Q1 2021 latest property news courtesy URA and Edmund Tie.

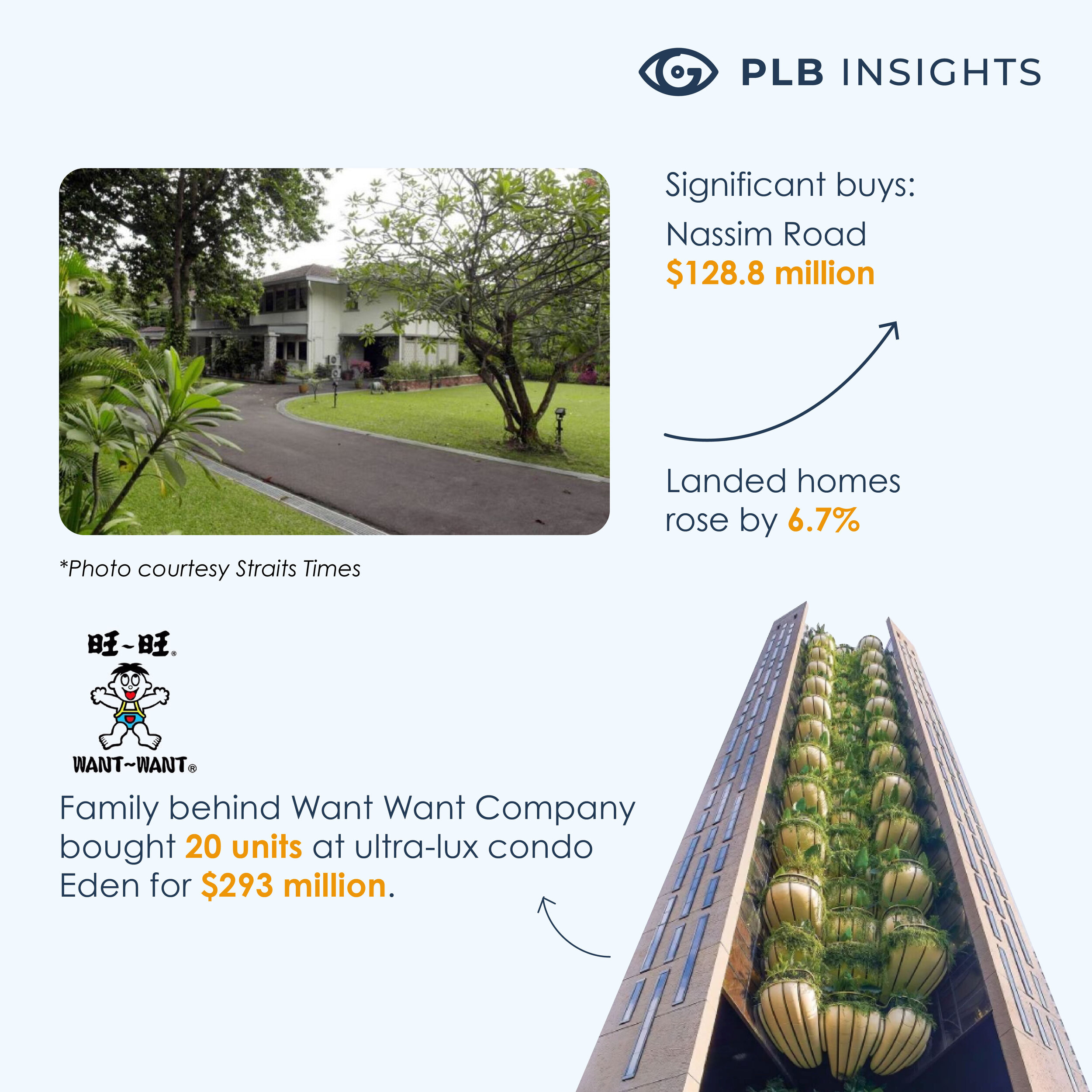

The latest Q1 2021 reports from Urban Redevelopment Authority (URA) climbed for the fourth consecutive quarter, a 3.3% increase quarter-on quarter (QoQ). Landed homes category rose for this quarter by 6.7%, trumping the 1.6% drop in the previous quarter. Median prices rose across the landed homes, contributed by the record-selling $128.mil Nassim Road GCB.

