The property market in Singapore has always been a barometer of economic confidence and consumer sentiment. In 2024, it mirrored the tale of two halves: a subdued beginning marked by hesitation and low activity, followed by a remarkable resurgence driven by new launches and heightened buyer interest. November 2024, in particular, emerged as a standout month, with private residential property and Executive Condominium (EC) sales hitting decade-high levels. Yet, beneath the surface of these stellar numbers lies a complex interplay of challenges and evolving market dynamics.

November was a pivotal month, where the highest private residential sales were recorded since March 2013, with 2,557 private units and 344 EC units sold. This strong performance brings into focus both the resilience of Singapore’s property market and dependency on new launches and external factors such as interest rate adjustments.

While these headline figures paint an optimistic picture, a closer examination reveals critical underlying trends and challenges, ranging from selective buyer demand to rising policy risks. The interplay of these factors underscores the complexity of navigating the property market in the near term.

New Launches: A Key Driver of Activity

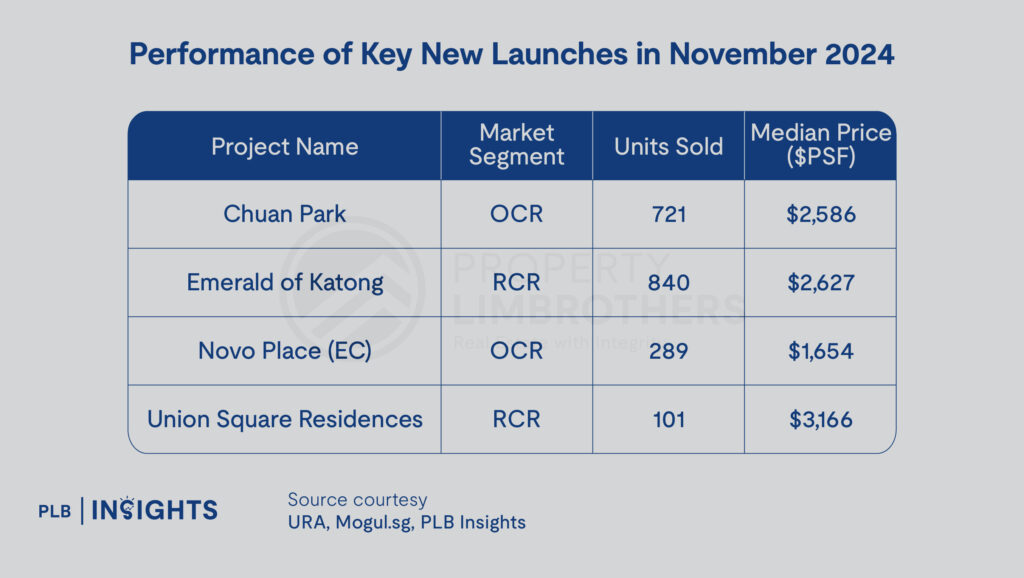

The stellar performance in November, with total developer sales of 2,891 units, was predominantly driven by six major project launches that collectively contributed 82.8% of the month’s sales. Key developments such as Emerald of Katong (840 units sold) and Chuan Park (721 units sold) demonstrated the importance of location, integrated amenities, and pricing in capturing buyer interest. These projects also set new pricing benchmarks in their respective districts.

The higher prices associated with these launches could also potentially accelerate property price growth, raising affordability concerns.

Performance of Key New Launches in November 2024

The projects launched in November continue to draw diverse buyer profiles, from HDB upgraders to first-time private homebuyers. These new sales also saw robust demand with approximately 72% of the units launched sold.

