If you have been keeping up to date with the Property Market, you would know the hottest segment right now is the Landed Property market. Why? Because it is the only market with an ever Limited Supply. With many looking to upsize their houses and grab a stake in the Landed Property Market, there is much to infer from the tendencies and motivations of this group of buyers and sellers. Since a complete transaction requires a willing buyer and a willing seller. We will take a closer look at some of these trends to help you navigate this densely populated but yet “small” market.

The Facts

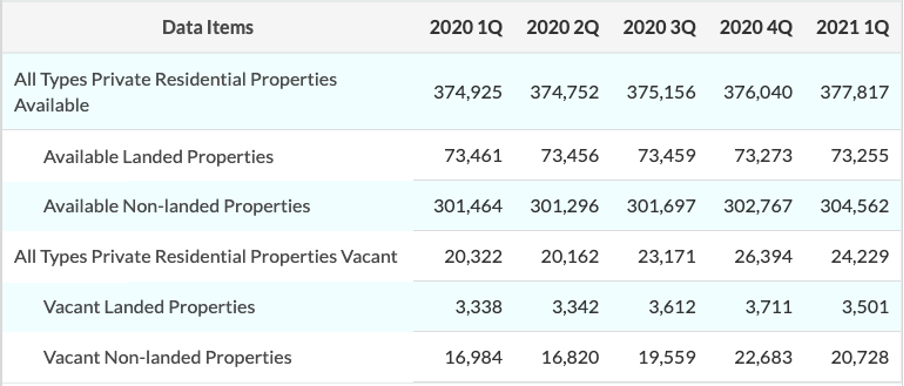

The Landed Housing supply is ever dwindling and ever limited. According to an article by Jones Lang LaSelle (JLL) the supply of landed homes rose by 5.1% from 69,743 units to 73,273 units in the period of 4Q10 to 4Q20. In comparison, the supply of non-landed homes rose by 60.6% from 188,500 units to 302,767 units in the same time period. Some may be wondering, why is there an increasing number of landed houses if the supply is limited by the Government? The profitability of a single house may not be as significant as 2 or even 3 houses. However, with the limitation of being able to only build landed properties, developers have no choice but to subdivide a larger plot of land to build more houses. Which is why you may often notice a stretch of new Inter-Terraces between relatively older Semi-Detached houses. Or maybe newer Semi-Detached houses within an area with Detached houses. The implication of the re-development of these older plots of land is that in the future, even our Landed houses may start shrinking in size like the Non-Landed developments we see these days. In order to keep up with the demand for landed housing, this seems like the only feasible solution if we want that extended privacy and exclusivity that only landed housing offers.

Price

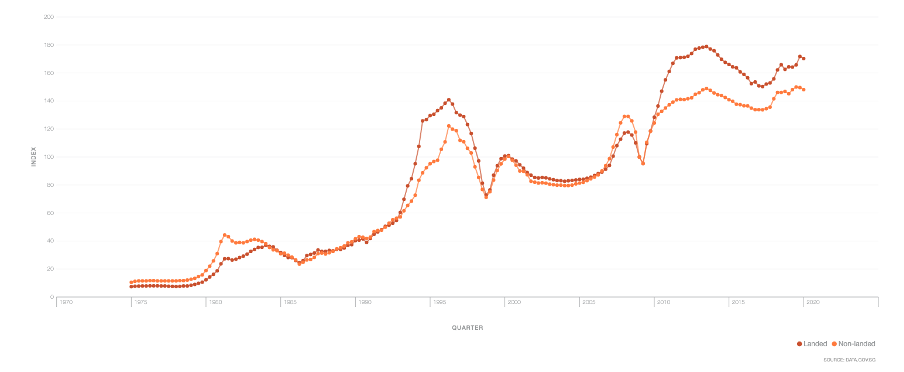

Once upon a time, the performance between Landed and Non-Landed properties were at a similar level according to the price indexes in the time period between 1999 up till 2009. However, we started to see an exponential increase in the difference between the two price indexes from Q1 in 2010. The reason for this is the Supply. As we have already mentioned, the supply of Private Non-Landed Residential properties almost doubled in supply over the course of 2010 to 2020. However, the increase in Landed Residential properties is insignificant in comparison to its counterpart at only 3,530 units over the course of 10 years. Not forgetting that our population has grown significantly by about 600,000 residents. As our population grows while the supply of landed houses dwindles, there is only one solution if you want to own a piece of land. Pay a higher price? At best, the supply in the Landed Residential market will stagnate as more buy into this category and fewer are willing to sell off their precious land for redevelopment and subdivision. While some may speculate that perhaps it may be time for a price correction in the Landed Residential market, we take a contrast in opinion. With some evidence of course.

