The decision to upgrade from a HDB makes sense. Now what? Moving houses and purchasing new properties always bring out dilemmas and countless questions.

What is the purchasing process of private property? Is this a safe investment to be made? What other considerations should I take into account?

This article will cover the fundamentals to consider when deciding whether to move.

Understanding Singapore’s Real Estate Context

In a previous article, we noticed that as a family’s monthly income increases, the more likely that they move to private properties. Income ceilings may be a form of motivation for higher-income households to move away from HDB properties.

Another motivation that may encourage residents to move up Singapore’s residential market is the investment opportunities that private properties provide. There is a key fundamental difference between HDB and private properties.

In the Singapore context, HDBs are built for the owner’s stay. Boosted with grants and subsidies, the government promotes essential home ownership in BTO and resale flats.

For HDB apartments, no matter how much paper gain your property makes, that equity is trapped. Let’s say you buy a BTO for $450k, and now it is worth $750k after five years of MOP. The paper gain for $300k cannot be withdrawn unless the property is sold. This is unlike private property, where owners can take up an equity term loan to finance their property, providing their equity when the property appreciates.

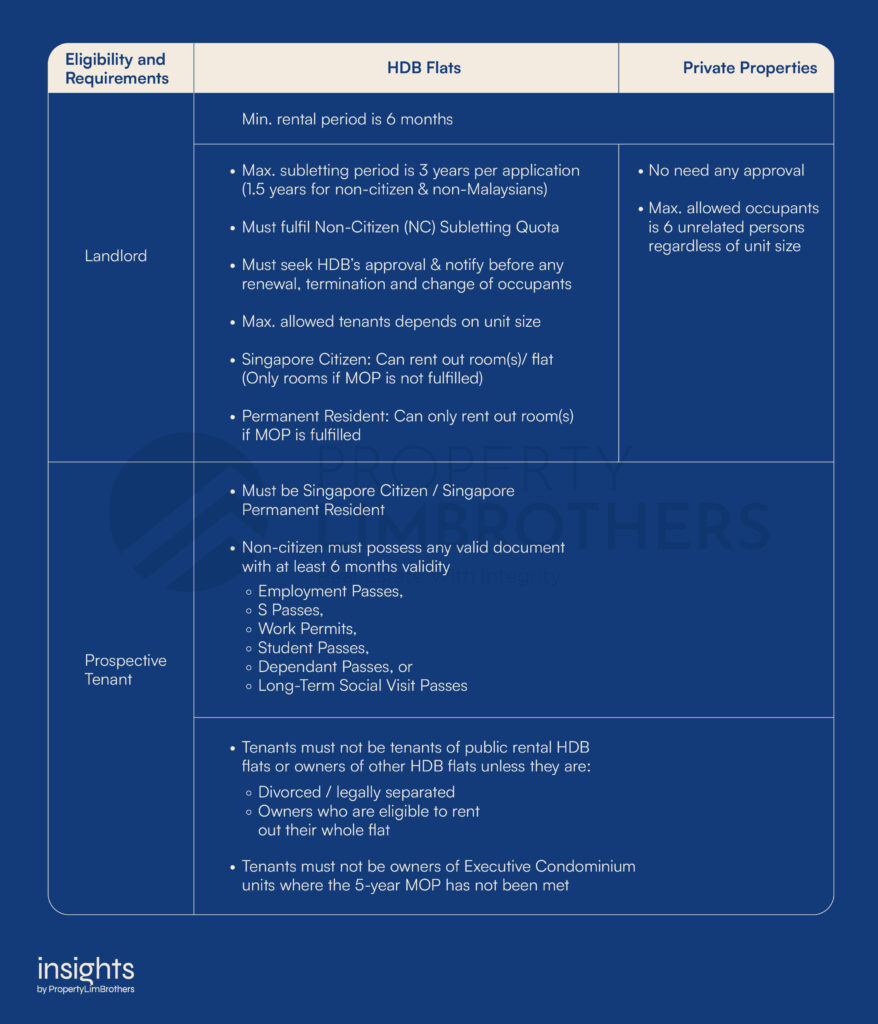

Additionally, renting out a bedroom or an entire unit is a common passive income for property owners. HDB flats under the Home Ownership Schemes are meant for owners to stay in, renting out a flat or room is possible with abidance of the below requirements.

As shown above, there are lesser restrictions to renting out as a private property owner than a HDB flat owner. If you are interested in potentially renting out a room or two, this may be something you may want to consider.