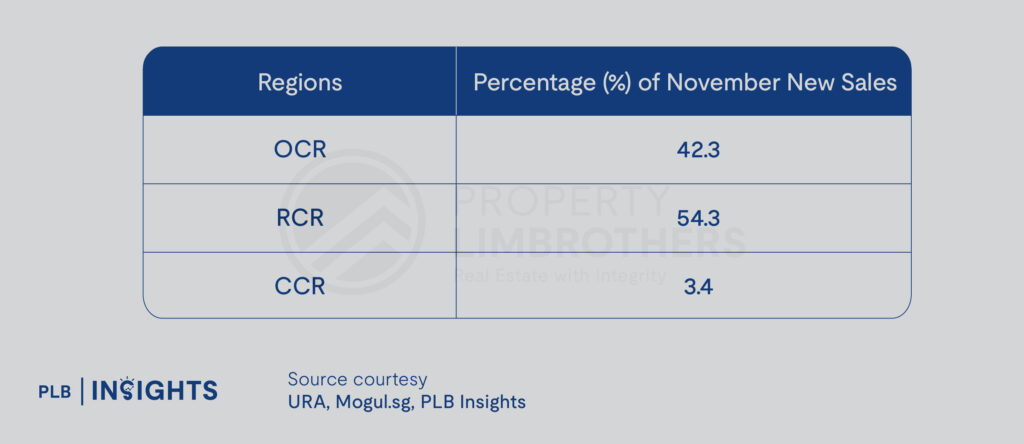

Percentage of November New Sales by Region

However, this success was not uniform across all segments. A closer look at the distribution of sales by region reveals nuanced buyer preferences that highlight the evolving dynamics of Singapore’s property market. This regional breakdown offers insights into the distinct performance of the OCR, RCR, and CCR, each shaped by varying affordability, location appeal, and buyer sentiment.

The suburban Outside Central Region (OCR) accounted for 42.3% of sales, with projects like Chuan Park achieving a 72% take-up rate. The Rest of Central Region (RCR) contributed 54.3% of the total transactions, thanks to highly sought-after projects such as Emerald of Katong. In contrast, the prime Core Central Region (CCR) captured only 3.4% of November’s sales, reflecting its limited contribution to the overall market despite the higher price points associated with the region.

While the numbers are impressive, they also highlight a critical dependence on fresh supply to drive demand. In months without significant launches, such as February and June, sales dipped below 300 units from both the primary and secondary market despite an ample inventory of unsold units. This selective demand underscores a market where buyers are increasingly discerning, favouring well-located, newly launched projects over older inventory in the resale market.

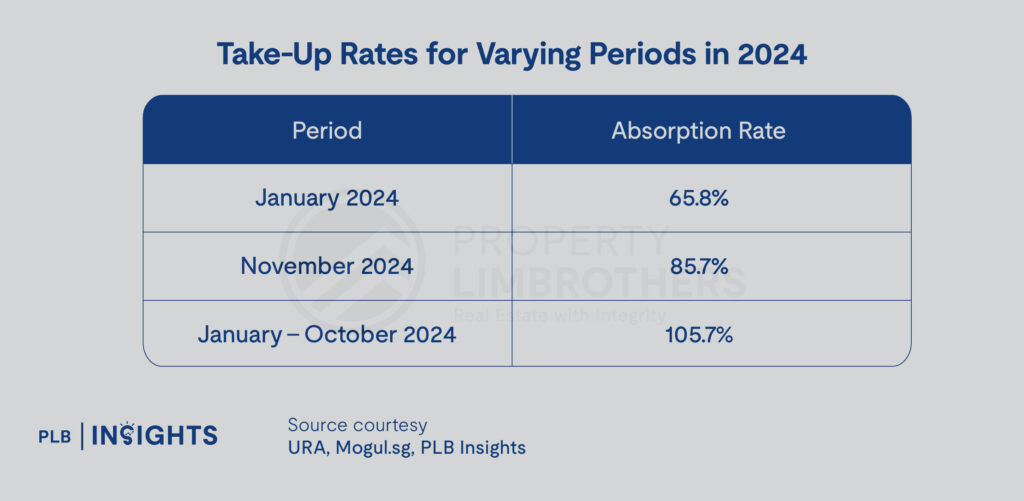

Take-Up Rates in 2024

While November’s headline figures are impressive, the overall take-up rate paints a less rosy picture. At 85.7%, the take-up rate—measuring the ratio of units sold to units launched—was the second lowest in 2024, surpassed only by January’s 65.8%, according to Mogul.sg In contrast, the average take-up rate for the first ten months of 2024 stood at 105.7%, underscoring the relatively subdued demand relative to supply during November’s spike. This suggests that while new launches drew significant attention, overall buyer appetite remains tempered in 2024.

