The Singapore government has unveiled its Government Land Sales (GLS) programme for the first half of 2025, aiming to balance housing demand and affordability amid an evolving real estate landscape. This carefully curated land supply is set to provide 8,505 private residential units in 1H 2025 through a mix of Confirmed and Reserve List sites, including three Executive Condominium (EC) plots to address rising developer interest and strong demand from eligible homebuyers.

Unprecedented Challenges in 2024

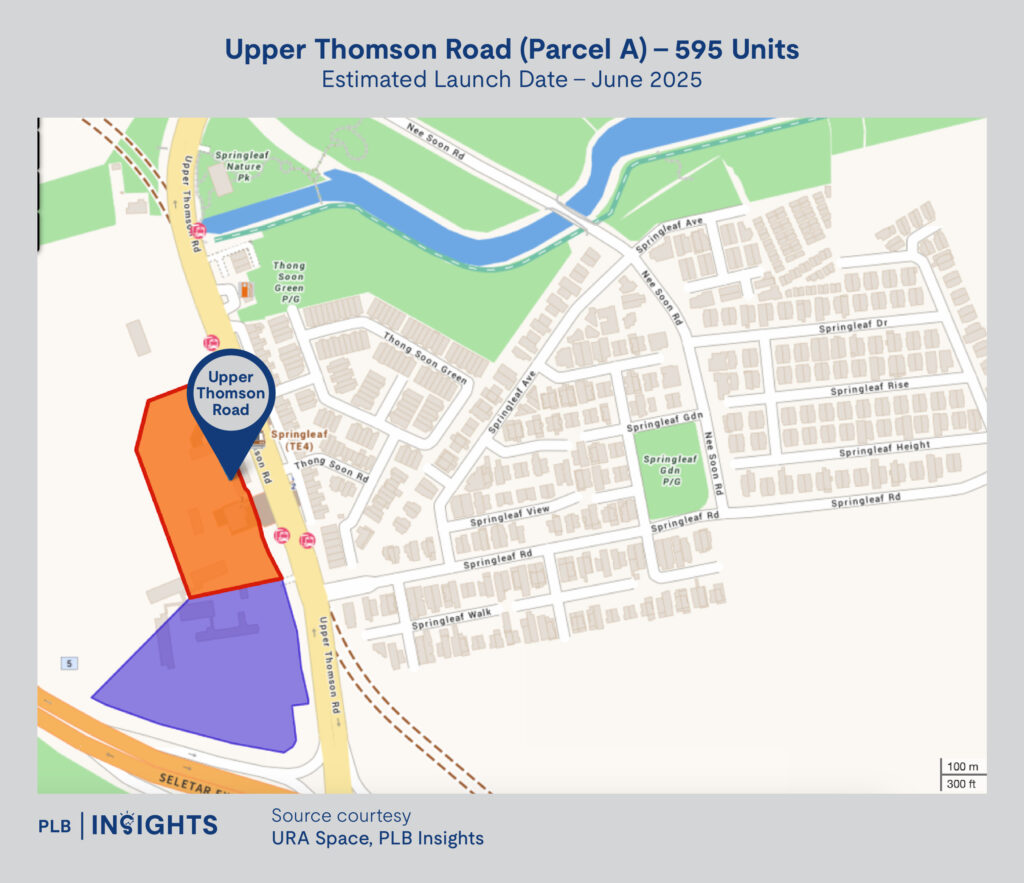

This year witnessed several high-profile GLS tenders where bids were rejected or sites received no interest, including the Marina Gardens Crescent plot, Jurong Lake District master developer site, and Media Circle (SA2), as the respective top bids were assessed to be too low. In addition, the Upper Thomson Road (Parcel A) site meant for long-stay serviced apartment (SA2) drew no bids. To address developer concerns, the government has introduced greater flexibility in the 1H 2025 programme, such as removing mandatory serviced apartment components from the Upper Thomson Road (Parcel A) site.

