The environment of the property market is different every year. Although many articles may suggest an “ideal” month to sell your property, we would instead want you to focus on the things to consider when timing the sale of your property and the specific market conditions to look out for when timing the sale of your property.

Reasons for timing the sale of your property

Timing the sale of your property is generally aimed at securing the most viewings, thus landing more offers and hence increasing the probability of earning the appraised valuation of your property, or better, above valuation.

Timing your property’s sale may also help reduce the time your property is on the market. If the property is left on the market for too long, there could be an associated stigma that makes potential buyers wonder if there is a problem; as a result, consider your property unfavourably.

The valuation process is often overlooked when making a sale of a property. Timing the valuation process could be vital to attaining a higher valuation. Both indicative and actual valuations (carried out by banks, appraisers, or real estate agents) will use some form of comparable historical data. Hence, timing the valuation process in a period of raising or peak valuation prices could help increase the appraised valuation of your property.

In the case of HDBs, HDB valuations can only be done after the buyer and the seller has settled on the selling price. HDB only publishes the selling prices of resale transactions daily. This means that both seller and the buyer will have to instead focus on negotiating the total selling price based on the prices of past resale transactions.

What should you consider before timing the sale of your property?

What is the reason for selling?

The “best time” for selling a property differs for every seller, depending on their objectives.

1. Right-sizing your home to accommodate a change in lifestyle

Although timing the sale can help realise a greater appreciation in the property’s value, increasing your budget for your new “dream home”. It is worth noting that selling in a seller’s market would likely mean buying in a seller’s market as well; thus, if you are selling for a lifestyle change, it may not be as critical to time the sale of your property.

Furthermore, when hunting for a new house, you probably may have already encountered your “dream home”, and it would provide you more satisfaction to snag it up before anyone else does, as almost no two properties are the same.

However, this could be different if you are downgrading to reduce financial commitment towards home loans. If reducing financial obligation is urgent, we would not advise you to time the market in selling your property.

2. Realise the appreciation in the value of the property

Over the course of your stay in the property, it may have appreciated greatly in value and you wish to capitalise on the opportunity of selling to realise the appreciation in the value of the property.

However, suppose the property you intend to sell is a rental-yield play investment piece. In that case, we need to consider whether continuing to rent out the property will bring in more value than selling at the appreciated value.

We also need to consider how to go about selling a tenanted property if the lease expiry does not coincide with the sale, as this would affect the eventual buyer’s consideration for your property if they’re planning this for their own occupation.

3. Cutting losses on a depreciating or underperforming piece of the property.

It could also be an investment piece where you are selling to cut losses. If there are no further future developments in the area of your property that could stimulate growth in property prices in the area, it could be a good idea to look into selling your property.

All cases considered, it would be most wise to consider the urgency of the sale of the property to conclude whether you can afford to time the market and that timing the market would bring about more significant benefits than consequences.

Our co-founder and CEO Melvin explains, “Why is it important not to time the market for your own stay property” in detail in a separate video. Through that video, you can learn more about our rationale on why timing the market for your own stay might not be such a great idea.

Market indicators of an excellent time to sell your property? (Seller’s vs Buyer’s market)

In a seller’s market, there are more potential buyers than available properties. Thus you are more quickly and more likely to receive multiple offers and sell for your asking price. This is because competition between buyers over available inventory has an inflationary effect on the sale price. It forces buyers to give their best offer in a bid to secure the property.

Whereas in a buyer’s market, the number of available properties exceeds the number of potential buyers. When inventory is high, sellers can expect their property to be listed on the market for longer before receiving an offer, and there is a higher probability of having to sell below the asking price or make additional concessions to the buyer on other terms related such as timeline, early move-in requests, amongst others.

Past Resale Transactions

As mentioned earlier in this article, HDB only publishes the selling prices of resale transactions daily. Both seller and the buyer will have to instead focus on negotiating the total selling price based on the prices of past resale transactions. Thus a good indicator of a seller’s market would be higher than average resale transactions.