Recognising Transaction Costs & Ownership Expenses Involved

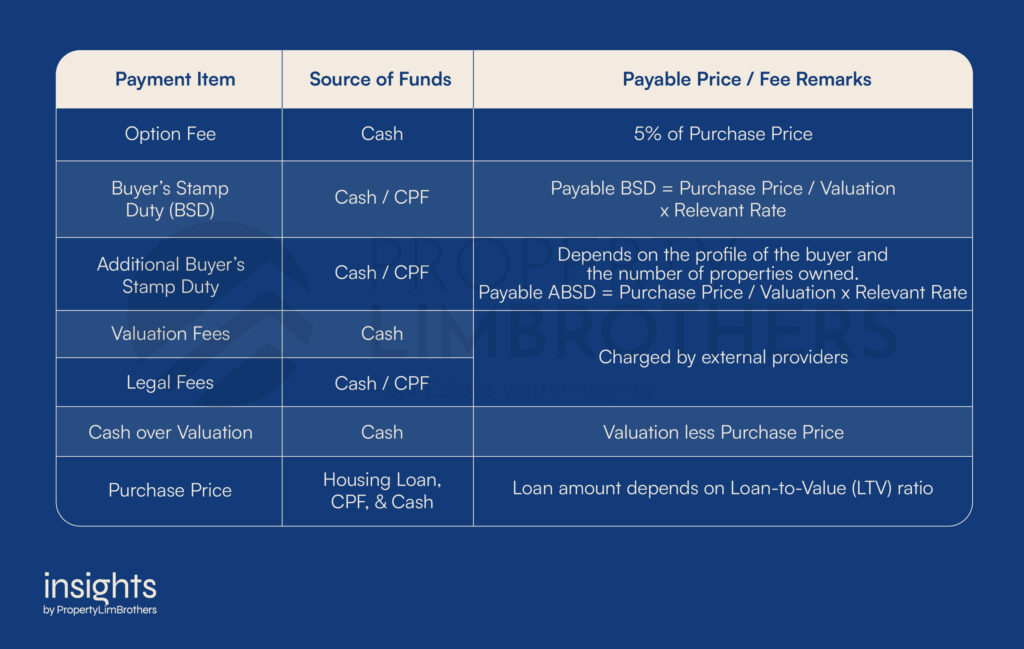

To envision and have a better understanding of costs and expenses involved, let us look at the below summary table that covers the initial cost of a private property.

To ‘reserve’ the property from the seller, prospective buyers have to sign an Option to Purchase (OTP) agreement. This legal agreement would require paying a small booking fee (an Option Fee), and in exchange, the seller cannot sell the property to another partner during the time stated in the agreement. The Option Fee to obtain and exercise the OTP is typically 1% & 4% of the purchase price, respectively (subject to buyer & seller agreement).

Buyers have to pay a Buyer’s Stamp Duty (BSD) tax levied on all property purchases in Singapore. The amount of BSD depends on the highest amount between the purchase price and market value/ valuation of the property multiplied by the appropriate rate stipulated. Additional Buyer’s Stamp Duty (ABSD) is a tax that is levied on top of BSD. It depends similarly to the BSD, except the rate stipulated is different.

Valuation fees are paid to a professional appraiser for a valuation of the property to find out its market value.

Legal fees involved include professional fees for lawyers, title searches and mortgage stamping fees. Cash over Valuation (COV) is the difference between the selling price and the property valuation.

The largest bulk of the cost will be the purchase price which will be covered in the next section.