1H 2025: Ramped-Up Supply of Private Housing Units

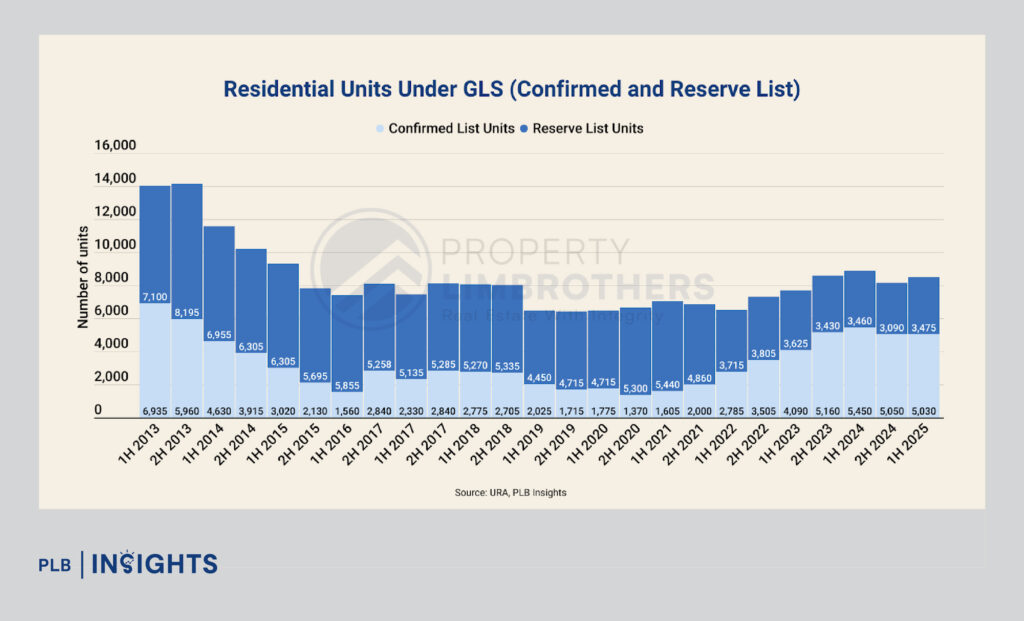

The Confirmed List for 1H 2025 comprises 10 sites, which can collectively yield an estimated 5,030 residential units, including 980 EC units. This is on par with the 5,050 units offered in the 2H 2024 GLS programme as seen in Figure 1 above, reflecting the government’s continuous efforts to ramp up a robust pipeline of private housing supply.

Confirmed List Highlights:

1. Executive Condominium (EC) Sites:

Three EC plots, yielding 980 units, mark the largest number of EC sites offered in a single GLS since 2014.

