As over 14,000 Build-to-Order (BTO) flats reach their maximum occupancy period in 2022, buyers looking for resale flats should anticipate a medley of potential homes up for grabs soon. Yet do not be mistaken, as much as BTO and resale flats are both considered HDB housing, they have entirely different buying processes and costs.

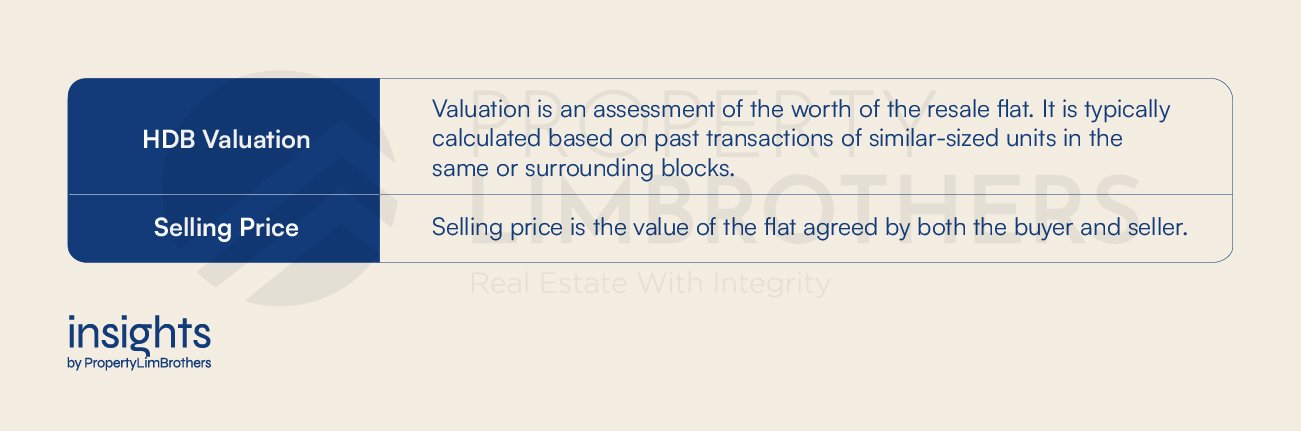

One crucial difference between BTOs and resale flats is the role HDB valuation plays in the transaction. Unlike BTOs where the prices are predetermined by HDB, resale flats have to consider two numbers – the selling price and HDB valuation.

Unfortunately for buyers, the desirability of resale flats has only driven the selling price up and likewise only increased the prospect of forking out cash over valuation (COV).

