The global financial system is undergoing a structural transition. For decades, the United States dollar (USD) has played a central role in global trade, finance, and reserves. However, recent geopolitical realignments, economic diversification efforts, and deglobalisation trends have given rise to an increasing shift: de-dollarisation. This movement away from USD-centric transactions is accompanied by a broader weakening of the US dollar, especially against currencies like the Singapore dollar (SGD).

While these macro shifts are often analysed from a global investment or trade perspective, they carry equally significant implications for Singapore’s real estate sector, which is both globally exposed and domestically anchored. In this article, we examine the likely effects of a weakening USD and de-dollarisation on Singapore’s housing market, across five critical dimensions: currency dynamics, interest rates, construction costs, foreign investment, and the rental market.

1. Currency Strength and Diverging Demand Impact

As the USD weakens, the SGD tends to appreciate. This is partly a function of Singapore’s exchange rate-based monetary policy, where the Monetary Authority of Singapore (MAS) manages the SGD against a basket of trading partner currencies. A stronger SGD has dual consequences for Singapore’s housing market.

Foreign Demand May Face Headwinds

For investors whose wealth is denominated in USD or USD-pegged currencies, an appreciating SGD makes Singapore properties more expensive in relative terms. This poses more challenges for the Core Central Region (CCR), where foreign investment plays a more significant role. High-net-worth individuals from the United States, the Middle East, and certain Southeast Asian economies may temporarily defer or scale back their acquisition plans.

This trend may also be compounded by Singapore’s strict residential property taxes on foreigners, such as the 60% Additional Buyer’s Stamp Duty (ABSD), further curbing foreign appetite for prime residential assets.

Domestic Purchasing Power Strengthens

Conversely, the appreciation of the SGD benefits local buyers by increasing their real purchasing power. A stronger currency supports household wealth and enables Singaporeans to finance property purchases with relatively lower exposure to imported inflation. This effect is likely to support mass market and upgrader demand, especially in the Rest of Central Region (RCR) and Outside Central Region (OCR), where buying activity is driven by genuine home buyers looking to stay long-term.

2. Interest Rate Relief and Its Stimulative Effect

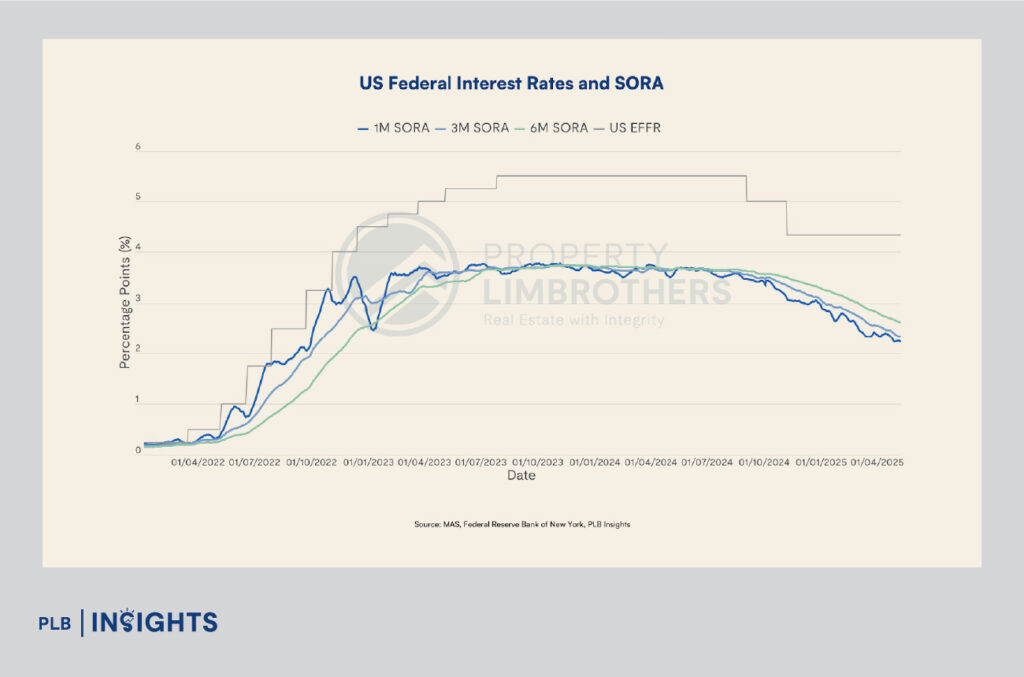

Although Singapore does not set interest rates via a central bank rate like the US Federal Reserve, domestic borrowing costs are still influenced by global liquidity conditions. The USD’s weakening typically reflects a more dovish US interest rate outlook, which lowers the cost of capital globally.

In Singapore, this is observed through SORA (Singapore Overnight Rate Average), the main benchmark for housing loans. A softer USD environment tends to lead to lower or stable SORA levels, translating to more affordable mortgage repayments.

This supports property affordability, particularly for:

- First-time buyers entering the private condominium market.

- HDB upgraders moving into new launches in RCR and OCR.

- EC (Executive Condominium) buyers, who tend to be highly mortgage-sensitive.