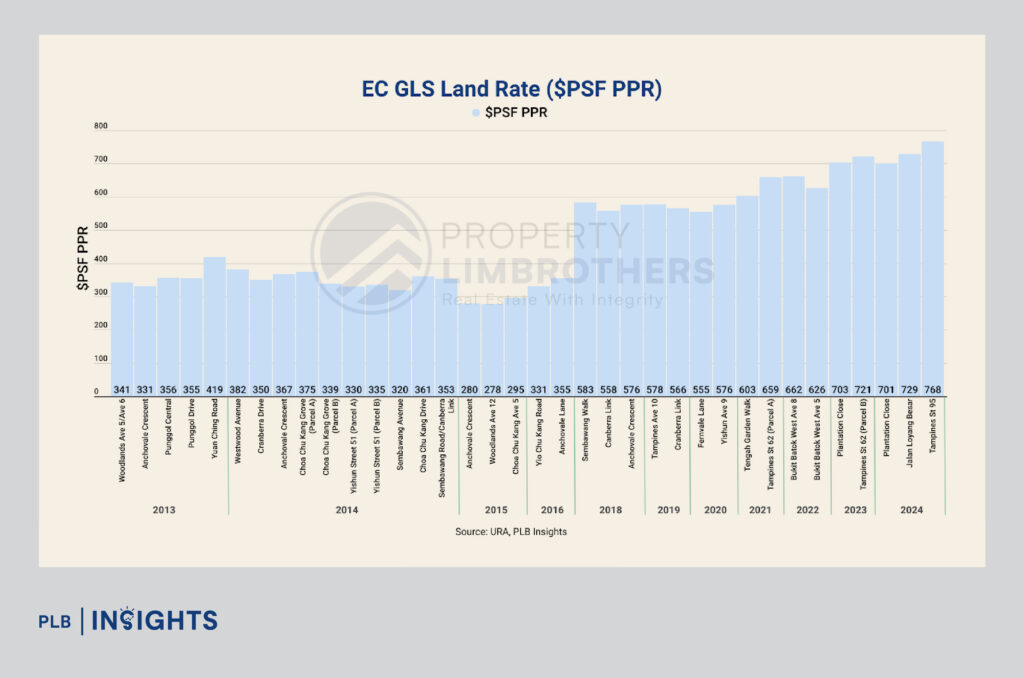

The move addresses growing competition among developers for EC land, as evidenced by record-breaking land prices in recent EC tenders.

2. Newly Introduced Sites:

Seven new plots have been added to the Confirmed List, located in sought-after precincts such as Bukit Timah Turf City (Dunearn Road), the Greater Southern Waterfront (Telok Blangah Road), and the former Keppel Golf Course site.

3. Mixed-Use Development:

A prominent mixed-use plot in Hougang Central will integrate residential units with 40,000 sqm of commercial space, creating a vibrant hub connected to the Hougang MRT interchange.

Additionally, the residential plot in Upper Thomson Road (Parcel A), which saw no bids when its tender closed in June 2024, is given more flexibility and that URA will not mandate the plot to be used for serviced apartment/long-stay serviced apartment. It will be extended for other use subjected to approval from technical agencies.

Reserve List: Flexibility for Market Demand

Meanwhile, the Reserve List includes nine sites that developers can trigger for sale if market conditions warrant. These comprise:

Addressing Market Needs: A Strategic Approach

The government’s GLS strategy reflects its responsiveness to market signals. By increasing the supply of EC sites, it aims to moderate land prices and end-user costs for EC projects, which remain a popular choice among middle-income homebuyers. A record bid of $786 PSF PPR for a recent EC site at Tampines St. 95 was awarded, as shown in Figure 2 above. The rising trend in land prices for EC sites indicates an upward trajectory in eventual EC prices for consumers. As such, the increase in EC GLS supply in 1H 2025 to cater to future demand is welcome news, as it may help to ease land costs and stabilise EC prices.