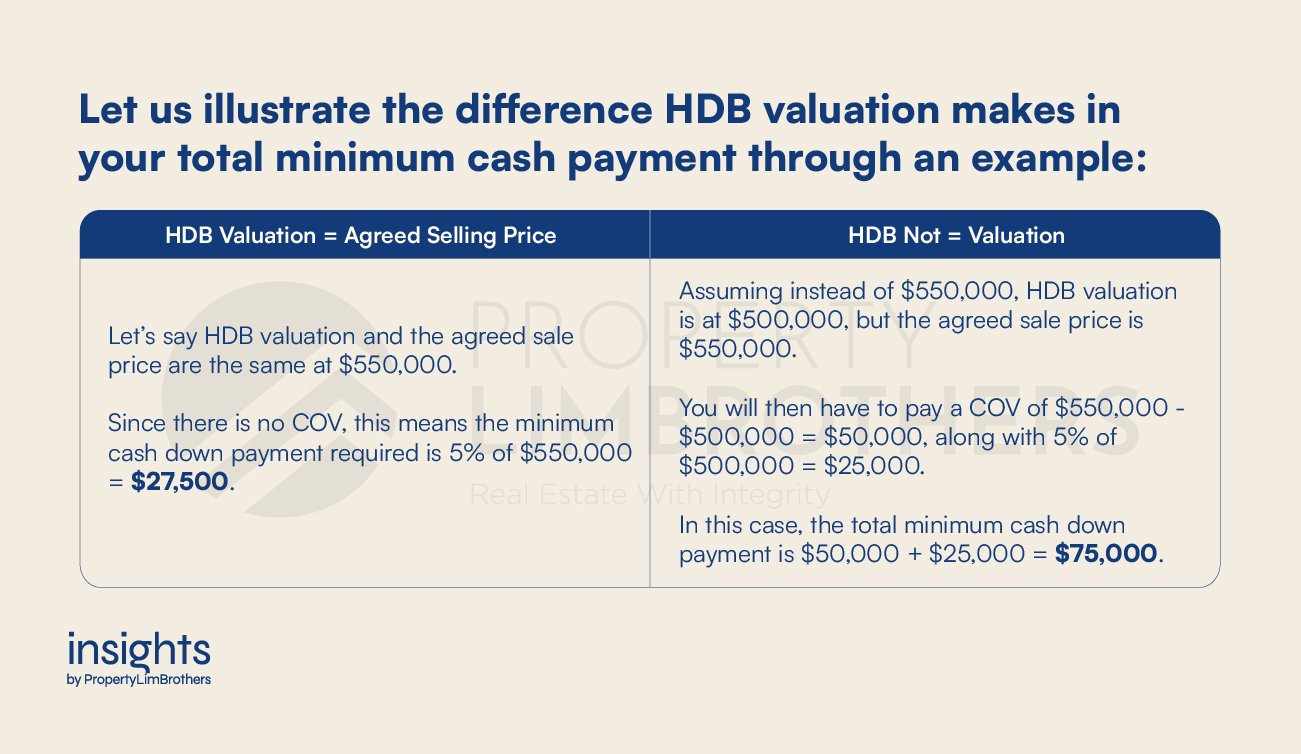

COV is another unique feature in the resale market as it refers to the amount you have to pay in cash when the selling price is higher than the HDB valuation.

In fact, 2021 saw a sharp increase in buyers paying COV, from 1 in 5 flat buyers in 2020 to 1 in 3 buyers in 2021. This means more and more resale flats are sold above their HDB valuation, and buyers have to pay more cold, hard cash in their real estate transactions.

Know your worth. In this article, we will cover the significance of HDB valuation to unravel how it influences the cost and payment of your potential home. On top of that, we will also break down the valuation process and what you should do subsequently, as knowing the valuation of your flat is only scratching the surface of your resale journey.

Significance of HDB Valuation

As mentioned, there are two numbers that you need to pay attention to during the buying phase – the selling price and HDB valuation. These numbers will influence the amount you eventually have to pay, be it by cash or loan, and the means of financing your new home.

Minimum Cash Payment

When you buy a resale flat utilising the full 75% Loan-To-Value via a Bank Loan, you will have to pay for certain portions in cash, one being the 5% down payment and another being COV (if necessary).

However, since 2014, HDB stopped publishing the valuation of flats to encourage a sale price that is agreeable to both buyers and sellers. Yet, the missing valuation sum instills an element of uncertainty as you might end up negotiating a higher selling price than its valuation.

Clearly, the valuation matters. Even though the selling price was the same in the examples, you will have to pay $47,500 more in cash for the latter scenario. This makes it easy to understand why some transactions fail, as the disparity between HDB valuation and the selling price may be too steep to follow through.

