What comes to mind when you think of real estate? To most, it is home, family, lifestyle. A place of rest and relief from the outside world. Real estate is a special asset class in the sense that it is a physical and tangible asset which can serve multiple purposes. Beyond our private residential use of real estate, it is also a common form of investment.

In this article, we cover the role of real estate in the portfolios of High Net Worth (HNW) individuals. Particularly, how a HNW portfolio should look like, what are the pain points that HNW individuals face, and facing the dilemma between concentrating holdings and diversifying them.

What Should a HNW Portfolio Look Like?

HNW are defined as having at least 1 million dollars in investable assets (which includes cash & cash equivalents, stocks, bonds, mutual funds, retirement accounts, and trusts). When asked the question of what an ideal HNW portfolio should look like, bankers and consultants will pull out tables and charts depicting how the top investment firms construct their portfolios. We will take a look at the existing norms in asset allocation and go through pain points that HNW individuals (HNWI) have. Thereafter, we take a look at how Real Estate plays a vital role in complementing other parts of your portfolio.

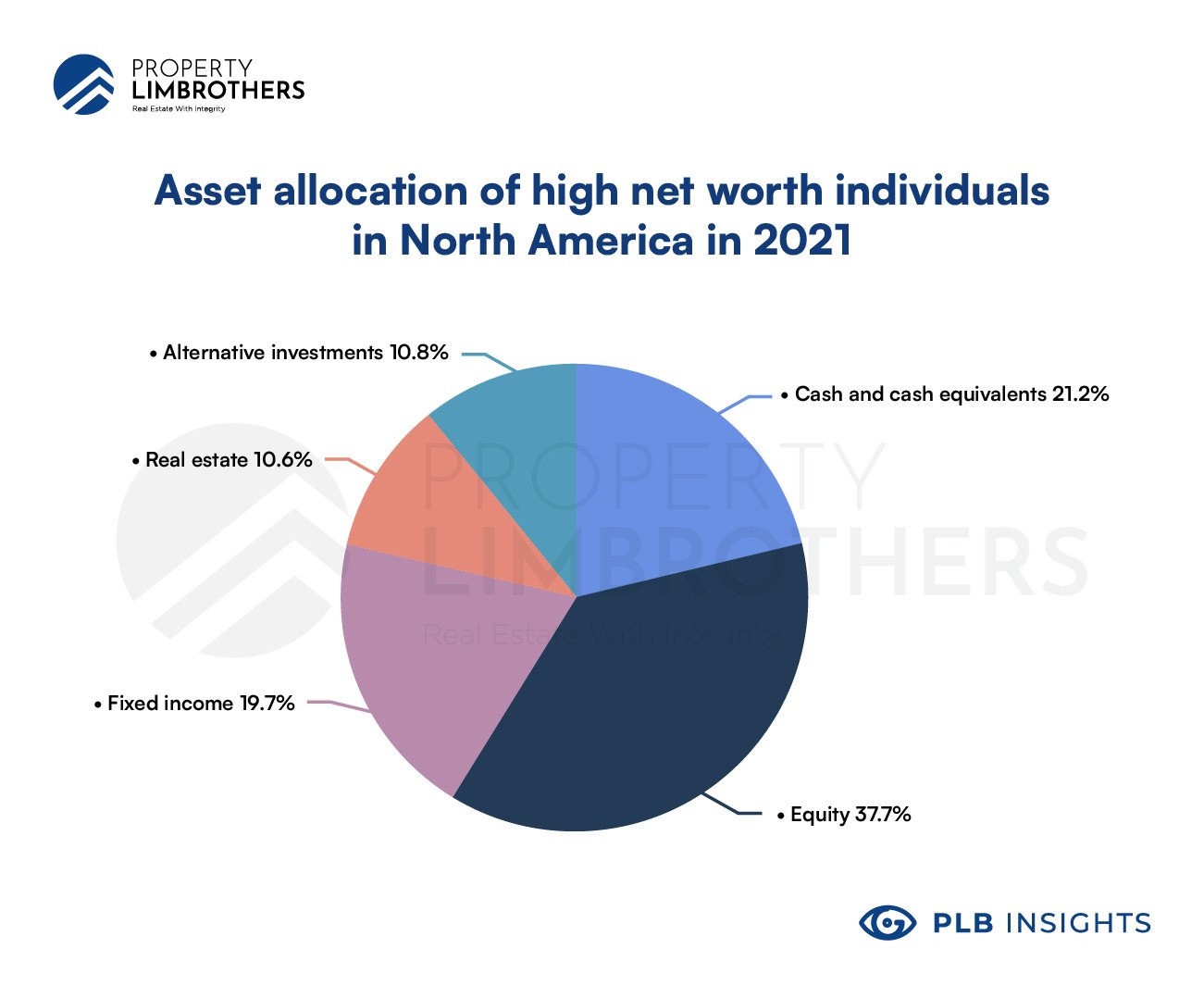

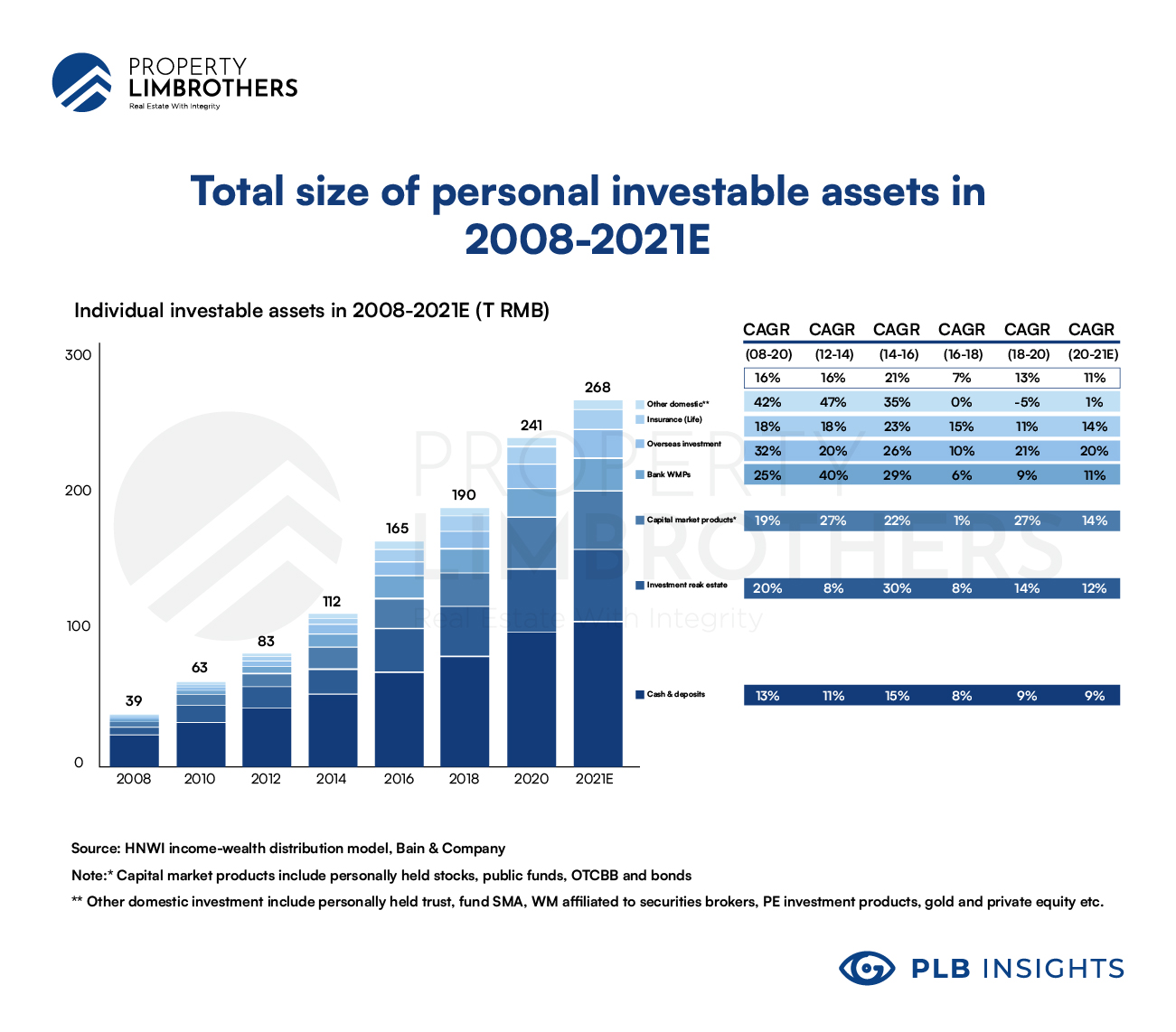

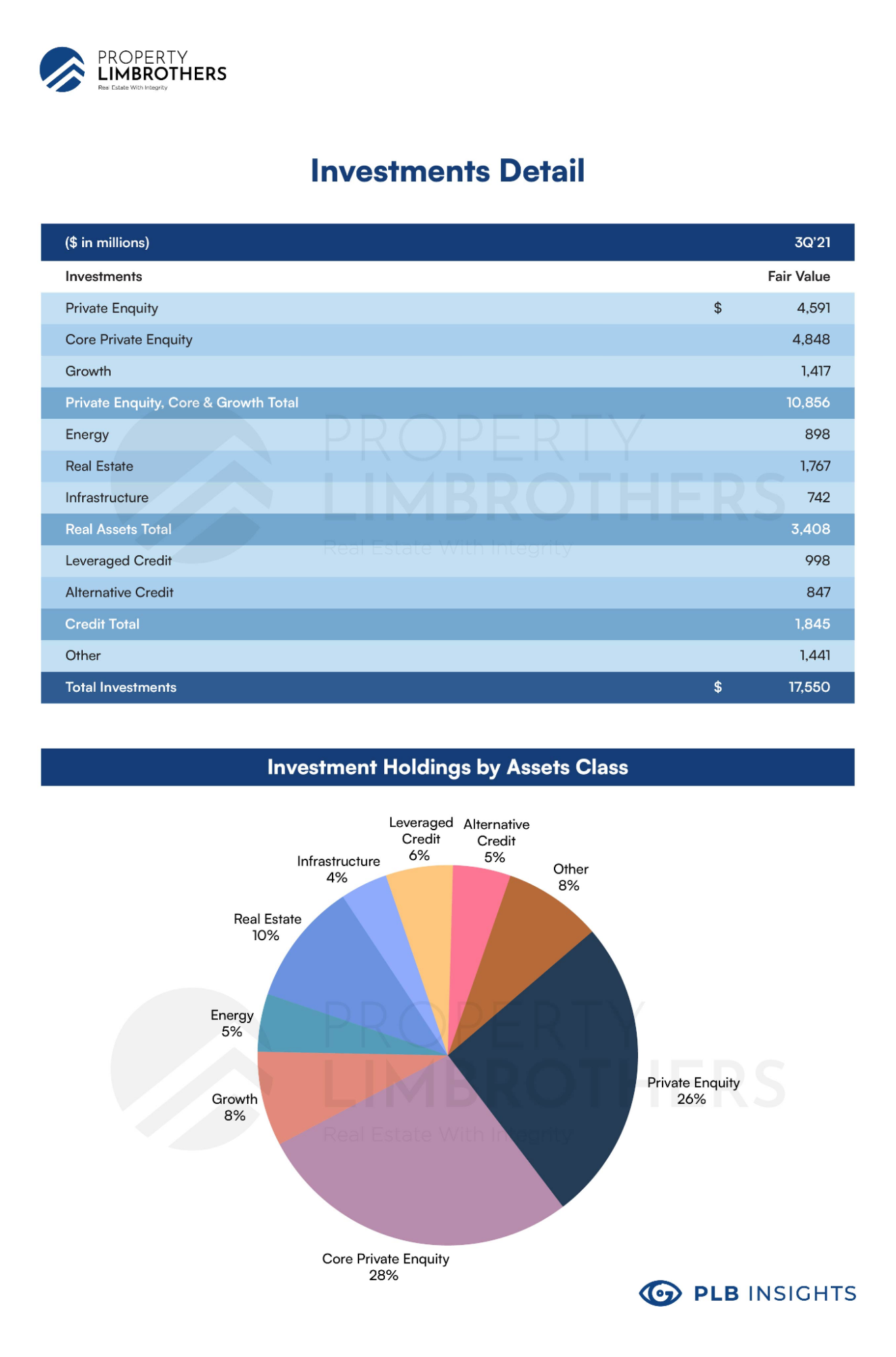

To have a comprehensive view on asset allocation of HNWIs, we look at American and Chinese HNWIs which make up the two largest segments of the market. We also look at how KKR & Co. Inc., the second largest Private Equity firm with Assets Under Management (AUM) totalling US$459 billion, structures their portfolios for HNWIs.