Exciting New Precincts and Revitalisation Projects

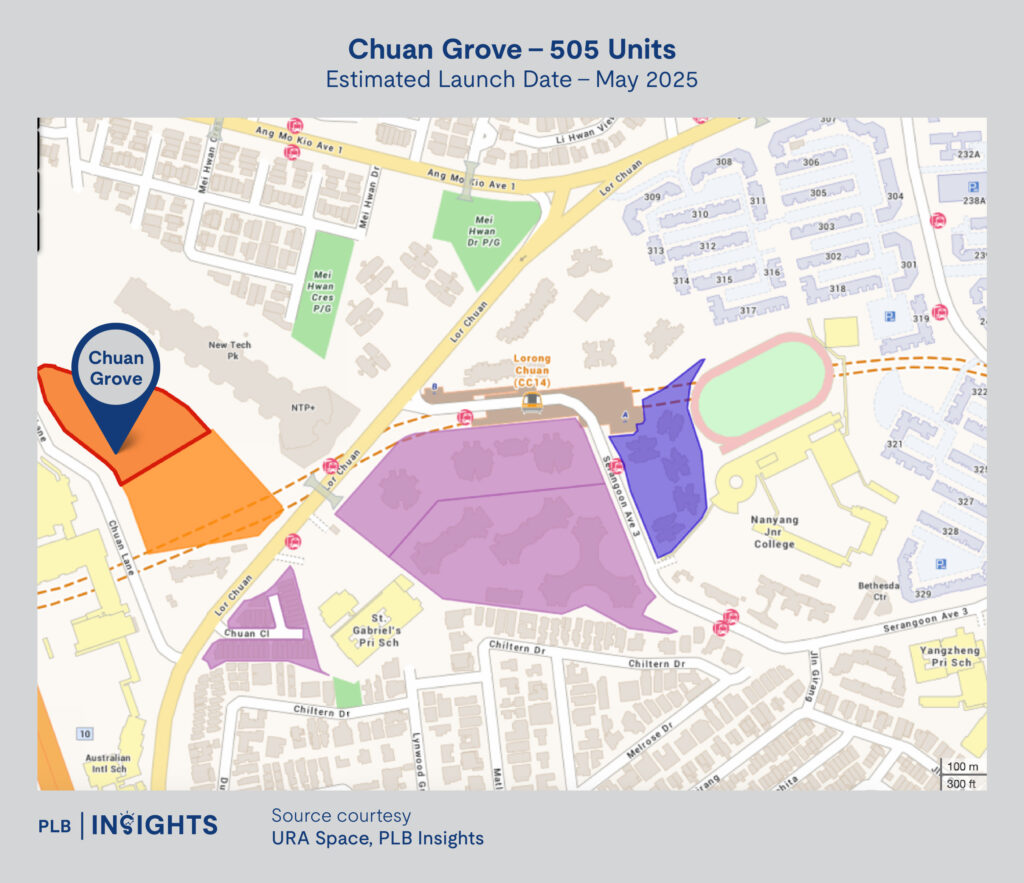

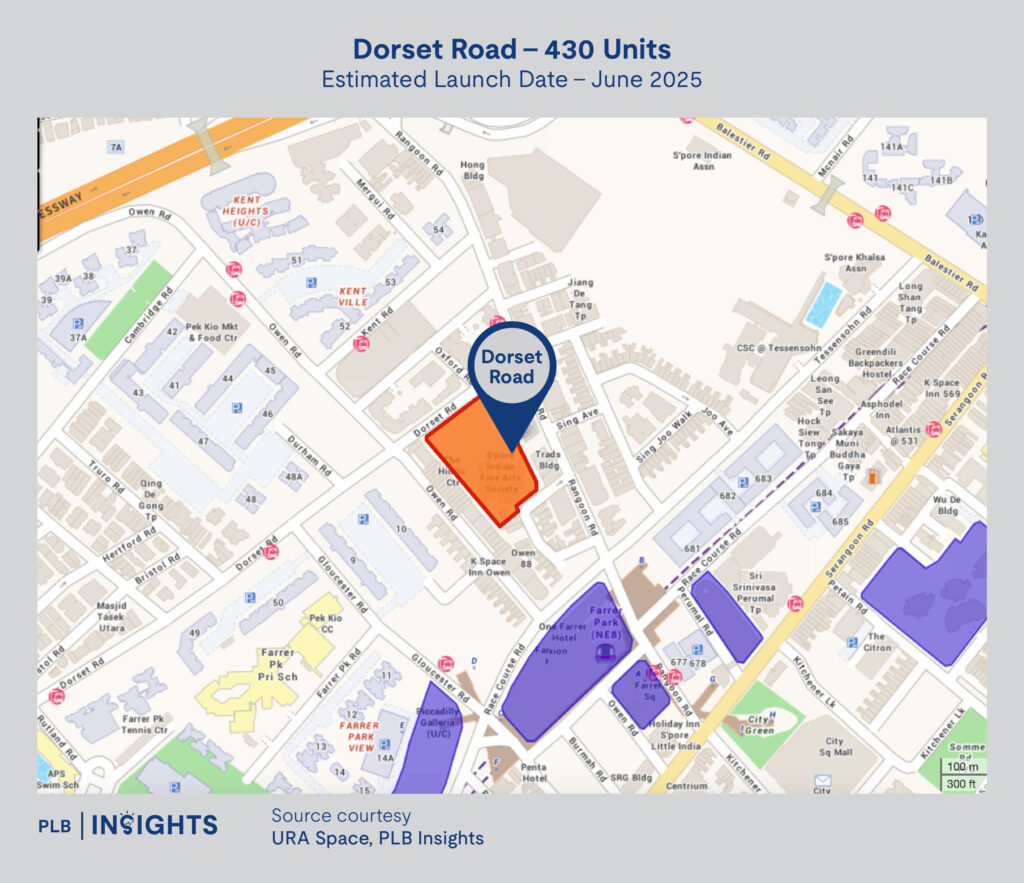

Additionally, the inclusion of other non-EC residential plots like Dunearn Road, Telok Blangah Road, Lakeside Drive, Dorset Road and Hougang Central highlights the focus on connectivity and proximity to amenities. These sites, located near MRT stations and recreational hubs, are likely to attract strong interest from developers and homebuyers.