One way we can interpret such data is by looking at the recent months’ average price per square foot of similar resale flats in the same area or even down to the same block of your property.

This can all be done through the HDB resale flat portal. Another tool you can also use is the HDB Map services which will allow you to search for resale transacted prices within 200 metres from any HDB Block or DBSS Site/Project, resale transacted prices for the same flat types in each block. The data is based on registered resale applications and is updated daily; hence you can assure that your research is always up to date.

By tracking the past resale transactions, sellers can understand how fast home prices are appreciating in their neighbourhood. Hence can time the sale of the property in line with the peak of a “Seller’s” market.

Best time to sell your property based on historical statistics

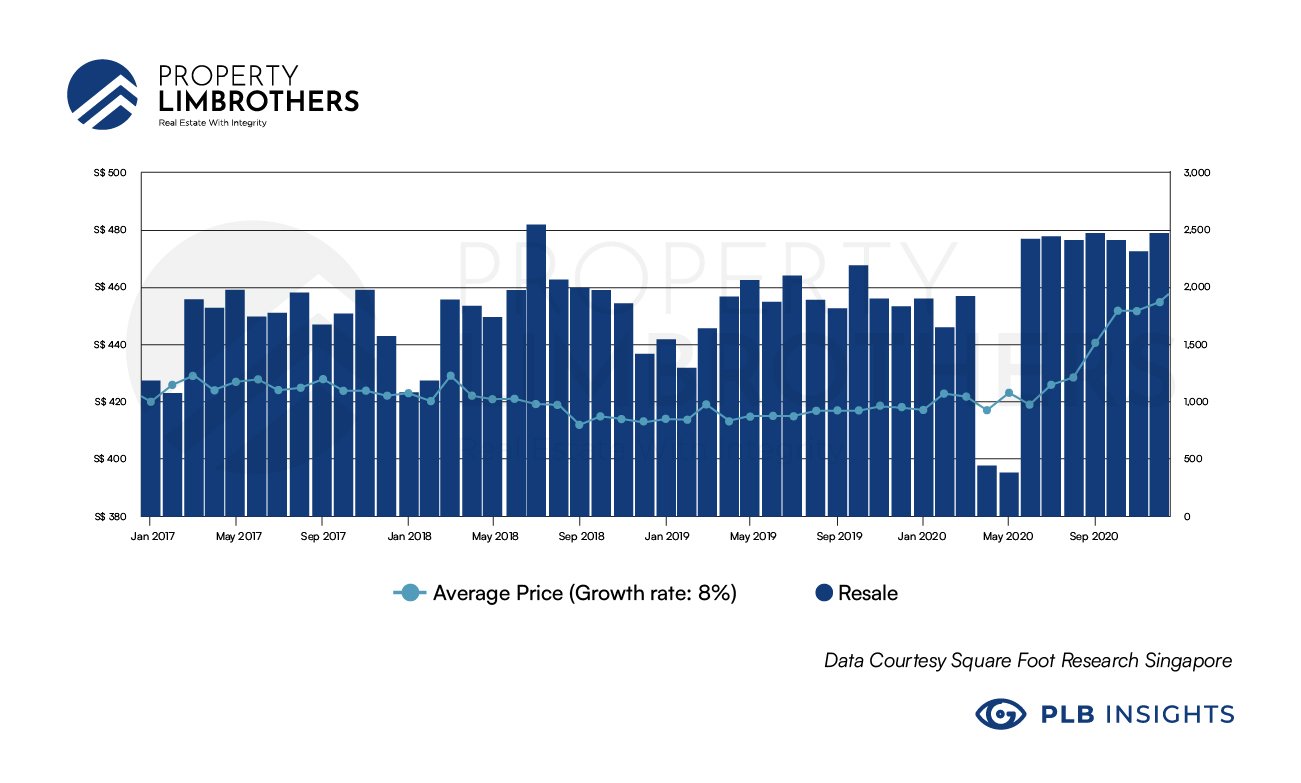

Figure 1: Resale HDB – Average PSF and Total transacted volume (Year: 2017-2020)

Sale transactions typically peak during the second and third quarter of the calendar year. As seen from figure 1, there is generally a higher volume of resale HDBs transacted in the second half of the year, compared to the first half of the year. The average price per square foot (PSF) is also generally higher in the second half of the year, compared to the first half of the year.