From the information we have gathered from published studies and reports, HNWIs in North America allocate 10.6% to real estate, while in China it is approximately 15%. KKR allocates 10% of their portfolio to real estate. This is not surprising given that real estate typically takes up a large portion of net worth at lower numbers, and does not grow proportionately with the total net worth of the individual. Investment in equity and alternative assets are the ones which rise disproportionately as an investable portfolio reaches HNW status.

From the charts, a key difference is that equity makes up a significant portion (37.7%) of North American portfolios but not Chinese ones. In Chinese portfolios, capital market products typically take up less than 15% of the portfolio. This is marginally less than the amount they allocate to real estate. What is the right way to structure portfolios? This is the golden question. And probably, there is no right answer. It depends on the individual investor.

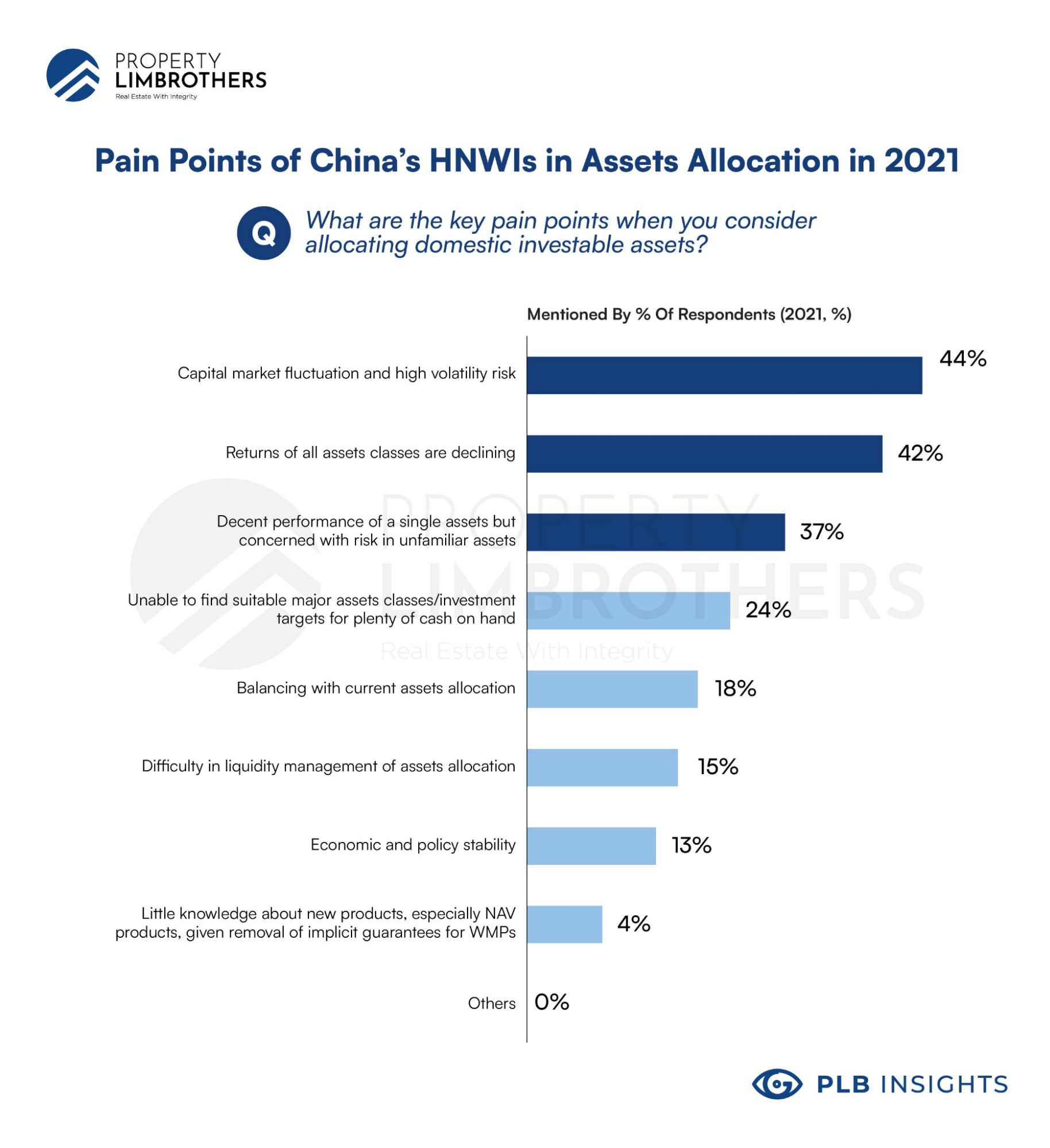

From the charts, a key difference is that equity makes up a significant portion (37.7%) of North American portfolios but not Chinese ones. In Chinese portfolios, capital market products typically take up less than 15% of the portfolio. This is marginally less than the amount they allocate to real estate. What is the right way to structure portfolios? This is the golden question. And probably, there is no right answer. It depends on the individual investor.Making money and good returns is not the only objective of your entire portfolio. Sure, for equities perhaps, return is everything. But the entire portfolio should cater best to all the needs and wants of the investor. Other priorities typically include managing risk, volatility, legacy, liquidity, and economic & policy issues.

The CMB–B&C survey suggests that the pandemic has shaken investor confidence. High volatility and declining returns across asset classes are challenging the acceptable levels to HNWIs. Furthermore, unfamiliar assets present risks that are hard to ascertain due to the lack of access to proper knowledge and diversification methods. When considering where to park substantial amounts of their capital, HNWIs are worried about how equities and crypto assets might perform and whether their high allocations are justified given the extreme volatility we have experienced in the past 2 years.