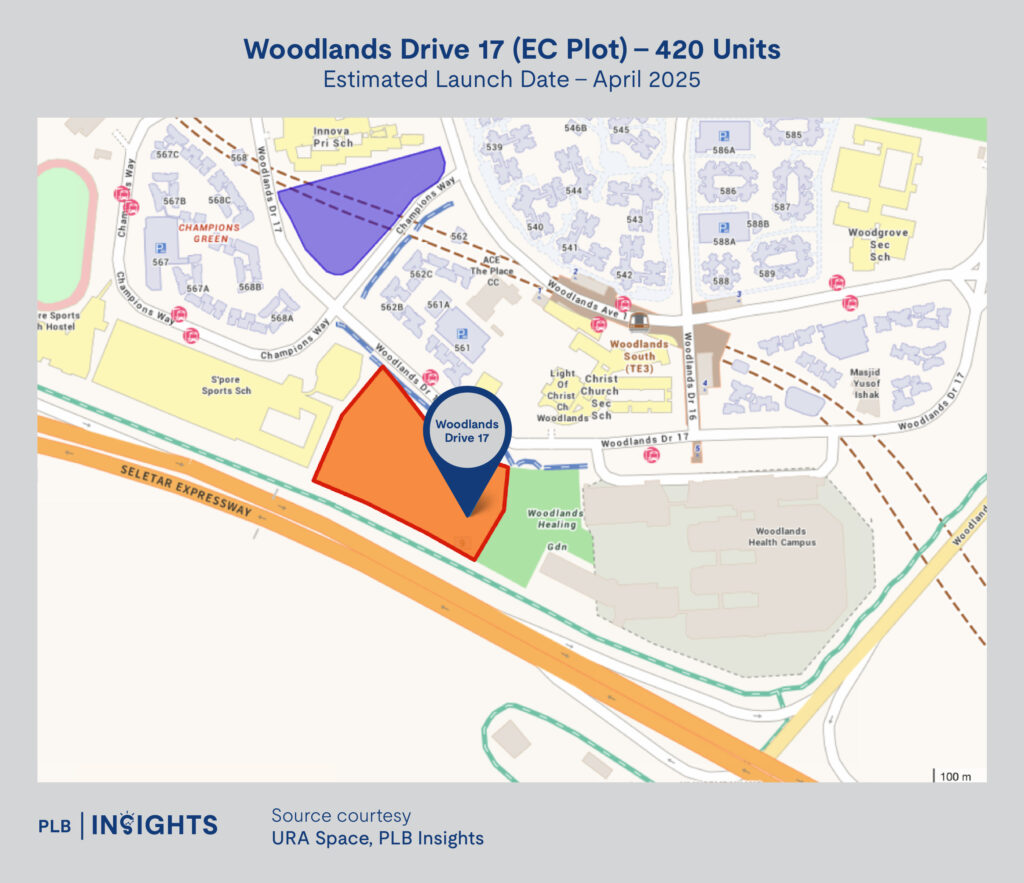

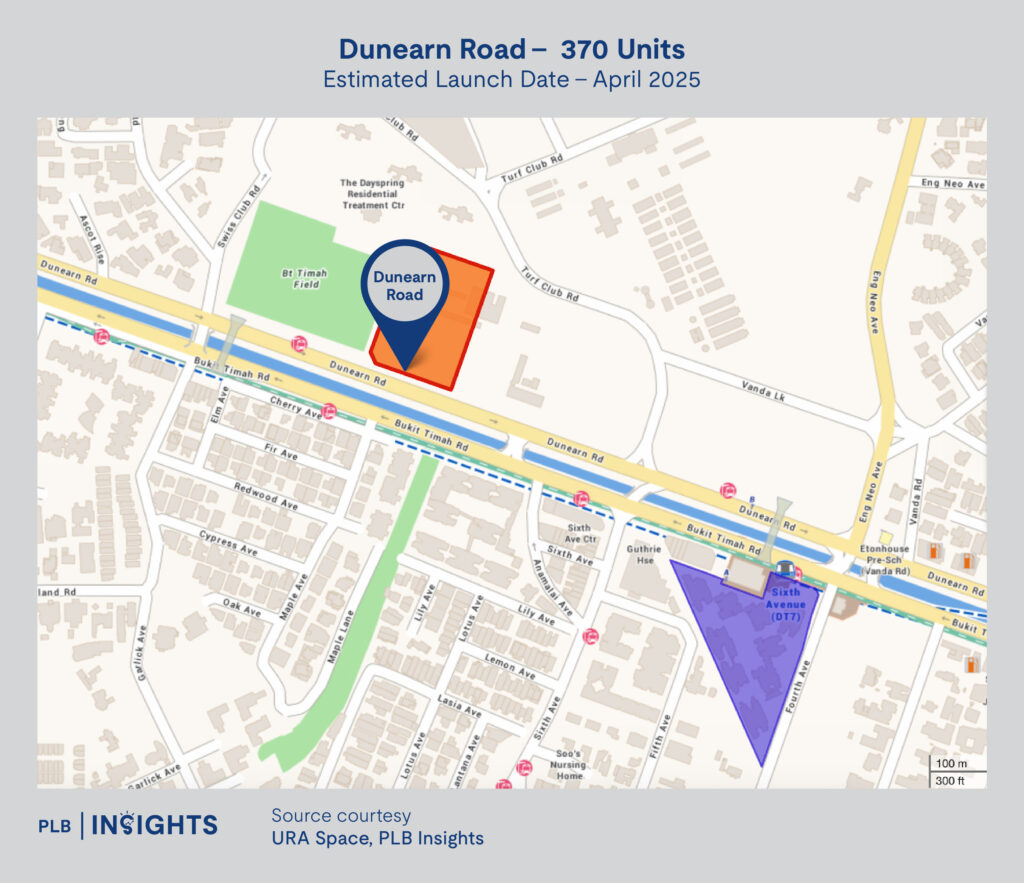

1. Bukit Timah Turf City (Dunearn Road):

A 370-unit site in a city-fringe area, near prestigious schools and Sixth Avenue MRT station.

2. Greater Southern Waterfront (Telok Blangah Road):

A 740-unit site within the transformative masterplan of the Greater Southern Waterfront, offering connectivity to Mount Faber, Sentosa, and HarbourFront.

