In the fast-paced landscape of fashion and real estate, an intriguing concept presents itself as a potential barometer of economic health: The Hemline Index. This theory posits that the length of women’s skirts is correlated to the current state of the economy. With the recent news of the US stock market facing downturns resulting from a jobs report that sparked fears of a recession, the market’s direction has been causing uncertainties among investors.

While historically, there may have been a connection between the two factors, how does this seemingly superficial trend tie into Singapore’s property market? As the world grapples with unprecedented events resulting in economic downturns and shifting consumer behaviours, we can look at concepts like the hemline index and determine how it might reflect consumer sentiments, and as a result, influence property values.

In this article, we are delving into the hemline index, its historical context, and its relevance to Singapore’s real estate landscape at present. We will also examine how current global events shape the property market and their broader implications.

What is the Hemline Index?

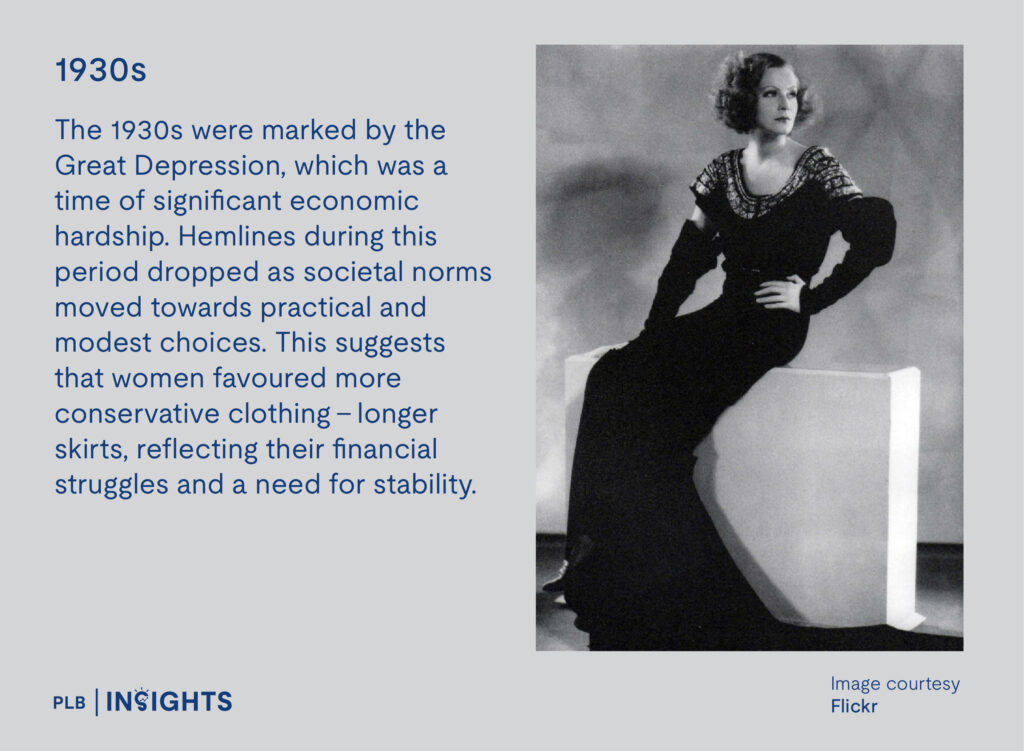

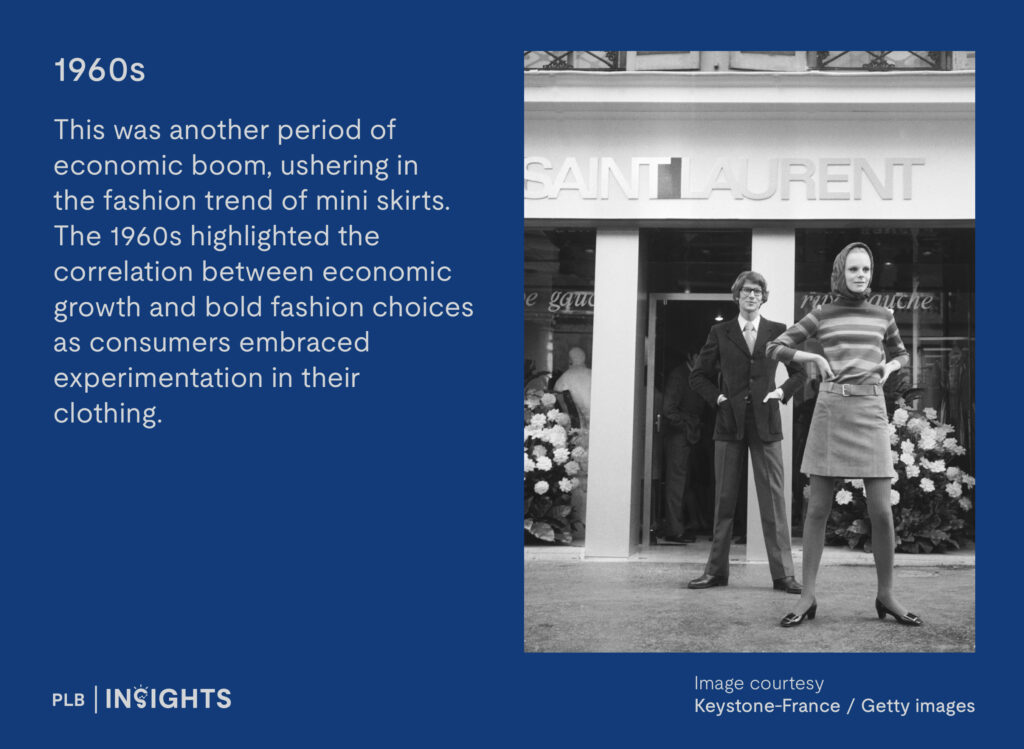

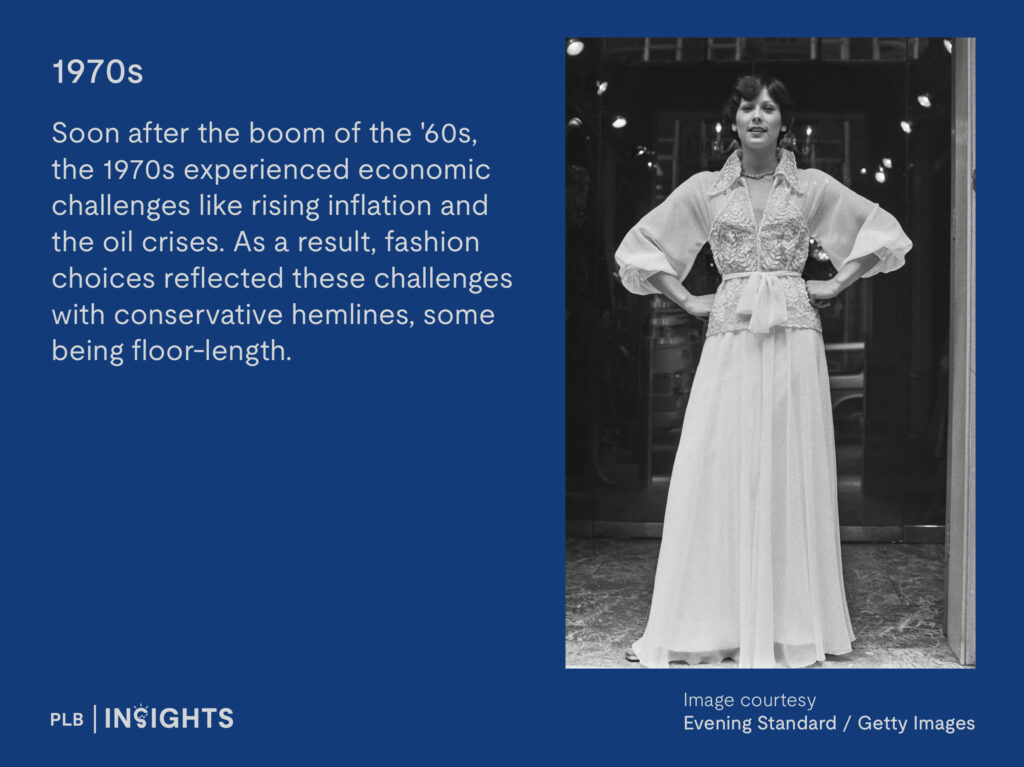

The hemline index refers to an economic theory that suggests a correlation between the length of women’s skirts and the state of the economy. According to the hemline index or indicator, a fashion trend of shorter hemlines indicates economic confidence and boom, whereas longer hemlines signal uncertainty and economic downturns. When stock prices are rising, skirt hemlines rise with them, and vice versa.