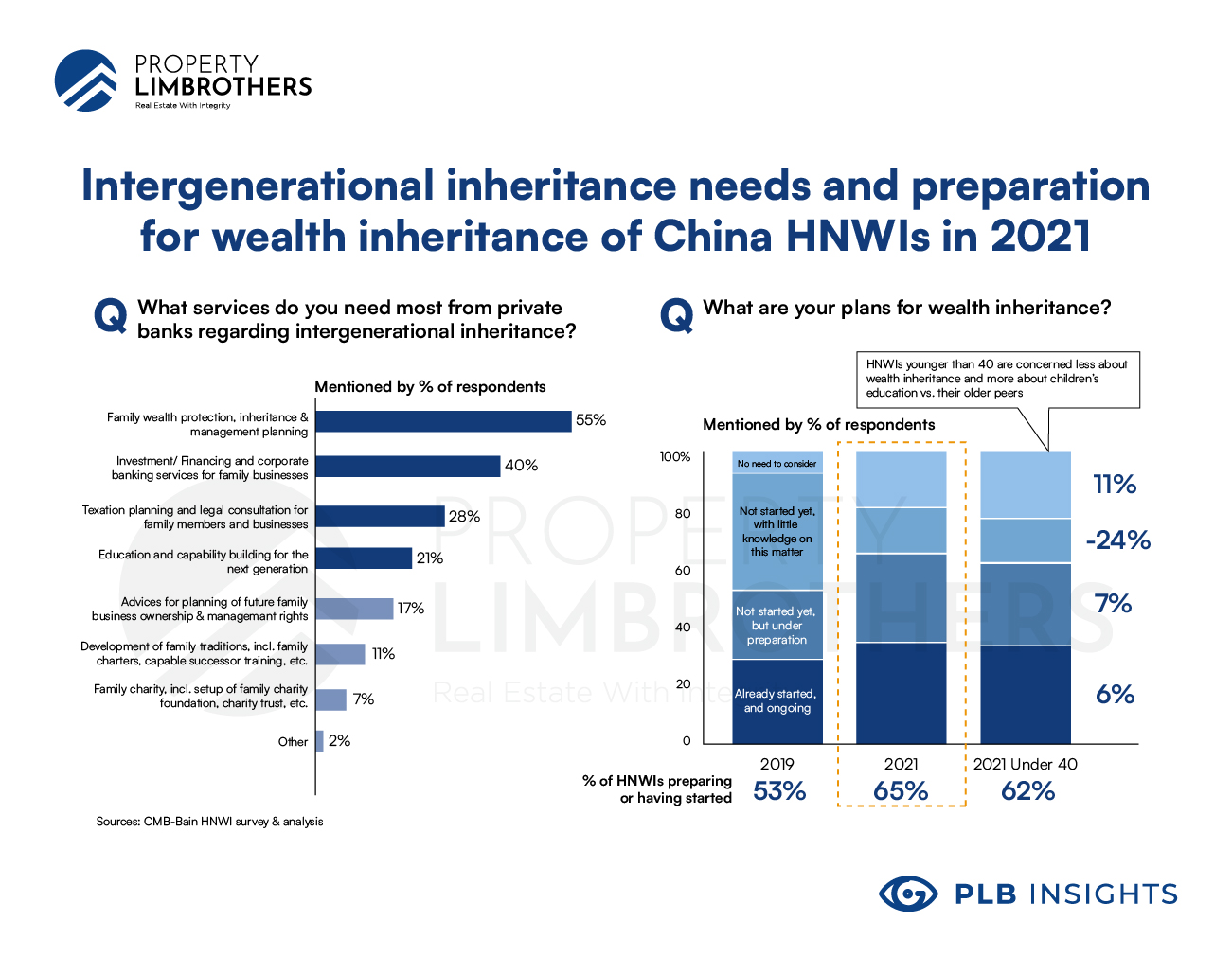

As mentioned above, perhaps a rebalancing of the portfolio is needed to meet the concerns of risk, volatility, legacy, liquidity, and economic & policy issues. On top of these concerns, we also learn from the CMB–B&C survey that a third of China’s HNWIs have not started their wealth inheritance planning, with 55% of the respondents stating that they needed help with family wealth protection and inheritance. This is a major concern for family wealth and we recognise that.

A comprehensive portfolio should not only deliver on returns, but also on these pertinent concerns that investors have.