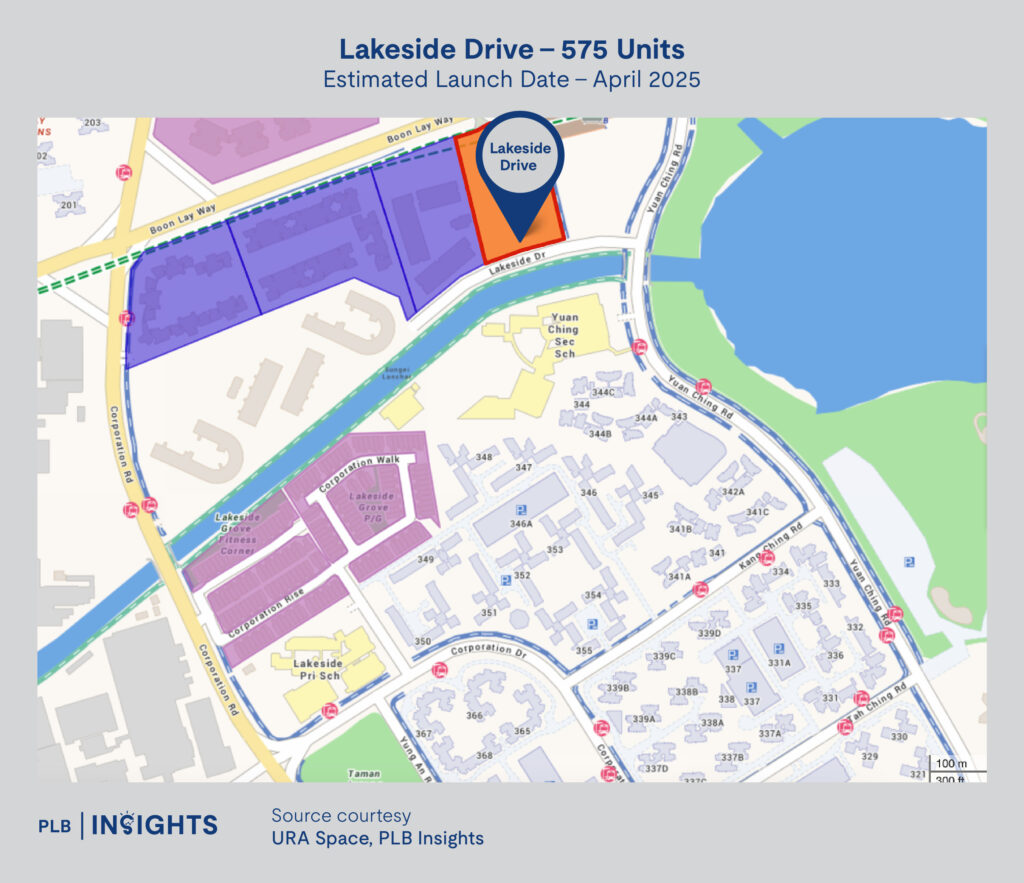

3. Jurong Lake District (Lakeside Drive):

A 575-unit site located at the doorstep of Lakeside MRT station, positioned to benefit from the Jurong Lake District’s redevelopment into Singapore’s next central business hub.

For full list of GLS Confirmed Lists in 1H 2025:

Outlook For 2025 Remains Optimistic

With optimism surrounding potential rate cuts and improving market sentiment, developers are likely to view the 1H 2025 GLS programme as an opportunity to replenish their land banks. The diverse range of sites across established and emerging precincts ensures balanced supply and supports Singapore’s long-term housing needs.

Final Thoughts

The 1H 2025 GLS programme demonstrates the government’s commitment to fostering a resilient and inclusive housing market as supply is being ramped up. By offering a mix of sites catering to varied housing needs and market segments, it addresses both near-term challenges and helps meet the longer-term demand. With its strategic location offerings and thoughtful planning, the programme is poised to sustain market confidence and ensure a steady supply of private housing for Singapore’s future.

Stay Updated and Let’s Get In Touch

Stay updated with PLB Insights for the latest insights on how GLS developments shape opportunities in Singapore’s dynamic real estate market. Questions? Reach out to PropertyLimBrothers for data-driven consultations tailored to your investment journey!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.