLimBrothers provide detailed analyses of new launches, accessible through our website here that could help in your research. Furthermore, you could approach our sales team for a free consultation on your property if you’re considering selling. Finally, stay tuned for more property related news and information.