The property landscape in Singapore remains dynamic as 2024 progresses, with key economic and real estate indicators shaping affordability metrics. As incomes recover and property prices show signs of stabilisation, the affordability of private housing remains a focal point for both policymakers and homebuyers.

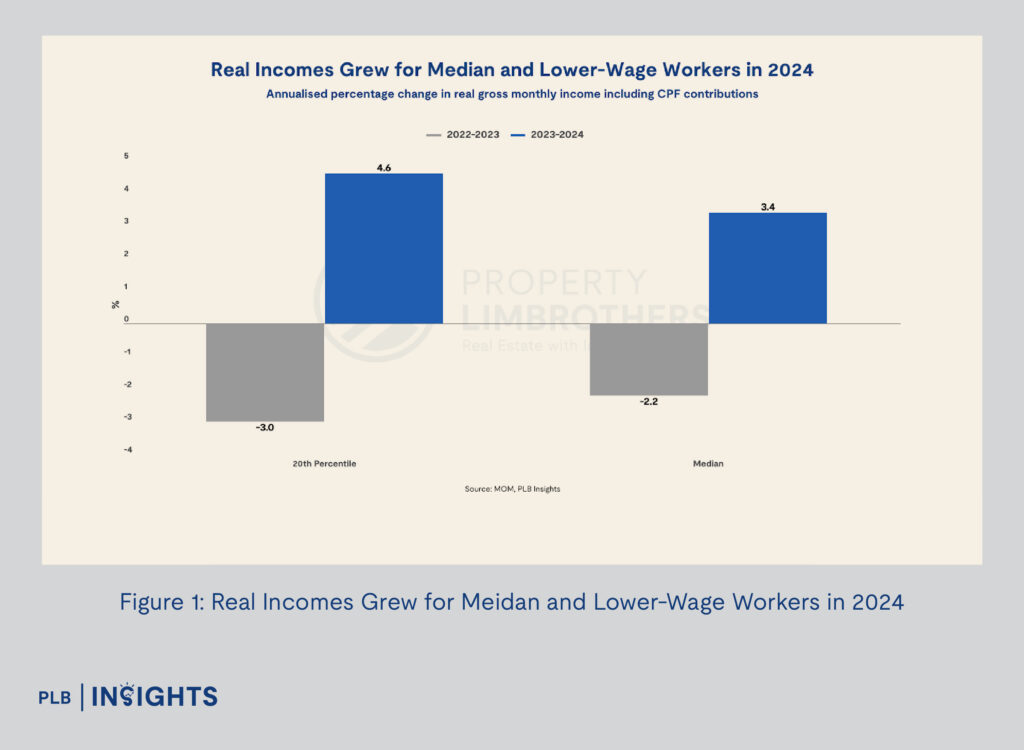

Inflation-adjusted Real Income Rebounded in 2024 from a Decline in 2023

The Ministry of Manpower (MOM) reported a rebound in real income this year, driven by easing inflation. The nominal median gross monthly income for full-time workers rose by 5.8% to $5,500. After taking into account inflation, the real income growth was 3.4%. This recovery followed a contraction of 2.2% in real income in 2023.

For lower-income workers, the gains were even more pronounced. At the 20th percentile, nominal incomes rose by 7.1% to $3,026, representing a real income growth of 4.6%.