Executive Condominiums and the HDB Market

EC Segment

The regional sales distribution highlights buyer preferences for specific segments, but these trends cannot be fully understood without considering the interplay with the EC and HDB markets.

The EC segment continued to play a stabilising role in 2024, bridging the gap between public and private housing. The success of Novo Place (289 units sold) underscores the sustained demand for ECs among HDB upgraders seeking private facilities at accessible price points. However, rising land costs for EC sites, as seen in the record $768 PSF PPR bid for a Tampines site, could push future EC prices higher, potentially narrowing their affordability advantage.

HDB Segment

The 1,003 million-dollar HDB resale transactions in 2024, including the most expensive transaction—a five-room flat at SkyOasis @ Dawson in Queenstown, which sold for $1.73 million in July—have become a focal point in Singapore’s property market this year, reflecting both the growing aspirations of buyers and underlying affordability concerns. These high-value transactions, typically involving rare or premium units such as those in centrally located estates or larger executive flats in mature towns, highlight strong demand for well-located and spacious homes.

The trend has raised questions about equity and accessibility, as it suggests a bifurcation in the public housing market. While the majority of resale transactions remain below the million-dollar mark, the rise of these record-breaking deals might signal the need for policies that ensure public housing remains affordable and fulfils its social purpose, even as it caters to evolving buyer preferences.

In addition, the HDB rental market added another dimension to 2024’s narrative. According to HDB data, executive flats experienced a 7% year-on-year increase in rents, outpacing the private rental market, which grew by only 0.1%. Factors such as affordability, larger layouts, and the preference of expatriate tenants for cost-efficient alternatives contributed to this trend. This divergence also highlights how HDB rentals serve as a pressure valve for housing demand, particularly when private rental rates remain elevated.

The Role of Interest Rates and Market Sentiment

The easing of interest rates in September, with a 50-basis point cut by the U.S. Federal Reserve, followed by two rounds of 25-basis point cuts in November and December, provided a much-needed boost to buyer sentiment. This was particularly evident in the sharp increase in sales momentum in the third quarter, where new home sales surged by 60% quarter-on-quarter. Lower borrowing costs potentially offer buyers improved affordability, particularly in the private residential segment, which had been weighed down by high financing costs in the last two years.

However, while the rate cuts have improved sentiment, they have not resolved underlying affordability concerns. Mortgage rates, though influenced by benchmark interest rates, remain elevated due to broader economic conditions. This has kept some buyers cautious, especially in the CCR, where new sales accounted for only 3.4% of November’s transactions.

Challenges and Emerging Risks

The easing of interest rates has undoubtedly provided a tailwind for buyer sentiment, but this optimism must be tempered by the possibility of policy intervention. Historical precedents remind us that rapid price growth and sales momentum often trigger government action to cool the market, adding another layer of complexity to the current environment.

While the robust performance in November paints a picture of resilience and market recovery, it also raises critical questions about the sustainability of such momentum. Beneath the surface of these stellar figures lie structural challenges and evolving risks that could shape the trajectory of the property market in the near term. An analysis of these challenges reveals complexities that must be addressed to maintain market stability and affordability.

Potential Risks:

Selective Demand and Reliance on New Launches: The market’s heavy reliance on new launches to drive activity in 2024 underscores a selective demand pattern. Months without major launches, such as February and June, saw sales dip below 300 units, despite an inventory of 3,500 to 4,000 unsold units. This phenomenon indicates that buyers are increasingly prioritising location, amenities, and pricing, favouring newly launched projects over older inventory. While this reflects discerning buyer behaviour, it also raises concerns about the sustainability of sales momentum in the absence of fresh supply.

Affordability Concerns: Rising land costs, particularly for EC and prime residential sites, are driving up new launch prices. For instance, record land bids signal a potential narrowing of the affordability gap between ECs and private homes. Additionally, new launches in prime locations like Bukit Timah Turf City and the Greater Southern Waterfront next year are expected to command premium prices. The rising costs could deter demand, especially in a high-interest-rate environment, and exacerbate affordability challenges.