Momentum

COVID-19 has changed the way we view our houses drastically. From being a place that most people would spend perhaps just 9-10 hours to rest and prepare for the next day. To a place where you have to spend that same 9-10 hours for rest PLUS the additional 14 hours working at home. Not forgetting that you have to share this space with 3 other people and not have a dedicated working space for you and your spouse. The house has now become a multi-dimensional space, spending the large amount of time in the same space started to create realisations of how small or underutilised your old space was. This has given rise to the demand of the luxury commodity of space. And there is no bigger space than a piece of land with all 3.5 storeys to your name. Ultimately, Price and Volume are reflective of Demand. Without Demand, Price and Volume, cannot be moved. While we cannot entirely assume the tendencies of homeowners, we can, however, infer their preferences. In locations, price point, type, and condition of the properties.

The Heat Map

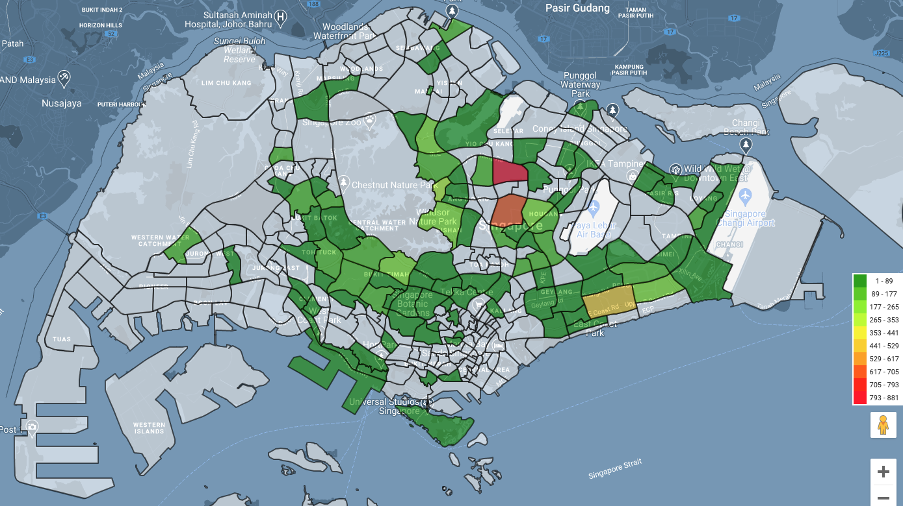

Most of the landed properties in Singapore are consolidated in the Central and Eastern regions. The Heatmap above provides a quick overview of the transactional volume across the regions in the time period of June 2016 to June 2021. Over the course of 5 years, the top 3 regions with the most transactions are Seletar Hills, Serangoon Gardens and Frankel respectively. Considering that these areas have some of the largest supply of landed properties, this comes as no surprise. What comes as a surprise is the transactional volume at Seletar Hills. The preference of homeowners searching for landed properties, are typically skewed towards District 15 and 19 for the convenience and ease of access to Central areas.

Not forgetting that the Luxus Hill enclave was also very popular amongst homeowners because of the larger spaces it offered in comparison to the ready stock of landed properties. Along with the fact that there are newly built units, ready to move in conditions, these will definitely attract a good number of buyers to this area. Another underlying factor here is that if you are spending a good amount of money to purchase a landed property for the serenity, privacy and exclusivity, the last thing you would want is to have difficulty accessing your property. Which is exactly what some of the homeowners in Districts 15 and 19 have to deal with on a daily basis. But of course, these slight inconveniences cannot be the only driving factors for the volume. Price plays a part.