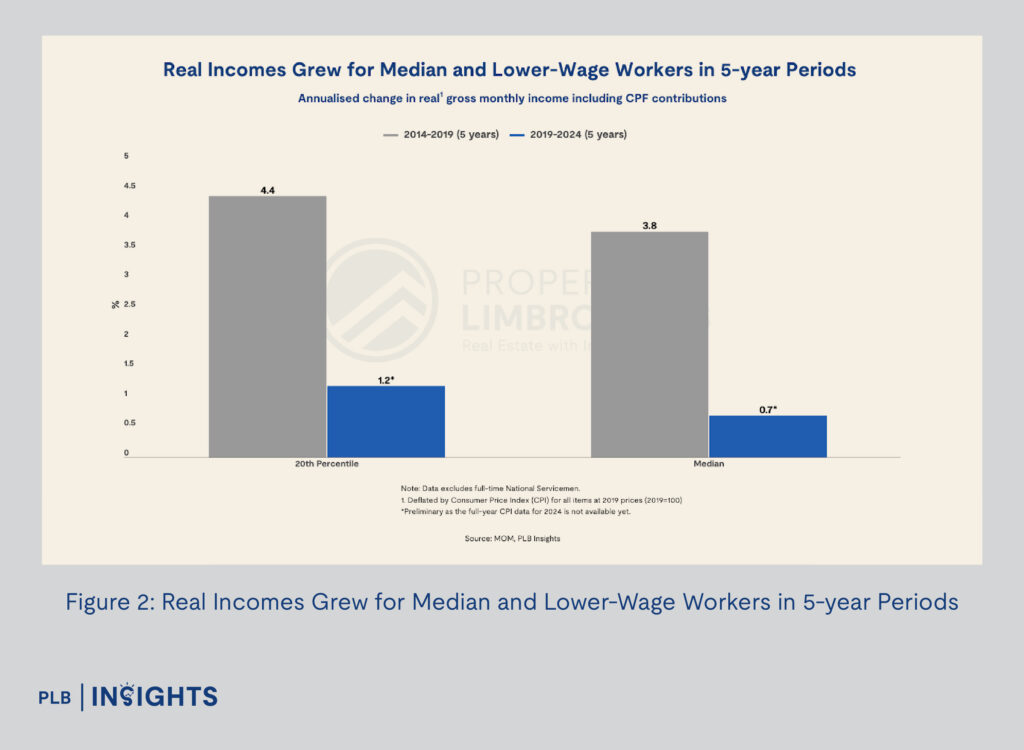

While these improvements are encouraging, the longer-term picture reveals a more subdued trend. Median real income growth for the 2019–2024 period averaged just 0.7% per annum, significantly below the 3.8% annual growth seen from 2014–2019.

Private Residential Property Market Trends

The private residential market experienced its first quarterly decline in overall housing prices since Q2 2023, with a modest 0.7% contraction in Q3 2024. Year-to-date, prices have risen by 1.6%, a marked slowdown from the 3.9% growth recorded over the same period in 2023. For more details, you may refer to PLB’s Q3 Quarterly Report here!

Segment Breakdown:

Price-to-Income Ratio Analysis

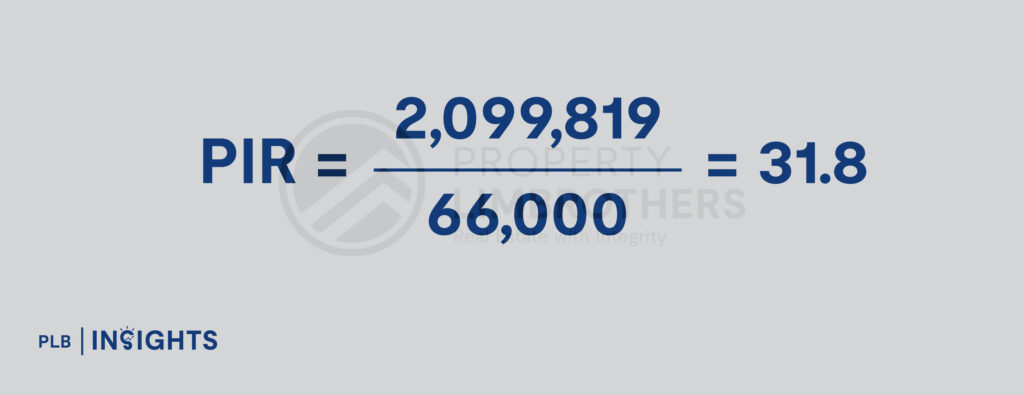

Affordability is often assessed using the Price-to-Income Ratio (PIR), calculated as the median property price divided by the annual median income.

- Based on URA Realis data and PLB Insights’ analysis, the median property price as of December 2024 for a 3-bedroom condo stood at $2,099,819.

- And with a nominal median gross monthly income for full-time workers being $5,500, the median annual income would amount to $5,500 x 12 = $66,000.

Key Calculations:

- PIR based on nominal income:

- Adjusted PIR for 2019 Income

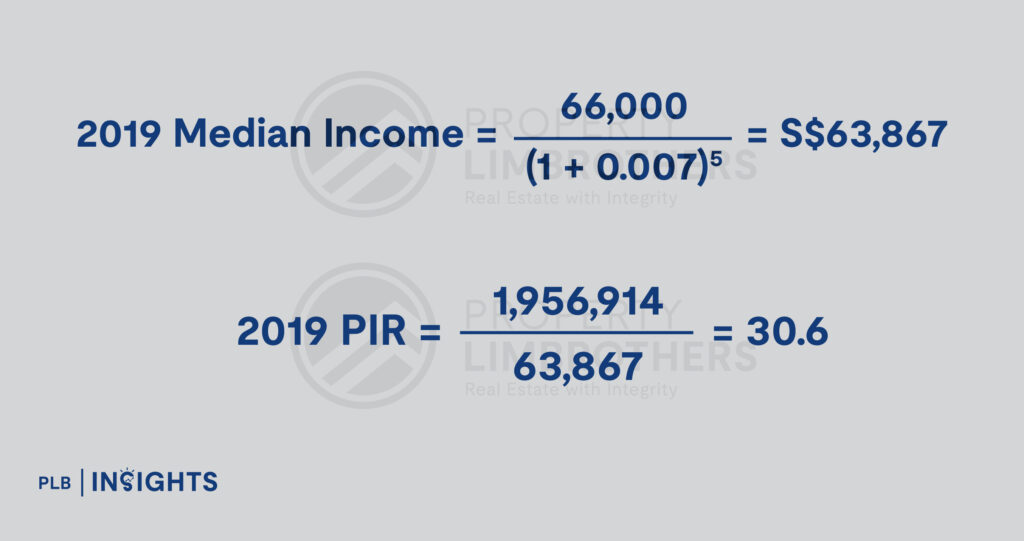

Over the 2019–2024 period, with inflation-adjusted real median income, the growth was 0.7% per annum. Adjusting for this growth rate to reflect 2019 income levels:

2019 Median Income (Inflation Adjusted):

Using Compounded Growth:

Adjusted PIR for 2019 Income:

Based on URA Realis data, the median property price for a 3-bedroom condo in 2019 was $1,956,914.

2019 PIR = 1,956,914/63,867 = 30.6

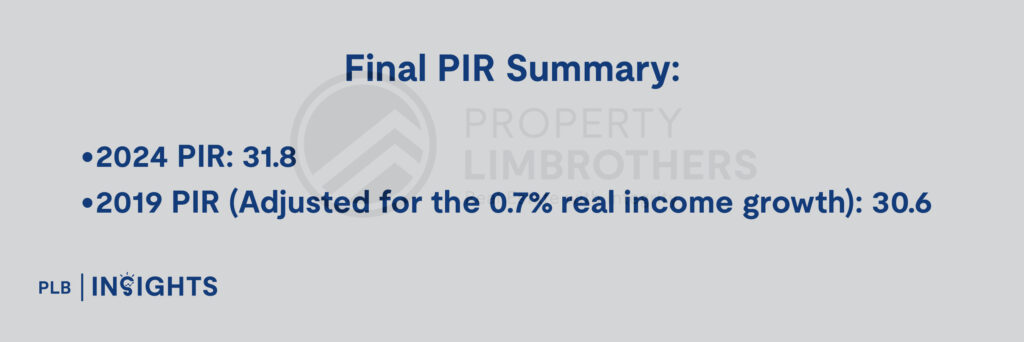

Final PIR Summary:

Rising PIR Highlights Worsening Affordability

The PIR has increased from 30.6 in 2019 to 31.8 in 2024, reflecting a deterioration in housing affordability over the past five years. While real incomes have rebounded in 2024, their growth has been outpaced by rising property prices, highlighting the persistent challenge of affordability in Singapore’s private housing market.

This can be concerning given that real income growth from 2019 to 2024 averaged just 0.7% per annum, compared to the 37.5% growth (according to URA’s data) in private residential property prices over the same period. Although easing price momentum in 2024 offers a glimmer of hope, the overall trajectory underscores the need for targeted policies to address affordability.

Broader Implications of Affordability Trends

The implications of rising PIR are far-reaching. For prospective homeowners, the increasing gap between income growth and property prices heightens the financial burden of property ownership. While the supply pipeline of 52,200 private housing units set for completion over the coming years could help moderate price pressures, high mortgage rates continue to challenge affordability.

The subdued price growth in the CCR and stable prices in the OCR suggest varying demand dynamics across market segments. Affordability improvements are more likely to benefit buyers in the RCR and OCR markets, where price points remain comparatively attractive.

Conclusion: A Mixed Outlook for Affordability

The rebound in real income in 2024 is a step in the right direction but remains insufficient to offset the affordability challenges posed by rising property prices and elevated mortgage rates. As the PIR rises, potential buyers face increased financial constraints, emphasising the need for careful financial planning and policy interventions to mitigate affordability concerns.

Looking ahead, the market’s ability to balance housing supply with sustainable price growth will be crucial in addressing the housing needs of Singaporeans.

Let’s Get In Touch

Our goal is to provide you with information as you navigate through the current property market. Do not hesitate to reach out to us and our team of experienced consultants will be ready to assist you with a personalised consultation.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.