Non-landed private home prices in the Rest of central Region (RCR) rose 6.1% QoQ for the first quarter of this year compared to the previous 4.4%, attributed to new launches such as successful take-up rates with Normanton Park and The Reef At King’s Dock.

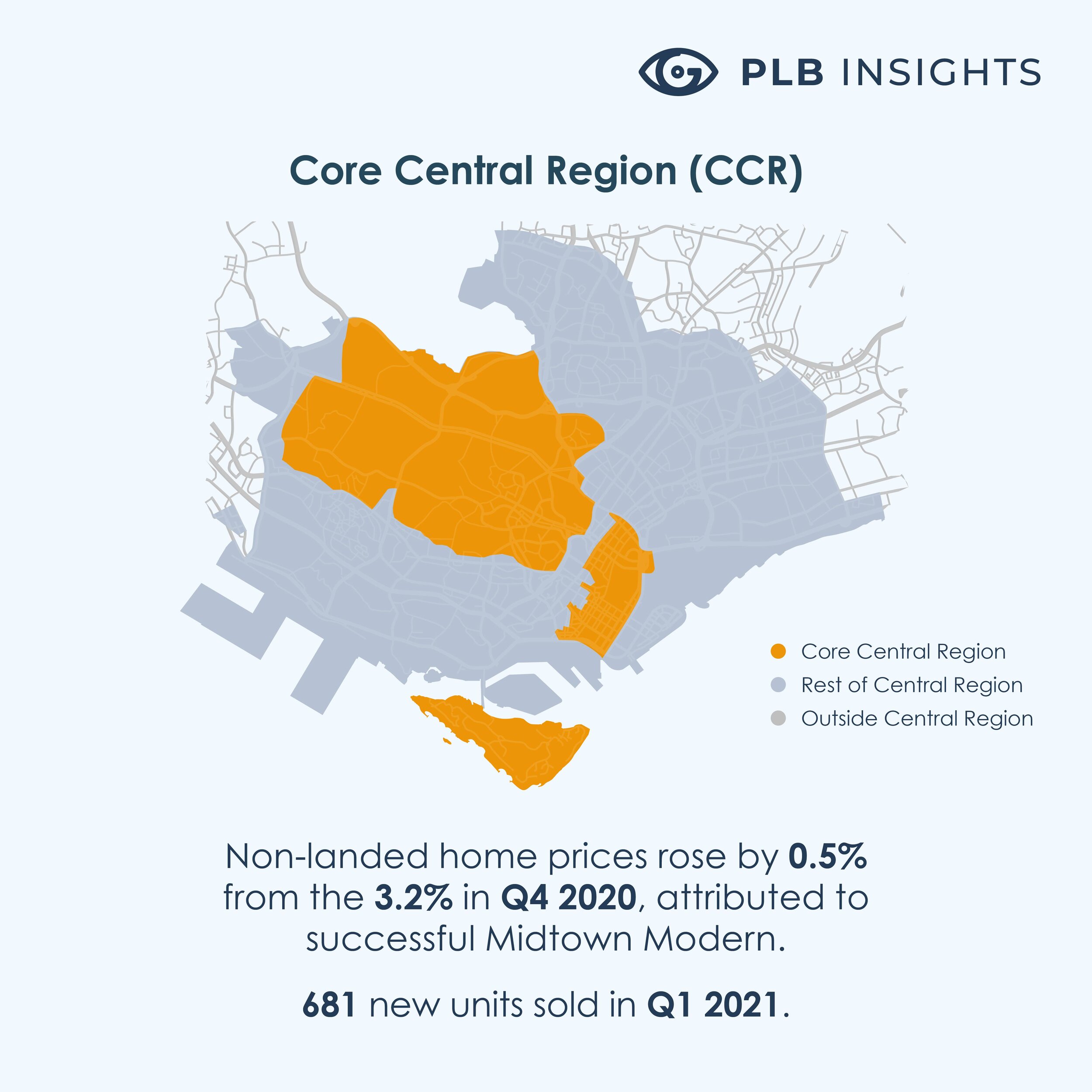

Midtown Modern by GuocoLand, showing buyers’ interest in the CCR this year.