We hypothesise that in a Singaporean context, many people tend to be away on holiday during the Chinese New Year period. Most families would also want to have settled into their new home by the end of the year before school starts for their children – as it is a common reason for families to relocate to be closer to the school that their children are attending.

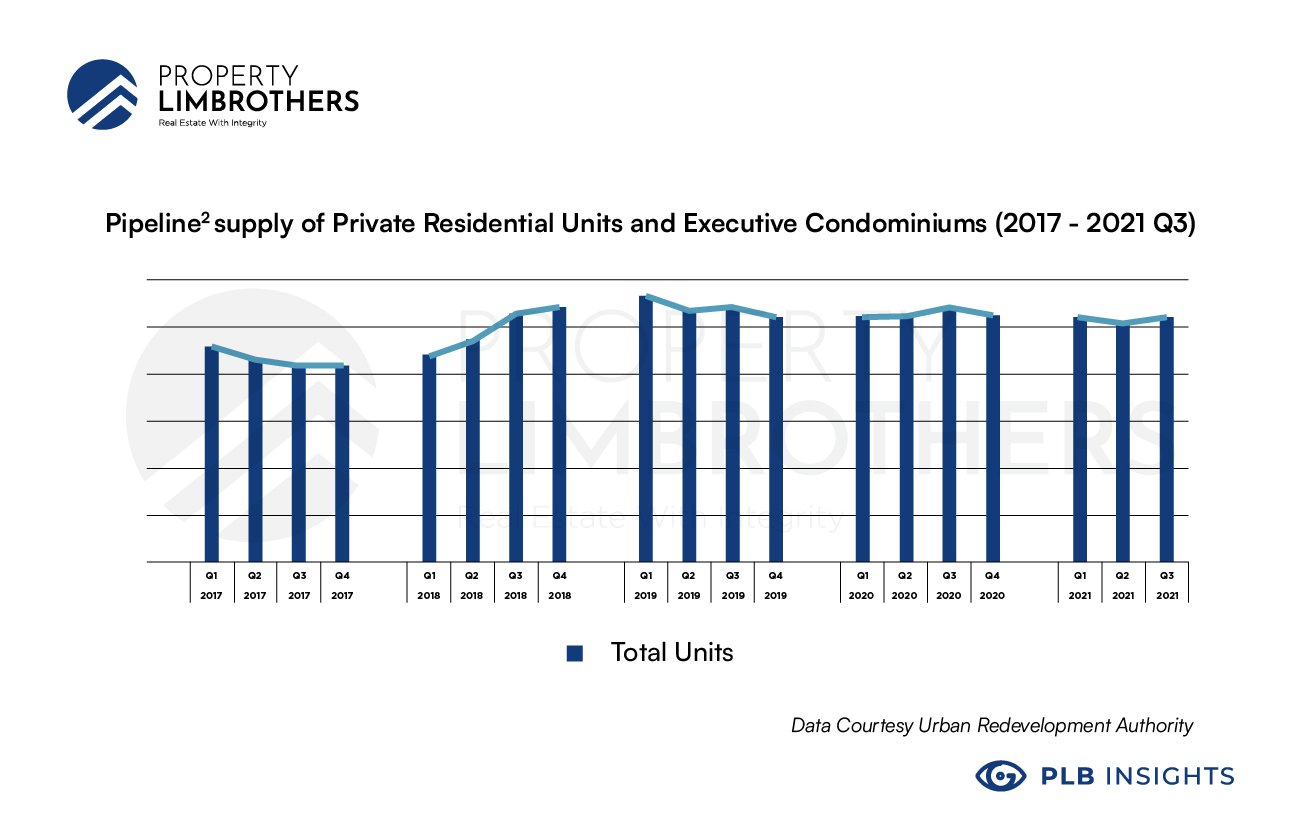

Figure 2: Pipeline² supply of Private Residential Units and Executive Condominiums (2017 – 2021 Q3)