Lower borrowing costs also positively influence market sentiment and can spur buying interest, particularly when combined with a stronger SGD and stable job market.

3. Lower Construction Costs Offer Developers Breathing Room

Many raw materials used in real estate development—such as steel, aluminium, oil, and copper—are priced in USD. A weaker dollar therefore reduces the SGD cost of importing these materials, providing cost relief to developers.

However, it is important to note that material costs account for only a portion of overall development costs. Land acquisition, labour, and government levies (e.g. development charge, ABSD remission conditions) continue to exert significant pressure on project feasibility. Therefore, any cost savings from USD weakness are likely to stabilise prices rather than meaningfully lower them.

4. De-Dollarisation and Capital Reallocation into Singapore Assets

As global central banks and investors reduce exposure to USD-denominated assets, alternative safe havens become more attractive. Singapore is well-positioned to benefit from this capital reallocation, due to its:

For institutional investors and sovereign wealth funds seeking diversification, SGD-denominated property assets (residential, commercial, or mixed-use) provide both stability and yield potential.

Although the ABSD remains a constraint on foreign residential investment, de-dollarisation may still:

5. Rental Market Rebalancing: Pressure in Prime, Resilience in Fringe

The rental market is another area impacted by currency movements. A stronger SGD increases the relative cost of rent for expatriates who are paid in USD. As a result, leasing in high-rent districts (such as Orchard, River Valley, and Sentosa) may become less affordable for US-based expats, potentially reducing occupancy and yields in these areas.

However, this is offset by rising rental demand from other regional tenants—particularly those from China, India, Indonesia, and Australia—whose currencies may have remained stable or even strengthened against the USD.

Furthermore, the flexible work environment and the establishment of regional offices in Singapore continue to support rental demand in city-fringe and suburban areas, sustaining yields for OCR and RCR landlords.

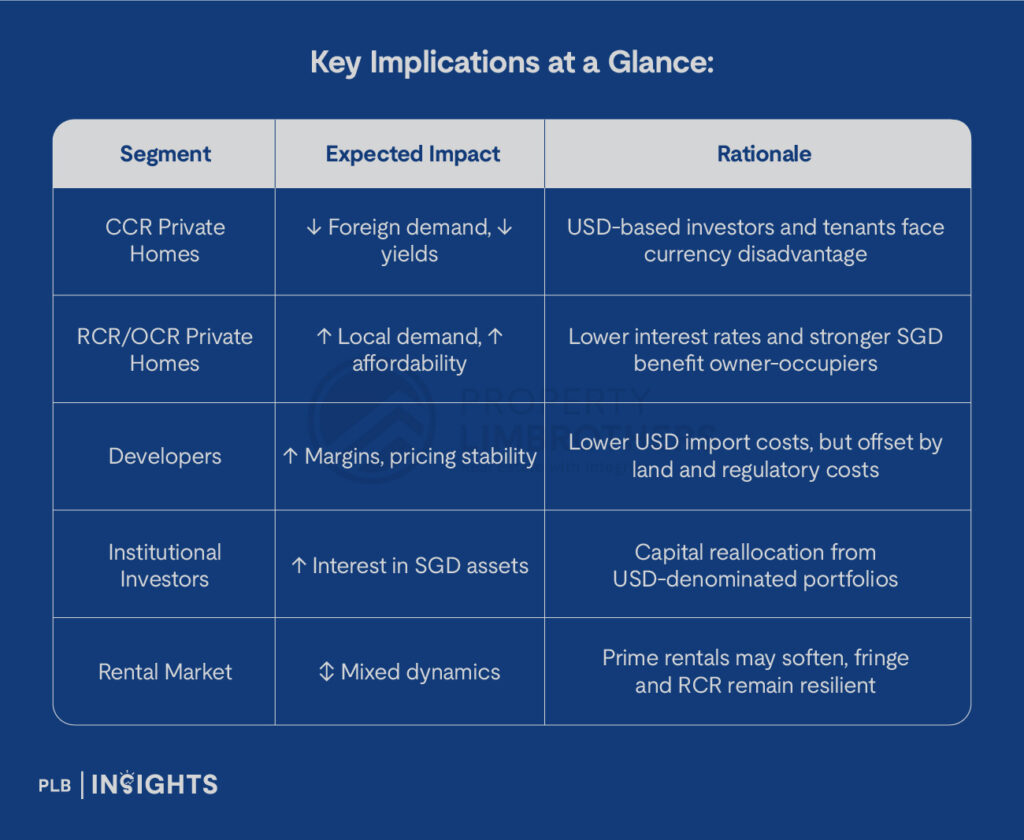

Conclusion: Currency as a Catalyst, Not a Driver

The weakening USD and growing de-dollarisation do not by themselves dictate the direction of Singapore’s housing market—but they act as powerful catalysts, influencing demand composition, funding costs, developer margins, and investment strategies.

Key Implications at a Glance:

Looking ahead, the resilience of Singapore’s housing market will hinge on its fundamentals—governance, financial prudence, and demographic health. Currency dynamics will continue to shape the tempo and tone of market activity, but pricing and demand will remain ultimately anchored in economic fundamentals and regulatory policy.

Stay Updated and Let’s Get In Touch

Questions? Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.