In the Core Central Region (CCR), non-landed home prices climbed slightly by 0.5% QoQ, aided by Want Want company’s family purchasing 20 ultra-lux units at the Eden for $293 mil and Midtown Modern’s sales. A total of 681 new units were sold, indicating regained interest in the CCR compared to the 780 units in Q4 2013.

Outside Central Region (OCR), have been climbing albeit slowly, rising 1.1% QoQ this year due to the lack of new launches as of time of writing.

In total, 3,493 new private homes (excluding ECs) were sold, a start increase of 62.5% from 2,149 units last year. The resale private home market also saw strong demand, as transactions doubled to 4,519 units this quarter.

A total of 2,808 units were profitable for both landed and non-landed in Q1 2021, contrast to the loss transactions of 480 properties or 14.6%.

Notably, Watten Residences was a freehold strata landed home transacted at $3.58 mil, $1,151 PSF. It was initially purchased for $755K in 1996.

Highest profit for GCB — Nassim Road’s $128.8 mil-dollar house

Nassim GCB at $128.8 mil courtesy Business Times.

Transactions for landed properties topped the profit-making deals in Q1 2021, with the famed Good-Class Bungalow (GCB) at Nassim Road leading the fray with over 32,000 sq ft sold at $128.8 mil, at $4,005 PSF. The house was purchased by. Jin Xiao Qun, wife of Nanofilm Technologies International founder Shi Xu.

That’s more than four times that it was bought for ($30.3 mil) in 2006. It beat James Dyson’s $50 million GCB for a 15,101 sq ft on Cluny Road.

Down the road is the top-price for a Singapore residence — a $230 million GCB, massive 84,544 sq ft sold by Cheng Wai Keung, chairman of Singapore-listed Wing Tai Holdings two years ago. It was purchased by a Singapore-owned trust, SG Casa, which sources say, might be linked to Facebook co-founder Eduardo Saverin.

Of the five most profitable transactions by percentage, four were freehold, three were located in Core Central Region (CCR). The height of the profitability was attributed to holding on to the properties for at least 14 years to reap capital gains to nearly 650%.

Top five loss-making deals

One of the units at The Azure on Sentosa was the top loss-making transaction by percentage. A 99-year leasehold, it was sold for $3.6 mil, compared to the $7.2 mil purchase in 2007.

The top five loss-making deals ranged from 36% to 50%, with three of the transactions surpassing $3 mil.

Another mention will be at St. Regis Residences, making a loss by per cent, with a 40% loss when sold at $4.8 mil, $1,850 PSF, compared to a purchase price of $8 mil, at $3,084 PSF. At 2,594 sq ft, it was held for 14 years in 2007, and sold in Jan 2021.

Biggest loss transaction by quantum

The biggest loss made was a villa at Kasara on Sentosa, a 9,042 sq ft sold at $14,68 mil, $1,624 PSF in March, with a loss of over $5 mil. It was purchased for $20 mil in 2012 — 3.7% loss while holding onto the property for over eight years.

Wrapping Up

As COVID-19 restrictions are slowly easing up to normalcy, the investments in the residential sector should continue its ascent for 2021, and is projected for private home prices to rise by a further 6-7%, as mentioned by Ismail Gafoor, CEO of of PropNex. This could be further attested to the low bank rate environment and sanguine outlook towards normalcy, as reported by Knight Frank.

If you’re seeking more of our insights, do approach PropertyLimBrothers here,

For more information, you may check out the analysis done by Edmund Tie.