Loan Amount

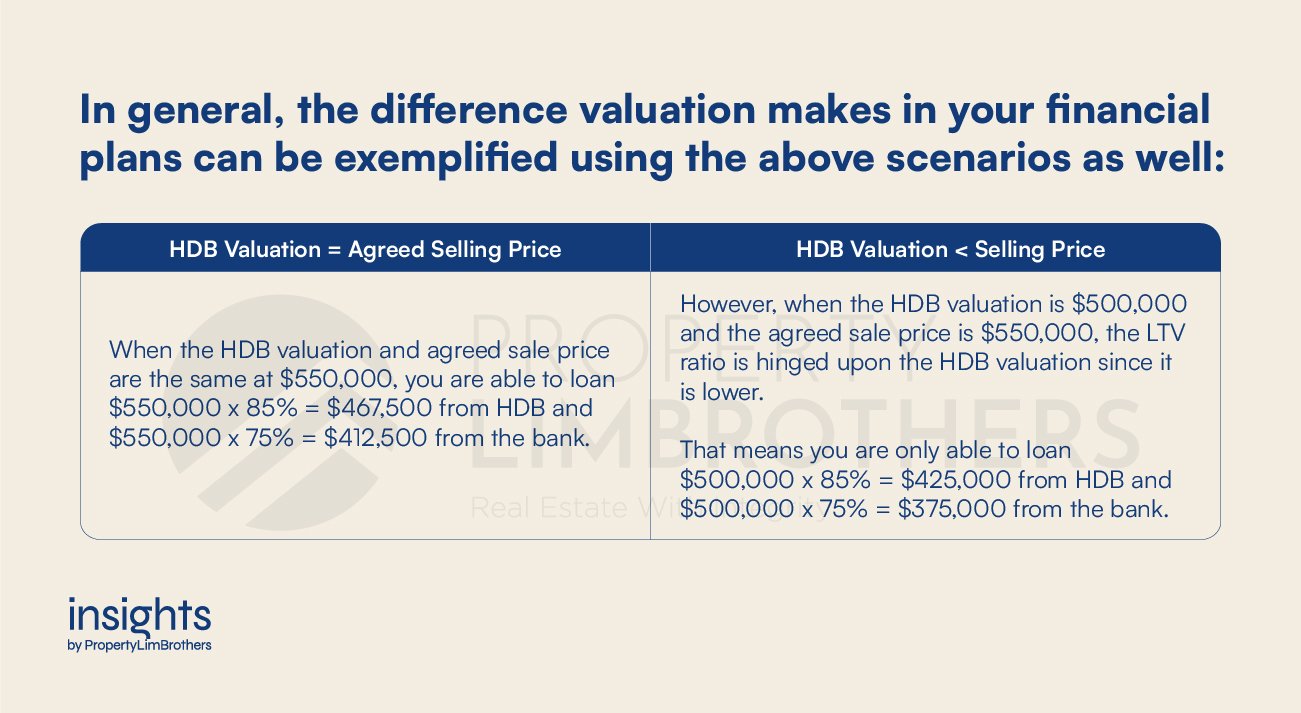

Beyond your cash payment, the maximum amount you can loan from HDB or the bank is also dependent on the valuation. Principally, your loan amount is contingent on the loan-to-value (LTV) ratio, and this amount is hinged on either the valuation or the selling price of the flat, whichever is lower.

Both HDB and banks use different LTV ratios – HDB at 85% and banks at 75% for the first loan. To find out which you should use, check out our in-depth article on HDB Loan Versus Bank Loan to make the savviest choice.

Hence, if your HDB valuation is lower than the selling price, the amount you can loan is also lower, and you will have to find other means to service your property expenditure.

CPF Withdrawal

Fret not, because one way to ease your financial burdens is through CPF withdrawal. Yet, the maximum amount that can be withdrawn is based upon HDB valuation, not the selling price.

In order to withdraw the full valuation amount, the remaining lease of the flat must be long enough for the youngest buyer to reach 95 years of age. Otherwise, the amount you can withdraw will be pro-rated. It will then depend on the number of lease years remaining and how close they are to when the youngest buyer hits 95 years old.

With all these components, it is not difficult to comprehend the importance of HDB valuation. But it is not enough to just understand the significance of HDB valuation; you should also know how to get the valuation and what to do after.

Steps to Check your HDB Valuation and What to do After

1) Obtain the Option to Purchase

It goes without saying that before you hunt for your dream home, you need to check whether you are eligible to buy a resale and work out your budget. Only then should you register your Intent to Buy. Upon HDB’s approval, you and the seller can start negotiating on the selling price of the flat.

When an agreement is reached, you will have to pay an Option Fee of (usually) $1000 for the seller to grant the Option to Purchase (OTP).