Quantum Play

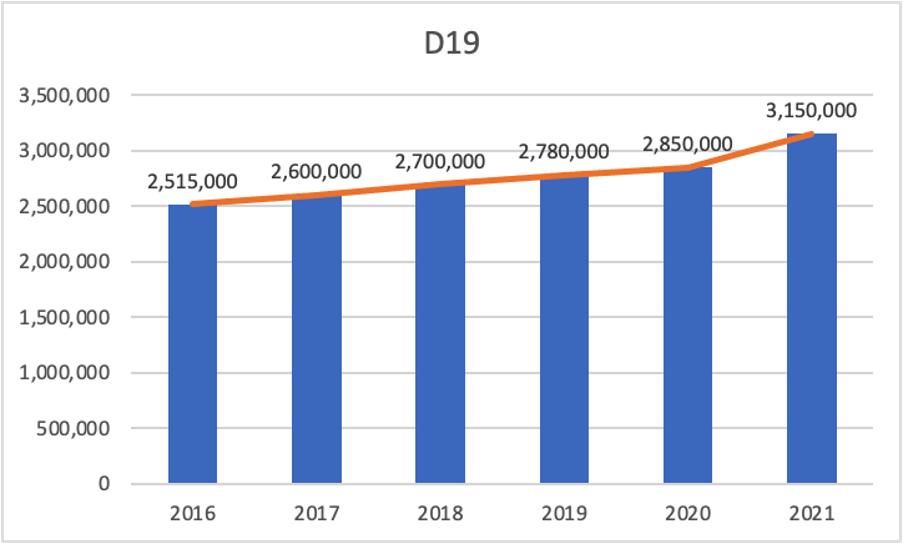

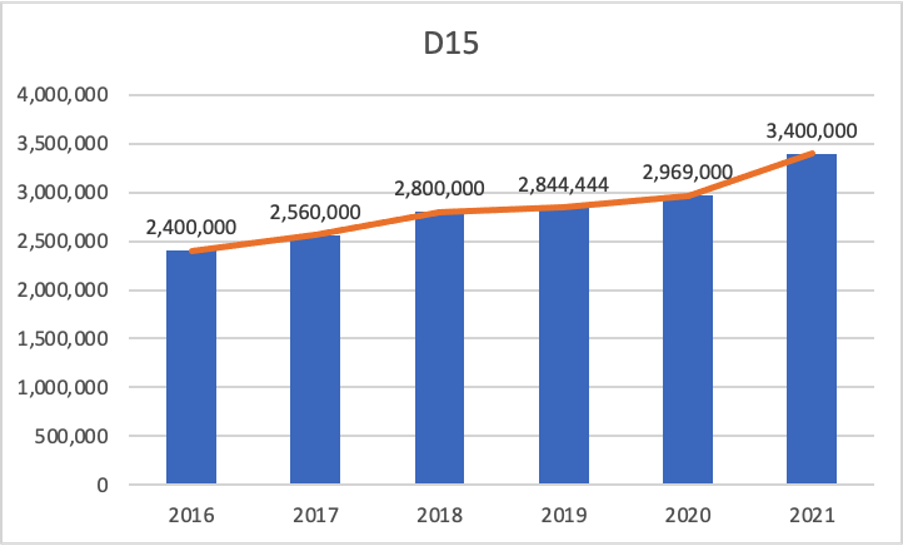

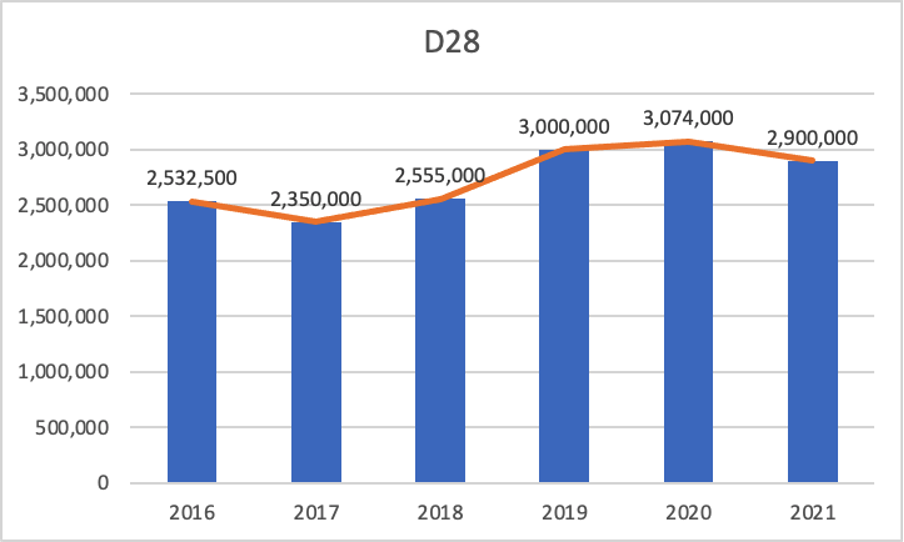

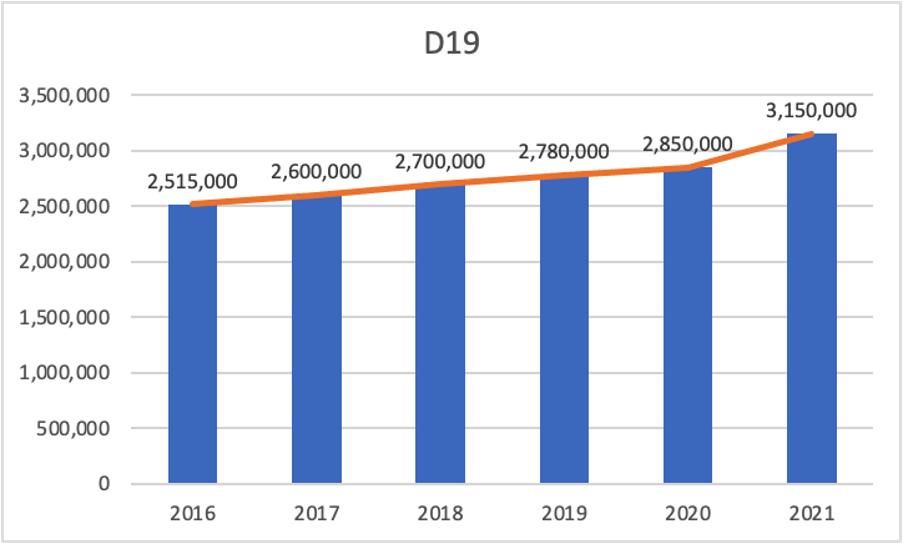

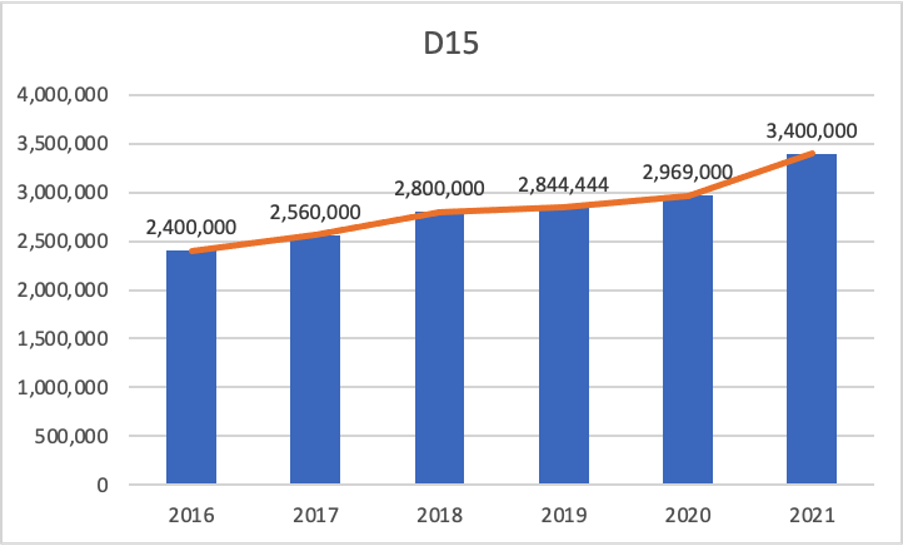

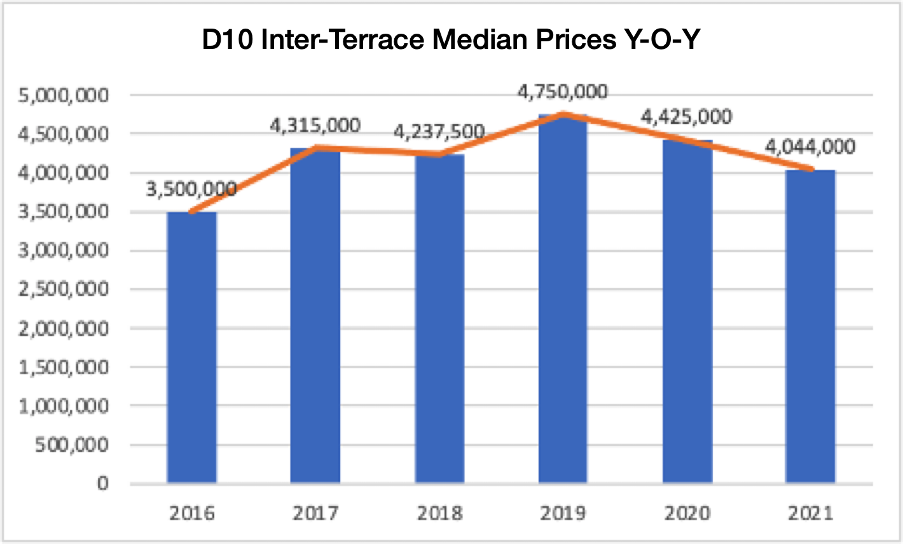

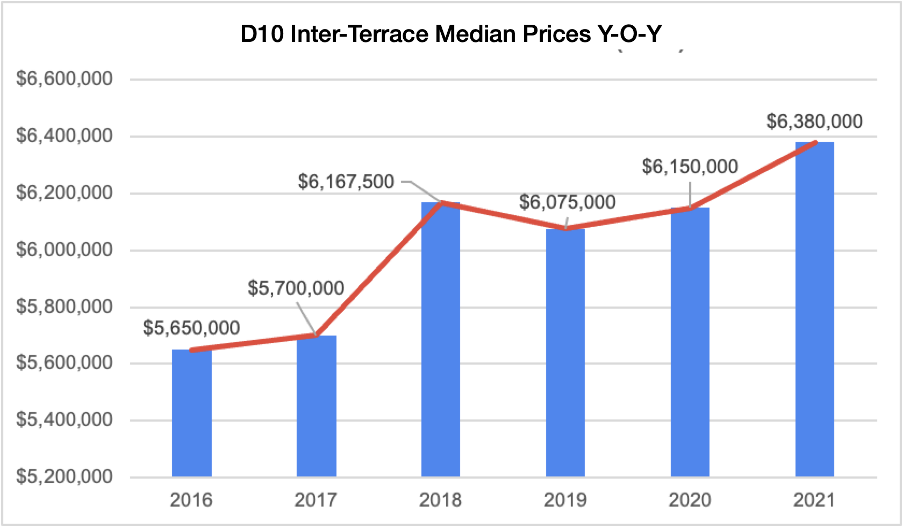

Inter-Terrace Median Prices across districts YoY