The idea that financial markets rise and fall in correlation with the length of skirts stems from the belief that in times of economic growth and financial stability, consumers are more willing to spend on fashion trends – including trendier, shorter skirts or dresses. On the contrary, during economically challenging times, longer hemlines reflect modesty in terms of spending.

A Brief History of The Hemline Index

The Hemline Index, Economic Indicators and the Property Market

The Hemline Index offers a unique perspective on the economic conditions of a market, as well as consumer behaviour throughout the different conditions. Fashion choices reflect psychological responses to economic conditions. As such, it may be particularly relevant when analysing Singapore’s property market since economic conditions can directly impact consumer sentiment towards purchasing property.

By examining the relationship between hemline trends and various economic factors, we can gain insights into how societal attitudes impact the demand for real estate.

Spending Power and Consumer Confidence

If shorter hemlines are an indication of consumers’ confidence and a higher spending power in a healthy economy, then this may also have a positive impact on property investments. When buyers feel secure with their finances, they will be more likely to either plan on investing or invest in real estate. This could be through purchasing new homes or upgrading from public to private housing. Conversely, in a period of economic downturns where historically hemlines would get longer, buyers may take a more cautious approach when investing in real estate. They may need to create a smaller budget or move the timeline of their purchase, thus lowering demand for property.

Inflation and Recessions

Economic challenges such as the 2008 global financial crisis or the COVID-19 pandemic would typically indicate longer hemlines. In Singapore’s property market, this could lead to a slowdown in property transactions or perhaps create a shift towards more affordable housing options. Additionally, developers may also adjust their strategies and focus on projects that offer value and cater to consumer references during a downturn.

Economic Growth and Employment Rates

Another factor that is impacted by economic boons and downturns is the employment rate. Strong employment rates during a period of economic growth are correlated with increasing disposable income, which is one of the various factors that play into driving up the demand for properties as well. Consumers may be more likely to invest in real estate when employment is stable, leading to increased transactions in the property market.

Global Events and Shifts In Culture

Major global events can disrupt fashion and economic trends, impacting Singapore’s property market. For instance, during the pandemic in 2020, there was a shift towards more modest fashion as people prioritised comfort and practicality.

While we may have not seen skirt hemlines specifically getting longer, we did see a rise in clothes that were better suited for casual wear or for wearing at home – like athleisure. This reflected broader economic conditions on a global scale which were causing uncertainties in the property market, with property prices both increasing and decreasing throughout the pandemic.