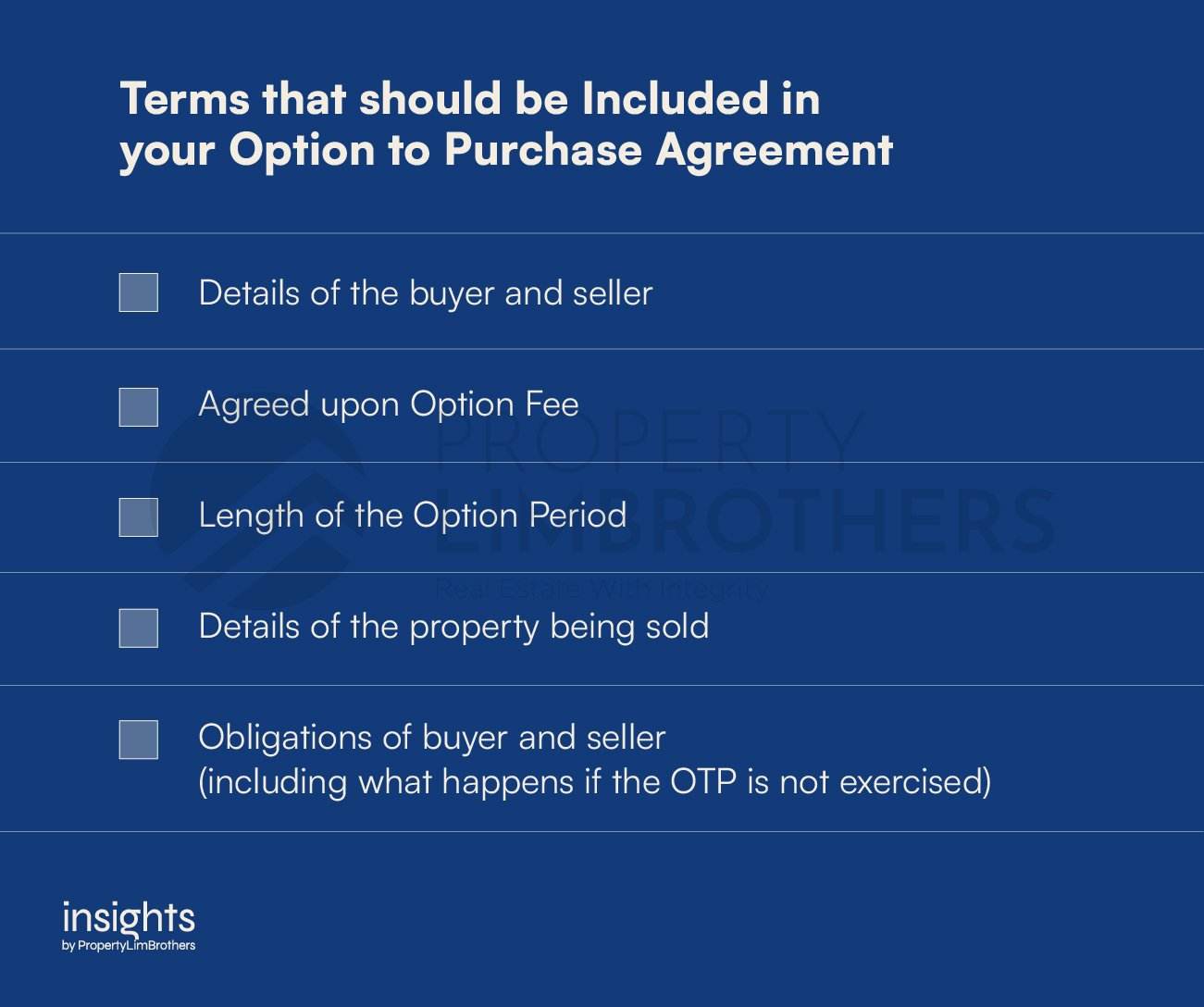

An OTP is a legal agreement that grants the buyer the exclusive rights to purchase the flat. The contract typically extends over 21 calendar days (including weekends and public holidays), and this duration is known as the Option Period.

This means the seller cannot look for other potential buyers and, of course, cannot sell the property to someone else during the Option Period. This buys some time for you to consider the deal before actually making the purchase and also obtain an HDB Loan Eligibility (HLE) letter if you intend to take an HDB Concessionary Loan.