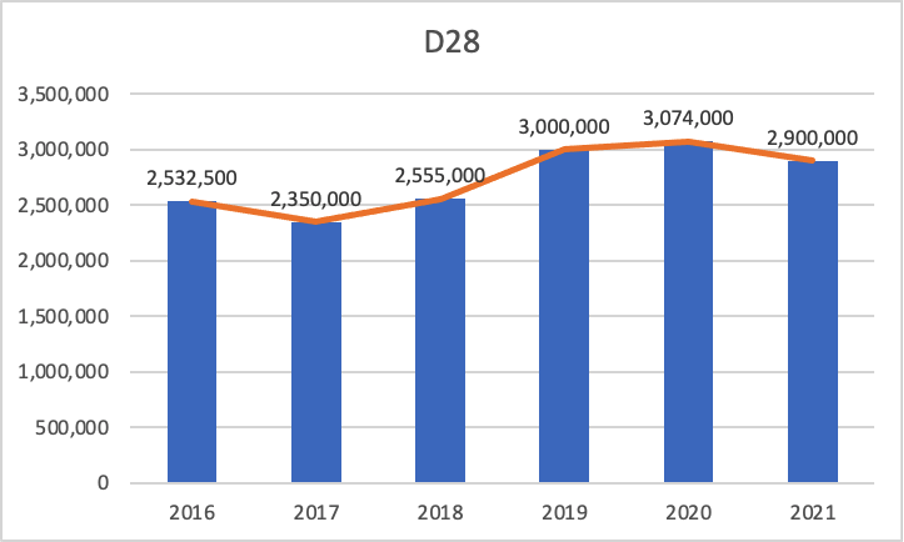

As much as we love new things, privacy, space, it has to make economic sense when considering these factors. These statistics compiled by our PLB Insights team shows the Inter-Terrace Median Prices year-on-year across the 3 districts mentioned. It would seem that the lower the district number, the higher the price quantum. Generally, across all districts, the performance of landed properties are all in a similar upward trend other than District 28, with the surge from the sales of the Luxus Hill developments. However, we believe after a slight correction and the expiry of the Seller Stamp Duty period of 3 years for those who bought into Luxus Hill, the trend in D28 will resume to be similar to that of the other two districts.