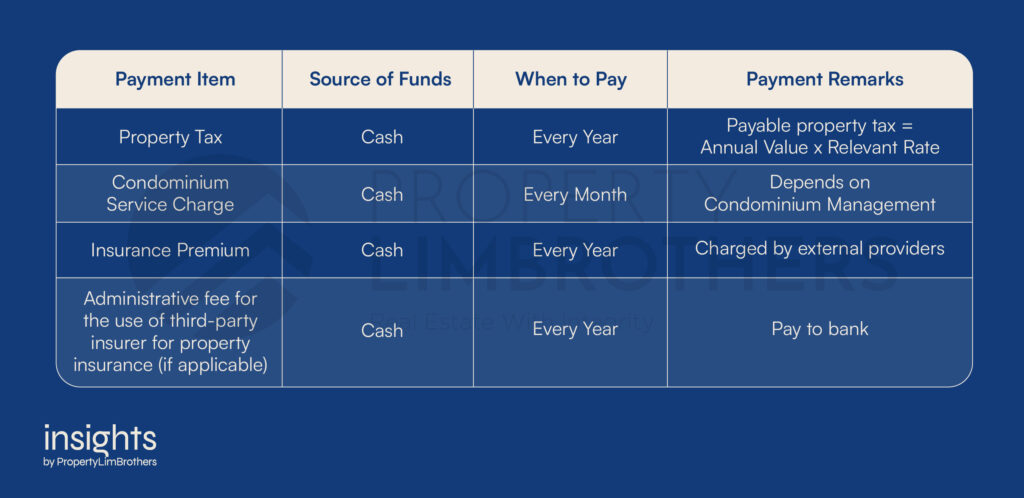

Aside from the initial cost of purchasing a property, there are recurring costs to the purchase. A summary of these costs is as follows:

Property tax is a tax on property ownership and applies whether the property is occupied by the owner, rented out or left vacant. It is calculated by multiplying the property’s Annual Value (AV) by the applicable property tax rates. The AV of properties would be the estimated gross annual rent of the property if it were to be rented out.

Depending on the condominium management (if you intend to purchase a condominium), there will be a monthly service charge to cover the maintenance costs of the housing estate.

Insurance premium to transfer certain risks & stress of unexpected situations such as a fire to a third party. Lenders typically require the asset that is being financed to be adequately insured. Some banks have a partner insurer that you may purchase from. The bank may require an annual administrative fee if a third-party insurer is used for property insurance.

Private properties are not eligible for housing grants, subsidies, and HDB loans, so how can owners finance the purchase?

Financing a Private Property

An important thing to understand about funding your dream home is the type of financing: debt and equity financing. Usually, a combination of the two is used to finance a property, as some items require upfront payments.

Debt financing refers to borrowing from an external source (typically banks) to pay for your property and subsequently paying the loaned amount plus interest. The amount you can borrow will depend on your Loan-to-Value, Total Debt Servicing Ratio, etc. The loan tenure is typically around 30 to 35 years.

Equity financing refers to using assets (typical cash on hand) to pay for the property without repayment. Payment such as Option Fees, Legal Fees, and Valuation Fee (refer to tables above) will need to be paid via cash.

Planning Your Time Horizon

Purchasing a property is one of the largest and longest investments someone can make. Even if you intend to move into your property, coming up with a time horizon will aid your future financial plan.

On this timeline, note your spouse and your current age and estimate when you might expect a lifestyle change. This could be when your children are in university, starting an occupation or planning to get married. From that decided age till now, you can aim to service the loan and move into your private property. At that decided age, you may choose to divest and sell off your private property and move back into a HDB apartment.