2) Submit Valuation Request to HDB

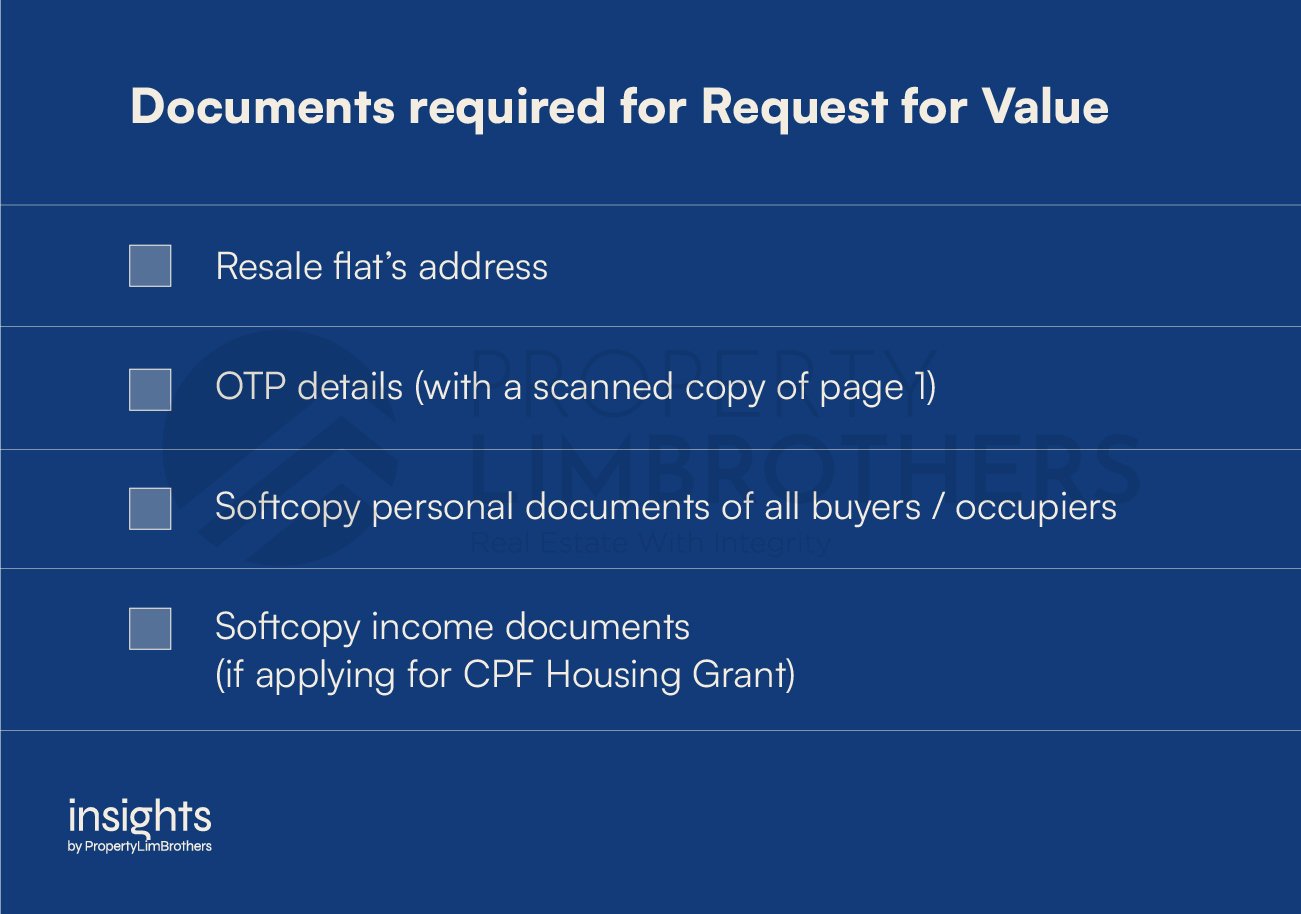

On the following working day after the Option Day (as stated in the OTP), you will have to submit a Request for Value to HDB.

The Request for Value is a compulsory submission that will give you the actual valuation of your flat. And as mentioned above, it is a crucial step in calculating your loan quantum and total cash payment.

After filling out the application form, you need to pay an admin fee of $120. HDB will subsequently determine the value of the flat and release its valuation in 7 business days.

Take note that the value of the flat is only valid for three months from the day it is made known. Should you not submit a Resale Application (see step 4) within the same three months, you will have to submit a new Request for Value (i.e. paying another $120 to HDB for the same process).

This not only incurs more cost and time but it will also affect the loan amount granted and the CPF savings that can be used. All of these factors will be recalculated based on the latest value of the flat determined through the new Request for Value.

3) Exercise the Option to Purchase (or not)

After knowing the valuation of the flat, you have the option to purchase or decline the deal during the Option Period. If you do go ahead with the sale, you will need to pay an amount that does not exceed $5,000 (inclusive of the amount used for the Option Fee) to actually exercise the OTP. Once the option is exercised, you are legally bound to buy the property and cannot pull out of the deal.

If you choose not to exercise the OTP, you will have to forfeit your Option Fee (or what is agreed upon in the OTP). This is a rather rational move if the disparity between the valuation by HDB and the agreed sale price is too significant, and you find difficulty affording it in cash.