Dependence on External Factors: The recent surge in sales was buoyed by interest rate cuts, with a 50-basis point reduction in September followed by two subsequent 25-basis point cuts. While these adjustments improved buyer sentiment, they remain contingent on global economic conditions. Any reversal in monetary policy could dampen affordability and derail momentum, leaving the market vulnerable to external shocks.

Policy Risks: Historical precedents, such as the introduction of the Total Debt Servicing Ratio (TDSR) in 2013, highlight the government’s propensity to act decisively when the market shows signs of overheating. November’s decade-high sales figures, coupled with anticipated price acceleration from 2025’s high-profile launches, could increase the likelihood of additional cooling measures. Such interventions, while necessary to maintain stability, could also temper growth and introduce uncertainty for developers and buyers alike.

HDB Market Pressures: The rise of million-dollar HDB resale flats and growing HDB rental demand point to pressures within the public housing segment. While these trends reflect evolving buyer aspirations and rental preferences, they also highlight widening disparities in affordability and accessibility. The government faces a delicate balancing act in ensuring that public housing continues to meet its social objectives without undermining market confidence.

These challenges underscore the complexities of navigating Singapore’s property market. Addressing these issues will require coordinated efforts from policymakers, developers, and other stakeholders to ensure that growth is both sustainable and inclusive. The coming months will be critical in determining whether the market can adapt to these pressures while maintaining its role as a cornerstone of economic confidence.

2025 Market Outlook

The challenges outlined provide a reminder that strong sales alone do not guarantee a healthy market. As we look to 2025, it becomes evident that the interplay between market forces and policy responses will play a pivotal role in determining the path forward. With key launches and potential policy adjustments on the horizon, the outlook offers both opportunities and uncertainties for stakeholders.

Looking forward to 2025, several factors are expected to shape the property market:

Upcoming Launches: Developers are poised to release well-located projects in areas like Bukit Timah Turf City and the Greater Southern Waterfront. These launches could command premium prices, setting new benchmarks but also testing buyers’ affordability thresholds. If these developments fuel a surge in sales and prices, policymakers may be compelled to introduce stricter measures.

HDB’s Stabilising Role: The resilience of the HDB resale and rental markets will continue to provide a foundation for overall housing demand. However, affordability concerns, particularly for resale flats exceeding $1 million, may prompt targeted policy interventions.

Cooling Measures: The stellar performance of November has inevitably reignited speculation about potential government intervention. The last time monthly sales reached similar heights in 2013, the TDSR was introduced, triggering a prolonged contraction in property prices and sales, before the market bottomed out in 2017.

Interest Rates: Further rate cuts could enhance affordability but may also reignite speculative activity, complicating market dynamics.

Melvin Lim, Co-Founder and CEO of PropertyLimBrothers, offers a forward-looking statement for 2025:

Conclusion

The Singapore property market in 2024 has demonstrated its resilience amid evolving economic conditions. However, the strong performance in the second half of the year masks pockets of challenges, including selective demand, rising costs, and the risk of regulatory intervention. As the market transitions into 2025, buyers, sellers, and developers alike must navigate a complex landscape shaped by affordability concerns, policy risks, and shifting sentiment.

Upcoming launches in prime locations, while offering significant opportunities, may accelerate price growth and raise affordability concerns. Policymakers are expected to tread cautiously, ensuring that measures are calibrated to maintain market stability without stifling genuine demand.

As the market moves into 2025, balancing these dynamics will be crucial. With interest rates expected to ease further, buyer confidence may strengthen, but the potential for policy intervention remains a key risk factor.

For further analysis, stay tuned to PLB 4Q & FY2024 Market Report!

Stay Updated and Let’s Get In Touch

For stakeholders, understanding these dynamics and staying informed will be critical to making strategic decisions in the year ahead.

Stay connected with PropertyLimBrothers for the latest updates, data-driven trends, and expert advice tailored to your property journey. Whether you’re buying, selling, or investing, we’re here to provide you with insights that matter.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.