In this post, we are going to address a few things: the key behaviour of new launch property upon TOP stage, and how it compares to that of resale property, in terms of its pricing trends.

What is the general behaviour of owners who have invested into new launches at showflats, and are waiting for the TOP period three to four years later?

Let’s take an example, there are 800 units in a new launch development, of which 250 units are 1 bedders, 250 units are 2 bedders, and 300 units are 3 and 4 bedders.

In 2019, you purchase a 2-bedder unit at $1 million. It works out to be about $1,400 to $1,500 psf.

You wait three to four years till 2022 to 2023 for the TOP date. This is the Temporary Occupation Permit, the day the developer writes to your lawyer, whom then informs you that it is time to collect your keys, check for defects, then commence your renovations and finally move into your new home (or rent it out).

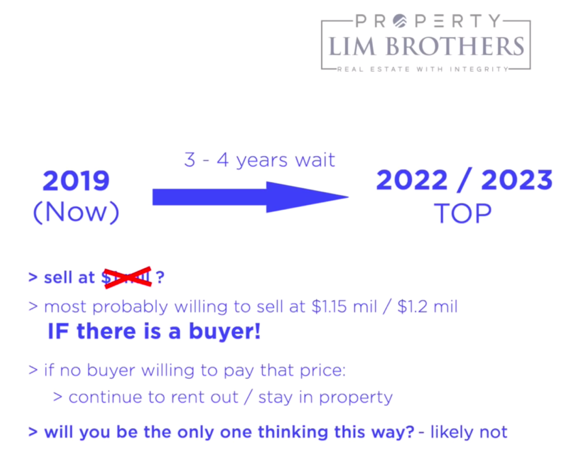

Let’s say, immediately after TOP, someone comes to you to express interest in purchasing your unit, and offers you $1 million. The question is, will you be willing to sell your property at the same price you bought it at, after waiting so long? Most likely, you wouldn’t, and definitely not at $1 million.

You would think to yourself that you have invested 25% in down payment, and a 75% loan, with small payments along the way, and have waited for three to four years. You may decide to sell the unit if there is an interested buyer who is willing to pay $1.15 to $1.2 million. If not, you will simply rent out or just stay in the unit yourself — you are in no hurry to sell it at the same price that you bought it at three to four years ago.

However, you will not be the only owner thinking this way. All your neighbours with the 2-bedder units paid approximately the same PSF, safe for slight differences due to the variations of facing, level and other factors. There will therefore be a one-off period in which everyone will think the same way as you do. This is called the one-off advantage of a new launch development, which is the only time in the whole life cycle of a new launch project that everyone will think the same way and everyone will have a target price they are willing to exit if there is a buyer willing to pay that same price.

The next moment to take note of is when one unit gets resold in the resale market. Let’s say one unit gets sold at $1.15 million. This forms the new benchmark for all the two-bedders in the entire development, and there will be an upsurge in valuation for these units. The rest of the owners will then benefit, because valuers will start to value the units based off this new benchmark. This is the explanation behind TOP projects and new developments having this one-off advantage, as everyone thinks the same way.

How do resale properties behave, and what is the key difference?

Take for example, XYZ development, built in 2010, has 600 over units. TOP is in 2014, and it is now 2019.

There are different groups of buyers: those who bought during initial launch at $800 psf in 2010, those who bought in resale market at $1000 psf in TOP 2014, after initial owners collected their keys and listed their units in the property market, and those who buy now in 2019— the current selling price would be about $1000 – $1,200 psf, depending on the development’s performance.

Therefore, if you buy today, you are entering into a mixed bag of owners who bought their units at different prices and entered at different stages. This development has already enjoyed its one-off advantage during the TOP period.

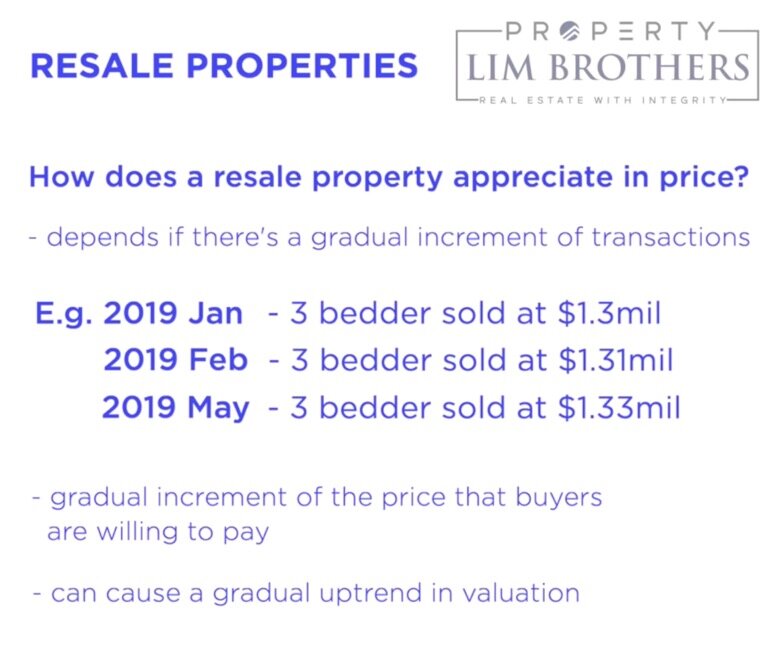

How does a resale property appreciate in its price?

This would happen if there are gradual upwards increments in transaction volume. In January 2019, a three-bedder was sold for $1.3 million. Then, in February, another was sold at $1.31 million, and in May, another for $1.33 million.

This kind of gradual increment that buyers are willing to pay in the resale market can lead to a gradual uptrend in terms of valuation, because at the end of the day, bankers will match buyers with a higher valuation according to all these past transactions. Most buyers will be influenced by this valuation of the property, and will be unlikely to be willing to pay a price that is a lot higher, unless it is perceived that the seller has previously spent a lot on renovation.

If this is the case, there is a possibility of new higher benchmark prices, and thus a gradual uptrend, if there are very frequent transactions and there are increments every transaction.

Another source of upward trend is an en-bloc fever, like the one in 2017 and 2018, which generates positive news and confidence in buyers in the market. With this upbeat momentum, banks also have a higher risk appetite, and more confidently match with higher valuations. Buyers with more confidence are also willing to pay more.

For resale property, price trends depend on transaction volume and market sentiments. Whereas for new launches, they will have a one-off advantage during the TOP period, and subsequently, prices may have gradual increments depending on the volume.

Lastly, if a project has stagnant transactions in terms of both volume and the transaction prices, owners may be a little concerned, as valuation may followingly not very upbeat either, as compared to that of a project with more frequent transactions.