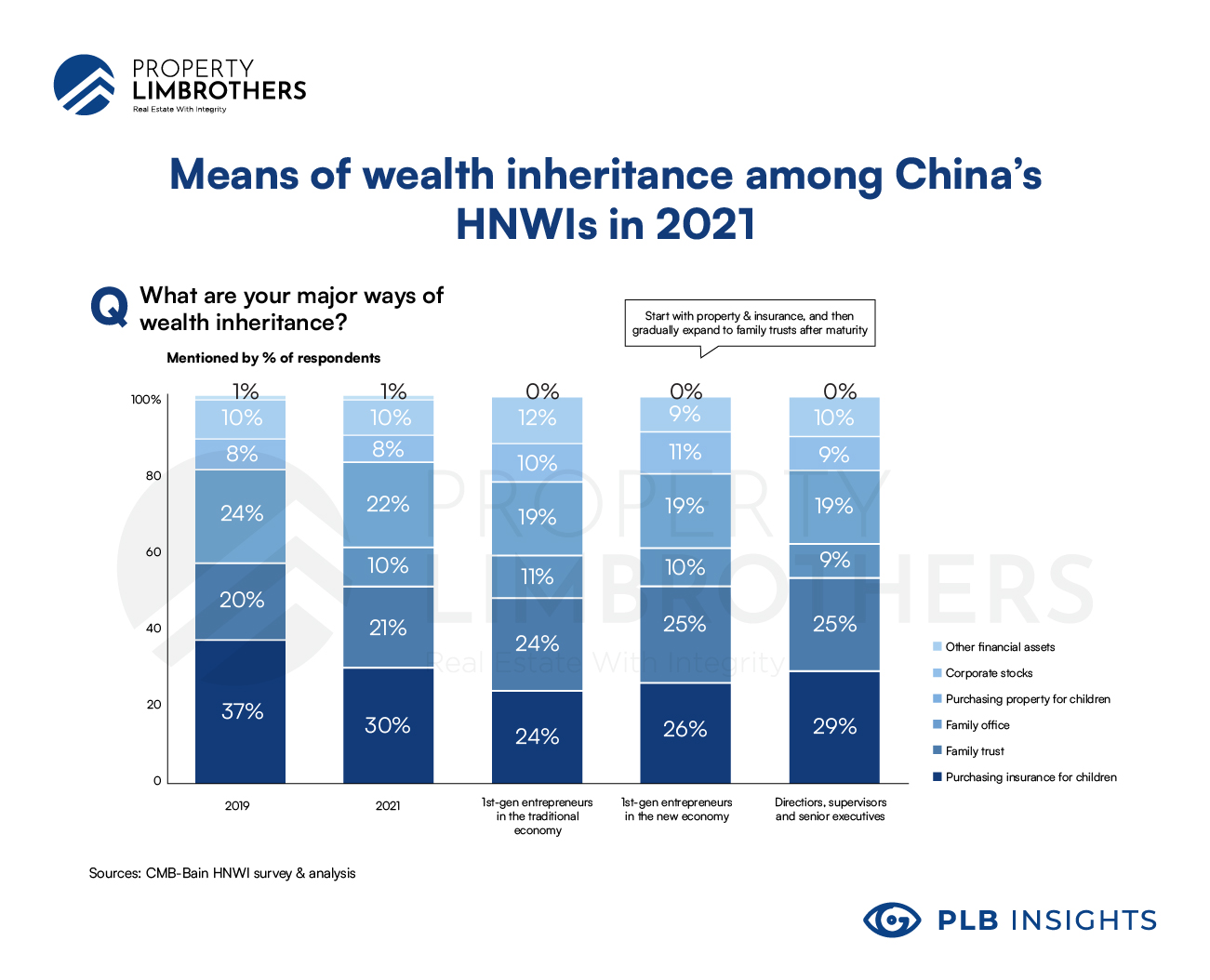

While Real Estate fits the bill for residential and investment purposes, it plays a key role in family wealth management as well. On top of insurance and trusts, properties act as the third most common means of wealth inheritance. Of course, each of these methods have their own benefits and shortcomings which we will not be covering in this article.

We opine that property will see greater usage in family wealth preservation and inheritance due to its strong growth prospects as an investment asset and its ability to ride out waves of volatility and uncertainty over equities and unfamiliar assets.

We also believe that real estate will play a greater role in HNW portfolios due to its ability to deal with multiple concerns that HNW individuals have. Ultimately, the value of real estate is also that it provides assurance to individuals in the form of its tangible existence and ability to be resilient in adverse market conditions. Thus, we advocate for a higher asset allocation into real estate.

Dealing with Concentration risk vs. Diworsification

In portfolio construction, a fundamental question is whether to concentrate or to diversify. Many would think that “diversification” is a sexy word. A way to reduce risk while increasing returns? That is a common misconception. Market and Academic research has shown time and again that diversification often results in a more inefficient portfolio. Risk might not necessarily be mitigated and performance is diluted. A single asset class might perform fantastic, but the portfolio is underexposed to it. Experts term this as “Diworsification”. You diversify into a portfolio that is worse.

Certainly, the trade-off is real. And strategies which concentrate on fewer asset classes and investments have their own problems. The assets chosen must be resilient, have a great growth outlook, and serve the multiple purposes of the portfolio. The key risk is that the process of investment decisions is not robust. Insufficient due diligence, lack of deep knowledge, and volatility from macroeconomic and policy implications can ruin the investment. However, the risks presented here are also a problem of diversified portfolios. In fact, it is much harder to have comprehensive knowledge of a diversified portfolio. The key problem of a concentrated portfolio remains that you have a lesser margin for error in investment decisions.