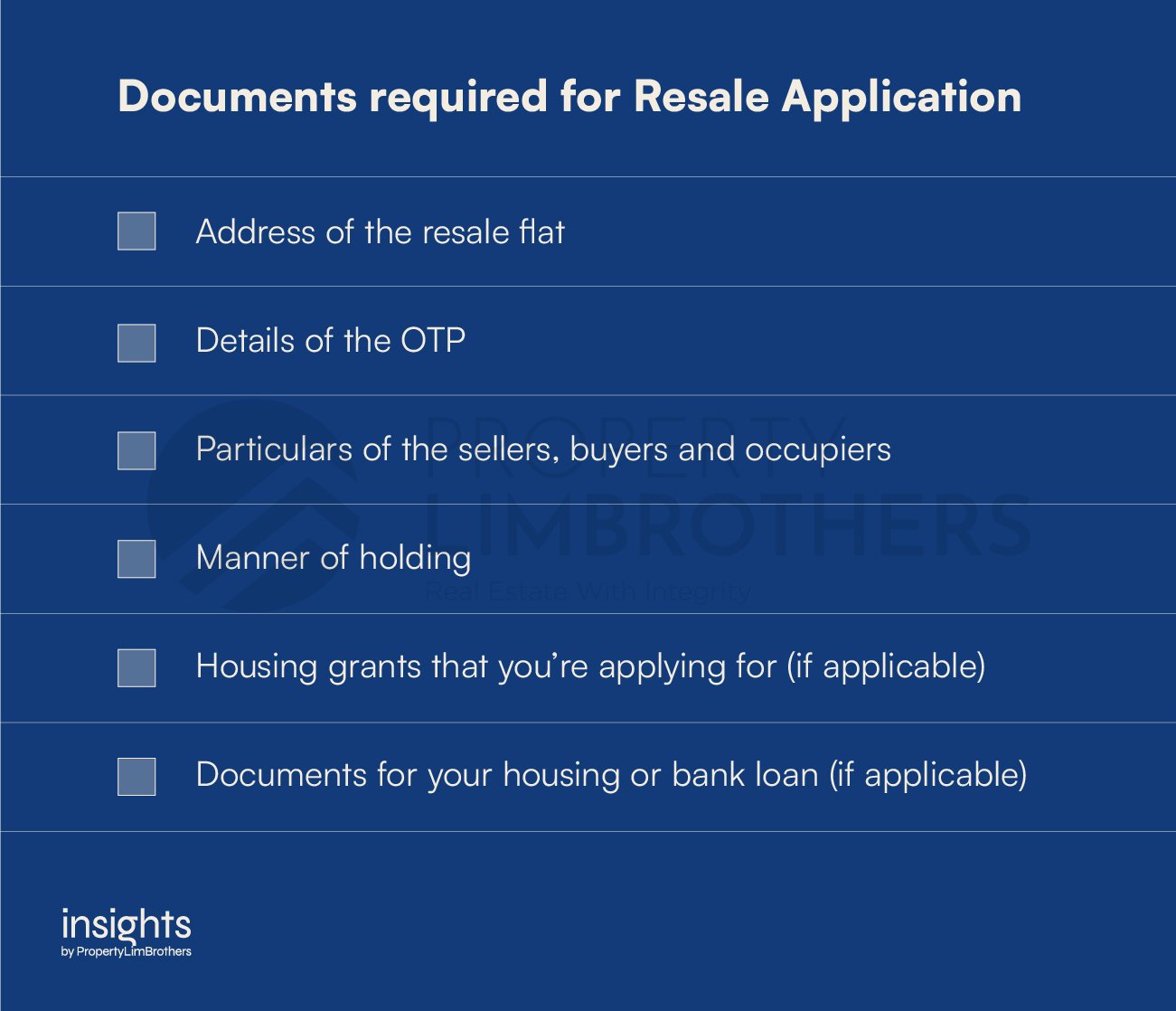

4) Submit the Resale Flat Application

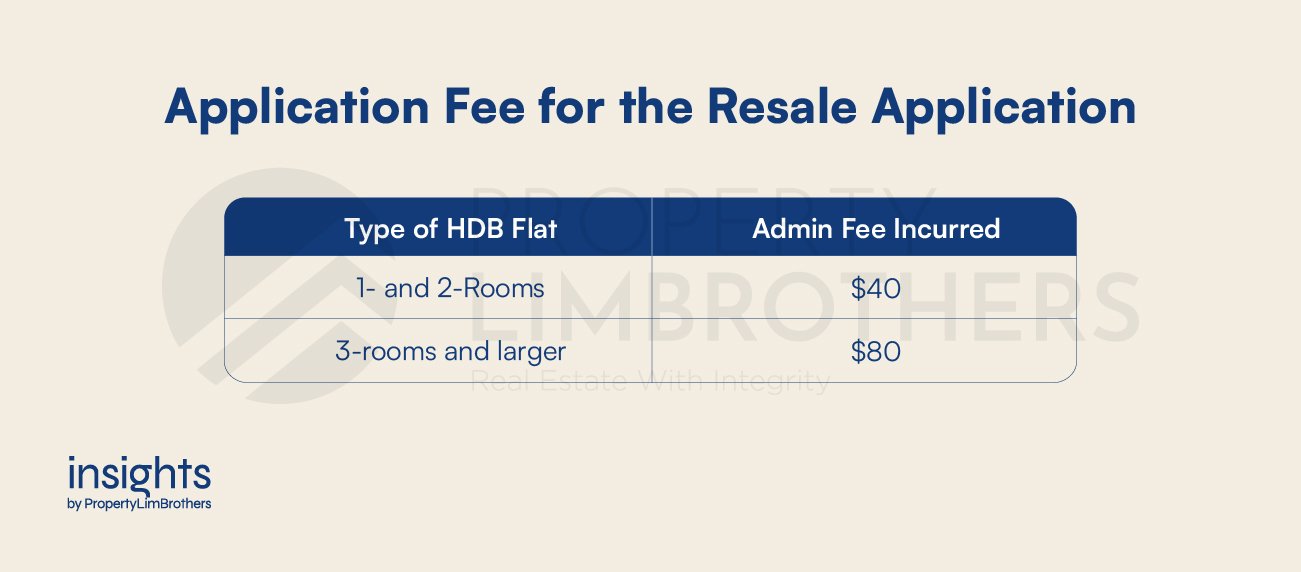

If you choose to go ahead with the deal, both you and the seller will need to submit the resale application within 7 days of each other. As such, you have to discuss your submission date with the seller, as submitting beyond seven days will result in the cancellation of your application and a forfeit of your application fee.

When the application is accepted, HDB will notify both parties via SMS or email. In the notification, HDB will provide a list of documents that need to be endorsed (eg. CPF withdrawal, conveyance fees, admin fees and so on) within six days.

As such, you should visit your loan provider in the meantime to formalise your loan terms. Any delays in the endorsement will result in the postponement of your resale completion date.

After HDB receives your supporting documents, it will take them approximately another two weeks to process and approve your application. During this window, HDB will also arrange for a technical executive to inspect your flat and ensure the seller has not made any illegal modifications to it. Commonly reviewed fixtures such as windows and/or window grilles (if they have been installed or replaced) will be scrutinised as these need to be done by a HDB Approved Contractor or HDB home shelters where at least 1 ventilation panel has to be left open for ventilation purpose.

