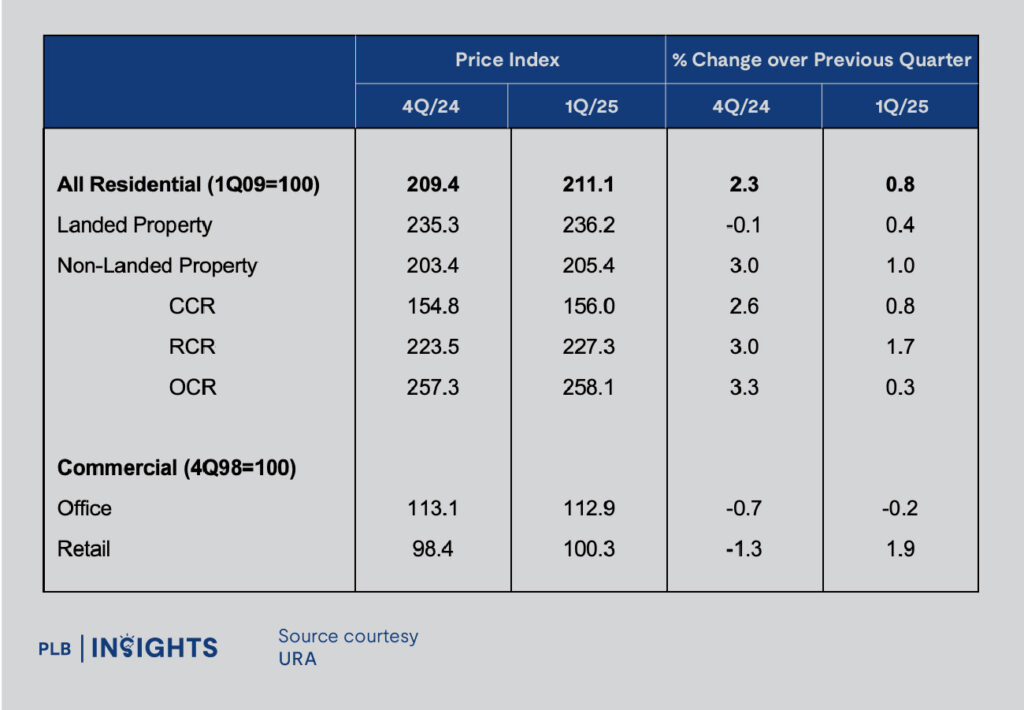

Singapore’s private residential market is off to a resilient start in 2025. Private home prices rose by 0.8% quarter-on-quarter (QoQ) in 1Q 2025, extending the 2.3% q-o-q increase in 4Q 2024, according to the latest Urban Redevelopment Authority (URA) data. The price movement was largely driven by strong performances in new launches — but beyond the topline growth, signs of segmentation and recalibration are emerging across different property sub-markets.

New Launches Are Dominating — But For How Long?