Using Luxus Hill as an example. We can understand the popularity of the development purely from a pricing standpoint. 91% of the landed homes in Luxus Hill was sold during the preview weekend as reported by The Straits Times in September 2019. Prices ranged from $3.05 million to $4.2 million for inter-terraces to semi-detached units. It is relatively easy to assume that if you were to buy a brand-new inter-terrace at $3.05 million versus an older unit that requires some renovation at about $2.7 – $2.8 million in 2019, the choice is fairly simple. In addition to the purchase price, you may have to fork out an additional $200K – $400K depending on the extent of renovation needed. Or if you want something more customized and an entirely new structure, that is an additional cost of around the $1 million range. That would already easily total up to be equivalent or more than the purchase price of a brand-new inter-terrace in Luxus Hill. This is what we call Price Disparity in PLB.

Of course, this method of comparison is assuming that the homeowners looking for a landed house have no preference in where their house is located. For buyers who would still prefer areas with better amenities, renowned schools, better connectivity, they would still primarily prefer D15 and D19. Price Disparity is not only apparent between regions, it also occurs between landed types and conditions.

Across Types

There are also price disparities between types as well. District 10 is probably the Apex of landed housing in Singapore. Given the abundance of amenities and proximity to sought-after schools. The charts from our Insights Team above show that the Median Prices of Inter-terraces have yet to break past the $5 million mark even though it came close in 2019. Semi-detached houses in D10 were typically in the $5 million range before 2017. However, when prices of Inter-terraces started to creep upwards approaching $5 million, the prices of Semi-detached houses started to push above the $5 million range and is now in the Median of $6.3 million. The implication here is that when homeowners of Semi-detached houses started observing that prices for Inter-terraces were closing in on their “territory”, they started to price their houses even higher. Semi-detached houses which usually have larger land size and more build up, could not possibly be priced similarly to Inter-terraces which have smaller land sizes and lesser build up area.

We have since seen a decline in Median Prices over the recent years, but if you are looking for an Inter-terrace in D10, there are prime units which are in the $5 – $7 million range at the time of writing. Obviously these are relatively well renovated or developed units. But another underlying reason that Inter-terraces are probably poised to move up a class is due to two main reasons. Popularity and COVID-19.

Local Popularity

In a separate article we spoke a little on the current general trends and how Singapore is becoming an increasingly self-sustaining market. Earlier this year, The Straits Times reported that there is a drastic decrease in Foreign buying of Singapore Private properties. This is resultant of all the travel restrictions in place due to COVID-19 which has prevented Foreign buyers from physical viewings. However, even with this decline, our property market has still been on the rise. Prices have been steadily rising amidst the pandemic, the demand for more space has propelled the demand for larger units and ready to move in houses. Hence, even without the “support” of foreign buying, the current climate has presented that Singapore is not reliant on the foreign market. This is very important as it implies that our property market is resilient to foreign forces and prices will not fluctuate or dip drastically. In a stable market, having a uniform and gradual increase will give buyers more confidence.

Foreign Popularity

At this point, we would like to remind our readers that landed properties are restricted properties. Which means that foreigners are not able to purchase these properties without the approval of the relevant authorities. To find out more on the can and cannots of purchasing properties as a foreigner, we have recently covered this topic in a separate article. For further reference to the actual guidelines, here is the link to the SLA webpage. Sentosa Cove is the only area that foregin buyers have a fast track approval from Singapore Land Dealings Approval Unit to purchase landed properties. However, the landed properties in Sentosa Cove are mostly 99 years leaseholds.

Our fellow Singaporeans are not our only competitors. Even though foregin buying has slowed down over the last year, Singapore’s stable market is still very popular amongst foreign investors in the region. With encouraging factors like a self-sustaining market, stable prices, economic development, foreigners around our region are all eyeing our properties wanting to compete for a piece of the pie. Most prices have already surpassed its respective highs and it may be entering a level of consolidation or decline. However, when foreign buyers decide to enter the market, they have to pay a hefty 20% ABSD on top of their purchase price. Any savvy investor will understand that when these foreign investors decide to exit the market, it is unlikely that they will consider anything below 120% of their purchase price in order to recover back what they have invested.