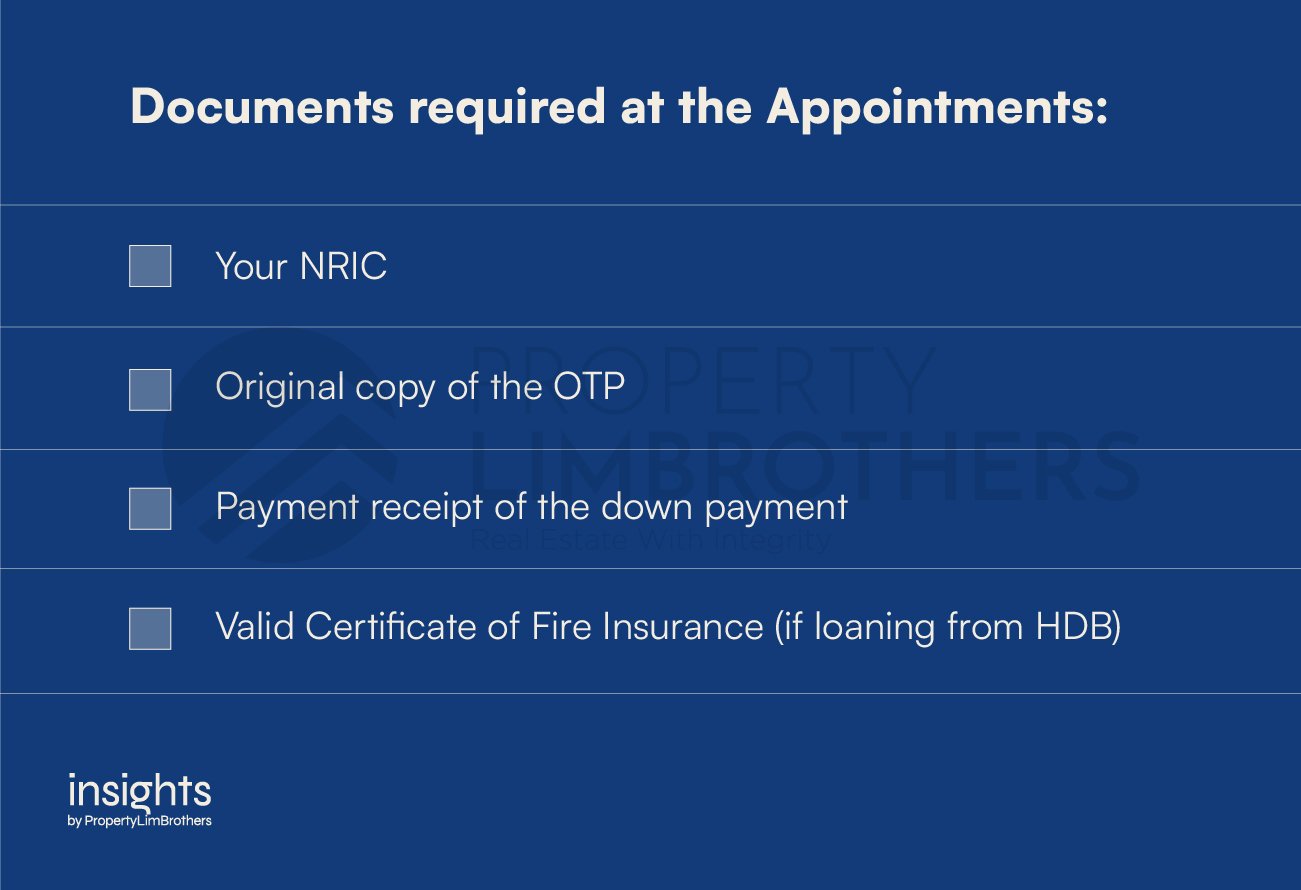

During the same 2 weeks, you should also purchase an obligatory fire insurance policy (if you are loaning from HDB). The Certificate of Insurance has to be produced at your final appointment before the handover.

5) Attend Resale Completion Appointments

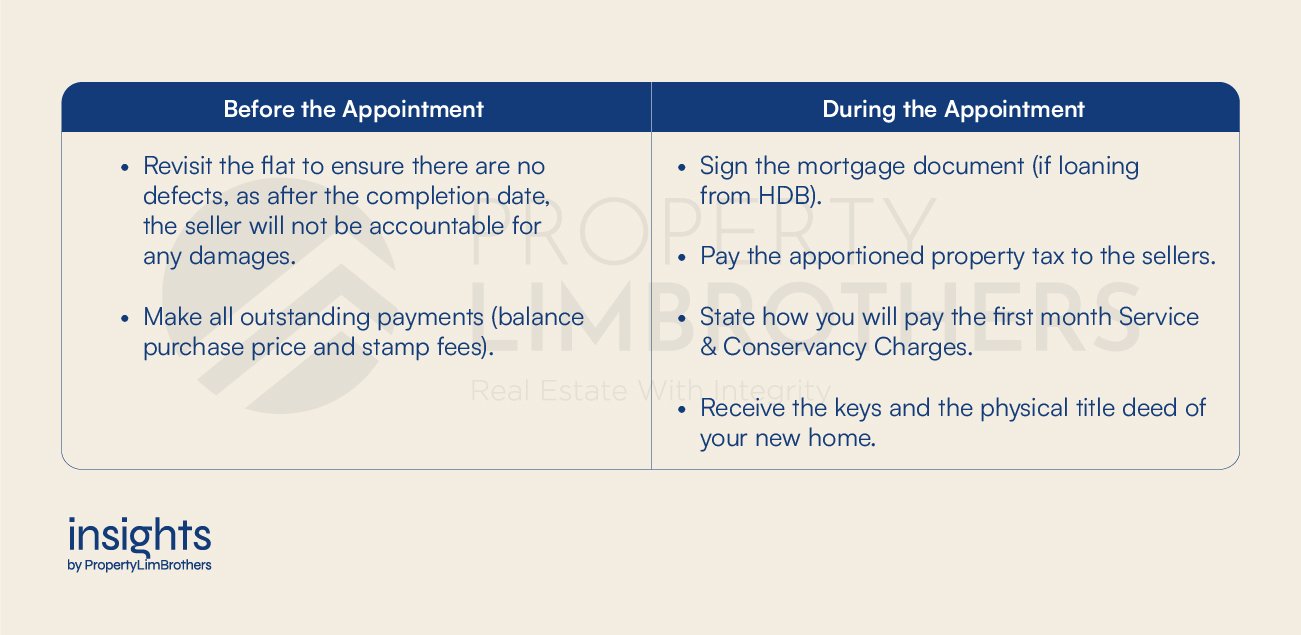

About 8 weeks after your resale application has been processed, HDB will schedule an in-person appointment to complete the resale transaction. Remember that you and the seller or your private law firm representatives have to be physically present at the Resale Completion Appointment.

With that, you just unlocked your new home!

Closing Thoughts

Opportunity only knocks once. As more resale flats enter the market, knowing how to cop your perfect home is increasingly important. This article has shown how influential HDB valuation plays in deciding and financing your home, and what the resale buying process is like.

If you are still unsure about the procedures for buying a resale HDB, feel free to contact our experts here. They will be happy to ease your buying process and secure the perfect home for you.