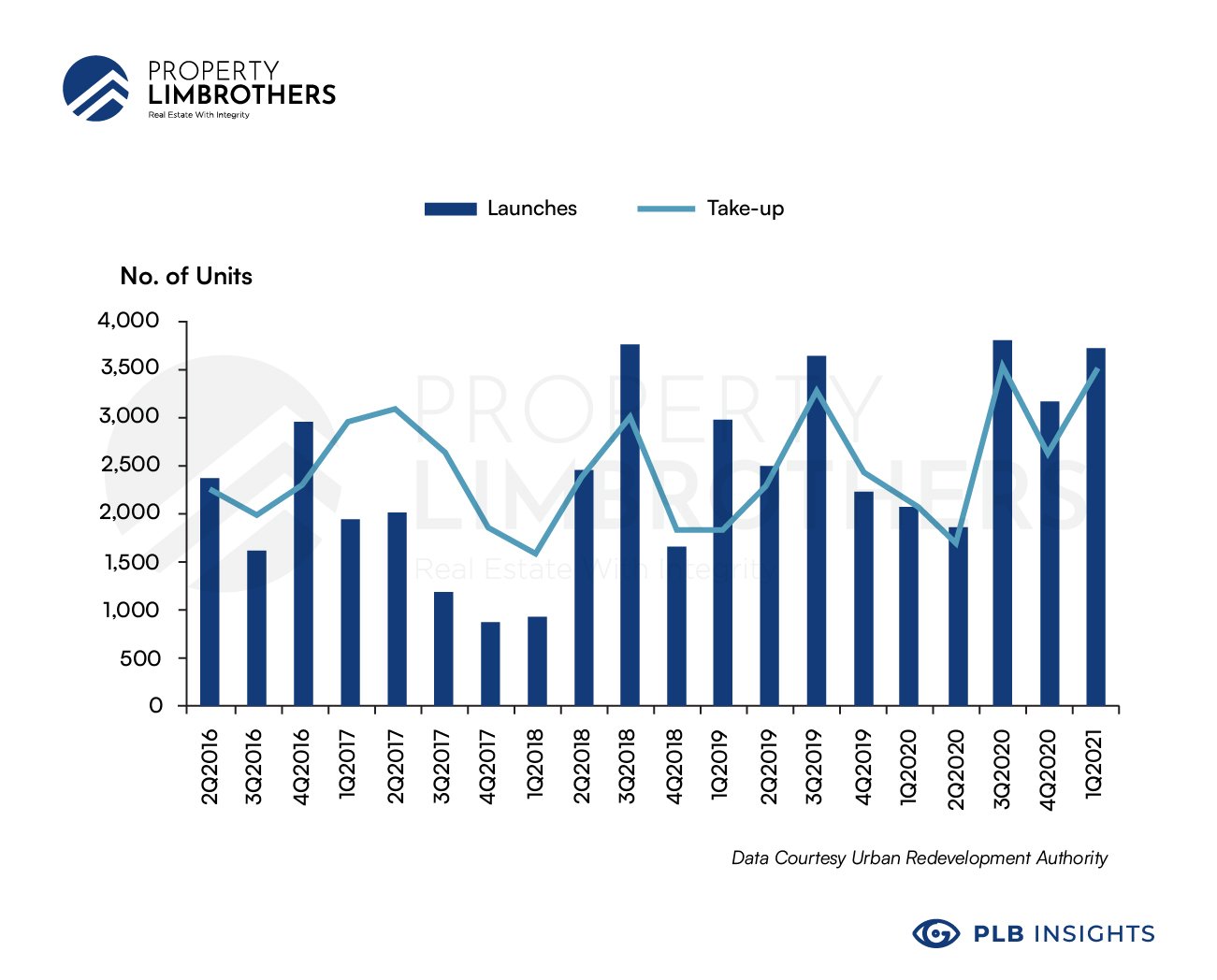

Figure 3: New Launches and Take-up of Private Residential Units and Executive Condominiums (2Q 2016 – 1Q 2021)

However, we would advise sellers to take action earlier in the second quarter rather than the third, as new pipeline supply of private residential units and executive condominiums increasing in the second half of the year could have a deflationary effect on the demand for resale properties.