Perhaps by some way of misinformation, some local investors are led to believe that the market is at its peak now. But as we have pointed out above, prices are likely to rise once our borders open. With the current instability in certain markets and countries, Singapore is still the prime choice for foreign investors. Not only in the region but globally as well. Even if you have not been keeping up with Real Estate news, several of our local media outlets have reported of notable foreign names making large notable purchases. The CEO of a certain notable ride hailing company, an English inventor that manufactures vacuum cleaners, or the son of everyone’s favorite hotpot chain. COVID-19 has affected many economies, some worse than others. However, with mass vaccination rollout across the world, economies will start to recover and open back up to foreign visitors. We believe that once we reach that checkpoint, prices will creep up even higher as a gradual pool of foreign investment hits our shores. If the current prices are already viewed as “threatening” which has led to talks about Cooling Measures, will we then see some actual measures in place if prices do reach a new peak from the fresh influx of purchases? Perhaps we will leave that thought for a later discussion but the takeaway from this lengthy read is, Never Time The Market.

4 Main Categories of Landed Properties

If you have been keeping up with our Signature Home Tour series, you would know that we have often brought up the different categories of Landed Properties and there are 4 main categories of landed properties.

Just to recap:

-

Landed properties that need total rebuild ≥ 30 years old

-

Middle-aged landed properties that require A&A ≈ 20 years old

-

Modern and Well-Renovated landed properties ≤ 15 years old

-

Brand new landed properties redeveloped by developers. Ranges from established to newer developers.

Of course the first question that would pop into your head is, which is the most popular and most sought after? To be completely honest, #RealEstateWithIntegrity, they all are very very popular in the current climate. Of course there are Pros and Cons for each category. It depends varyingly on the preference and profile of the buyers.

For example, if you were to purchase a landed property that requires total rebuild because it is currently a 1- or 2-storey landed property that is not in a very liveable condition then you would have the freedom to redesign and choose the layout and facade of your brand new landed house. This category is also very popular amongst buyers who have an “extra name” to purchase the property under and they currently have a place of residence that they can continue living in for the duration of the rebuilding. For reference, the entire process of designing, approval by BCA and other relevant authorities plus the actual build time totals out to be about 1.5 – 2 years. Thus the time factor here is considered an opportunity cost which is lost because you have already committed at least 1.5 years and maxed out the names in which you can purchase property under. The same goes for Middle-aged landed properties that require A&A, although the time factor is not as drastic as rebuilding from scratch. However, any recent homeowner will know the amount of delays and increase in cost that the pandemic has brought about. Talk about killing the mood when you are excited about moving into your new place.

The next category which are the modern and well-renovated types which are usually less than 10 years old, in our opinion is still one of the most preferred types. Simply because you are able to move in right away after furnishing the place, in some cases owners might even leave behind some furnishing that may not suit their next property. Yet you still have that flexibility to choose to rebuild from scratch in another 10 years if you think you require to do so. The flexibility comes with entering lower than the brand new types and at the same time, the price quantum is not that far off a rebuild type. So it would make sense to pay a little premium to have that option, yet move in immediately and still not lose any time factor or opportunity costs. It is somewhat the sweet spot in today’s market. Lastly, you have the brand new type which speaks for itself. As long as the price is right, everyone would choose a brand new house. Just like how we have shown in the example of Luxus Hill where there is a Price Disparity between the brand new types in D28 and the median prices around the neighbouring D19 area.

Our take

If you have already been keeping up with our Podcast series, Nuggets on The Go, you would have seen that our Co-Founder/CEO Melvin Lim has touched a little bit on the general trends and movements in the landed market and why we think that Strata-Landed Houses are the next up and coming underdog. Although it is not exactly a pure landed house, it technically offers the same living space as a landed house would have and it has the extended benefit of facilities and a private compound.

For those who would still prefer to own the land in which their houses are built on, the different categories of landed properties would definitely be a key consideration when budgeting and deciding on their property. Landed Properties have their own audience which can be further broken down into preference in areas. D10, D15, D19, D28 are definitely top the list when buyers start searching for landed properties. Foreign investors will definitely influence prices when the pandemic is better settled. Hence, timing the market is not advisable. With the limited supply of landed houses and the increasing demand for larger spaces, hunting for the right house will definitely be challenging. Will it then justify paying a premium to secure the unit or keep searching for a unit with fair value? If you require some guidance or general advice, do contact our consultants, we would be more than happy to guide you along your home buying journey. Till our next article, we will catch you on one of our Signature Home Tour episodes, Take Care!