Singapore’s Property Market Now

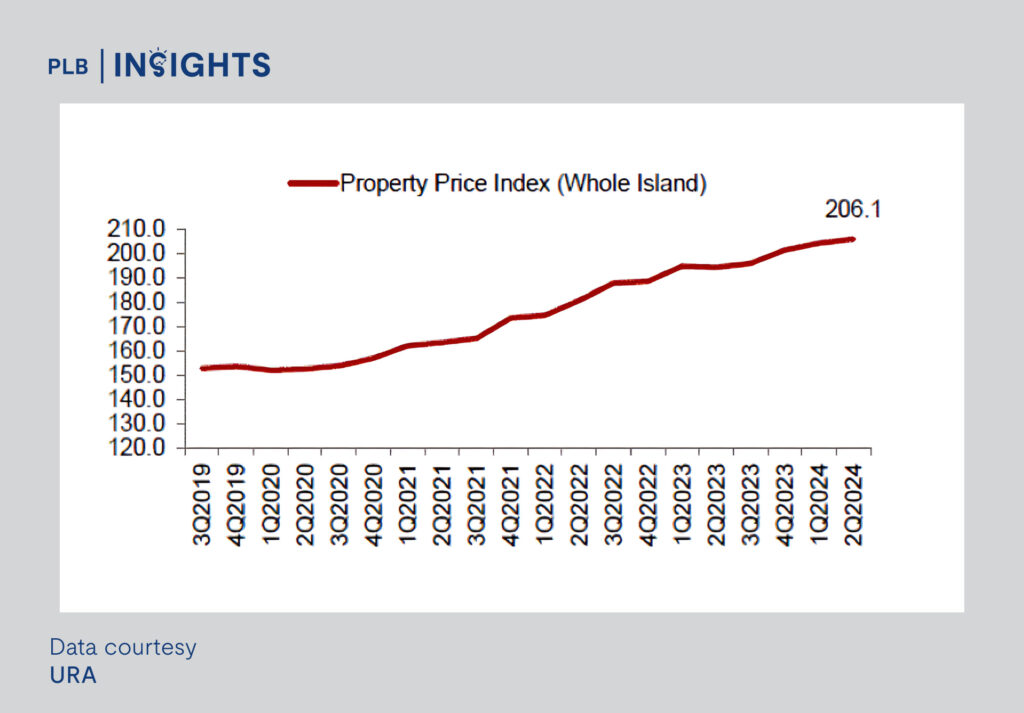

As of 2024, Singapore’s property market has been experiencing a mix of resilience and challenges that have been shaped by various economic factors and shifting consumer preferences.