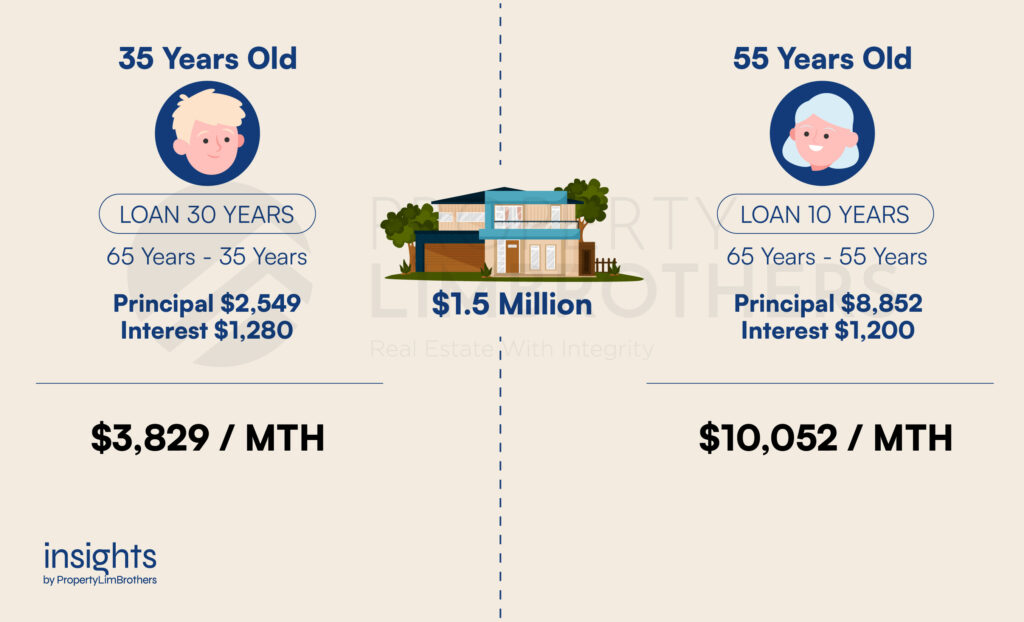

We must understand that we have a short time horizon to invest in private residential properties. The best years we can enjoy a higher income ability, and loan tenure longevity is around 20 to 40 years old. You can expect a higher monthly mortgage if you decide to enter the private property market later.

Taking a purchase of a $1.5 million property as an example, Person A, at age 35 can still take a maximum loan tenure of 30 years. At age 55, Person B can only take a maximum loan tenure of 10 years.

Assuming that both parties are granted to take a 75% loan with a 1.4% interest rate, person B will have a higher monthly instalment to pay off.

From the above scenario, we can tell there is a drastic difference between the monthly instalments. Entering real estate earlier on may be less stressful as compared to entering later and paying a higher monthly instalment.

Looking Towards 2030

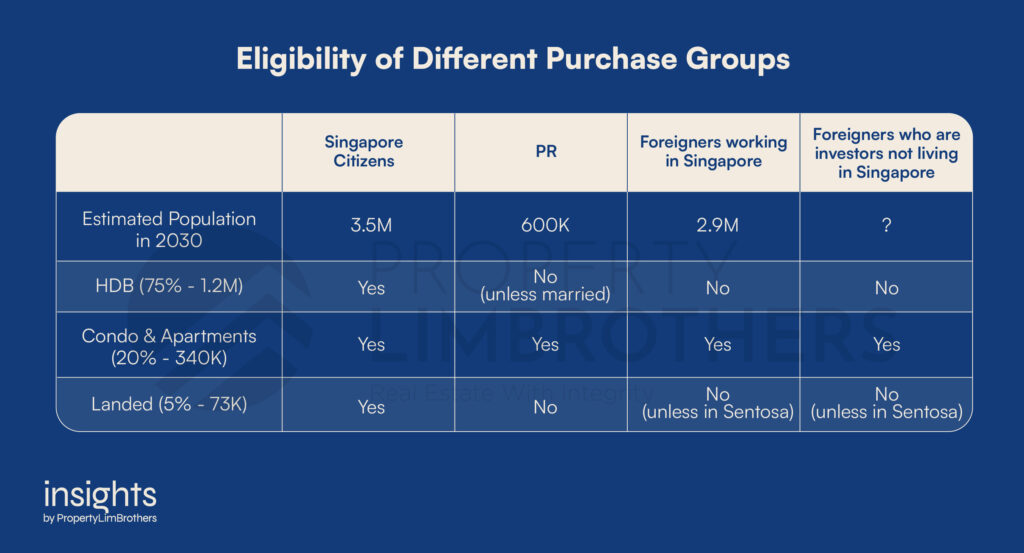

As projected by Singapore’s 2013 Population White Paper, we can expect a 1:1 ratio of Singaporeans and foreigners by 2030. To understand and foresee possible housing demands, we summarised the eligibility of different purchase groups in the table below:

Looking at the overall picture, landed properties and HDBs are primarily reserved for Singapore citizens. At the same time, permanent residents and foreigners have restrictions in place. The only category that everyone is eligible to purchase is condominiums and apartments.

Although there will be micro-permutations and groups of people that may not have the financial means to upgrade, the limited supply of private properties and the significant possible demand may play a role in your decision. Applying a simple economics concept of demand and supply, prices of private properties may appreciate at a higher possibility rate.

Final Thoughts

At the end of the day, the final choice is always yours. Ensuring the move is something that your family is happy and agreeable with is very important. Don’t be a slave to your property. Let the property serve your family.

Here are some To Dos as you move forward:

- Do your fundamental financial analysis to make sure you are prudent and have planned for at least the next couple of years to ensure you can substantiate.

- Do consider your timeline horizon and family preferences.

- Do some planning & buffer to ensure your family is comfortable to proceed.

If you are interested in exploring a possible move to private property and would like to seek professional guidance, feel free to contact our experienced consultants. Till next time!