As seen in figure 2, where out of the five years represented, there has been an increase in total units in the pipeline supply of private residential units and executive condominiums in 4 respective years. This phenomenon is further supported by figure 3, where peaks in take-up of private residential units and executive condominiums generally occur during the third quarter of each year represented in the graph.

It might also be a good idea to list during the second quarter of the year as it coincides with the Inter-monsoon period when Singapore gets the most sunshine. The natural light could help brighten the home and give a better overall impression of the home.

We would also advise to avoid the “Seventh Month”. Singapore being multicultural and multigenerational, would have some people who are hesitant to buy properties during the “Seventh Month” as it is considered inauspicious in Chinese culture.

As such, we hypothesise that the best time to sell your property in Singapore would be during the second quarter of the year, with all else being equal.

Other things to consider when selling your property

Home Staging – Is your home ready to be listed on the market?

If your goal is to secure a quick sale, or if you are not in a hurry to sell the property, it would be either way, still beneficial to consider the minor repairs and cosmetic enhancements that you can make to prepare your home for listing.

Home staging and styling can potentially have a more significant effect on the negotiated selling price of the property than timing the market.

According to research that surveyed “The Impact of Staging Conditions on Residential Real Estate Demand” ¹, the house’s overall condition significantly impacts the perceived liveability and, hence, the overall impression of the property.

Even if you cannot afford a professional, there are many things that you as a homeowner can do yourself. Without conditioning a house for sale, it may reduce your eventual sale price or potentially prevent you from getting a deal at all.

Even minor issues such as a leaky faucet could signal to potential buyers that the house may have more extensive, costlier issues that have yet to be addressed. They would also not be able to envision themselves living in the home with satisfaction with such perceived problems that they have to rectify and perhaps lead to a more brutal negotiation on the sale price to buffer for such maintenance works.

As explained in our previous article, “Achieving The Best Possible Price: 5 Key Factors”, Home staging provides potential buyers with an overview of how their potential future home will look while also decluttering unwanted items to enhance the viewing experience. Furthermore, most home sellers are already going the extra mile of preparing their houses to look neat and well maintained for sale. A unit will only stand to lose out if no preparation work was done in order to save perceived cost.

Otherwise, if you would prefer a professional real estate team to take care of such matters, you may reach out to our Listings Team or find out more here.

Can you afford to sell your property to buy a new property?

From resale application administrative fees to legal fees, agency fees and Seller’s stamp duty (if applicable), the total cost of selling a home can subtract a considerable percentage from the sale price.

Do consider the breakeven price, which is the overall cost of paying off a property, to get a more accurate estimate of the amount pocketed after selling the property.

After understanding how much it will cost to sell the property allows for proper budgeting for buying the next home to occur.

Conclusion

A good rule of thumb is to follow a timeline that makes the most sense for you when selling your property. Although it may be true that homes may tend to sell more quickly during the second half of the year and closer to or above valuation. However, that does not mean that listing during the second half of the year will guarantee an ideal outcome. Past performance is not indicative of future performance.

Sometimes, life deals you a particular set of circumstances and selling your home might become a necessity. In these instances, waiting for a better season to sell your property might have more significant consequences, such as missing out on a job opportunity or delaying an important life goal.

If you are still in doubt or would like a professional to handle the selling process, do drop us a message, and our consultants will be happy to help you along the process. We hope this article has provided you with some helpful information. Keep a lookout for our next bleubricks article by PLB coming soon. Until our next article, take care! For those interested in finding out more beyond the realms of HDBs or would like to start planning for your property portfolio, you may contact our PropertyLimBrothers team! In the meantime, please do check out our very own portal, Bleubricks, which caters to all HDB buyers and sellers.