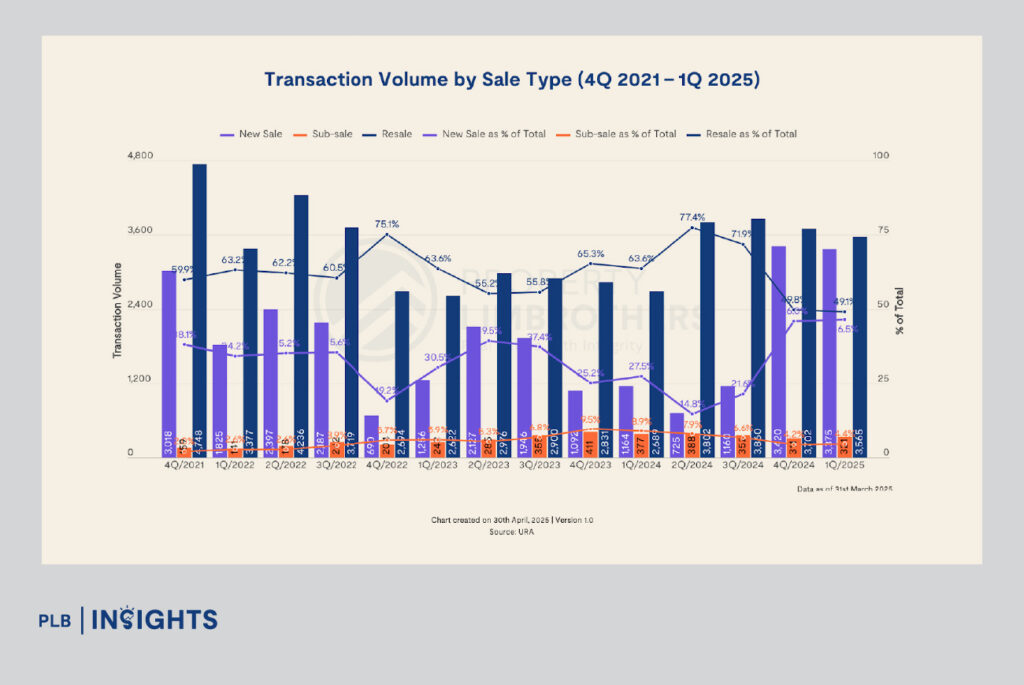

The top-performing new launches of the quarter — The Orie (91%* sold), Parktown Residences (90%* sold), Elta (65%* sold), and Lentor Central Residences (99%* sold) — saw brisk take-up, buoyed by strategic locations and a dearth of recent supply in their vicinity. In total, developers sold 3,375 new private homes (excluding ECs) in 1Q 2025, down slightly from 3,420 units in 4Q 2024, but significantly up from 1,164 units in 1Q 2024 (+190% YoY).

* As at 1 May 2025

This rebound in the primary market translated into a stark market share shift:

- New sale share of total private residential transactions rose from 27.5% in 1Q 2024 to 46.5% in 1Q 2025.

- Resale share dropped from 63.6% in 1Q 2024 to 49.1% in 1Q 2025.

- Sub-sales accounted for the remaining 4.4% of sales, up slightly from 2.8% a year prior.

The numbers suggest a decisive pivot among buyers toward new launches — likely due to the narrowing price disparity between resale and new sale in the current season, as well as new launches’ design appeal, perceived value, and relative certainty in pricing and quality.

Sales Volumes Show a Market That Is Selective, Not Soft

Despite price gains, total private residential transaction volume contracted slightly to 7,261 units in 1Q 2025, down from 7,433 units in 4Q 2024 and from 4,562 units in 1Q 2024.

While some may interpret this as a softening, it more accurately reflects increased buyer discernment. With a slew of up to 15 new private residential launches expected from April to December — potentially adding ~7,800 units — both buyers and developers are tactically positioning themselves.

Executive Condos: The Quiet Outperformer

Executive Condominiums (ECs) are seeing a mini-resurgence. In 1Q 2025, sales surged off the back of Aurelle of Tampines, which was nearly sold out during its launch phase and fully booked after opening to second-timers in April.

EC buyers — especially first-timers — are drawn to their favorable price point relative to private condominiums. As of 1st May 2025, approximately 33 unsold EC units remain islandwide, underscoring a looming supply crunch ahead of the anticipated EC launches at Otto Place (Plantation Close) and Jalan Loyang Besar.

Supply Pipeline Shrinking

Only 1,988 private residential units were completed in 1Q 2025, with another 3,199 units expected between April and December. This brings the projected full-year completion total to 5,187 units, a 38.4% decline from 2024’s 8,433 units.

Tighter supply is likely to put upward pressure on prices, especially in high-demand regions or mature estates where resale inventory is thinning.

Forward Outlook: Stability Anchored by Fundamentals

Despite global headwinds — notably renewed trade tensions and geopolitical uncertainty — the Singapore market remains anchored by genuine domestic demand. There is little evidence of speculative froth; buyers are largely owner-occupiers or long-term investors with holding power.

PLB’s Take: The Market Is Evolving, Not Overheating

Rather than overheating, we believe Singapore’s residential property market is entering a disciplined, demand-led phase. Buyer preferences are shifting toward new projects that offer modernity, efficiency, and certainty. Meanwhile, the resale market must recalibrate — both in pricing and positioning — to stay relevant amid competition from launches.

We expect further segmentation ahead:

- Prime and fringe RCR projects will continue to draw demand.

- The OCR may see price resistance unless launches are attractively priced.

- ECs remain undervalued relative to the broader market and may appreciate further.

- The landed market will polarise between true high-net-worth buyers and aspirational upgraders.

Final Thought

Singapore economic fundamentals remain sound, but navigating this next phase will require precision — in timing, product choice, and financing strategy.

Stay Updated and Let’s Get In Touch

For home buyers and investors alike, PLB’s in-depth research and data-led insights remain your competitive advantage in 2025. Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.