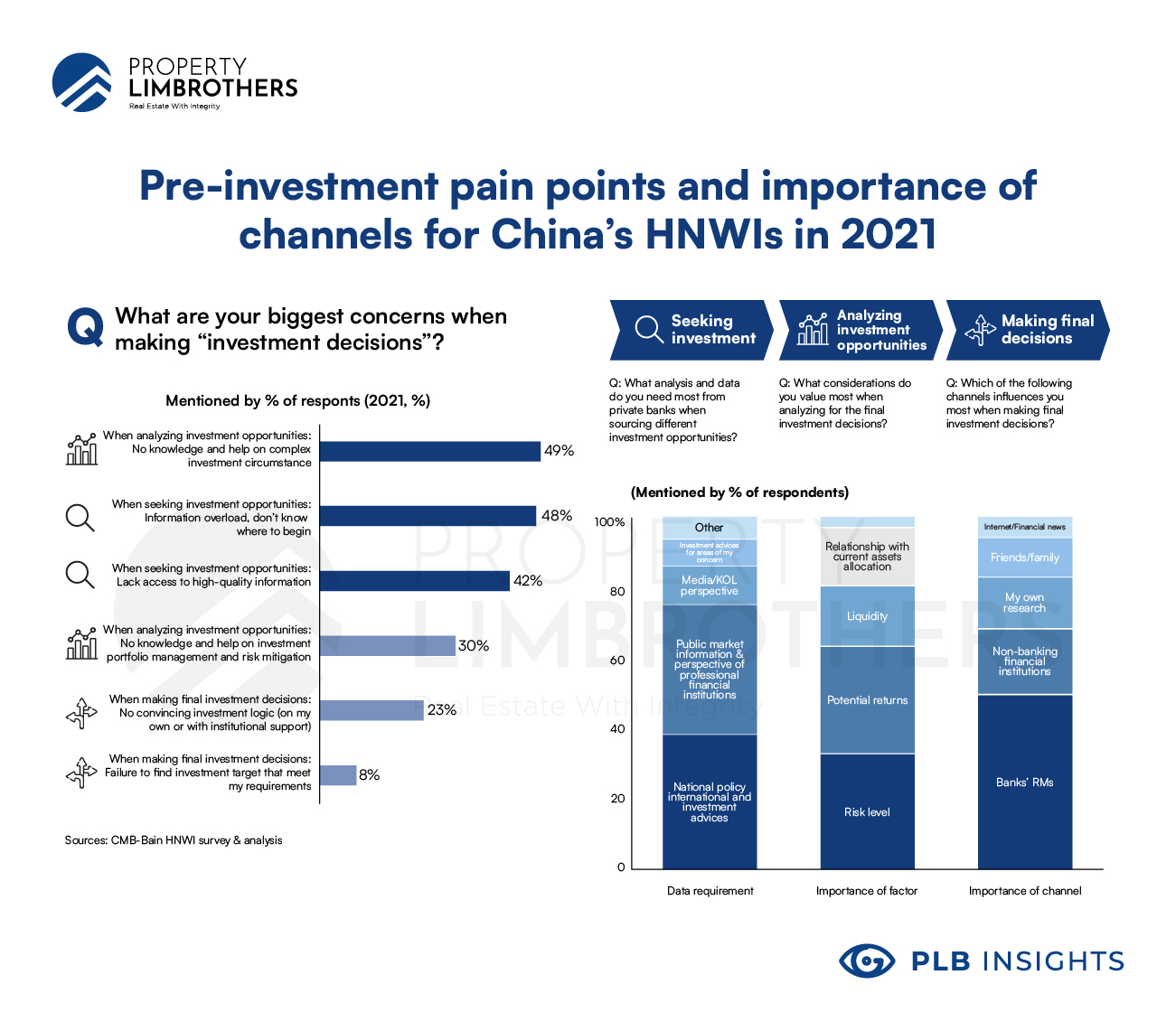

Key problems in investment decision making for HNW individuals are the lack of assistance in dealing with complex market situations, information overload, and lack of access to high quality information and experts. These are real concerns. In equity and crypto markets, a major information overload is occurring as “experts” attempt to feed viewers their own opinions of where the market is going. Even though these markets are much more liquid, with more information available, decisions are still difficult if not more difficult than before to make. We believe that with the right partners and experts on your team, private markets and real estate can become a better prospect than publicly traded assets.

We make the case for concentrated portfolios while managing concentration risks. A great example is the U.S. Investing Championship. Recurrent winners in the championship follow this philosophy of investing. In 2020, Oliver Kell won the under 1M title with 941.1% returns and in 2021, Mark Minervi won the above 1M title with 334.8% returns. We understand the concerns of concentration risk and its implications. Typically in larger portfolios, it is difficult to concentrate asset allocations due to its size. If the asset class or market presents opportunities of a low volume or quantum, it becomes a challenge to enter with a large investment.

Referring to our previous example of the U.S. Investing Championship, the key method to the madness of concentration is the ability to pick the right investment. The stock picking skill and the timing of entry (barring psychological impulses and challenges), are the two most important technical factors. Therefore, expert knowledge and advice in the domain of investment is critical.

Closing Thoughts

We don’t expect everyone to be a real estate picking champion. In fact, it’s much easier when you’re not doing it alone. To help alleviate the pain points of clients, PLB looks to create value through sound advisory and excellent service. Real estate is more than just about investing and returns. We look at how real estate fits into the portfolio and needs of the individual. Helping our clients ensure that their needs and those of their family are cared for.

If you wish to contact us for a deeper discussion on how real estate can play a role in HNW portfolios, you can reach out to us here or drop a direct message to your favourite IST member on their socials.