Price Trends

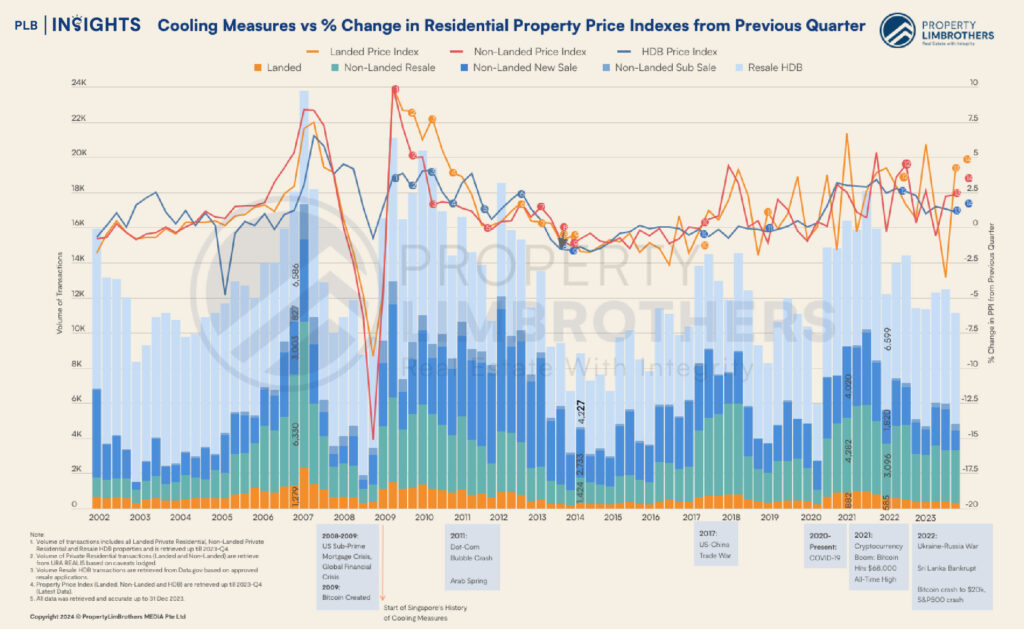

While it was a slower increase compared to the last three years, private housing prices saw an increase of 1.4% in the first quarter of 2024. By the second quarter, prices started to reflect cooling measures that were implemented last year as there was a slowdown in price increase. Moreover, the price momentum has continued to moderate in the second quarter with a 0.9% rise in prices. This can also be an indication of buyers becoming more cautious in response to rising interest rates and economic uncertainties.

Government Policies: Cooling Measures

The government has implemented various cooling measures to manage price growth and ensure housing affordability for citizens over the years. The last cooling measures were implemented in April 2023 with the aim to stabilise the property market. These included an increase in Additional Buyer’s Stamp Duty (ABSD) for residential properties, with ABSD rates for foreigners doubling to 60%.

The purpose of these cooling measures was to curb speculative buying and ensure housing affordability as prices increased. Prior to the measures, the property market experienced a significant surge in prices, which raised concerns about the affordability of housing for the average Singaporean – particularly for first-time homebuyers.

Additionally, with global interest rates rising and the need for economic stability, cooling measures were implemented to moderate excessive demand and foster a more sustainable property market while protecting the interests of buyers.

Property Price Index Vs Stock Market

In light of the recent stock market volatility, we can understand the relationship between the recession price index and the performance of Singapore’s property market for any potential developments in the future. Fluctuations in the stock market can have a significant impact on buyer sentiment and investment decisions made in real estate. As the stock market faced declines recently, fears of an economic slowdown and uncertainties for the property market may have heightened and brought up a cautious sentiment that could potentially be reflected in slower transactions in the near future.

Monitoring these indicators can provide valuable insights into market trends and consumer behaviour, and allow you to navigate the complexities of the property market. For instance, we can take a look at how downturns in history have impacted property price indices to better grasp how events play out during economic downturns for Singapore’s property market.

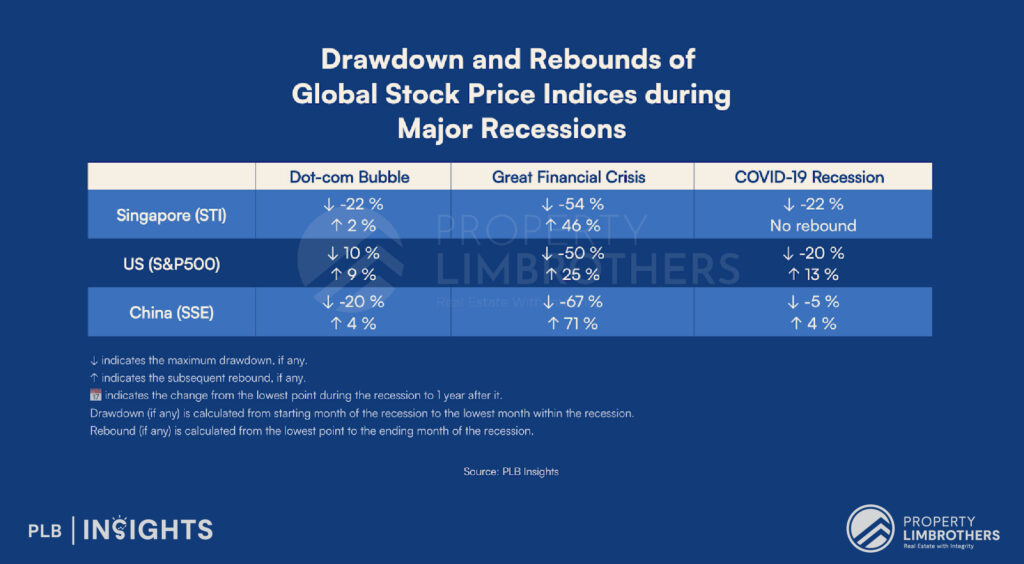

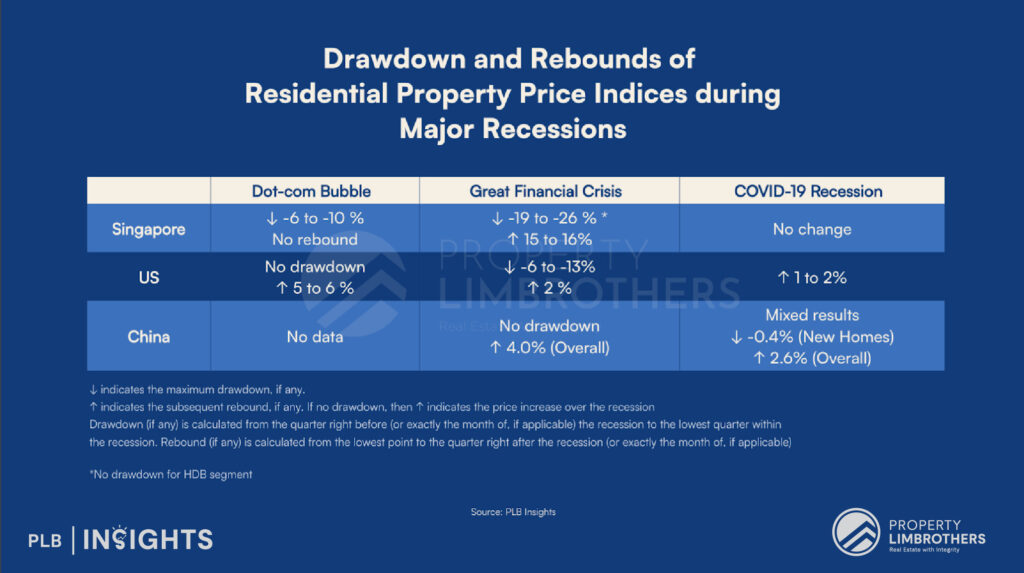

Significant economic downturns where stock markets are also down indicate potential drawdowns in residential property prices. For instance, the Dot-Com Bubble (2000-2002), the Great financial Crisis (2007-2009), and the Covid-19 pandemic (2020) have all been periods of economic downturn that have impacted Singapore’s property market. Let’s take a look at the following charts highlighting this.

Evidently, there is a correlation between stock prices declining and property prices facing drawdowns during periods of recession. During the Dot-com Bubble and Great Financial Crisis, prices first faced drawdowns and then rebounds in Singapore and the US’s stock market. These drawdowns were also reflected in property price indices in Singapore. Whereas Singapore’s property market experienced no change from February to April 2020 during the recession resulting from Covid-19.

Is There a Connection Between The Hemline Index and Singapore’s Property Market?

The correlation between the Hemline Index and Singapore’s property market is complex yet intriguing. The Hemline Index and its application are limited today due to various factors, especially the diversity and fluidity in both fashion and lifestyle choices. Despite its limitations, a concept like the Hemline Index may still offer valuable insights into Singapore’s property market by directly reflecting consumer confidence and spending, cultural and societal shifts, and responses to global events.

While the connection between the Hemline Index and Singapore’s property at present may not be direct, the interplay between fashion trends and economic indicators can offer valuable insights into consumer behaviour and market dynamics.

Get In Touch With Us

Curious about how market trends can impact your property’s pricing and exit strategy? If you’re looking for a second opinion or guidance regarding your property decisions, feel free to reach out to our team of experienced consultants here. We are more than happy to help you at every stage of your property journey.

Until the next one, see you.